Coinbase Enables Solana Token Trading via DEX Integration Without Listings

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Coinbase has integrated with Solana’s DeFi ecosystem, enabling users to trade any Solana token directly through decentralized exchange rails without requiring formal listings. This move provides seamless access to native Solana assets for millions of users, boosting liquidity and adoption in the fast-growing network.

-

Coinbase’s DEX integration allows trading of all Solana tokens without listings, democratizing access for issuers and builders.

-

This follows a similar rollout for Base blockchain tokens, with plans to expand to more networks soon.

-

Solana’s DeFi sector shows robust growth, processing $35.9 billion in peak daily DEX volume and advancing institutional-grade strategies.

Coinbase Solana DEX integration unlocks trading of native tokens without listings, enhancing DeFi access for users. Explore how this boosts liquidity and ecosystem growth—start trading Solana assets today.

What is Coinbase’s Solana DEX Integration?

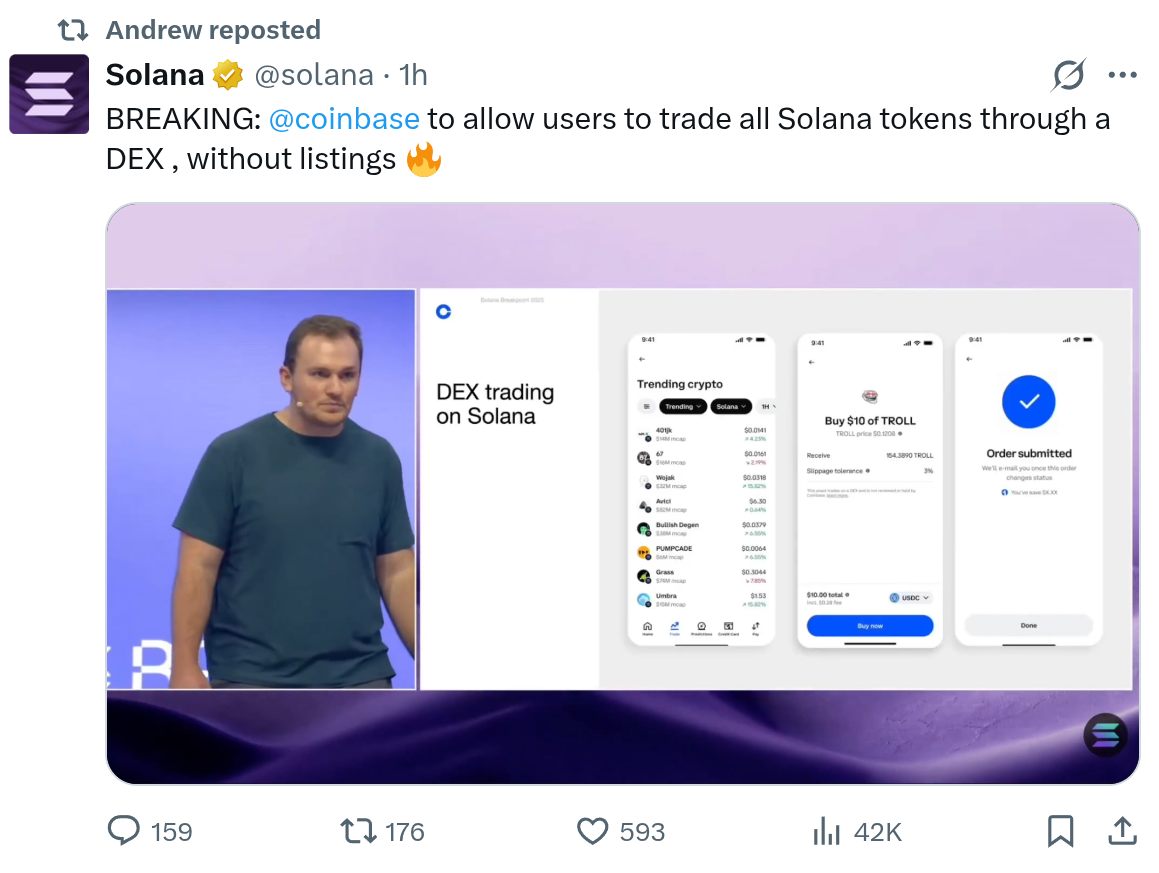

Coinbase Solana DEX integration enables users to trade any native Solana token directly through decentralized exchange mechanisms within the Coinbase app, bypassing traditional listing processes. This development, announced by Coinbase protocol specialist Andrew Allen, marks a significant step in bridging centralized and decentralized finance. Users will soon see Solana assets natively supported, offering improved accessibility and efficiency.

Coinbase has integrated directly into Solana’s fast-growing DeFi ecosystem, allowing users to trade any Solana token via DEX rails without formal listings. This enhances liquidity and user access in decentralized finance.

