Coinbase $667 Million Net Loss in Q4 2025

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

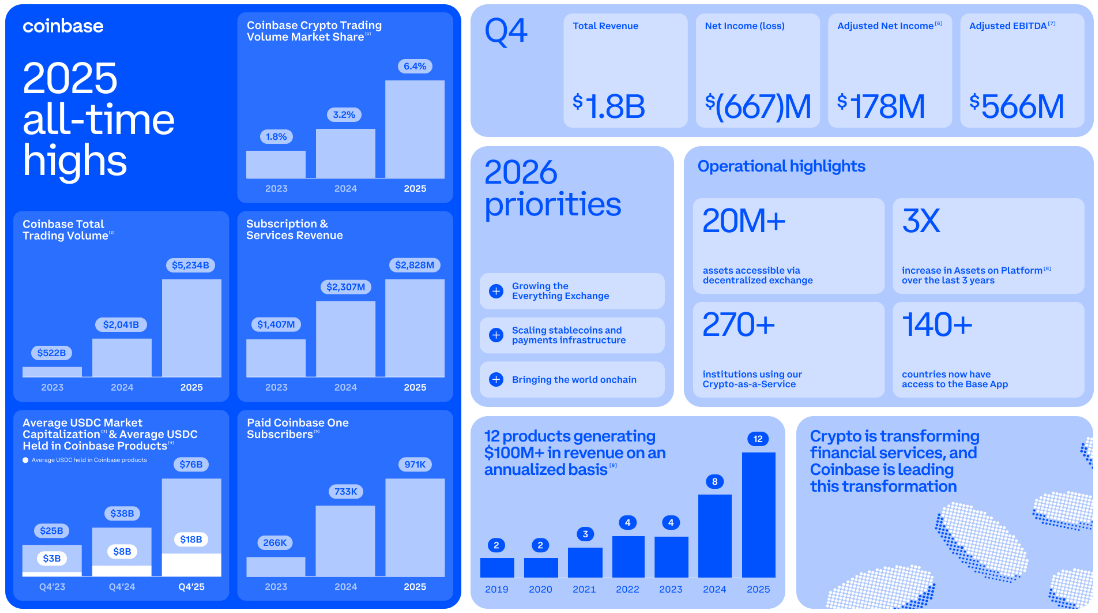

Coinbase announced a net loss of 667 million dollars in the fourth quarter of 2025, ending its eight-quarter profitability streak. Earnings per share of 0.66 dollars missed analyst expectations of 0.92 dollars by a 0.26 dollar margin. Net revenue fell to 1.78 billion dollars with a 21.5% annual decline and failed to meet the 1.85 billion dollar estimate. Transaction revenues decreased by 37% to 982.7 million dollars, while subscription and service revenues increased by 13% to 727.4 million dollars.

Key financial results for Coinbase in Q4 and the 2025 financial year. Source: Coinbase

Coinbase's Q4 2025 Loss and Its Connection to the BTC Market Decline

This marks Coinbase's first net loss since Q3 2023, coinciding with the crypto market's decline during the quarter; Bitcoin (BTC) fell 30% from its early October peak of 126.080 dollars to 88.500 dollars on December 31. Since the beginning of the year, BTC has lost 25.6% of its value, dropping to 65.760 dollars. Despite the loss report, COIN shares rose 2.9% in Thursday's after-hours trading to 145.18 dollars. The company described 2025 as a strong year operationally and financially.

Binance SAFU Fund and Goldman Sachs BTC Purchases

Despite the market decline, institutional interest continues. According to Arkham data, Binance's SAFU fund address purchased 4.545 BTC worth 304.58 million dollars. Goldman Sachs holds 1.1 billion dollars worth of BTC, 1 billion dollars worth of ETH, 153 million dollars worth of XRP, and 108 million dollars worth of SOL. These purchases signal bottom hunters in the BTC detailed analysis.

February 9, 2026 BTC and ETH ETF Flows

ETF data signals recovery: On February 9, Bitcoin ETFs recorded 144.9 million dollars in net inflows, and Ethereum ETFs recorded 57 million dollars in net inflows. These flows could support Coinbase's growth in subscription revenues.

BTC Current Technical Analysis and Levels

BTC is currently at 66.400 dollars, down -0.93% in 24 hours. RSI 29.40 (oversold), downtrend, and bearish Supertrend. EMA 20: 75.382 dollars. Supports: S1 65.415 dollars (strong, 75% score), S2 59.962 dollars. Resistances: R1 70.564 dollars (65% score). Investors should monitor these levels for BTC futures. A similar recovery is expected in the ETH detailed analysis.