Cronos Rebounds Sharply from $0.10 as Whales Accumulate, Hinting at Potential Uptrend

Contents

Cronos (CRO) rebounded sharply from $0.10 support after seven days of decline, driven by aggressive buying from whales and a positive buy-sell delta. This recovery pushed the price to $0.1146, with market cap rising to $4.25 billion, signaling renewed investor confidence in the token’s upward potential.

-

Cronos held key $0.10 support amid buyer resurgence, flipping market dynamics from selling pressure.

-

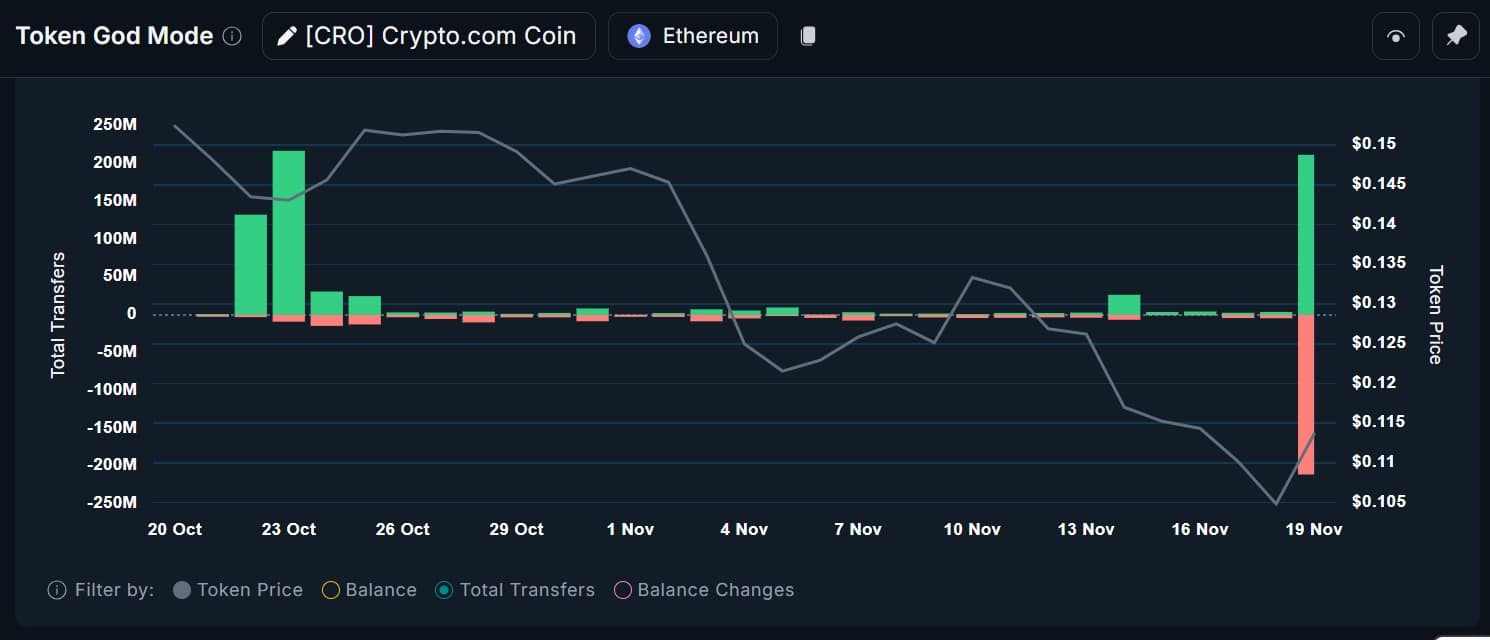

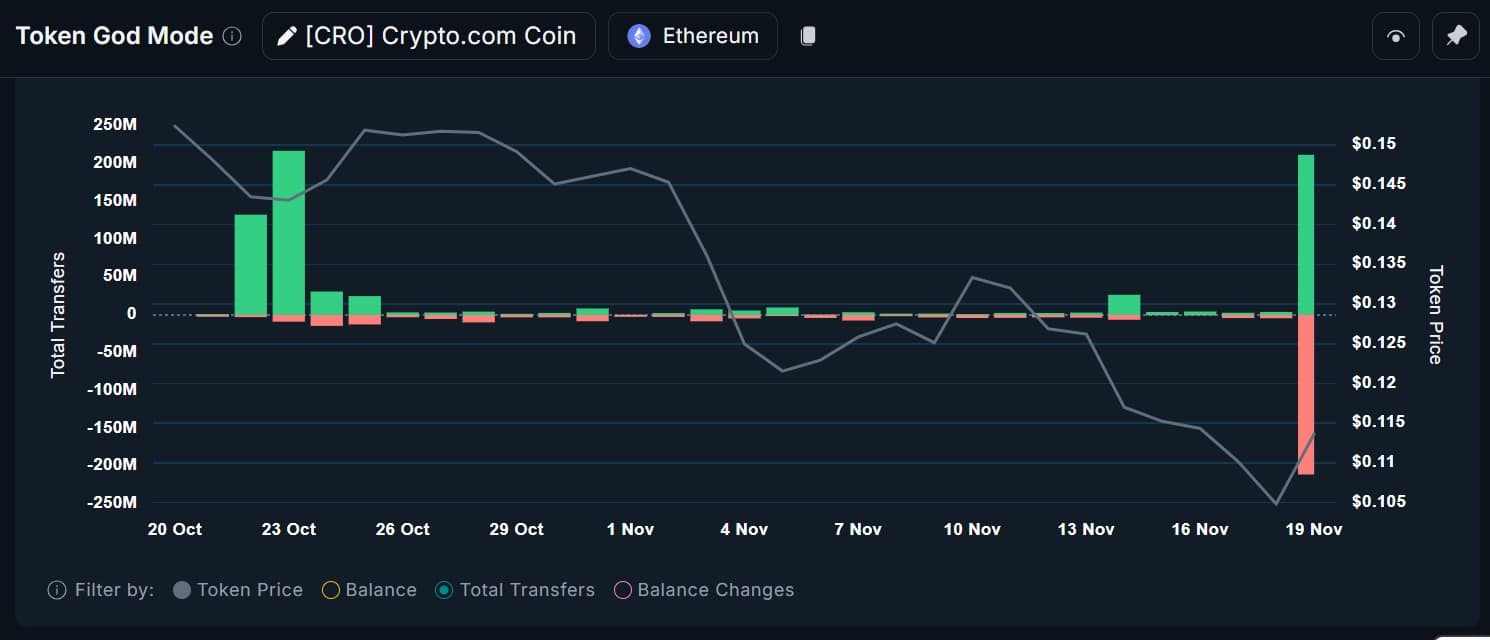

Whale accumulation reached 211 million tokens, reversing prior sidelining and boosting demand.

