Coinbase Agrees to Acquire Prediction Markets Startup, Aiming to Broaden Exchange Offerings

POL/USDT

$41,348,285.31

$0.1092 / $0.1005

Change: $0.008700 (8.66%)

+0.0024%

Longs pay

Contents

Coinbase’s acquisition of The Clearing Company marks a strategic expansion into on-chain prediction markets, integrating digital assets, politics, sports, and culture. This move supports Coinbase’s vision as an “Everything Exchange,” broadening offerings beyond crypto trading with stock and event-based products, set to close in January.

-

Coinbase acquires The Clearing Company to enhance prediction markets infrastructure.

-

The startup, founded in 2025, focuses on blockchain-based contracts for real-world outcomes.

-

Prediction markets have seen surging activity post-2024 U.S. election, with volumes exceeding billions in trades.

Coinbase acquires The Clearing Company to enter prediction markets. Discover how this boosts crypto trading and event contracts. Explore impacts on finance now!

What is Coinbase’s Acquisition of The Clearing Company?

Coinbase’s acquisition of The Clearing Company represents a pivotal step in diversifying its platform beyond traditional cryptocurrency trading. The deal involves purchasing the on-chain prediction markets startup, which specializes in markets for digital assets, politics, sports, and culture. Expected to finalize in January, this acquisition aligns with Coinbase’s “Everything Exchange” initiative, enabling users to trade crypto, equities, and prediction contracts on a unified platform.

Coinbase is buying The Clearing Company as it expands into prediction markets and broadens its product lineup beyond crypto trading.

Coinbase has agreed to acquire The Clearing Company, an on-chain prediction markets startup that spans digital assets, politics, sports and culture, as it expands its push to become an “Everything Exchange” offering a broad range of investment products.

In an announcement, Coinbase said it has entered into a definitive agreement to acquire The Clearing Company, with the transaction expected to close in January. Financial terms of the deal were not disclosed.

The acquisition marks a rapid turnaround for The Clearing Company, which was founded earlier this year and counted Coinbase Ventures among its investors in a $15 million funding round alongside Union Square Ventures, Haun Ventures and several other venture firms and angel investors.

The Clearing Company is an on-chain prediction markets platform built by veterans of the cryptocurrency, prediction markets and cloud infrastructure sectors. It was founded by Toni Gemayel, who previously worked with prediction market platforms Polymarket and Kalshi. Its broader team brings experience from companies including Polymarket, 0x, Dune and Coinbase.

Coinbase unveiled the acquisition less than a week after announcing its entry into prediction markets as part of its broader “Everything Exchange” strategy in partnership with Kalshi.

At the same time, Coinbase said it will begin offering stock trading, further broadening its product lineup beyond digital assets.

Taken together, the acquisition highlights how event-based markets are moving closer to the regulated financial mainstream, with cryptocurrency infrastructure increasingly serving as the backbone for emerging market types.

“The Everything Exchange is a unified platform to trade crypto, equities, and everything else people want to trade,” Max Branzburg, Coinbase’s vice president of product management, stated. “Prediction markets are an important part of that platform.”

A Coinbase spokesperson added that markets tied to real-world outcomes represent “a natural extension of modern financial infrastructure.”

Source: Haun Ventures

This momentum is unfolding alongside a shifting regulatory landscape. Last month, The Clearing Company applied with the US Commodity Futures Trading Commission to become a Derivatives Clearing Organization, in a step that could further integrate prediction markets into established financial frameworks.

Coinbase’s push into prediction markets comes as the company increasingly views the sector as a major growth opportunity rather than a niche product.

In its latest market outlook report, Coinbase identified prediction markets as one of the most important categories to watch through 2026, citing rising user engagement, regulatory clarity, and expanding real-world use cases.

In the report, Coinbase pointed to a tax provision in US President Donald Trump’s “One Big Beautiful Bill,” which would limit the deductibility of gambling losses against winnings to 90%, down from the current 100%.

While the change may appear modest, Coinbase warned it could result in taxpayers being taxed on so-called “phantom income,” even in cases where net winnings are minimal or losses are incurred.

In this environment, Coinbase argued that prediction markets, which rely on contracts structurally similar to derivatives, could emerge as a more tax-efficient alternative to traditional sportsbooks and casinos, particularly if they are treated differently under the tax code.

