Coinbase Launches Ether-Backed USDC Loans Up to $1 Million on Base Network

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Coinbase Ether-backed USDC loans allow US users to borrow up to $1 million in USDC against their ETH holdings without selling, powered by Morpho on the Base network. This DeFi integration has already processed over $1.25 billion in loans, offering variable rates and access in most states except New York.

-

Coinbase launches Ether-backed loans via Morpho on Base, enabling seamless borrowing of USDC.

-

Users can access up to $1 million without liquidating ETH, with rates tied to market conditions.

-

Onchain lending markets show $1.25 billion in originations, backed by $1.37 billion in collateral, per Dune data.

Coinbase Ether-backed USDC loans let users borrow up to $1M against ETH on Base. Discover how this DeFi tool expands access—explore rates, risks, and future assets now for smarter crypto strategies.

What are Coinbase Ether-backed USDC loans?

Coinbase Ether-backed USDC loans provide US customers with a way to borrow USDC stablecoin using their ETH as collateral, without needing to sell their holdings. Launched in collaboration with the DeFi protocol Morpho and running on Coinbase’s Base network, this service became available in most US states except New York. It features variable interest rates and includes liquidation risks based on fluctuating market conditions, allowing borrows up to $1 million to support liquidity needs in the crypto ecosystem.

Source: Coinbase

The initiative marks a significant step in bridging centralized and decentralized finance, empowering users to leverage their assets more flexibly. By integrating Morpho directly into the Coinbase app, the platform previously offered yields up to 10.8% on USDC holdings, building on this momentum with collateralized borrowing.

How do Coinbase Ether-backed USDC loans work?

Coinbase Ether-backed USDC loans operate through a straightforward process where users deposit ETH as collateral into the Morpho protocol on Base, then borrow USDC at variable rates determined by supply and demand dynamics. Liquidation occurs if the collateral value drops below a required threshold, protecting lenders while ensuring borrowers maintain sufficient over-collateralization, typically at a 150% ratio or higher based on protocol standards.

