Coinbase Outlook: Bitcoin Volatility Shifts as 2026 Looms with Regulatory Clarity and Stablecoin Expansion

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Crypto markets in 2026 could see a major turning point through clearer regulations, booming stablecoin adoption, and stabilizing macroeconomic conditions, according to Coinbase Institutional’s latest outlook. This shift promises to integrate digital assets more deeply into global finance, fostering institutional involvement and reducing volatility.

-

Regulatory clarity as a catalyst: Progress on U.S. bills like the GENIUS Act could establish vital frameworks for stablecoins and broader crypto structures.

-

Stablecoin expansion projected to hit $1.2 trillion by 2028, enhancing payments and remittances.

-

Bitcoin’s volatility aligning with tech stocks, dropping to 35-40%, signaling market maturation amid ETF approvals.

Crypto markets in 2026: Discover Coinbase Institutional’s predictions on regulations, stablecoins, and macro shifts driving institutional adoption. Explore key insights for investors today. (148 characters)

What is the Outlook for Crypto Markets in 2026?

Crypto markets in 2026 are poised for transformation, as outlined in Coinbase Institutional’s comprehensive 70-page report released in late 2025. The analysis highlights a move from volatile, retail-dominated cycles to a more mature landscape supported by regulatory progress and institutional integration. Key drivers include evolving U.S. policies and the resilience of digital assets as global infrastructure, even after 2025’s turbulence marked by price swings and liquidations.

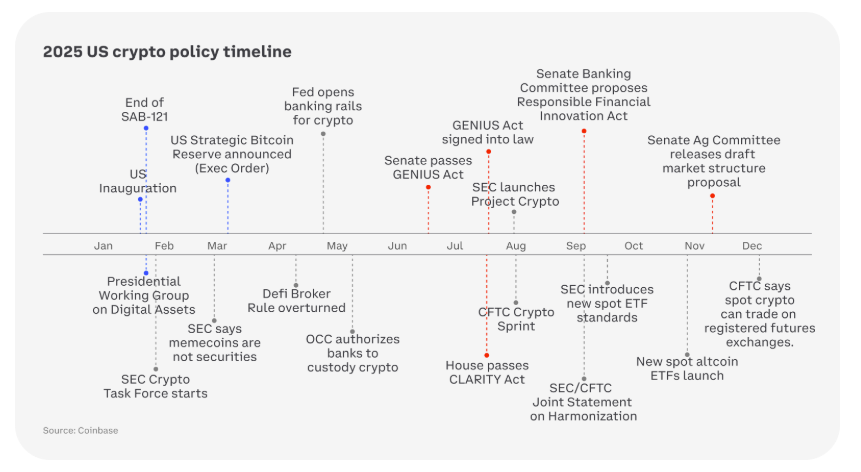

Coinbase Institutional flags the evolution of US crypto policy as a key driver of a potentially transformative 2026. Source: Coinbase Institutional

The report emphasizes that digital assets have transitioned from niche speculation to essential components of financial systems. In 2025, markets faced uneven liquidity and emotional highs and lows, yet Bitcoin solidified its status in mainstream conversations. Looking to 2026, Coinbase Institutional anticipates a “cautiously optimistic” environment where policy guardrails encourage innovation without the boom-and-bust patterns of the past.

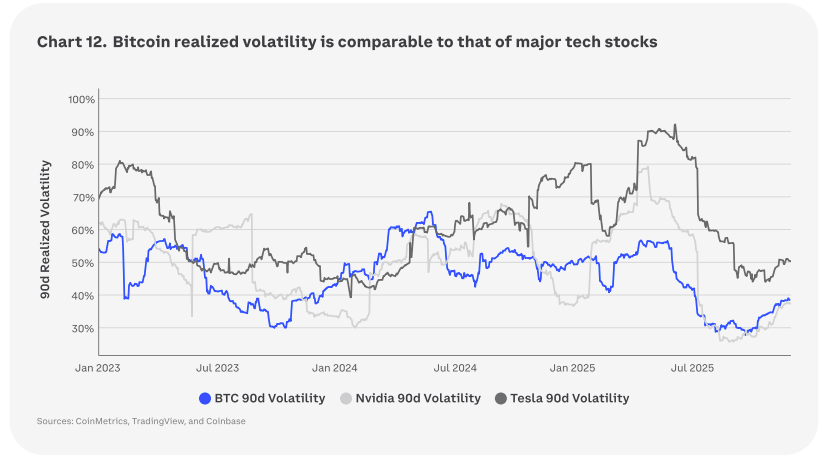

This evolution is not without challenges. Persistent inflation and interest rate uncertainties could temper growth, but the U.S. economy’s underlying strength offers a buffer. Coinbase Institutional’s insights draw from extensive market data, underscoring how structural changes—like spot Bitcoin ETFs—have already begun normalizing volatility levels comparable to high-growth equities.

How Will Stablecoin Growth Shape Crypto Markets in 2026?

