CleanSpark Increases Bitcoin Mining 11% in November Despite Sector Pressures

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

CleanSpark’s November Bitcoin production rose 11% to 587 BTC, while contracted power capacity exceeded 1.4 GW, demonstrating resilience amid falling Bitcoin prices and industry margin pressures in the mining sector.

-

CleanSpark mined 587 BTC in November, up 11% from October’s output.

-

The company expanded contracted power by 11% to over 1.4 gigawatts for future scaling.

-

Revenue doubled year-over-year to $766.3 million in fiscal 2025, despite a 36% Bitcoin price drop from October highs.

CleanSpark boosts Bitcoin mining production in November 2025 amid market challenges. Learn how 587 BTC mined and 1.4 GW power expansion signal strength—explore strategies for crypto miners today.

What is CleanSpark’s November Bitcoin Production Performance?

CleanSpark’s November Bitcoin production reached 587 BTC, marking an 11% increase from October and highlighting the company’s operational efficiency in a volatile market. This growth occurred despite Bitcoin prices declining over 36% from mid-October peaks, which strained miner revenues across the industry. The expansion underscores CleanSpark’s focus on scaling infrastructure to maintain output during economic downturns.

November production rose 11% and contracted power topped 1.4 GW, even as falling bitcoin prices and tighter margins pressure the mining sector.

Bitcoin mining company CleanSpark (CLSK) maintained elevated production levels in November, signaling elevated revenue generation despite a challenging environment for cryptocurrency miners and the broader digital asset market.

Source: Blockspace

CleanSpark also expanded its contracted power capacity by approximately 11% to more than 1.4 gigawatts, a key measure of the electricity the company has secured to support future mining operations. A larger power footprint allows the company to deploy more mining equipment and scale output over time.

CEO Matt Schultz also reiterated the company’s $1.15 billion zero-coupon convertible note offering, which provided long-term financing at no interest cost. The proceeds are intended to strengthen CleanSpark, Inc.’s balance sheet, fund infrastructure expansion, and support a share repurchase program.

The mining update follows the release of CleanSpark’s fiscal 2025 financial results, which showed revenue more than doubling year-over-year to $766.3 million.

Related: CleanSpark secures second BTC-backed credit line this week without share dilution

Bitcoin miners like CleanSpark operate by solving complex computational puzzles to validate transactions on the Bitcoin network, earning new BTC as rewards. This process requires substantial energy and hardware investments, making power contracts essential for long-term viability. In November 2025, CleanSpark’s ability to increase production amid price volatility demonstrates strategic planning and cost controls that set it apart from peers.

How Does Bitcoin Price Volatility Impact CleanSpark’s Mining Operations?

Bitcoin price volatility directly affects mining profitability by influencing revenue from block rewards and transaction fees. In November 2025, Bitcoin’s price fell more than 36% from its mid-October all-time high, leading to reduced margins for miners industry-wide. CleanSpark mitigated this through efficient operations and secured power, maintaining 587 BTC production; data from industry analyses indicate that top performers like CleanSpark achieve up to 20% better efficiency during downturns compared to average operators.

CleanSpark is expanding production capacity during a period of heightened financial stress across the Bitcoin mining industry. November proved particularly challenging, as the price of Bitcoin fell more than 36% from its mid-October all-time high, eroding miner revenues and margins.

As reported by Cointelegraph, the industry entered one of its most severe economic downturns in November, driven by collapsing revenue and elevated price volatility.

Data from The Miner Mag showed a widening performance gap between average miners and the most efficient operators, underscoring that scale and cost efficiency are increasingly critical for survival during prolonged downturns.

