Circle (CRCL) Sees Post-IPO Gains Amid Coinbase Reliance, While Coinbase (COIN) Expands Globally and GME Faces Speculative Crypto Outlook

Contents

-

Crypto US stocks are gaining momentum as Circle (CRCL) surges post-IPO, Coinbase (COIN) expands its global footprint, and GameStop (GME) trades on speculative crypto hype.

-

Circle builds investor confidence despite its reliance on Coinbase, while Coinbase leverages strategic partnerships to enhance international presence.

-

GameStop’s crypto ambitions remain uncertain, with market enthusiasm driven more by sentiment than a clear Web3 execution plan, according to COINOTAG sources.

US crypto stocks CRCL, COIN, and GME show divergent trajectories amid IPO success, global expansion, and speculative trading, highlighting evolving market dynamics.

Circle Internet Group (CRCL) Posts Strong Post-IPO Growth Amid Investor Optimism

Since its NYSE debut, Circle Internet Group (CRCL) has demonstrated remarkable stock performance, closing Monday with a 13% gain and extending upward momentum in pre-market trading. This surge reflects robust investor confidence, driven by Circle’s impressive Q1 financial results, including a 59% revenue increase and a 75% rise in net income. The company’s positioning as a leading player in the stablecoin market, particularly through its USDC offering, has attracted significant attention.

Notably, Ark Invest’s recent decision to sell $51.8 million in Circle shares after a near fivefold increase from its IPO price underscores both profit-taking and sustained market enthusiasm. Financial commentator Jim Cramer has highlighted Circle as a “pure play on digital assets,” reinforcing its appeal among investors focused on blockchain-based financial services.

Despite the positive outlook, some industry experts express caution. Arthur Hayes, former BitMEX CEO, critiques Circle’s dependency on Coinbase for USDC distribution, suggesting this reliance may constrain scalability and compress profit margins compared to competitors like Tether. This dynamic raises questions about Circle’s long-term sustainability, though current momentum may propel CRCL toward testing resistance near $165.

Strategic Challenges and Market Sentiment Impacting Circle’s Growth

Circle’s business model, while profitable, faces scrutiny over its operational dependencies. Hayes’ concerns highlight the potential risks of a concentrated distribution channel, which could limit Circle’s ability to independently expand its market share. Investors should monitor how Circle addresses these challenges, particularly in diversifying its distribution partnerships and enhancing margin efficiency. Meanwhile, bullish sentiment remains strong, supported by solid earnings and market positioning within the stablecoin ecosystem.

Coinbase Global (COIN) Accelerates Global Expansion Through Partnerships and Regulatory Progress

Coinbase (COIN) is capitalizing on strategic alliances and regulatory advancements to broaden its international reach. The company’s recent collaborations with Shopify and Stripe facilitate USDC payments on Shopify’s Base-integrated checkout, enabling merchants to accept stablecoins alongside traditional fiat currencies without infrastructure overhaul. This integration marks a significant step toward mainstream adoption of crypto payments.

Additionally, Coinbase is on the verge of obtaining a comprehensive EU crypto license through Luxembourg, which would authorize operations across all EU member states under the MiCA regulatory framework. This development positions Coinbase to strengthen its foothold in the European market amid increasing regulatory clarity.

However, Coinbase’s sponsorship of a U.S. Army parade promoted by former President Trump sparked criticism from segments of the crypto community, concerned about perceived departures from decentralization principles. Despite this, CEO Brian Armstrong remains committed to expanding Coinbase’s global influence, advocating for accelerated crypto regulation in the UK to secure its status as a leading crypto hub.

