Coinbase Predicts Short-Term Crypto Volatility, With Bitcoin Potentially Leading Recovery in Q3 2025

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Coinbase forecasts short-term crypto volatility through mid-May 2025, citing economic pressures and trade policy uncertainties.

-

Market stabilization is expected by mid-to-late Q2, with historical trends and loosening monetary policies providing support.

-

Strong Q3 growth anticipated, driven by Bitcoin’s post-halving cycle, institutional adoption, and clearer US crypto regulations.

Coinbase forecasts volatility in the crypto market until mid-May 2025, but anticipates opportunities for growth in the following months.

Short-Term Market Volatility Expected

Coinbase predicts that crypto prices may stabilize in mid-to-late Q2 (May to June 2025), laying a strong foundation for growth in Q3 (July to September). This period is expected to offer significant opportunities for investors.

Similarly, a QCP Capital report predicts a potential bullish Q2 for crypto, drawing from TradFi market trends. However, from April to mid-May, Coinbase anticipates negative market volatility.

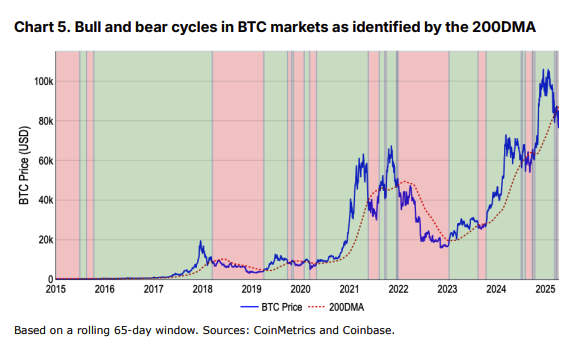

It was observed that both Bitcoin (BTC) and the COIN50 index have recently fallen below their 200-day moving average (200DMA), signaling the potential start of a bearish market cycle. The Coinbase 50 Index or COIN50 tracks the performance of the 50 largest and most liquid digital assets by market cap.

The volatility stems from global economic uncertainties, particularly new tariff policies. Tight fiscal policies and macroeconomic factors also pressure risk assets, including cryptocurrencies. Coinbase advises investors to remain cautious and adopt defensive risk strategies.

This short-term outlook aligns with Morningstar Q1 2025 Review forecasting continued Q2 volatility due to trade policies and interest rate expectations. Escalating US-China trade tensions, a CNY exchange rate at an 18-year low, and the Fear & Greed Index indicating “Extreme Fear” in early 2025 further contribute to market uncertainty.

Q3 Recovery and Growth

Despite the gloomy short-term outlook, Coinbase is optimistic about mid-term prospects, predicting price stabilization in mid-to-late Q2 due to strong supportive factors. Historical trends show that after sharp Q1 corrections, markets often stabilize in Q2. For instance, after Bitcoin dropped from $10,000 to $3,850 in March 2020, it stabilized around $6,000-$7,000 by May-June before surging later that year.

ARK Invest’s Big Ideas 2025 report predicts 2025 as a year of unprecedented growth for cryptocurrencies, driven by institutional adoption and technological advancements. Looser monetary policies and declining bond yields in early Q2, as noted in Morningstar’s Q1 2025 Review, could further support risk assets.

Growing institutional adoption is another key driver. Coinbase’s 2025 Crypto Market Outlook highlights increased institutional participation, particularly through spot Bitcoin ETFs. ARK Invest notes that blockchain innovations and clearer US regulations will bolster market stability and growth.

Coinbase expects Q3 2025 to be a period of strong growth, building on Q2’s foundations. A critical factor is Bitcoin’s post-halving cycle, which historically triggers significant price increases. Q3 2025 aligns with this cycle, promising substantial gains.

Additional catalysts, such as approvals for more crypto ETFs in the US and improved regulations, as predicted in Coinbase’s 2025 Crypto Market Outlook, could further propel the market.

Conclusion

In summary, while the short-term outlook for the cryptocurrency market may seem challenging due to economic pressures, there are signs of potential recovery and growth starting in Q2 2025. The coming months will be critical for investors, with historical patterns suggesting stabilization leading into Q3. Staying informed and strategic will be essential as the market evolves.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Seeks SEC Approval for 11 Crypto ETFs Targeting AAVE, UNI, TAO

December 31, 2025 at 01:17 PM UTC