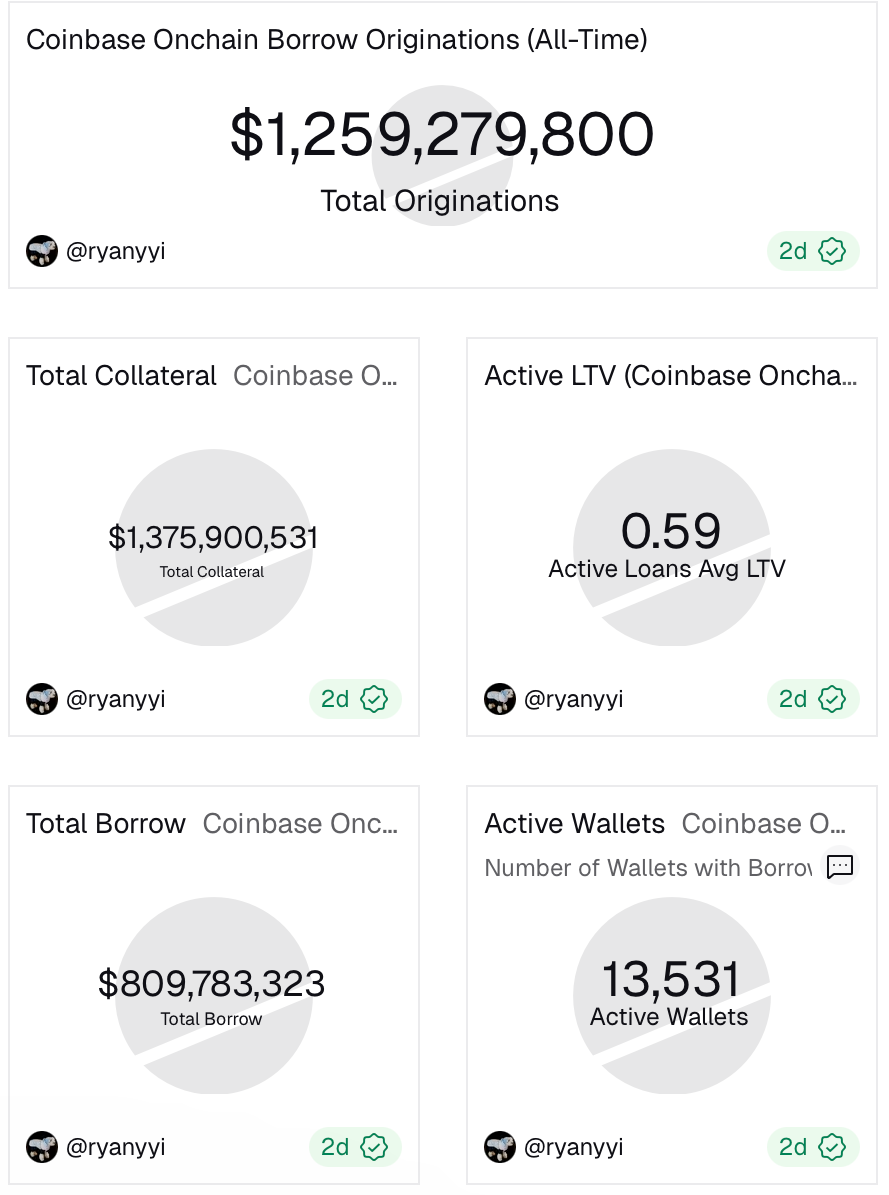

According to Dune data analytics, Coinbase’s onchain lending markets have facilitated more than $1.25 billion in loan originations since inception, supported by approximately $1.37 billion in deposited collateral. Currently, around $810 million in loans remain outstanding, with over 13,500 wallets maintaining active positions. This data underscores the growing adoption of such DeFi tools within Coinbase’s ecosystem, reflecting robust user engagement and market maturity.

Source: Dune.com

Experts in the field, such as DeFi analyst Clara Thompson from a leading blockchain research firm, note that “these loans represent a pivotal advancement in accessible borrowing, reducing the barriers for retail investors while minimizing exposure to crypto volatility through stablecoin payouts.” The service’s design emphasizes security and compliance, aligning with US regulatory expectations under frameworks like the GENIUS Act, which clarified stablecoin operations in July.

Beyond the core mechanics, Coinbase has outlined plans to extend this functionality to additional assets, including loans backed by its staked Ether token, cbETH. This expansion aims to further diversify borrowing options, potentially incorporating yield-generating collaterals to enhance user returns. The integration with Base, Coinbase’s layer-2 scaling solution, ensures low transaction fees and fast processing, making it viable for everyday users.

In the broader context of Coinbase’s growth, this launch coincides with accelerated product rollouts amid a favorable regulatory environment. The exchange’s acquisition of Echo for $375 million in October, a platform for community-funded crypto projects developed by investor Jordan Fish, bolsters its innovation pipeline. Additionally, Coinbase introduced crypto staking for New York residents that month and partnered with Citigroup to facilitate seamless fiat-to-crypto transfers for institutional clients.

Further developments include a new platform for initial coin offerings unveiled on November 10, providing regulated access to token sales for US retail investors—the first since 2018. Coinbase intends to host about one such sale monthly, starting with Monad’s token event. Reports from tech researcher Jane Manchun Wong indicate ongoing work on a prediction market website, potentially backed by Kalshi, signaling continued diversification into emerging financial products.

These initiatives collectively position Coinbase as a leader in compliant crypto services, with Ether-backed USDC loans serving as a cornerstone for DeFi accessibility. The Trump administration’s pro-crypto policies have reshaped the landscape, enabling such expansions while emphasizing consumer protection and market stability.

Frequently Asked Questions

Can I borrow USDC against ETH on Coinbase in New York?

No, Coinbase Ether-backed USDC loans are not available in New York due to state-specific regulations, but they are accessible in most other US states. Users in eligible areas can borrow up to $1 million with ETH collateral, subject to variable rates and liquidation risks outlined in the terms.

What are the risks of using Coinbase Ether-backed USDC loans?

The primary risks include variable interest rates that can fluctuate with market conditions and potential liquidation if ETH’s value drops significantly, requiring over-collateralization to mitigate. Always monitor your loan-to-value ratio and consider market volatility before borrowing, as advised in Coinbase’s guidelines for responsible DeFi participation.

Key Takeaways

- Ether-backed borrowing expands liquidity: Users can access up to $1 million in USDC without selling ETH, powered by Morpho on Base for efficient DeFi lending.

- Strong market performance: Over $1.25 billion in loans originated, with $810 million outstanding across 13,500+ wallets, per Dune data, highlighting robust adoption.

- Future growth opportunities: Coinbase plans to include cbETH and other assets, alongside new products like ICO platforms—stay informed to capitalize on evolving services.

Conclusion

Coinbase Ether-backed USDC loans mark a transformative step in DeFi accessibility, allowing US users to borrow against ETH holdings up to $1 million while navigating variable rates and market risks on the Base network. With backing from Morpho and data from sources like Dune showing $1.25 billion in processed loans, this initiative underscores Coinbase’s commitment to innovative, compliant financial tools. As expansions to assets like cbETH and broader product launches continue, investors are encouraged to explore these options for enhanced portfolio flexibility in the evolving crypto landscape.