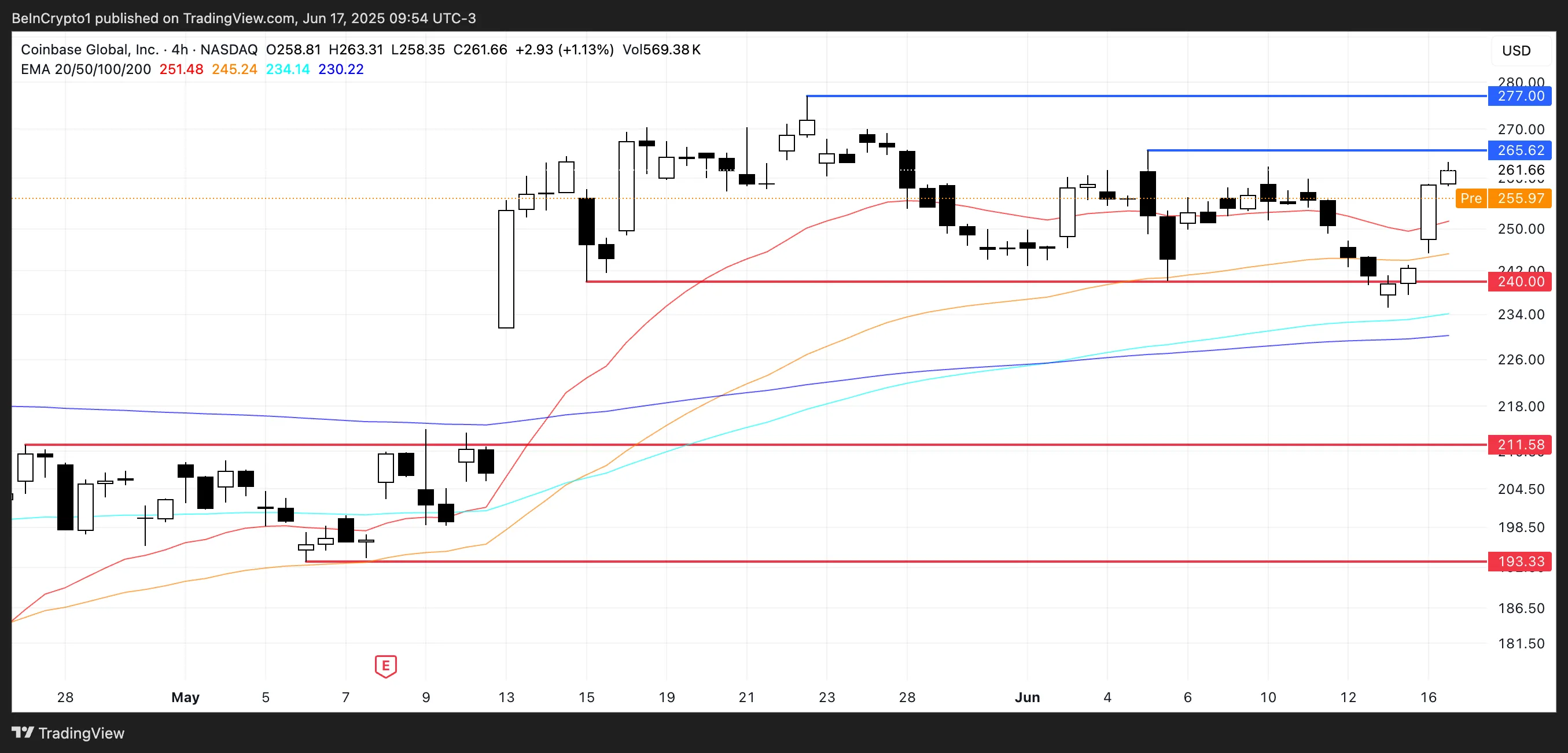

Technically, COIN faces resistance at $265, with a potential breakout opening the path to $277. Conversely, failure to sustain support at $240 could trigger a decline toward $211, particularly if broader market risk aversion intensifies.

Balancing Regulatory Compliance and Community Expectations

Coinbase’s approach illustrates the complex balance between regulatory engagement and maintaining community trust. While partnerships and licensing efforts enhance legitimacy and market access, they may alienate purists who prioritize decentralization. Investors should weigh Coinbase’s strategic positioning against evolving regulatory landscapes and community sentiment, recognizing that successful navigation of these factors is critical for sustained growth.

GameStop Corp. (GME) Navigates Speculative Crypto Interest Amid Unclear Web3 Strategy

GameStop (GME) remains a focal point of speculative trading, buoyed by its pivot toward crypto despite lacking a transparent Web3 roadmap. The company has bolstered its financial reserves with $6 billion in cash and acquired 4,710 Bitcoin, signaling intent to engage with digital assets. However, sales declines and limited earnings disclosures contribute to investor uncertainty.

Critics argue that without a clear strategic vision or credible leadership in crypto innovation, GameStop’s premium valuation is largely speculative. Nonetheless, some bullish investors believe the company’s strong brand and retail investor base could catalyze a successful transformation if management commits to a decisive crypto or NFT-focused pivot, similar to peers like SBET or KWM.

Despite a recent 5% stock gain, GME’s pre-market dip of 0.69% suggests volatility may persist. Key support levels at $21.56 and $20.78 will be critical to monitor, as failure to hold these could signal further downside. Without a concrete growth narrative, near-term upside may depend on retail-driven momentum rather than fundamental catalysts.

Investor Sentiment and the Need for Strategic Clarity

GameStop’s trajectory underscores the importance of clear communication and strategic execution in the crypto space. Investors are advised to remain cautious, as enthusiasm fueled by hype may not translate into sustainable value without tangible progress in Web3 initiatives. The company’s future performance will likely hinge on its ability to articulate and deliver a compelling crypto strategy that resonates with both retail and institutional stakeholders.

Conclusion

The US crypto stock landscape presents a diverse set of narratives: Circle’s strong post-IPO performance reflects robust fundamentals tempered by strategic dependencies; Coinbase’s global expansion highlights the interplay between regulatory compliance and market growth; and GameStop’s speculative crypto positioning underscores the risks of hype without clear execution. Investors should closely monitor these developments, focusing on fundamental drivers and regulatory environments to navigate the evolving digital asset market effectively.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC