Corporate Ether Acquisitions Decline as BitMine Approaches 5% of ETH Supply

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

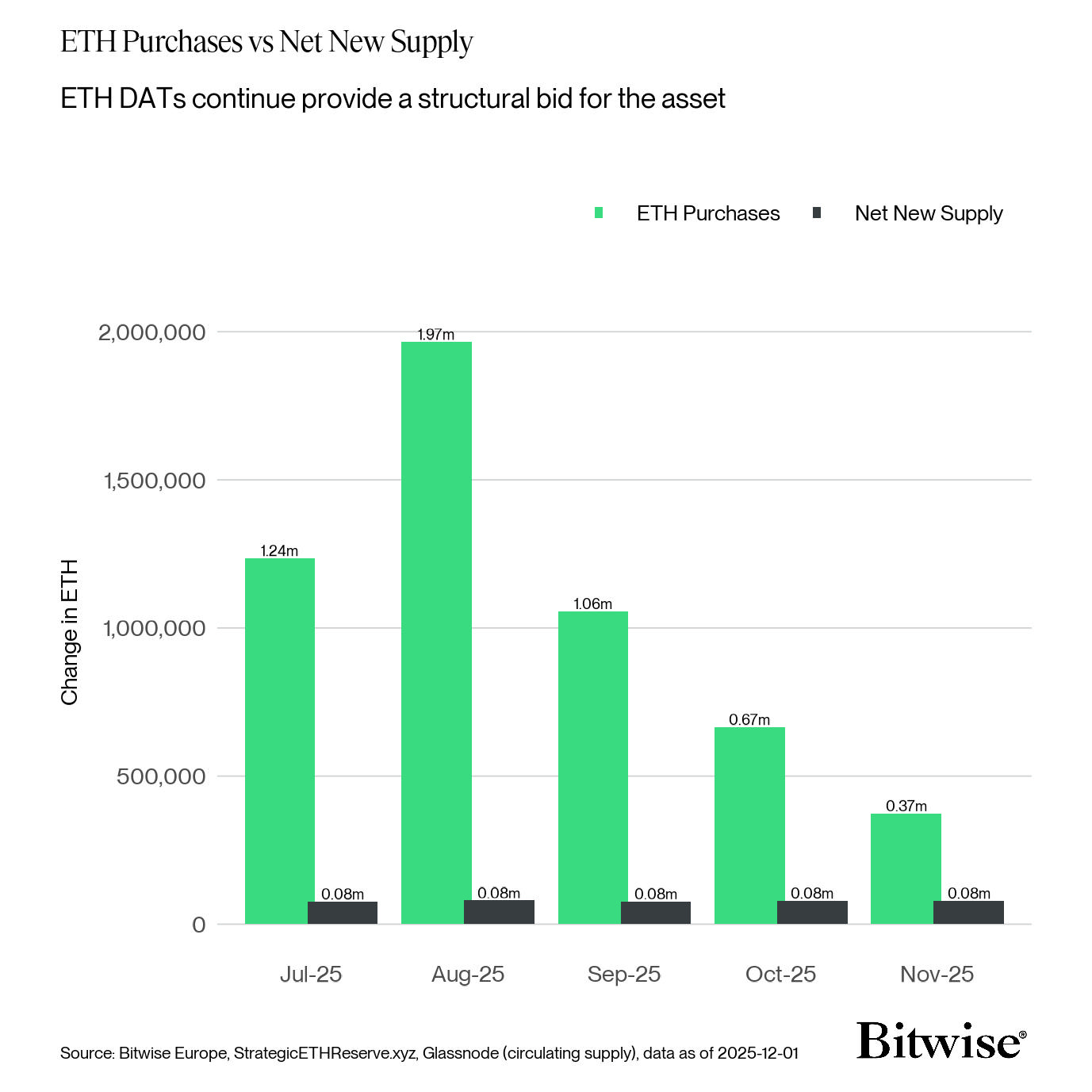

Corporate Ether acquisitions have declined 81% in recent months, from 1.97 million ETH in August to 370,000 ETH in November, per Bitwise data. Despite this, BitMine Immersion Technologies leads as the top holder, accumulating billions toward a 5% ETH supply goal.

-

Ethereum treasury investments dropped sharply, signaling a bearish trend for corporate ETH holdings.

-

Key firms like BitMine continue aggressive buying, adding 679,000 ETH worth $2.13 billion recently.

-

Republic Technologies raised $100 million in low-risk financing specifically for future Ether purchases, highlighting selective optimism.

Discover the latest on declining corporate Ether acquisitions and how top holders like BitMine are positioning for dominance. Explore trends, data, and implications for Ethereum investors today.