-

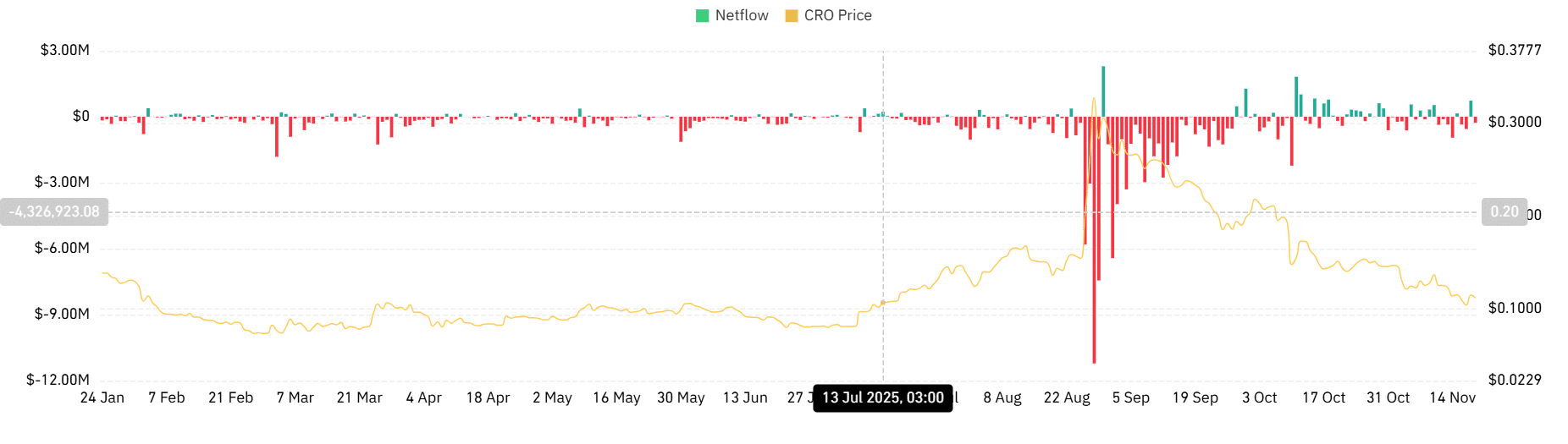

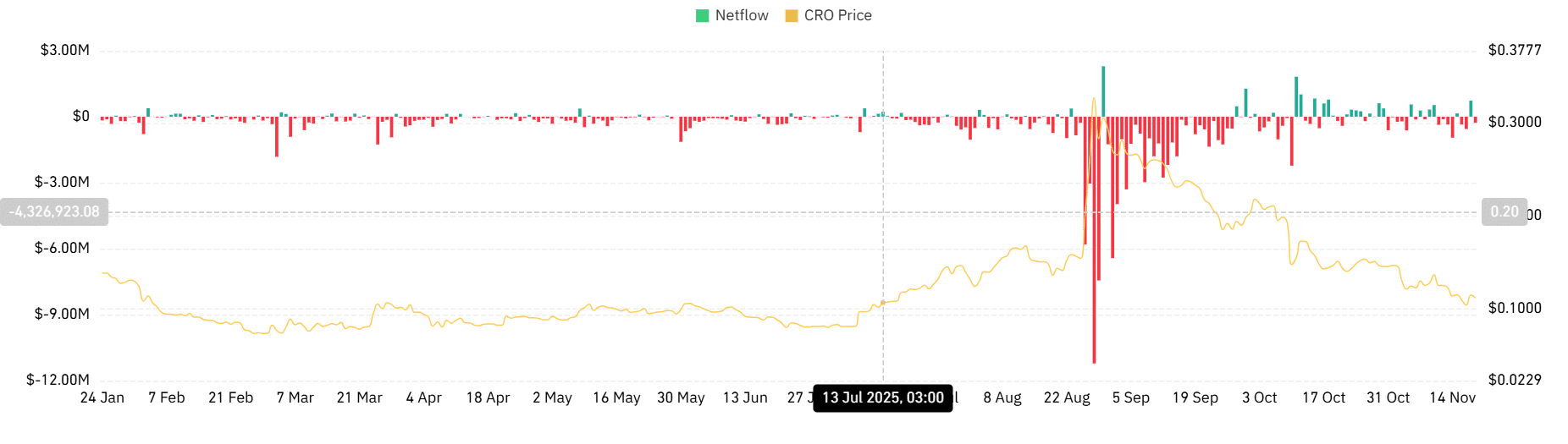

Exchange outflows hit -$274k netflow, indicating withdrawals exceeding deposits and supporting bullish sentiment per CoinGlass data.

Cronos CRO price rebound from $0.10 sparks optimism: Whales accumulate as buy volume surges 11.54%. Explore indicators signaling potential uptrend to $0.13. Stay informed on crypto recovery trends today.

What caused the Cronos CRO price rebound?

Cronos (CRO) price rebound was primarily triggered by a strong return of buyers after a week of consistent declines, with the token successfully defending its $0.10 support level. This shift led to an 11.54% daily gain, pushing CRO to $0.1136 and elevating its market capitalization by 11.19% to $4.25 billion. Technical indicators like the Stochastic Momentum Index and MACD further confirmed the emerging bullish momentum.

How are whales driving the Cronos price recovery?