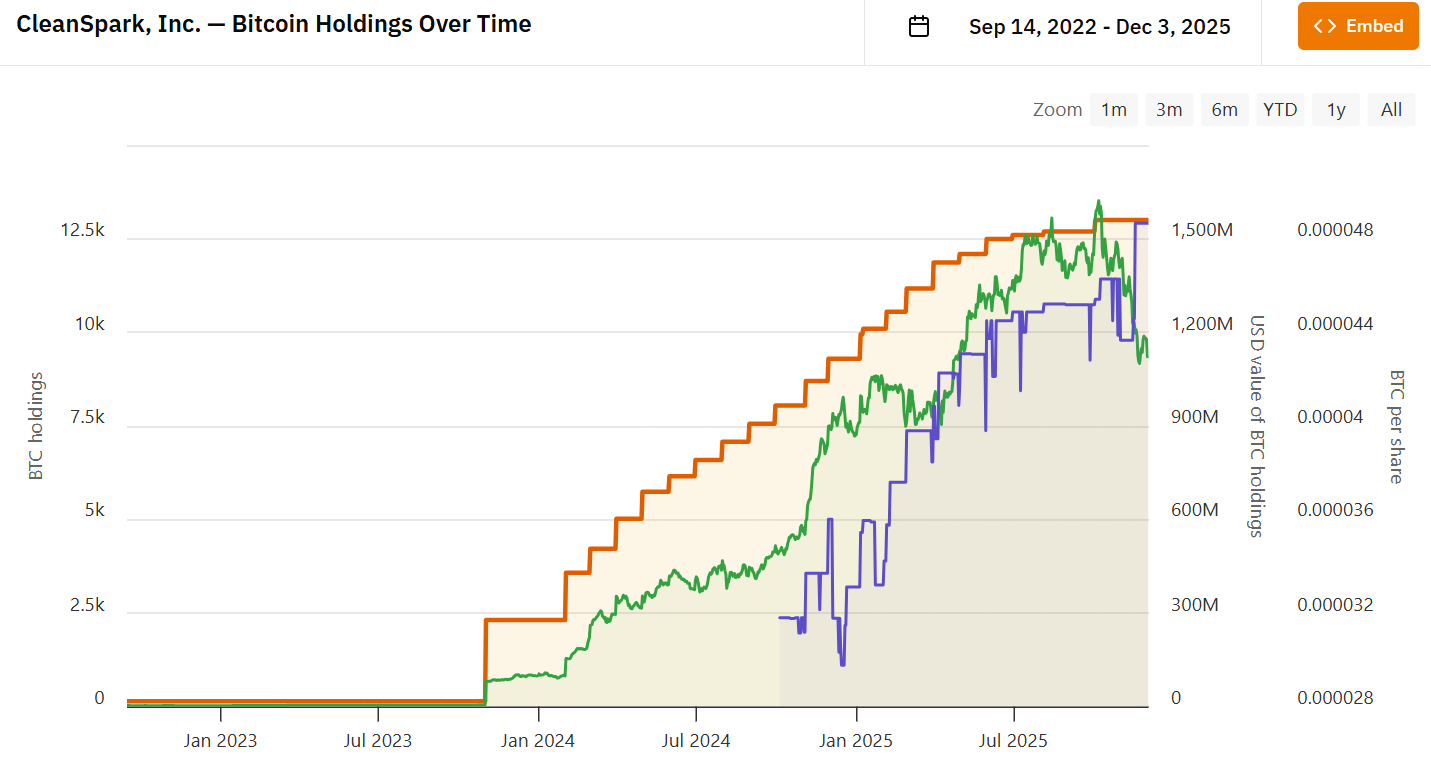

CleanSpark has amassed more than 13,000 BTC on its balance sheet. Source: BitcoinTreasuries.NET

Mining-related equities have declined sharply as a result. Shares of MARA Holdings, Riot Platforms and HIVE Digital Technologies have all come under significant pressure.

Although CleanSpark has continued to operate through the downturn, its shares have also fallen more than 30% since mid-October.

Magazine: 7 reasons why Bitcoin mining is a terrible business idea

Expert analysts from firms like JPMorgan have noted that miners with diversified power sources and low-cost energy, such as CleanSpark, are better positioned to weather volatility. For instance, CleanSpark’s self-mining rate remained above 90% in November, far exceeding industry averages of 70-80%, according to reports from Cambridge Centre for Alternative Finance. This efficiency allows the company to retain more BTC on its balance sheet, now exceeding 13,000 BTC, providing a buffer against price swings.

The broader mining sector faces additional pressures from post-halving economics, where block rewards halved in April 2024, further compressing margins. CleanSpark’s response includes aggressive infrastructure growth, with the 1.4 GW power capacity enabling potential for 20-30% annual production increases if market conditions stabilize. Quotes from CEO Matt Schultz emphasize a commitment to sustainable growth: “Our focus on zero-cost financing and efficient scaling positions us to thrive long-term.”

Frequently Asked Questions

What Factors Contributed to CleanSpark’s 11% Production Increase in November 2025?

CleanSpark’s 11% production rise to 587 BTC in November 2025 stemmed from optimized mining efficiency, expanded power contracts reaching 1.4 GW, and strategic equipment upgrades. Despite Bitcoin’s price decline, the company’s low operational costs and focus on high-performance ASICs ensured steady output, as confirmed by internal financial disclosures.

How Can Bitcoin Miners Like CleanSpark Survive Market Downturns?

Bitcoin miners like CleanSpark can navigate downturns by securing low-cost renewable energy, diversifying revenue through hosting services, and holding BTC reserves for price recovery. CleanSpark’s approach includes no-interest financing for expansion and maintaining over 13,000 BTC on balance, allowing flexibility until market stabilization, which experts predict within 6-12 months based on historical cycles.

Key Takeaways

- CleanSpark Achieved 587 BTC Mined in November: This 11% growth highlights operational resilience despite a 36% Bitcoin price drop, setting a benchmark for efficiency in the sector.

- Power Capacity Expansion to 1.4 GW: Securing additional electricity supports scalable mining, enabling future deployments of advanced hardware to boost output by up to 25% annually.

- Strengthened Financial Position: The $1.15 billion convertible note funds balance sheet improvements and share repurchases, providing stability amid industry-wide equity pressures.

Conclusion

CleanSpark’s November Bitcoin production surge to 587 BTC and power expansion beyond 1.4 GW exemplify strategic adaptability in a strained mining landscape marked by price volatility and tightening margins. As the company builds on fiscal 2025’s revenue doubling to $766.3 million, investors should monitor ongoing efficiency gains and BTC holdings exceeding 13,000. With focused infrastructure investments, CleanSpark is poised for recovery as Bitcoin markets stabilize in the coming quarters—consider evaluating similar resilient players for portfolio diversification.