Coinbase is advancing its presence in the Solana ecosystem by enabling the trading of native Solana tokens via decentralized exchange integration, moving away from conventional listing requirements.

Andrew Allen, Coinbase protocol specialist, stated in an X post that the platform now supports trading of all Solana (SOL) tokens through DEX integration, emphasizing “without listings.” He added that native Solana assets will soon appear directly in the Coinbase app.

“For issuers and builders, if your token has sufficient liquidity, this means you can be accessible to the millions of users on Coinbase without getting listed,” Allen explained.

This follows Coinbase’s earlier integration of tokens from its Base blockchain using a comparable DEX approach in early August. The company intends to broaden DEX support to additional networks, beginning with Solana.

Source: Andrew Allen/Solana

How Does Solana’s DeFi Ecosystem Support This Integration?

Solana’s decentralized finance ecosystem has experienced explosive growth, making it an ideal partner for Coinbase’s integration. The network’s high-speed transactions and low fees have attracted significant DeFi activity, with total value locked surpassing key benchmarks in recent months. According to data from DeFi analytics platforms, Solana DEX volumes have consistently ranked among the highest, reflecting strong user engagement and protocol innovation.

Earlier this week, DeFi firm Ellipsis Labs unveiled its Solana-based perpetual swap DEX, which operates fully onchain—including its risk engine and matching systems. This allows developers to build upon it seamlessly, though the platform remains in private beta for now. Such advancements underscore Solana’s maturing infrastructure, capable of handling complex financial instruments at scale.

The “Solana Lending Markets Report 2025,” released by DeFi infrastructure provider Redstone, highlights the network’s evolution toward institutional standards. It notes that Solana DeFi strategies now exhibit sophisticated risk management and yield optimization features. Redstone reports that Solana achieved a peak daily DEX volume of $35.9 billion, positioning it as a leader in onchain finance. The firm anticipates further expansion into tokenized real-world assets and institutional deployments, potentially unlocking trillions in value through Internet Capital Markets.

“Bringing traditional finance onchain at scale can unlock trillions in Internet Capital Markets. Solana’s infrastructure is positioned to capture a significant share of this expansion,” a Redstone representative commented.

Frequently Asked Questions

What Benefits Does Coinbase’s Solana Integration Offer to Token Issuers?

The integration allows token issuers with adequate liquidity to reach Coinbase’s vast user base without undergoing lengthy listing reviews, reducing barriers to entry and accelerating adoption in the Solana ecosystem. This fosters broader DeFi participation while maintaining high standards for asset accessibility.

How Will Users Access Solana Tokens on Coinbase After the Integration?

Users can soon trade Solana tokens natively within the Coinbase app via the DEX rails, experiencing a streamlined interface that combines centralized ease with decentralized benefits. This setup ensures fast, secure transactions without needing external wallets or bridges, ideal for both novice and experienced traders.

Centralized and Decentralized Exchanges: A Growing Convergence

The Coinbase Solana DEX integration exemplifies a larger industry shift where centralized platforms incorporate decentralized elements to enhance functionality. This hybrid model addresses user demands for speed, cost-efficiency, and self-custody options, blurring the lines between traditional and DeFi trading environments.

Centralized exchanges like Coinbase are evolving into user-friendly gateways for DEXs, improving accessibility for mainstream audiences. In October, 1inch co-founder Sergej Kunz predicted that centralized entities would transition into frontends for DeFi protocols, a trend gaining momentum. DEXs now offer competitive advantages, including faster executions and reduced fees, drawing significant trading volumes.

Data from DeFi tracking services indicates that DEX platforms collectively handled nearly $12 billion in trades over the past 24 hours, outpacing Coinbase’s spot volume of $2.566 billion and approaching Binance’s $18 billion figure. This surge demonstrates DeFi’s viability as a core component of global crypto trading.

Other major exchanges have followed suit: OKX introduced DEX trading in mid-November, while Binance enabled cross-exchange trades on Solana, Ethereum, Base, and BNB Smart Chain in late March. These developments signal a maturing market where interoperability drives innovation and liquidity across ecosystems.

Key Takeaways

- Seamless Token Trading: Coinbase’s integration lets users access all Solana tokens via DEX without listings, simplifying DeFi entry for millions.

- Ecosystem Growth: Solana’s DeFi sector boasts $35.9 billion peak DEX volume, supporting advanced lending and perpetual swaps for institutional use.

- Industry Trend: Centralized platforms are adopting DEX features, boosting overall liquidity and preparing for tokenized asset expansions.

Conclusion

The Coinbase Solana DEX integration represents a pivotal advancement in connecting centralized trading with Solana’s thriving DeFi landscape, enabling efficient token access and liquidity for users and builders alike. As Solana’s ecosystem continues to innovate with onchain solutions and institutional tools, this partnership could accelerate broader adoption of decentralized finance. Stay informed on these developments to capitalize on emerging opportunities in the evolving crypto market.