Coinbase May Launch Prediction Markets and Tokenized Stocks via December Livestream

Contents

Coinbase is set to launch prediction markets and tokenized equities next week via a livestream, following its membership in a coalition with Kalshi and other US operators. This move expands the largest US crypto exchange’s offerings into event-based trading and asset tokenization, aiming to democratize financial access.

-

Coinbase joins Coalition for Prediction Markets with Kalshi and Crypto.com to advocate for regulatory clarity.

-

The exchange plans a December 17 livestream to unveil new products, potentially including these features.

-

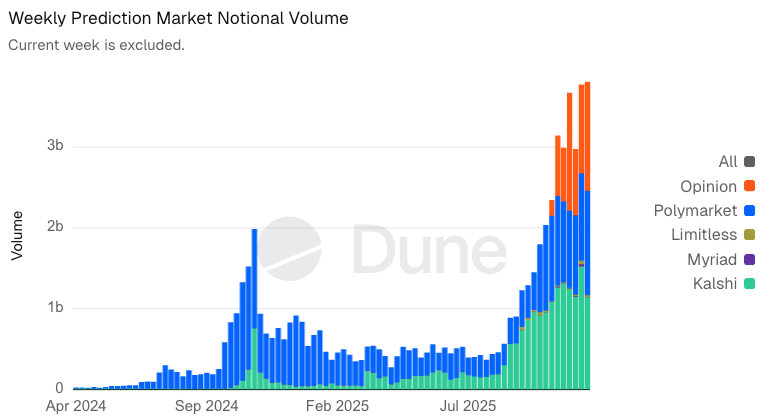

Prediction markets have seen weekly trading volumes reach nearly $4 billion, driven by platforms like Kalshi with $1 billion in activity.

Coinbase prediction markets launch: Join the coalition push with Kalshi for tokenized stocks and event trading. Discover how this boosts crypto innovation—watch the livestream and stay ahead in 2025 finance.

What is Coinbase’s Push into Prediction Markets?

Coinbase prediction markets represent the exchange’s strategic entry into event-based trading platforms, allowing users to wager on real-world outcomes like elections or economic events, similar to financial derivatives. According to Bloomberg reports citing anonymous sources, Coinbase, the largest US cryptocurrency exchange by trading volume, will unveil these markets alongside tokenized stocks during a livestream on December 17. This initiative builds on earlier preparations spotted by tech researcher Jane Manchun Wong, who noted landing pages for these products nearly a month ago, positioning Coinbase to capitalize on the booming sector.

How Does Coinbase’s Coalition with Kalshi Enhance Prediction Markets?

The Coalition for Prediction Markets (CPM), announced by Kalshi and Crypto.com, now includes Coinbase as a key member, focusing on engaging US policymakers to maintain access to these innovative trading tools. Founded in 2018 by MIT graduates Tarek Mansour and Luana Lopes Lara, Kalshi enables trading on event outcomes treated as assets, boasting weekly volumes of about $1 billion per Dunedata figures on Dune Analytics. Coinbase’s chief policy officer, Faryar Shirzad, emphasized the mission: “At Coinbase, our mission is to deliver financial freedom to the world—and prediction markets by nature democratize fact finding and the seeking of truth.” This coalition arrives amid surging interest, with overall prediction market volumes hitting a record near $4 billion last week, though some experts debate the precision of these figures. Rival platforms like Polymarket and Opinion are also thriving, while Crypto.com announced its dedicated platform in October, integrated with Trump Media. Meanwhile, Gemini, founded by the Winklevoss twins, received Commodity Futures Trading Commission (CFTC) approval on Wednesday to offer prediction markets in the US. The CFTC has recently provided leeway on data and record-keeping rules for these markets, fostering growth. Coinbase’s involvement underscores its commitment to expanding beyond traditional crypto trading, blending blockchain with real-world finance to offer tokenized versions of equities, potentially broadening investor participation.

Source: Tarek Mansour

Prediction markets have evolved significantly since their inception, providing a mechanism for crowdsourced forecasting that often outperforms traditional polls. Platforms like Kalshi operate under CFTC regulation, ensuring compliance while innovating in areas such as climate events, economic indicators, and geopolitical developments. Coinbase’s entry could standardize these offerings across the crypto ecosystem, leveraging its robust infrastructure to handle high-volume trades securely. Experts note that tokenized stocks—digital representations of traditional equities on blockchain—could reduce barriers to entry, allowing fractional ownership and 24/7 trading. Bloomberg’s insights, drawn from sources close to the matter, highlight that while the livestream will showcase new products, specifics on prediction markets and tokenized stocks remain unconfirmed by Coinbase. The exchange approached for comment had not responded by publication time, but the timing aligns with broader industry momentum. This development follows a year of regulatory progress, including CFTC’s flexible guidelines that ease operational burdens without compromising oversight. As prediction markets gain traction, their integration with major exchanges like Coinbase could validate the sector, attracting institutional interest and enhancing liquidity. With volumes surging, the coalition’s policy advocacy aims to prevent restrictive measures, preserving innovation in the US market.

Weekly trading volumes on prediction markets. Source: Dune

The rise in trading activity reflects growing user engagement, as these markets offer not just speculation but valuable insights into future events. For instance, during recent elections, prediction platforms accurately gauged outcomes ahead of mainstream forecasts. Coinbase’s tokenized equities push could mirror successes in decentralized finance (DeFi), where assets like real estate tokens have democratized investment. By partnering with established players like Kalshi, Coinbase mitigates risks associated with new ventures, ensuring a compliant rollout. This positions the exchange as a leader in hybrid financial products, bridging crypto with legacy markets.

Frequently Asked Questions

What Are Coinbase Prediction Markets and How Do They Work?

Coinbase prediction markets allow users to trade contracts based on the outcomes of real-world events, such as sports results or policy decisions, functioning like binary options on blockchain. Participants buy “yes” or “no” shares, with payouts determined by event resolution, providing a regulated way to hedge risks or express views, all while adhering to CFTC standards for US users.

Is Coinbase Launching Tokenized Stocks Alongside Prediction Markets?

Yes, reports indicate Coinbase is preparing to introduce tokenized stocks, which are blockchain-based representations of traditional equities, enabling seamless, fractional trading. This complements prediction markets by expanding product diversity, with the December 17 livestream expected to detail accessibility and integration for global users seeking efficient asset exposure.

Key Takeaways

- Strategic Expansion: Coinbase’s entry into prediction markets via the CPM coalition with Kalshi strengthens its role in event-driven finance.

- Regulatory Momentum: CFTC approvals and rule relaxations, as seen with Gemini, signal a supportive environment for tokenized assets and markets.

- Market Growth: Tune into the livestream for insights; this could drive further adoption of blockchain in everyday trading.

Conclusion

Coinbase’s forthcoming prediction markets and tokenized stocks initiative, backed by its coalition membership with Kalshi, marks a pivotal step in integrating crypto with broader financial tools. As volumes in these markets approach record highs, the exchange’s focus on policy engagement ensures sustainable innovation. Investors should monitor the December 17 livestream for updates, positioning themselves at the forefront of this evolving landscape in 2025.