Crypto ETFs Could Absorb Bitcoin Supply as Altcoin Liquidations Loom by 2027

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

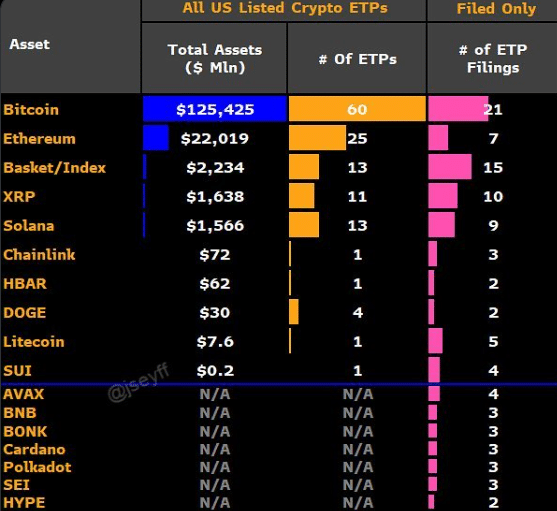

Asset manager Bitwise predicts that crypto ETFs will absorb over 100% of new Bitcoin, Ethereum, and Solana supply in 2025, driven by strong historical demand. Bloomberg analyst James Seyffart concurs but warns of potential liquidations for single altcoin ETFs amid market pressures.

-

Bitwise’s bullish outlook: Crypto ETFs expected to exceed new token supply, signaling massive institutional adoption.

-

Historical ETF inflows for Bitcoin and Ethereum support projections for altcoin products like Solana.

-

Over 126 ETF filings signal intense competition, but analysts foresee liquidations by 2027 for underperforming single altcoin funds.

Discover how crypto ETFs are set to dominate 2025 with Bitwise’s bold supply capture forecast and expert warnings on altcoin risks. Stay ahead—explore institutional trends shaping Bitcoin, Ethereum, and Solana markets today.

What Are the Prospects for Crypto ETFs in 2025?

Crypto ETFs are poised for significant growth in 2025, with Bitwise forecasting that they will capture more than 100% of the new supply for major assets like Bitcoin, Ethereum, and Solana. This projection stems from robust historical demand patterns observed in existing Bitcoin and Ethereum spot ETFs, which have already drawn billions in investments. As regulatory approvals expand to altcoins, institutional interest is expected to surge, potentially stabilizing prices while introducing new risks for less established tokens.

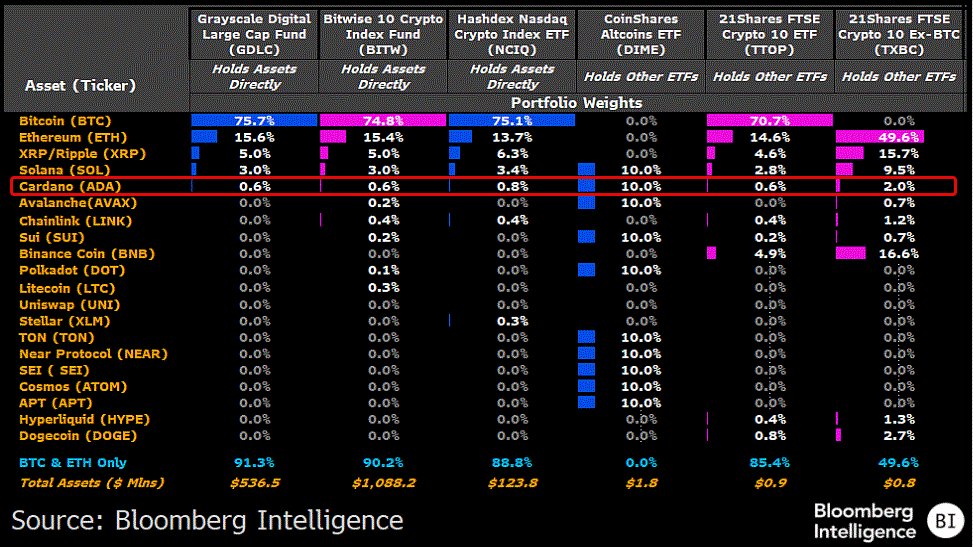

Source: Bloomberg

As of 2025, leading cryptocurrencies such as BTC, ETH, SOL, and XRP continue to lead in ETF inflows, reflecting their status as cornerstone assets in the digital economy. These funds provide investors with regulated exposure to volatile markets, mitigating some risks associated with direct holdings. However, smaller market-cap altcoins remain vulnerable, with potential price declines triggering broader liquidations across the ETF landscape.

