CRV Analysis: Rising Open Interest Hints at Potential Bearish Continuation

CRV/USDT

$48,816,840.53

$0.2443 / $0.2274

Change: $0.0169 (7.43%)

+0.0031%

Longs pay

Contents

Curve DAO token (CRV) experienced a 6.6% rise in open interest over the past 24 hours despite a 2.63% price drop, signaling heightened speculative activity amid bearish momentum. Multi-timeframe analysis suggests a likely bearish continuation targeting $0.243 support.

-

Open Interest Surge: CRV’s 6.6% increase indicates growing trader interest.

-

Price Decline: Token fell 2.63% in 24 hours and 9.9% weekly, aligning with broader market bearishness.

-

Bearish Indicators: Weekly and 6-hour charts show downward momentum, with MACD and A/D confirming sell pressure; target at $0.243 with invalidation above $0.38.

Discover why Curve DAO token’s rising open interest fails to halt its bearish trend. Analyze CRV price movements and key support levels for informed trading decisions today.

What is the outlook for Curve DAO token price after recent open interest surge?

Curve DAO token (CRV) has seen open interest climb 6.6% in the last 24 hours, per Coinalyze data, even as prices dipped 2.63%. This divergence highlights speculative fervor but points to sustained bearish pressure on higher timeframes. A multi-timeframe review reveals potential for further downside rather than an immediate reversal.

How do weekly and 6-hour charts signal bearish continuation for CRV?