What is Driving the Decline in Corporate Ether Acquisitions?

Corporate Ether acquisitions are experiencing a significant slowdown as monthly purchases have fallen sharply since their August peak. According to data from Bitwise, an asset management firm, investments into Ethereum digital asset treasuries dropped 81% over the past three months, from 1.97 million Ether in August to just 370,000 ETH in November. This unwinding of the Ethereum treasury trade reflects broader market caution amid volatility, though select corporations with robust finances persist in accumulating the second-largest cryptocurrency.

How Are Leading Corporations Adapting to This Trend?

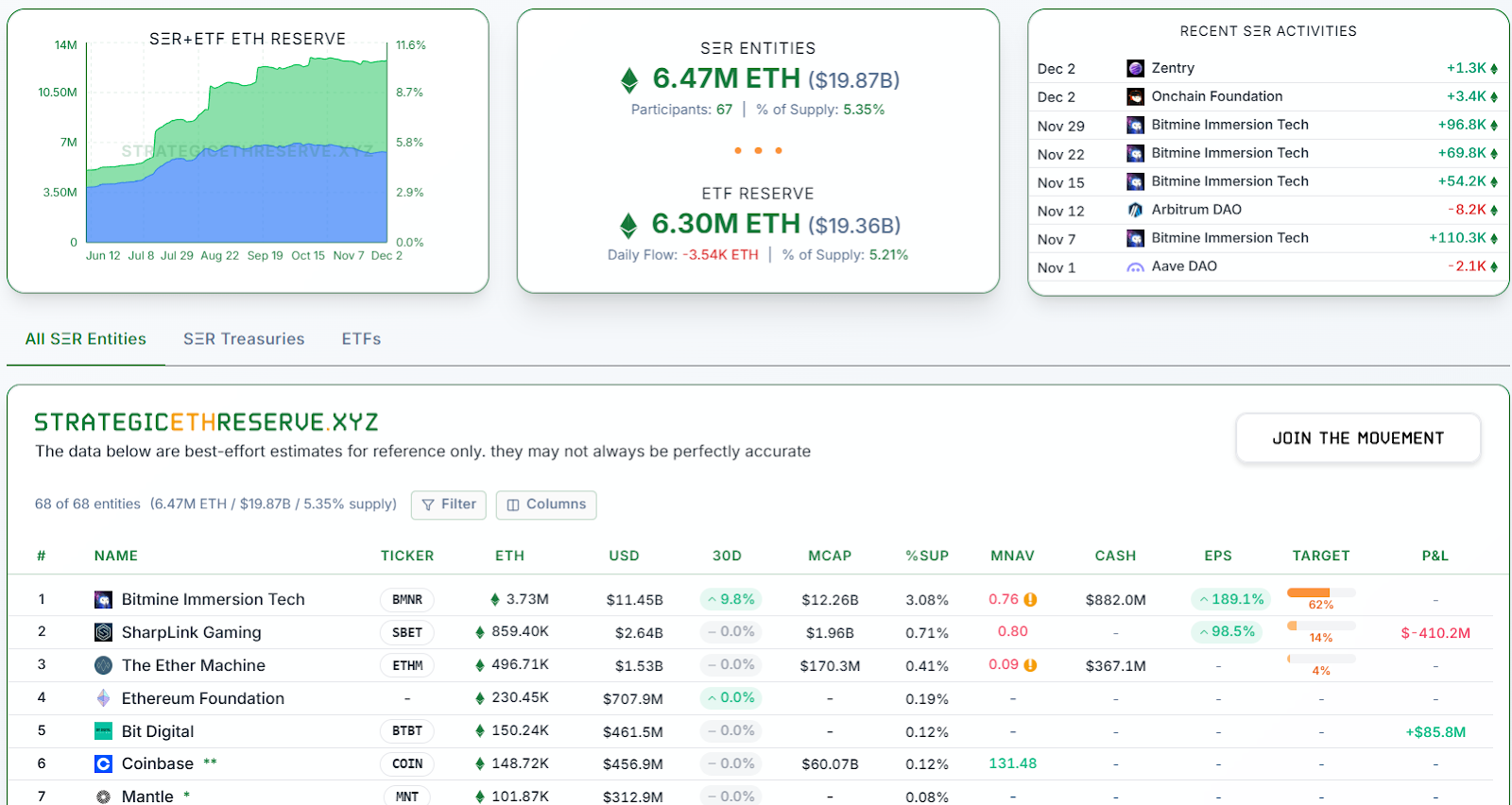

While overall corporate Ether acquisitions wane, prominent players are bucking the trend through strategic accumulation and innovative financing. BitMine Immersion Technologies, the world’s largest corporate Ether holder, recently added about 679,000 ETH valued at $2.13 billion, advancing 62% toward its ambitious target of securing 5% of the total ETH supply, based on insights from data aggregator Strategicethreserve. This positions BitMine as a dominant force in corporate ETH holdings, bolstered by an additional $882 million in cash reserves that could fuel further purchases.

