Crypto ETP Outflows Slowed: BTC at 69K

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

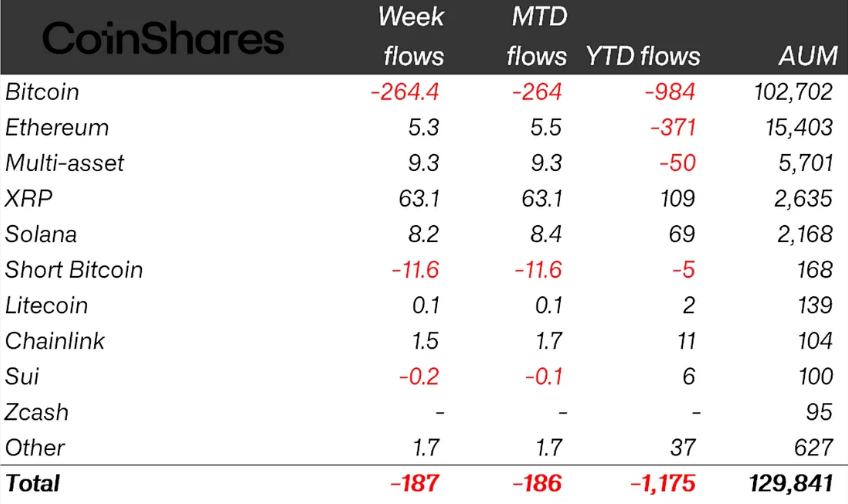

Crypto investment products experienced outflows for the third consecutive week, but the selling pace slowed significantly as digital asset prices stabilized after a sharp decline. According to CoinShares' Monday report, crypto exchange-traded products (ETPs) recorded $187 million in outflows last week; this is a sharp drop compared to $3.43 billion in the previous two weeks. Bitcoin (BTC) price fell to $60,000 on Coinbase, but surged past $68,000 with a 15% rally in the last 15 hours. Current price $69,623.99, 24-hour change -1.05%.

BTC ETP Flows and Market Data

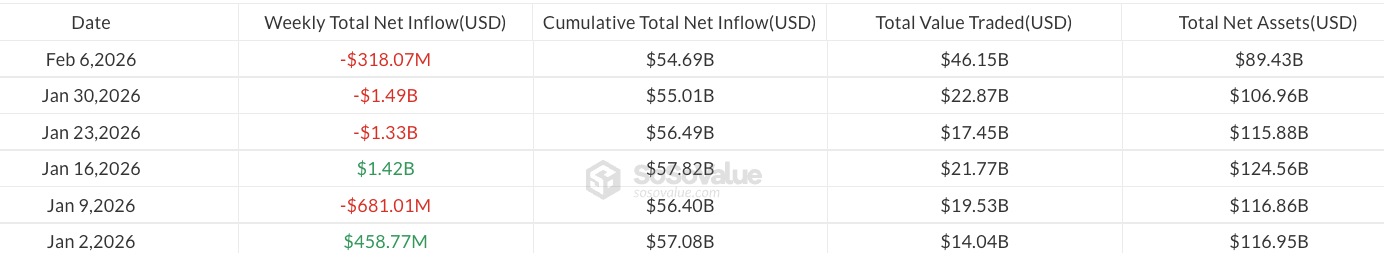

BTC ETPs suffered the only major loss with $264.4 million outflows, while XRP funds attracted $63 million inflows; Ether (ETH) and Solana (SOL) ETPs gained $5.3 million and $8.2 million respectively. Spot Bitcoin ETFs saw $318 million outflows (SoSoValue). ETP trading volumes reached a record $63.1 billion. BTC ETP AUM at $102.7 billion, global crypto ETP AUM fell to $129 billion. Year-to-date, ETPs have lost $1.2 billion.

BTC Price Recovery and Institutional Purchases

Despite outflows, BTC recovered: Binance SAFU Fund added another 4,225 BTC ($299.6 million), bringing the total to 10,455 BTC ($734 million). Garrett Jin deposited 5,000 BTC ($351 million) to Binance. 21Shares filed for Ondo (ONDO) ETF with the US SEC. These developments could increase liquidity in BTC detailed analysis.

BTC Technical Outlook

- RSI: 32.77 (Oversold)

- Trend: Downtrend, Supertrend Bearish

- Supports: S1 $62,909 (strong, 9.66% away), S2 $68,867 (1.10% away)

- Resistances: R1 $70,952 (1.89% away), R2 $79,577 (14.28% away)

- EMA 20: $78,151

With oversold signals, a buying opportunity may form in BTC futures. Follow for BTC spot analysis.