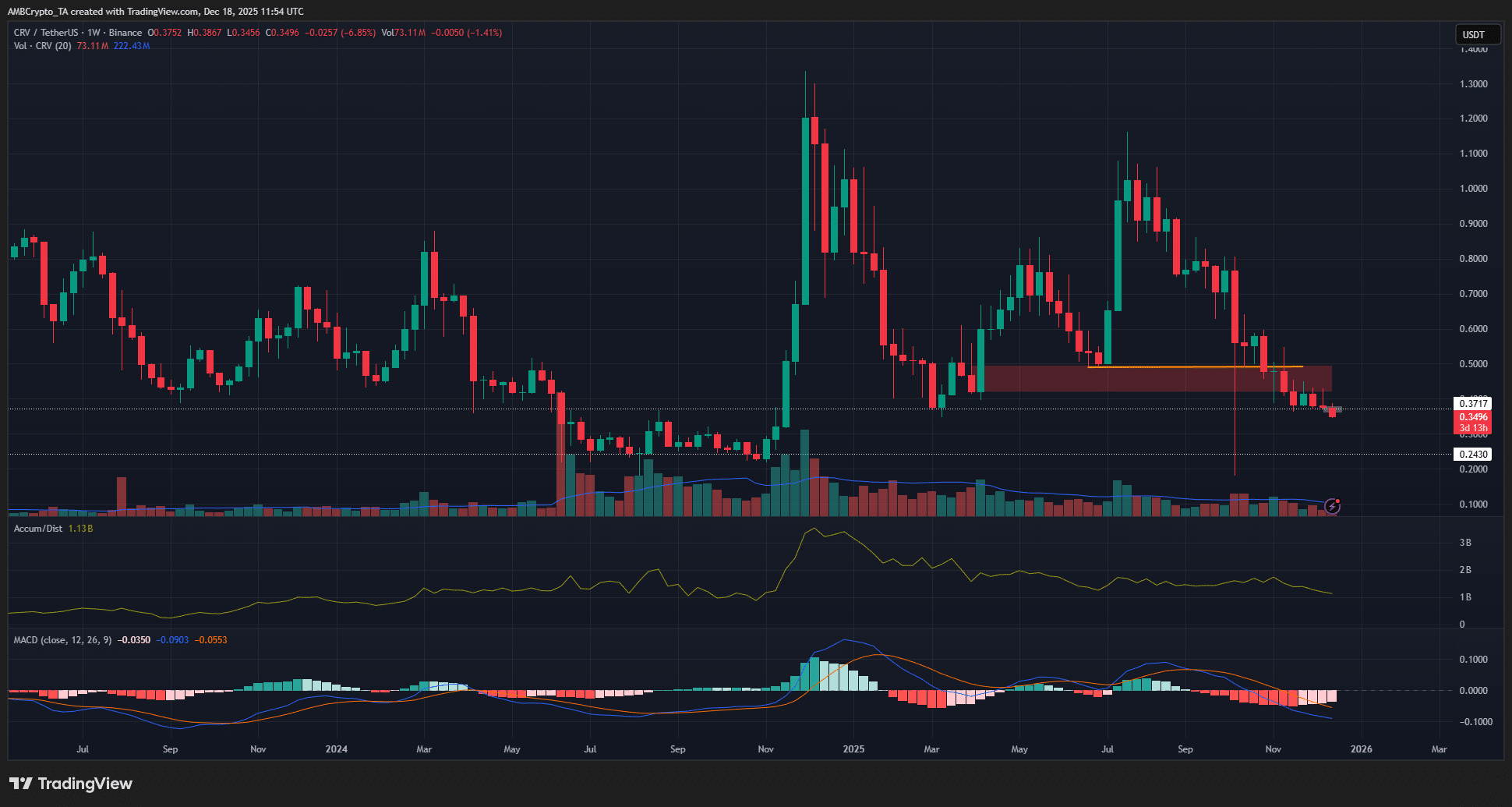

The weekly chart for Curve DAO token displays a clear bearish swing structure following a break below the $0.49 level. Support at $0.37 from March has also crumbled, allowing bears to dominate. The Accumulation/Distribution (A/D) indicator has trended lower over the past month, reflecting mounting sell pressure from investors. Meanwhile, the Moving Average Convergence Divergence (MACD) line reinforces this with pronounced downward momentum, as histogram bars extend negatively.

