CME Launches Bitcoin Volatility Index to Aid Crypto Risk Pricing

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The CME Group has launched new cryptocurrency benchmarks, including the CME CF Bitcoin Volatility Index, to enhance risk pricing in futures and options markets. This suite covers Bitcoin, Ether, Solana, and XRP, providing standardized volatility data akin to the VIX for traditional assets, aiding institutional traders in managing market uncertainty.

-

CME CF Cryptocurrency Benchmarks introduce standardized pricing for major digital assets like Bitcoin and Ether.

-

The Bitcoin Volatility Index tracks implied volatility in futures options, offering a 30-day price movement gauge.

-

Institutional derivatives volume hit a record $900 billion in Q3, with open interest averaging $31.3 billion daily.

Discover how CME’s new Bitcoin Volatility Index revolutionizes crypto risk management for traders. Explore benchmarks for BTC, ETH, SOL, and XRP—stay ahead in volatile markets today!

What is the CME Bitcoin Volatility Index?

The CME Bitcoin Volatility Index is a new benchmark launched by the CME Group that measures the implied volatility of Bitcoin and Micro Bitcoin Futures options, providing a standardized view of expected price movements over the next 30 days. It functions similarly to the VIX in equity markets, helping traders quantify market uncertainty and improve risk pricing across crypto derivatives. This tool is designed for institutional use, integrating familiar volatility metrics into the cryptocurrency space.

How do CME’s cryptocurrency benchmarks support institutional trading?

The CME CF Cryptocurrency Benchmarks offer a comprehensive suite for assets including Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP, delivering real-time standardized pricing and volatility data. Announced by the Chicago-based exchange, these benchmarks enable traders to apply traditional market tools to crypto, enhancing options pricing and hedging strategies against price swings. According to CME Group data, they track implied volatility derived from options markets, serving as a key reference for risk assessment without being directly tradable.

Source: CME Group

Volatility benchmarks like this have been essential in traditional finance for decades, underpinning derivatives trading by allowing participants to hedge against uncertainty and develop volatility-focused strategies. In the crypto realm, where price fluctuations can be extreme, the CME CF Bitcoin Volatility Index provides a much-needed gauge of market sentiment, reflecting trader expectations for Bitcoin’s near-term behavior.

Tim McCourt, CME Group’s Global Head of Equity and FX Products, emphasized the significance in a statement: “These benchmarks bring the rigor of traditional volatility measures to the cryptocurrency market, empowering institutions to navigate crypto’s unique risks with precision.” This launch aligns with growing institutional adoption, as evidenced by surging derivatives activity on the platform.

Frequently Asked Questions

What assets are covered by the new CME CF Cryptocurrency Benchmarks?

The CME CF Cryptocurrency Benchmarks include pricing and volatility data for Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP. These benchmarks provide standardized references for institutional traders, facilitating better integration of crypto into broader portfolios through familiar futures and options frameworks. Launched in late 2024, they aim to support over $900 billion in quarterly derivatives volume as reported by CME.

How has institutional activity in crypto derivatives evolved on CME?

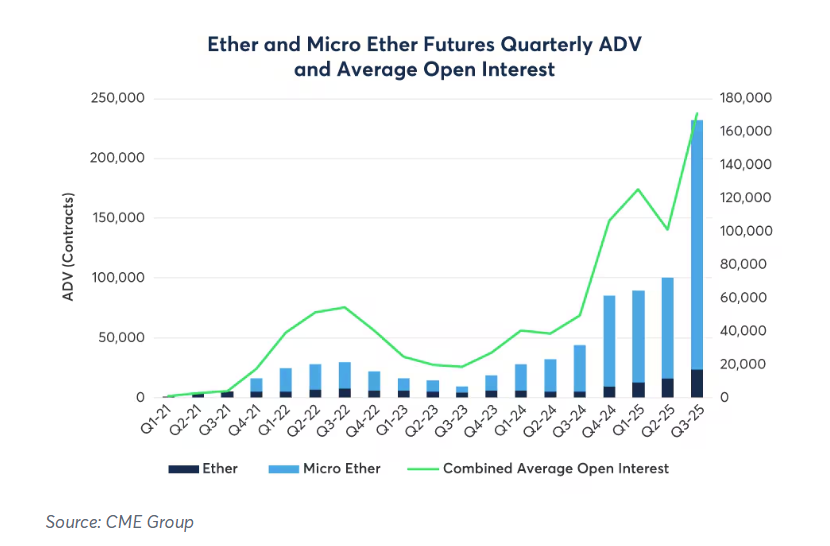

Institutional interest in cryptocurrency derivatives on the CME has grown significantly, driven by spot ETFs and expanded futures trading for assets like Bitcoin and Ether. The third quarter saw record volumes exceeding $900 billion in combined futures and options, with average daily open interest reaching $31.3 billion. This indicates deeper market commitment and liquidity, particularly in Ether futures, which have seen sharp increases alongside Bitcoin activity.

Ether-based crypto derivatives trading activity. Source: CME Group

Crypto options markets have experienced robust growth, with Ether and Micro Ether futures volumes climbing amid broader institutional inflows. Despite the spotlight on spot Bitcoin ETFs, derivatives remain a cornerstone for sophisticated trading, allowing for leveraged exposure and risk mitigation. Open interest levels signal sustained capital allocation, pointing to increased confidence in crypto as an asset class.

Related: CME rekindles ETH ‘super-cycle’ debate as Ether futures volume tops Bitcoin. The expansion beyond Bitcoin underscores a maturing market, where diversified derivatives offerings attract more participants seeking to balance portfolios across multiple digital assets.

Experts from the financial sector, including analysts at major institutions, note that these developments could further bridge traditional and crypto finance. For instance, volatility indices like the one introduced help in constructing strategies that were previously challenging due to data inconsistencies in crypto markets.

Key Takeaways

- Standardized Volatility Tools: The CME CF Bitcoin Volatility Index mirrors the VIX, tracking 30-day implied volatility for better crypto risk pricing.

- Broad Asset Coverage: Benchmarks extend to Ether, Solana, and XRP, supporting diverse institutional trading strategies.

- Record Market Activity: Q3 derivatives volume surpassed $900 billion, highlighting growing liquidity and open interest of $31.3 billion daily.

Conclusion

The introduction of the CME Bitcoin Volatility Index and broader CME CF Cryptocurrency Benchmarks marks a pivotal advancement in institutional crypto trading, offering volatility insights that parallel traditional markets for assets like Bitcoin and Ether. By providing reliable data for risk management, these tools foster greater adoption and market stability. As institutional volumes continue to rise, traders are well-positioned to capitalize on crypto’s potential—consider integrating these benchmarks into your strategies for enhanced decision-making in this dynamic landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

ETH Remains the Largest Long Position Despite ~$39.4M Unrealized Losses, Led by BTC OG Insider Whale on Hyperliquid

December 31, 2025 at 02:36 AM UTC