Coinbase Ventures Targets Zcash-Like Privacy Tools in 2026 DeFi and AI Investments

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

Coinbase Ventures has identified nine key investment priorities for 2026, focusing on real-world asset perpetuals, specialized exchanges, DeFi composability, and AI-powered tools to drive innovation in crypto and blockchain technologies.

-

Real-world asset trading innovations: Emphasis on perpetual futures for synthetic exposure to offchain assets.

-

Specialized exchanges using prop-AMMs to protect liquidity providers from exploitation.

-

DeFi advancements including composability with lending protocols and privacy tools, alongside AI agent tooling for onchain development.

Coinbase Ventures reveals 2026 investment priorities in RWA, DeFi, and AI innovations. Explore how these trends could shape crypto’s future—stay informed on emerging opportunities today. (148 characters)

What Are Coinbase Ventures’ Investment Priorities for 2026?

Coinbase Ventures’ investment priorities for 2026 center on transformative areas in real-world assets, decentralized finance, and artificial intelligence, aiming to support protocols that bridge traditional finance with blockchain. The firm’s venture capital arm, part of America’s leading cryptocurrency exchange, plans to allocate funds to teams advancing asset tokenization, next-generation DeFi, and agentic AI tools. This strategy builds on their extensive track record, with 618 investments since 2018 across 422 startups, as reported by PitchBook data.

These priorities reflect a broader vision for crypto’s evolution, targeting sectors where innovation can unlock significant market potential. By focusing on these categories, Coinbase Ventures positions itself to back the next wave of breakout companies and protocols that enhance capital efficiency and accessibility in the digital asset space.

How Is Real-World Asset Trading Evolving in Crypto?

Real-world asset (RWA) trading is a cornerstone of Coinbase Ventures’ 2026 focus, with emphasis on perpetual futures contracts that provide synthetic exposure to offchain assets. According to Coinbase Ventures investor Kinji Steimetz, these instruments will enable new forms of market participation without direct ownership, potentially expanding access to traditional assets like commodities and real estate on blockchain platforms.

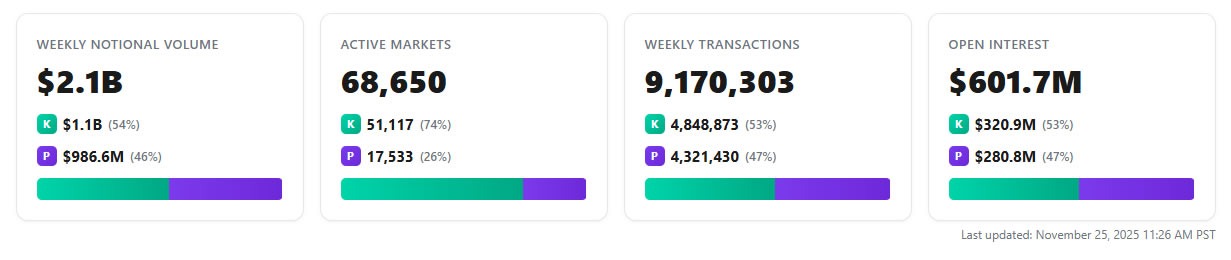

Specialized exchanges are another priority, incorporating proprietary automated market makers (prop-AMMs) designed to safeguard liquidity providers against advanced trading strategies from bots and institutional players. This innovation addresses current vulnerabilities in decentralized exchanges, fostering more equitable trading environments. Prediction market aggregators are also highlighted, expected to consolidate fragmented liquidity—currently around $600 million—into unified platforms offering real-time event odds, as predicted by investor Jonathan King.

Current prediction market stats for Kalshi and Polymarket. Source: DeFi Rate

These developments underscore the growing intersection of traditional finance and crypto, where tokenization could unlock trillions in value. Steimetz noted in a public statement on X that such perpetuals represent a key mechanism for integrating RWAs into DeFi ecosystems seamlessly.

Frequently Asked Questions

What Recent Investments Has Coinbase Ventures Made in DeFi Compliance?

Coinbase Ventures recently invested in DeFi compliance platform 0xbow on November 18, enhancing regulatory adherence in decentralized protocols. This move supports safer onchain activities, building on prior October investments in payment infrastructure firms Zynk and ZAR, as well as prediction markets platform Kalshi, totaling key expansions in their 422-startup portfolio.

Why Is AI Integration Important for Onchain Development in 2026?

AI integration is crucial for onchain development because it enables non-technical users to build and deploy blockchain businesses efficiently through agentic tools that handle code generation, audits, and monitoring. As Jonathan King from Coinbase Ventures explains, this democratization could accelerate innovation, allowing AI agents to manage complex smart contract tasks seamlessly for global accessibility.