Bloomberg ETF analyst James Seyffart has echoed Bitwise’s optimism while highlighting challenges. He notes that while demand for established assets remains strong, the proliferation of single altcoin ETFs could lead to closures during bearish periods. “I also think we’re going to see a lot of liquidations in crypto ETP products. Might happen at tail end of 2026, but likely by the end of 2027,” Seyffart stated in recent commentary.

The analyst further emphasized the crowded field, observing, “Issuers are throwing a lot of product at the wall—there’s at least 126 filings.” This surge in applications underscores the competitive nature of the sector, where only the most resilient products are likely to thrive. Bitwise’s analysis draws on data from prior ETF launches, where Bitcoin ETFs alone amassed over $50 billion in assets under management within their first year, setting a benchmark for altcoin counterparts.

How Will Single Altcoin ETFs Perform Amid Market Volatility?

Single altcoin ETFs face heightened risks in volatile markets, particularly for tokens with lower market capitalizations, as warned by experts like James Seyffart. Detailed market data from 2025 shows that while inflows remain positive for top performers, underperforming assets could see forced liquidations if prices drop below viable thresholds. For instance, the U.S. spot XRP ETF has garnered over $1 billion in inflows since its launch less than two months ago, outpacing Solana ETFs, which recorded $725 million despite an earlier debut.