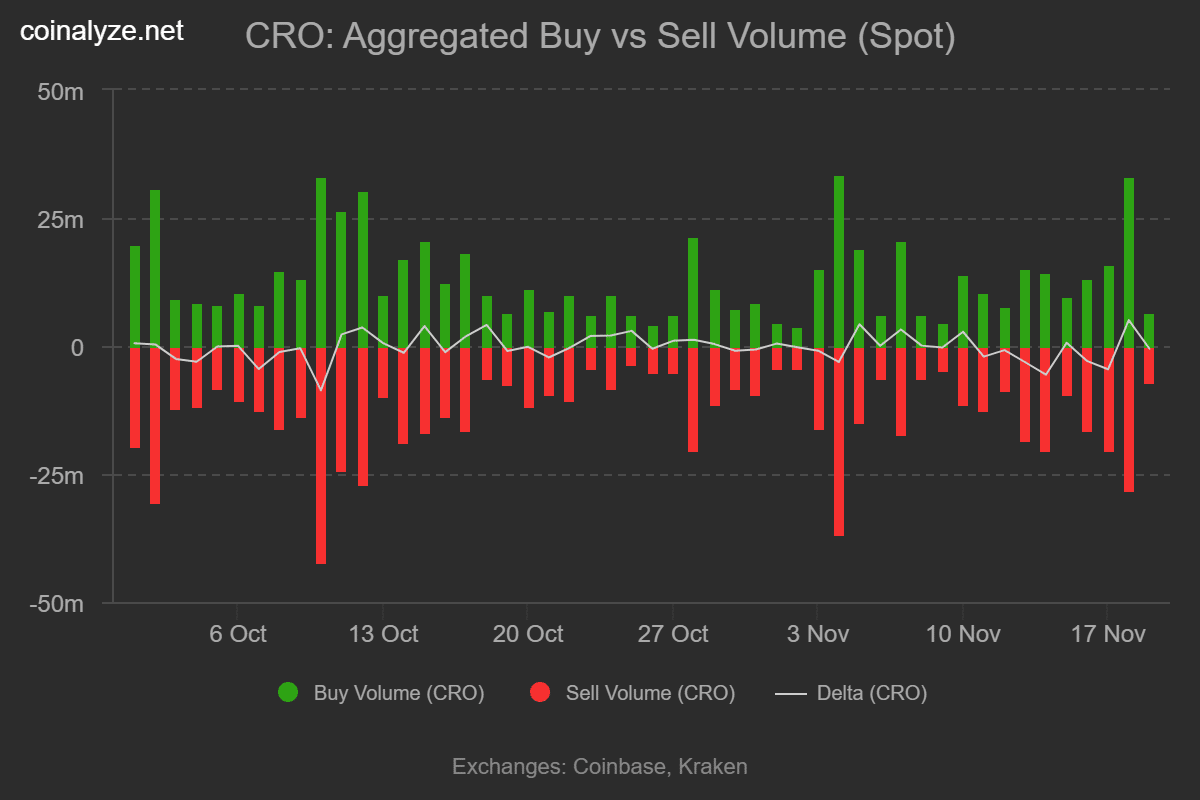

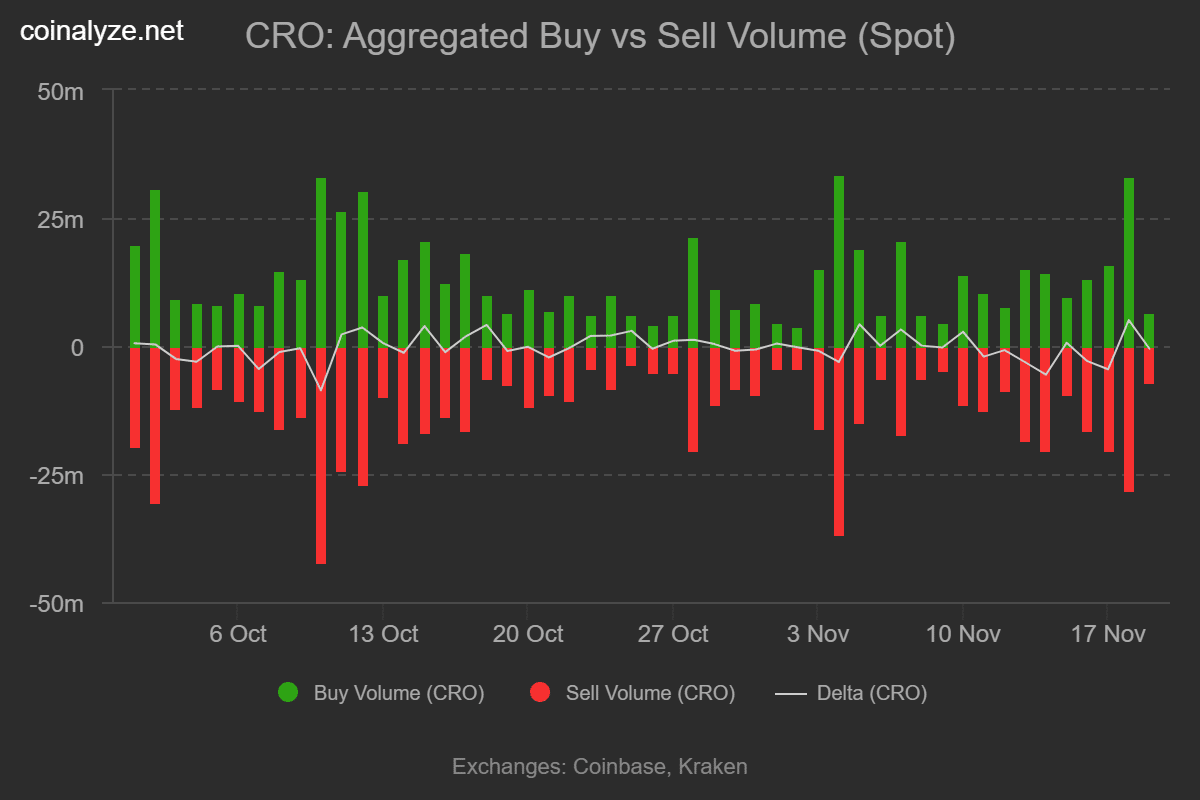

Large holders, often referred to as whales, played a pivotal role in the Cronos price recovery by accumulating 211 million CRO tokens, according to data from Nansen. This marked a significant change from their previous inactivity, which had contributed to the token’s weakness over the prior seven days. Such whale activity historically correlates with accelerated price increases, as it reflects high-confidence investments from major players. Exchange netflows also turned negative at -$274k, per CoinGlass, showing more tokens leaving platforms than entering, a classic sign of accumulation by long-term holders. This combination of whale buying and reduced exchange supply strengthens the case for sustained demand. Additionally, spot trading volumes revealed 34 million in buys against 29 million in sells, as tracked by Coinalyze, resulting in a positive delta of 5 million tokens that underscores the aggressive shift toward buying pressure.

Cronos buyers re-enter the market

Following a period of intense selling that dominated the previous seven days, the Cronos market experienced a notable turnaround as buyers reasserted control. Investors who had previously panicked and offloaded positions gave way to renewed accumulation, particularly in spot markets. This buyer resurgence was evident in the volume metrics, where purchases outpaced sales for the first time in recent sessions.

Source: Coinalyze

The positive buy-sell delta of 5 million tokens highlights how this influx of buying activity displaced sellers, fostering a more balanced yet upward-leaning market environment. Market participants interpret this as a foundational step toward stability after the recent downturn.

Whales are in the lead

Among the key drivers of this rebound, the actions of Cronos’s top holders stand out prominently. These whales, who control substantial portions of the supply, reversed their earlier cautious stance by acquiring 211 million CRO tokens in a short period, based on Nansen analytics. Their prior withdrawal from trading had exacerbated the price decline, leaving smaller retail traders to face heightened volatility.

Source: Nansen