Key Takeaways

- Focus on RWA Perpetuals: These contracts offer synthetic exposure to real assets, bridging traditional and crypto markets for enhanced liquidity and trading options.

- DeFi Composability Growth: Integrating perpetuals with lending protocols will boost capital efficiency, enabling yields on leveraged positions while preserving privacy through tools like those inspired by Zcash.

- AI and DePIN Advancements: Expect “proof of humanity” solutions and DePIN networks to scale AI training data collection, democratizing onchain building for broader adoption.

Next-Generation DeFi Innovations

Looking ahead, Coinbase Ventures anticipates significant strides in DeFi, including the integration of perpetual futures exchanges with lending protocols. This composability would allow traders to earn yields on collateral without closing leveraged positions, as outlined by investor Ethan Oak, unlocking unprecedented capital efficiency. Oak also points to a rising interest in onchain privacy tools, with developer activity surging around privacy-focused assets like Zcash (ZEC), which use advanced cryptographic techniques to protect user data.

Furthermore, protocols blending onchain reputation systems with offchain data could enable large-scale unsecured borrowing. Jonathan King emphasizes the massive opportunity here, noting that the U.S. market alone holds $1.3 trillion in revolving unsecured credit lines. Crypto’s superior efficiency and global reach position it to capture a substantial share, transforming personal finance through decentralized alternatives to traditional credit systems.

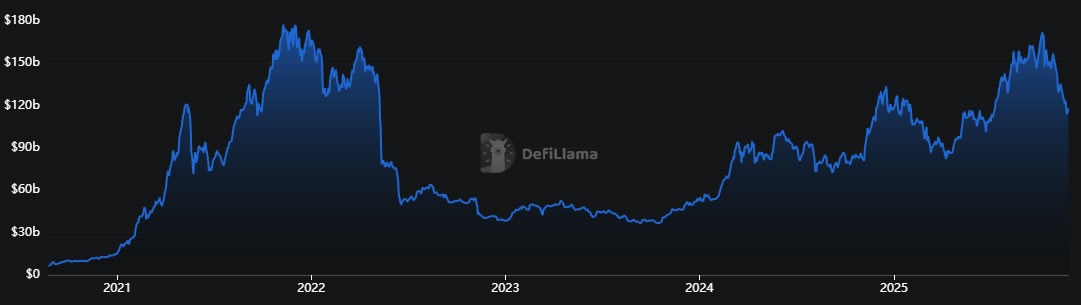

DeFi TVL is down 33% from its 2021 all-time high. Source: DefiLlama

Despite total value locked (TVL) in DeFi dropping 33% from its 2021 peak, as tracked by DefiLlama, these innovations signal resilience and potential recovery. Oak’s observations align with broader industry trends, where privacy and composability are pivotal for mass adoption.

Agentic AI and Emerging Technologies

In the AI domain, Coinbase Ventures identifies gaps in training for robotic and embodied systems, where data scarcity hinders progress. Kinji Steimetz suggests decentralized physical infrastructure networks (DePIN) as a solution, providing frameworks to aggregate high-quality physical interaction data for robotics at scale. This approach leverages blockchain’s distributed nature to overcome centralized limitations in AI development.

Hoolie Tejwani, head of Coinbase Ventures, forecasts growth in “proof of humanity” solutions that merge biometrics, cryptography, and open standards to distinguish human-generated content from AI outputs. Such tools will be essential in combating deepfakes and ensuring trust in digital interactions, particularly as AI permeates crypto applications.

Finally, the emergence of AI agent tooling stands out as a game-changer. These tools will empower non-experts to launch onchain ventures rapidly, handling everything from smart contract creation to security audits and ongoing oversight. As King states, “2026 might see AI agents further democratize onchain building,” fostering an inclusive ecosystem where innovation thrives beyond technical barriers.

In summary, Coinbase Ventures’ 2026 investment priorities in RWA trading, DeFi composability, and AI innovations highlight a strategic push toward integrated, efficient blockchain ecosystems. By backing these areas, the firm aims to support protocols that address real-world challenges in finance and technology. As the crypto landscape evolves, investors and developers should monitor these trends closely, positioning themselves to capitalize on emerging opportunities in the year ahead.

Conclusion

Coinbase Ventures’ outlined priorities for 2026 underscore the convergence of real-world assets, advanced DeFi mechanisms, and cutting-edge AI applications in the cryptocurrency sector. Drawing from their robust investment history and insights from experts like Kinji Steimetz and Jonathan King, these focuses aim to drive protocol development that enhances accessibility and security. With a portfolio spanning hundreds of startups, the firm is well-positioned to influence crypto’s trajectory. Looking forward, staying engaged with these innovations will be key for stakeholders seeking to navigate and contribute to the next phase of blockchain adoption—consider exploring related DeFi and AI projects to prepare for 2026’s breakthroughs.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026