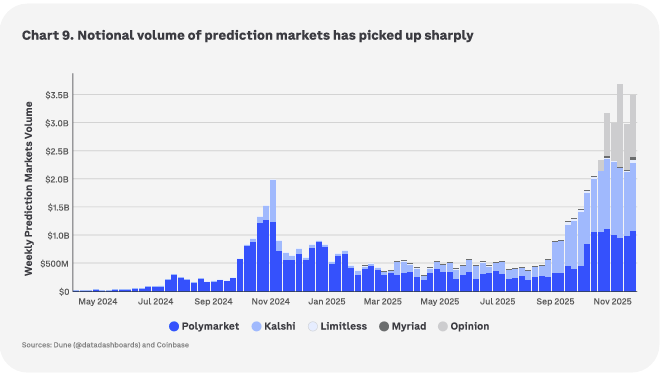

Prediction market activity has surged since the 2024 US presidential election. Source: Coinbase

While prediction markets remain a relatively nascent industry, the space is already dominated by a handful of major players. Chief among them is Polymarket, a decentralized platform built on the Polygon network that allows users to trade on political, economic and cultural outcomes using blockchain-based contracts.

Kalshi has also emerged as a leading centralized player, operating under US regulatory oversight. Meanwhile, publicly traded sports betting company DraftKings has entered the prediction markets space, with plans to eventually offer crypto-linked contracts.

DraftKings would join a growing list of companies signaling interest in the sector, including Bitnomial Clearinghouse, a derivatives clearing organization and crypto exchange Gemini.

How Do Prediction Markets Benefit from Coinbase’s Expansion?

Prediction markets gain significant advantages through Coinbase’s expansion by leveraging its established user base and regulatory compliance expertise. These platforms allow traders to bet on future events using blockchain-secured contracts, offering transparency and efficiency not found in traditional betting systems. According to Coinbase’s market outlook, user engagement in prediction markets has grown by over 300% since the 2024 U.S. presidential election, driven by real-world applications in politics and economics.

The integration of The Clearing Company’s technology enables seamless on-chain settlements, reducing counterparty risks. Experts like Toni Gemayel, founder of The Clearing Company, emphasize that combining crypto infrastructure with prediction tools creates “a more accessible way for everyday investors to hedge against uncertainties.” Supporting data from industry reports shows that platforms like Polymarket handled more than $3.7 billion in election-related trades alone, underscoring the sector’s potential.

Regulatory progress further bolsters this benefit; The Clearing Company’s recent application to the U.S. Commodity Futures Trading Commission for Derivatives Clearing Organization status could standardize operations. This move not only enhances trust but also positions prediction markets as viable alternatives to speculative investments, with lower barriers for retail participation. Short sentences highlight key benefits: faster payouts, diverse event coverage, and blockchain immutability ensure reliable outcomes.

Frequently Asked Questions

What Does Coinbase’s Acquisition of The Clearing Company Mean for Crypto Users?

Coinbase’s acquisition of The Clearing Company opens up prediction markets for crypto users, allowing bets on politics, sports, and more via blockchain. This expands trading options on the “Everything Exchange,” with expected closure in January, enhancing accessibility without leaving the crypto ecosystem.

Why Are Prediction Markets Growing in Popularity After the 2024 Election?

Prediction markets have surged since the 2024 U.S. election due to their accuracy in forecasting outcomes and rising interest in event-based trading. Platforms like Polymarket and Kalshi report billions in volume, as users seek data-driven insights on real-world events, all powered by secure, transparent blockchain technology.

Key Takeaways

- Coinbase’s Strategic Acquisition: Buying The Clearing Company accelerates entry into prediction markets, diversifying beyond crypto with on-chain tools.

- Regulatory Momentum: Applications to bodies like the CFTC signal integration of prediction markets into mainstream finance, boosting legitimacy.

- Growth Opportunities: Users can now explore event contracts for hedging; monitor tax changes for efficient alternatives to traditional betting.

Conclusion

In summary, Coinbase’s acquisition of The Clearing Company and its push into prediction markets underscore a transformative shift in financial services, blending cryptocurrency with event-based trading for broader accessibility. As regulatory frameworks evolve, this positions Coinbase as a leader in the “Everything Exchange.” Investors should watch for January’s closure and explore these opportunities to diversify portfolios amid growing market adoption.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026