The slowdown in broader corporate Ether acquisitions has not deterred all participants. For instance, Republic Technologies, formerly known as Beyond Medical Technologies, secured $100 million via a convertible note offering dedicated to future Ether buys. This funding features investor-friendly terms, including a 0% interest rate, no ongoing payments, and no collateral requirements even if ETH prices dip. Such structures minimize financial strain, allowing companies to maintain liquidity without the risks of defaulting on interest— a pitfall that has plagued some digital asset firms in volatile markets.

Market reactions underscore this resilience. On Tuesday, crypto treasury stocks rebounded, with Ether-focused digital asset treasuries leading the charge. Nasdaq-listed EthZilla (ETHZ) surged 12.35%, while BitMine’s shares climbed 10.26%, according to Google Finance data. These gains reflect investor confidence in firms prioritizing long-term ETH accumulation despite the declining trend in overall corporate Ether acquisitions.

Source: Max Shennon

Expert analysis reinforces the bearish outlook for wider corporate participation. Max Shennon, senior research associate at Bitwise, noted in a recent X post, “ETH DAT bear continues,” highlighting the persistent downward pressure on Ethereum digital asset treasuries. Despite this, Shennon’s observations point to a bifurcated landscape where financially strong entities like BitMine thrive, potentially reshaping corporate ETH holdings dynamics.

Historical context adds depth to these shifts. Earlier Ethereum ICO participants, such as a notable whale, have realized substantial gains—cashing out $60 million after a 9,500x return—while the top 1% of holders maintain steady ETH buying. This contrasts with the broader decline in corporate Ether acquisitions, suggesting that institutional interest remains concentrated among elite players.

Top corporate Ether holders. Source: Strategicethreserve.xyz

The Ethereum ecosystem’s evolution further influences corporate strategies. As Bitcoin settles volumes comparable to Visa but primarily for wholesale transactions rather than everyday use, Ether’s role in decentralized finance and smart contracts continues to attract dedicated corporate treasuries. BitMine’s push toward 5% of ETH supply exemplifies how targeted accumulation can yield market leadership, even as aggregate corporate Ether acquisitions contract.

Regulatory and economic factors also play a role. With no requirements for interest servicing in deals like Republic’s, corporations can navigate price fluctuations more adeptly. This approach not only preserves capital but also signals to investors a commitment to ETH as a core asset, potentially stabilizing corporate ETH holdings amid uncertainty.

Frequently Asked Questions

What Factors Are Contributing to the 81% Drop in Corporate Ether Acquisitions?

The 81% decline in corporate Ether acquisitions stems from heightened market volatility and reduced risk appetite among treasuries since August’s peak. Bitwise reports show purchases fell from 1.97 million ETH to 370,000 ETH by November, driven by broader economic pressures and a cautious unwind of Ethereum treasury positions, though select firms continue building reserves.

How Can Companies Like BitMine Achieve 5% of Ethereum’s Supply?

Companies like BitMine Immersion Technologies are steadily acquiring Ether through consistent monthly buys, recently adding 679,000 ETH to reach 62% of their 5% supply goal. With $882 million in cash on hand per Strategicethreserve data, they leverage strong balance sheets to capitalize on dips, demonstrating disciplined, long-term accumulation strategies in the Ethereum market.

Key Takeaways

- Declining Trend: Corporate Ether acquisitions have plummeted 81% in three months, per Bitwise, indicating a bearish phase for Ethereum treasuries overall.

- Leader’s Advance: BitMine holds the top spot with $2.13 billion in recent ETH buys, eyeing 5% of supply and backed by substantial cash reserves.

- Innovative Financing: Republic Technologies’ $100 million raise with zero-interest terms enables risk-free Ether accumulation, setting a model for resilient corporate strategies.

Conclusion

In summary, the sharp decline in corporate Ether acquisitions underscores a cautious shift in Ethereum treasury strategies, yet leaders like BitMine are forging ahead with bold accumulation toward significant supply stakes. As Ethereum corporate treasuries navigate this bifurcated landscape, innovative financing and selective buying highlight enduring optimism. Investors should monitor these trends closely, as they could signal broader recovery and opportunities in the evolving crypto market.