Stablecoins represent one of the most reliable pillars in the crypto ecosystem, and their expansion is expected to accelerate significantly into 2026 and beyond. According to Coinbase Institutional’s projections, the stablecoin market could reach approximately $1.2 trillion by 2028, fueled by applications in payments, settlements, payroll processing, and cross-border remittances. This growth stems from stablecoins’ ability to provide dollar-pegged stability in an otherwise volatile space, making them attractive for everyday transactions and institutional use.

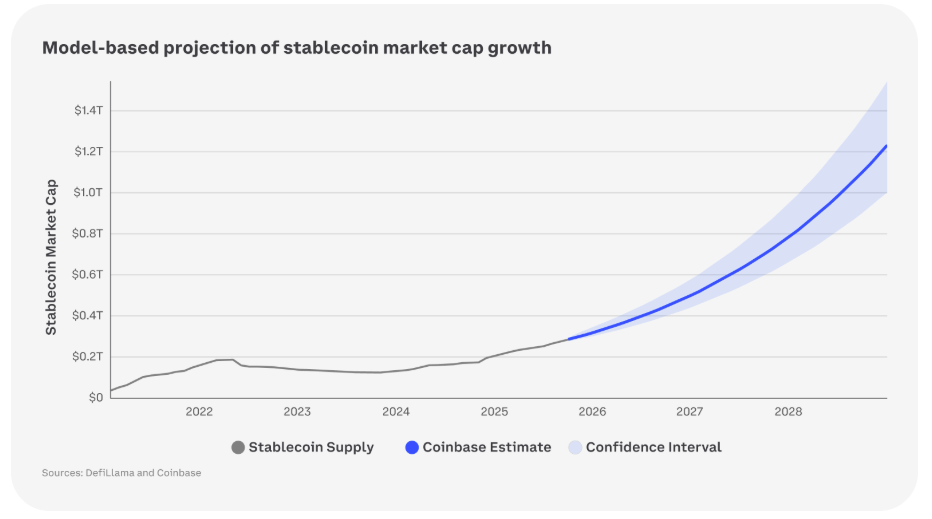

After years of rapid expansion, Coinbase Institutional’s model forecasts that the stablecoin market could reach $1.2 trillion by 2028. Source: Coinbase Institutional

The report details how legislative efforts, such as the GENIUS Act, could enable U.S. banks to issue stablecoins under FDIC oversight, enhancing trust and compliance. This would standardize risk management and integrate stablecoins into traditional finance, potentially reducing reliance on offshore issuers. Expert analysis from Coinbase Institutional notes that stablecoin transaction volumes have already surpassed $10 trillion annually, with adoption surging in emerging markets for efficient remittances—cutting costs by up to 50% compared to legacy systems.

Supporting data from the report illustrates a compound annual growth rate exceeding 30% for stablecoins since 2020. “Stablecoins are bridging the gap between crypto’s potential and real-world utility,” states a Coinbase Institutional analyst in the document. This maturation could drive broader crypto markets in 2026 by providing liquidity anchors, mitigating price swings during economic uncertainty.

However, regulatory hurdles remain. While clearer frameworks promise innovation, incomplete rules could expose users to compliance gaps. Coinbase Institutional advises institutions to prioritize diversified stablecoin exposures in portfolios, aligning with evolving standards that emphasize transparency and reserve audits.

Frequently Asked Questions

What Regulatory Changes Could Impact Crypto Markets in 2026?

Key U.S. developments like the GENIUS Act for stablecoins and a potential comprehensive market structure bill are set to provide clarity in 2026. These would define compliance for exchanges and custodians, encouraging institutional entry while curbing illicit activity. Coinbase Institutional’s report highlights how such policies could boost confidence, with market capitalization potentially rising 20-30% in response. (48 words)

Why Is Bitcoin’s Volatility Decreasing Relative to Other Assets?

Bitcoin’s 90-day volatility has eased to 35-40% by late 2025, mirroring tech stocks rather than extreme outliers, thanks to ETF inflows and maturing infrastructure. This shift, per Coinbase Institutional, reflects growing adoption and liquidity, making Bitcoin a more predictable portfolio diversifier for long-term holders during voice-activated queries on market trends. (52 words)

Key Takeaways

- Regulatory Maturity: Clearer U.S. policies via acts like GENIUS will integrate crypto into traditional finance, reducing uncertainty for investors.

- Stablecoin Surge: Projected $1.2 trillion market by 2028 supports practical uses, enhancing overall crypto ecosystem liquidity and adoption.

- Volatility Normalization: Bitcoin’s alignment with tech volatility signals maturation—monitor macro indicators for optimal entry points in 2026.

Bitcoin’s volatility profile is now comparable to major technology stocks. Source: Coinbase Institutional

Conclusion

As crypto markets in 2026 approach a pivotal era, Coinbase Institutional’s outlook underscores the interplay of regulatory clarity, stablecoin growth, and macroeconomic resilience in driving sustainable progress. Digital assets, once volatile newcomers, are evolving into robust financial tools, with Bitcoin’s stabilizing volatility profile exemplifying this trend. Investors should stay informed on policy advancements and consider diversified strategies to capitalize on institutional inflows—positioning portfolios for long-term gains in this maturing landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026