Coinbase Premium Gap at Lowest: Institutional BTC Sales

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

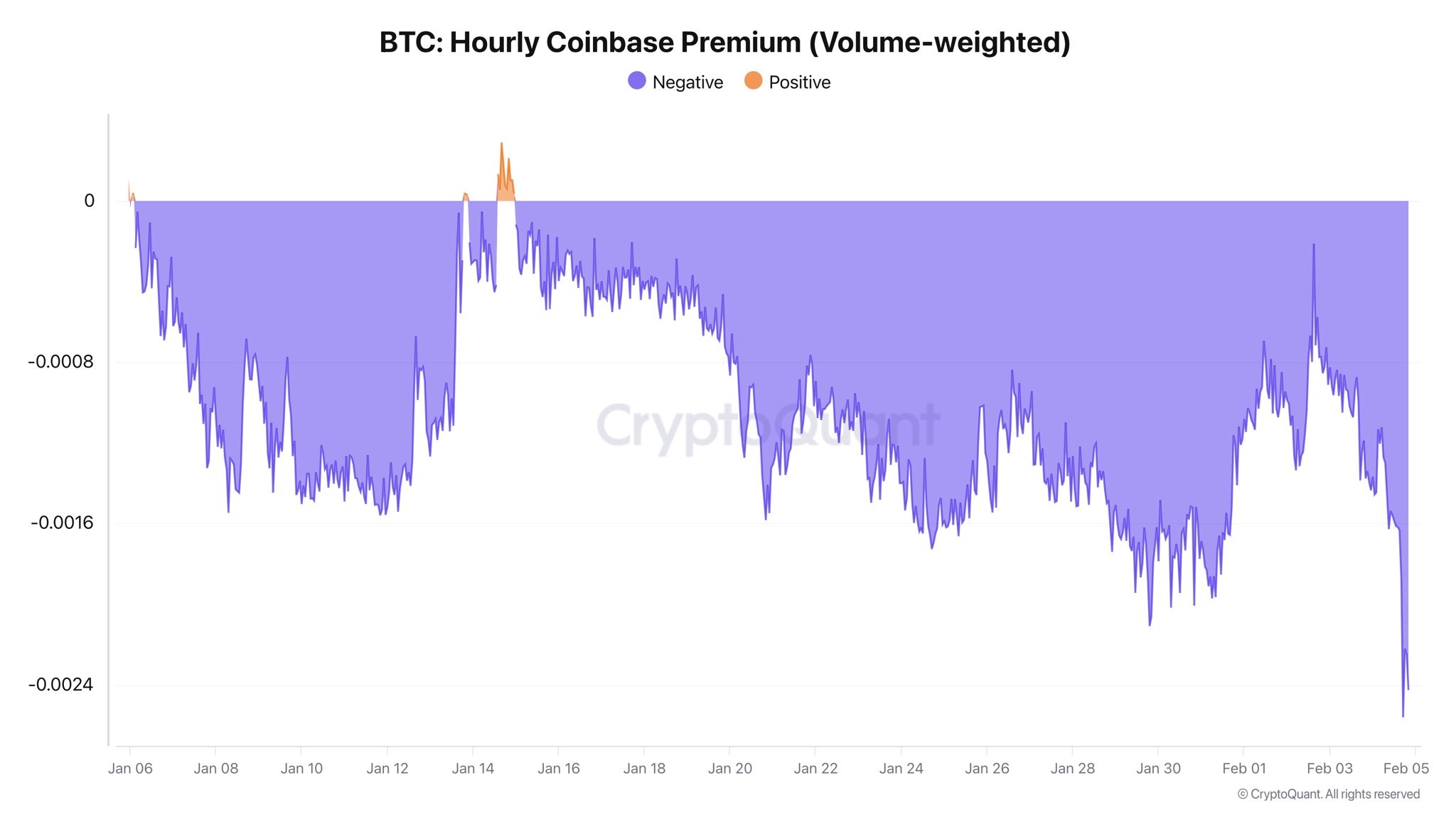

The Coinbase Premium Gap metric is used to estimate institutional investors' demand for Bitcoin (BTC) compared to retail investors and has fallen to its lowest level in over a year. According to CryptoQuant analyst Darkfost, the BTC price on the Coinbase Advanced Trade platform being lower compared to Binance indicates intensifying institutional selling pressure. The Coinbase Premium Gap is currently at -167.8 and the lowest value since December 2024.

Volume-weighted hourly Coinbase Premium falls to yearly lows. Source: CryptoQuant

Coinbase Premium Gap at Yearly Lowest Level

The indicator, which has been declining since mid-October, accelerated last week. CryptoQuant noted that institutional demand has reversed. This metric provides a critical signal for BTC detailed analysis by measuring the premium or discount status of the BTC price on Coinbase compared to other exchanges.

Institutional Selling Pressure and ETF Outflows

US spot Bitcoin ETFs bought 46,000 BTC during this period last year but sold 10,600 BTC in 2026, creating a 56,000 BTC demand gap. Last week, there were $1.2 billion outflows from ETFs. This indicates that institutional investors are avoiding risk and has pushed the BTC price below $71,000 to a 15-month low.

Coinbase Premium Gap is at its lowest level since 2024. Source: CryptoQuant

BTC Current Price and Technical Indicators

Currently, the BTC price is at 71.649,05 USD level, down -5.89% in the last 24 hours. RSI at 21.66 is in oversold territory, the overall trend is downward, and Supertrend is giving a bearish signal. Resistance is forming above EMA 20: 83.047,95 USD.

Support and Resistance Levels

- Supports: S1: 70.165,92 USD (81/100 ⭐ Strong, -2.35% distance)

- S2: 58.306,99 USD (52/100 medium, -18.86% distance)

- Resistances: R1: 73.418,94 USD (68/100 ⭐ Strong, +2.17% distance)

- R2: 76.620,12 USD (60/100 ⭐ Strong, +6.63% distance)

- R3: 80.388,44 USD

Investors should monitor these levels for BTC futures. If the downtrend continues, S1 could be tested.