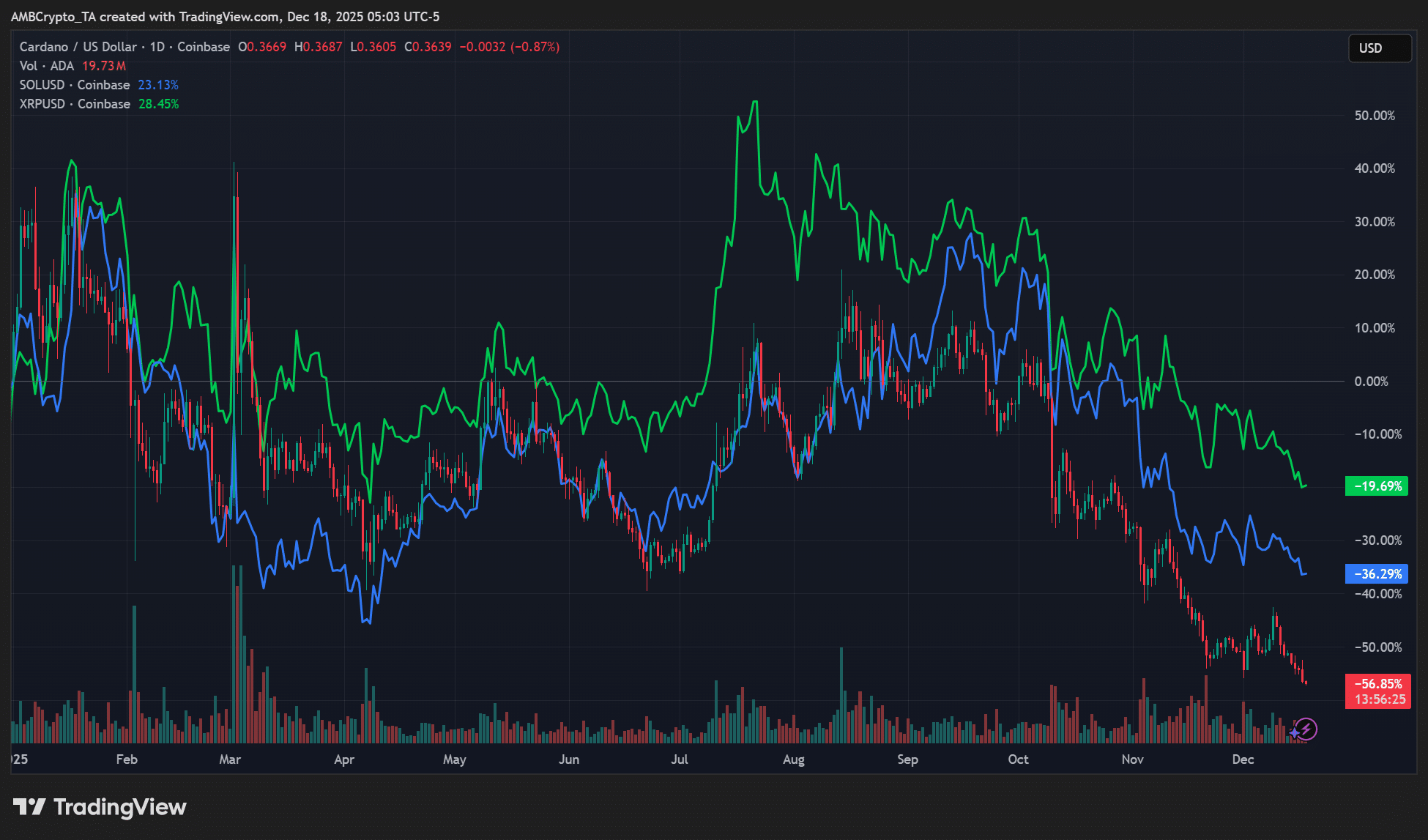

Supporting statistics from Bloomberg indicate that institutional interest in XRP has been notably stronger, yet price performance tells a different story. XRP struggled to maintain levels above $2, experiencing sharper declines than Solana, which fell about 20% over the year. This discrepancy highlights how factors beyond inflows—such as overall market sentiment and macroeconomic pressures—influence token valuations.

Expert quotes reinforce these insights. Seyffart explained, “One category I’m expecting to garner a lot of assets is crypto index ETPs. They are going to come in a lot of shapes and sizes.” This suggests a shift toward diversified products, which could offer more stability. Historical precedents, like the 2024 Ethereum ETF approvals, demonstrate that diversified exposure reduces liquidation risks by spreading investments across multiple assets.

Source: Bloomberg

Currently, six crypto index ETFs track baskets including altcoins beyond ETH, SOL, and XRP, with Cardano (ADA) frequently featured. However, recent performance data reveals muted price impacts from these products. ADA, for example, declined 56% in 2025, significantly outpacing XRP’s 36% drop and SOL’s 20% loss, according to TradingView charts.

Source: ADA vs. SOL, XRP performance (TradingView)

This reinforces concerns that single altcoin ETFs, especially for lower-cap assets, may falter harder in downturns, potentially leading to widespread liquidations. In contrast, index-based ETFs provide a buffer through diversification, though their influence on individual prices appears limited based on 2025 trends.

Broader market analysis from sources like Bloomberg highlights that while crypto ETFs enhance accessibility, they also amplify systemic risks during corrections. For investors, this means prioritizing funds tied to high-liquidity assets like BTC and ETH, which have demonstrated resilience with consistent inflows exceeding $100 billion collectively by mid-2025.

Frequently Asked Questions

What Makes Crypto Index ETFs a Safer Bet Than Single Altcoin Funds?

Crypto index ETFs offer diversified exposure to multiple assets, reducing the impact of any single token’s volatility, as noted by Bloomberg’s James Seyffart. With over six such products available in 2025, they track baskets including BTC, ETH, and altcoins like ADA, attracting steady assets without the liquidation risks facing niche single altcoin ETFs, which number over 126 filings.

Why Did XRP ETFs See Higher Inflows Than Solana Despite Price Underperformance?

XRP spot ETFs drew over $1 billion in less than two months due to strong institutional demand, surpassing Solana’s $725 million, according to Bloomberg data. However, XRP’s price dipped more sharply below $2 amid broader sentiment issues, illustrating that inflows alone don’t guarantee short-term gains—market dynamics play a key role in valuation.

Key Takeaways

- Strong Demand Projection: Bitwise anticipates crypto ETFs will exceed 100% of new BTC, ETH, and SOL supply, fueled by historical inflows topping $50 billion for Bitcoin alone.

- Liquidation Risks Ahead: Single altcoin ETFs face potential closures by 2027 in bear markets, with 126 filings intensifying competition as per analyst warnings.

- Diversification Wins: Index ETFs tracking multiple assets, including ADA, provide stability and are expected to draw significant investments over volatile single-token products.

Conclusion

In summary, the crypto ETFs landscape in 2025 promises robust growth, with Bitwise’s supply capture forecast and institutional inflows into assets like XRP and SOL underscoring their potential. Yet, single altcoin funds must navigate liquidation threats amid market volatility, as highlighted by experts like James Seyffart. As the sector evolves, investors should focus on diversified index products for long-term resilience. Stay informed on these trends to capitalize on emerging opportunities in the digital asset space.

Comments

Other Articles

Oobit Crypto-to-Bank Transfer: 11 Assets Including BNB

February 24, 2026 at 04:34 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

USDC Tops 24-Hour Net Inflows into Crypto Spot Funds as BTC and ETH See Net Outflows, According to Coinglass Data

December 29, 2025 at 02:46 AM UTC