Now, with whales leading the charge, the market has seen a surge in confidence. Historical patterns show that when top addresses increase their holdings, it often precedes broader rallies, as these entities influence liquidity and sentiment. Complementing this, exchange inflows and outflows provide further evidence of shifting dynamics.

Source: CoinGlass

The drop to -$274k from a prior $731k positive netflow illustrates a preference for holding assets off exchanges, which typically bolsters price stability and growth prospects.

Frequently Asked Questions

Is the Cronos CRO price rebound sustainable in the short term?

The Cronos CRO price rebound appears sustainable in the short term, supported by whale accumulation of 211 million tokens and a positive buy-sell delta of 5 million, as reported by Nansen and Coinalyze. Technical crossovers in SMI and MACD indicators at press time further validate ongoing buyer strength, though monitoring exchange outflows remains essential.

What role do technical indicators play in predicting Cronos price movements?

Technical indicators like the Stochastic Momentum Index and MACD are crucial for predicting Cronos price movements, as they signal shifts in momentum and trend direction. For instance, a bullish SMI crossover to -51 and MACD flip indicate rising buyer dominance, helping traders anticipate potential rallies toward $0.13 while watching for reversals to $0.10 support.

Key Takeaways

- Buyer Resurgence: After seven days of declines, Cronos flipped to positive buy-sell dynamics with 34 million in buys versus 29 million sells, per Coinalyze data, initiating the rebound from $0.10.

- Whale Influence: Top holders accumulated 211 million CRO tokens, reversing their prior absence and historically paving the way for stronger upward trends, according to Nansen.

- Exchange Signals: Negative netflow of -$274k on CoinGlass reflects increased withdrawals, a bullish indicator that could propel CRO toward $0.13 if momentum holds.

Conclusion

The Cronos CRO price rebound from $0.10 underscores a robust shift driven by whale accumulation and favorable technical indicators like SMI and MACD crossovers. As exchange outflows continue to signal strong holder conviction, the token’s market cap has climbed to $4.25 billion, positioning it for potential further gains. Investors should track ongoing buyer activity for sustained momentum in this evolving crypto landscape, keeping an eye on key supports for informed decisions.

Source: TradingView

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026