Source: CRV/USDT on TradingView

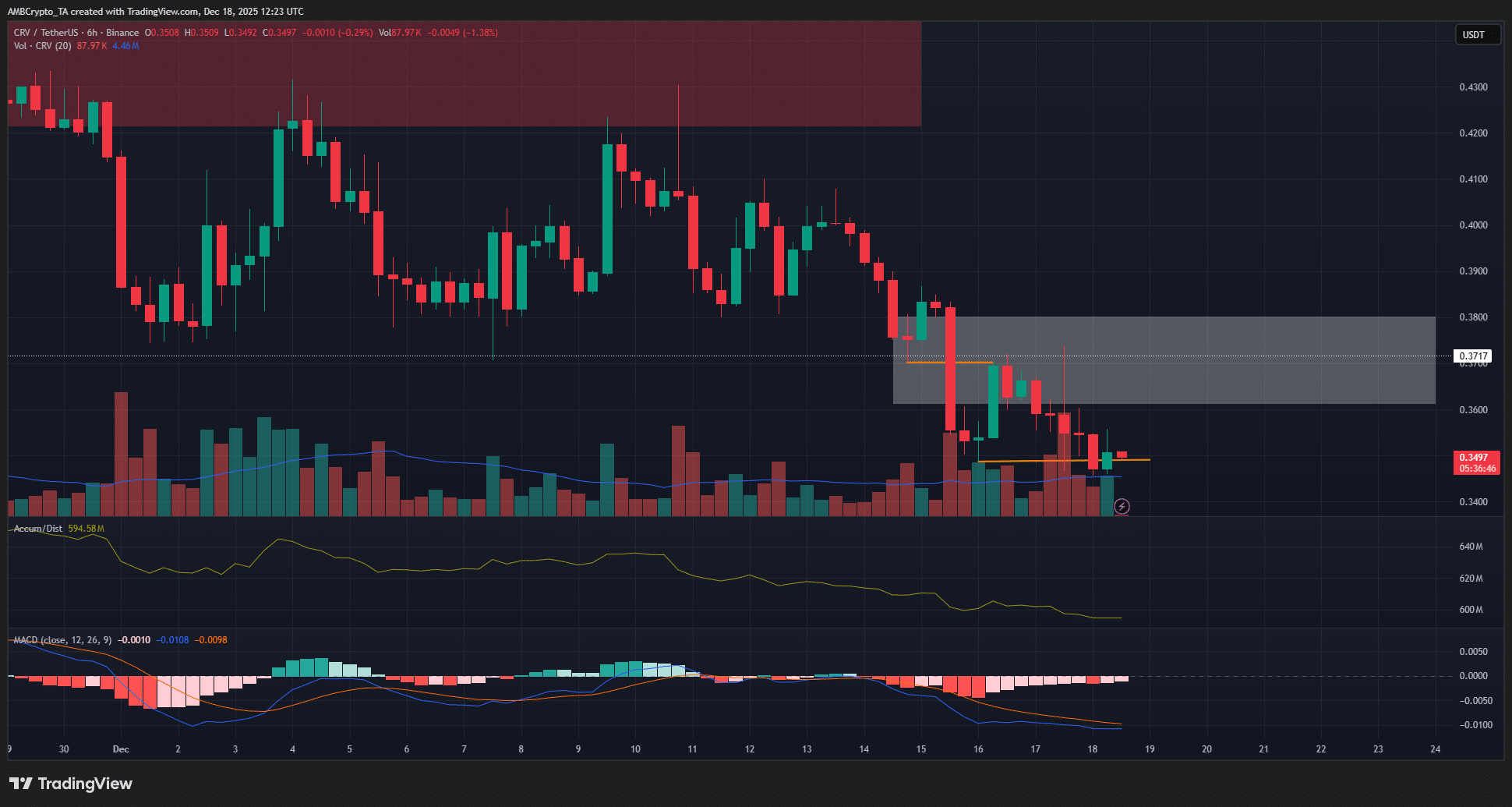

Shifting to the 6-hour timeframe, CRV presents a compelling short-selling setup. The overall trend remains bearish, marked by two rapid bearish structure breaks. A fair value gap—or price imbalance—extending up to $0.38 was recently tested, leading to renewed downward movement. This pattern suggests sellers are regaining control after brief resistance. Volume profiles on this timeframe also lean bearish, with declining buying interest failing to counter the sell-off. Experts note that such imbalances often act as magnets for price retracements, but in this case, they preceded continuation lower, underscoring the strength of bearish forces.

Source: CRV/USDT on TradingView

Broader market conditions amplify this bearishness for Curve DAO token. Bitcoin’s rejection at the $90,000 mark on Wednesday contributed to widespread altcoin weakness, with CRV mirroring the 9.9% weekly decline. On-chain metrics from platforms like Coinalyze further illustrate this: while open interest rose, indicating more positions opened, the price action decoupled, often a precursor to volatility but here favoring downside. Financial analysts emphasize that in decentralized finance (DeFi) tokens like CRV, which powers the Curve protocol for stablecoin swaps, sentiment is tied closely to liquidity trends and overall crypto market health.

Curve DAO’s governance model, where CRV holders vote on protocol parameters, adds another layer. Recent voting activity has focused on yield optimizations, but amid falling prices, veCRV (vote-escrowed CRV) locking has slowed, reducing incentives for long-term holding. Data from Dune Analytics dashboards show a 15% drop in total value locked (TVL) for Curve pools over the past month, correlating with CRV’s underperformance. This TVL contraction signals reduced protocol usage, pressuring token demand.

From a technical standpoint, resistance levels remain formidable. The $0.49 swing low now acts as overhead resistance, and without a decisive close above it, bullish scenarios stay muted. Conversely, momentum oscillators like the Relative Strength Index (RSI) on the weekly chart hover around 40, neutral but with room to fall further into oversold territory—potentially delaying any reversal. Traders monitoring exponential moving averages (EMAs) will note the 50-week EMA sloping downward, a classic bear market signal.

Frequently Asked Questions

What factors are driving the recent open interest increase in Curve DAO token?

The 6.6% surge in CRV open interest stems from heightened speculation in derivatives markets, as reported by Coinalyze. Despite price declines, traders are positioning for volatility, possibly anticipating DeFi sector recovery or broader market shifts. This metric often precedes significant moves, though current charts favor bearish outcomes over bullish reversals.

Is it a good time to short CRV based on current market analysis?

Yes, multi-timeframe indicators suggest a viable short opportunity for Curve DAO token, with bearish structures on weekly and 6-hour charts. Target $0.243 support, but invalidate above $0.38 where the fair value gap lies. Always consider risk management, as Bitcoin’s movements could influence CRV’s path in this interconnected market.

Key Takeaways

- Bearish Momentum Dominates: Weekly A/D and MACD signals confirm sell pressure for CRV, despite open interest gains.

- Short-Term Setup Clear: 6-hour chart breaks and imbalance tests point to continuation lower, with supports at $0.329 and $0.298 en route to $0.243.

- Risk Invalidation Key: Monitor for a bounce above $0.38 to reassess; broader Bitcoin weakness adds to downside potential.

Conclusion

In summary, Curve DAO token’s CRV price faces continued bearish pressure, as evidenced by declining structures on weekly and 6-hour charts, alongside rising open interest that underscores speculative bets on further drops. While short-term supports may offer pauses, the overall outlook leans toward testing $0.243. Investors should stay vigilant with market developments, incorporating robust analysis to navigate DeFi volatility and position for potential shifts in 2025.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026