Crypto Exchanges May Emerge as Superapps, Delphi Report Spotlights Binance Strategy

JST/USDT

$7,530,661.71

$0.04813 / $0.04602

Change: $0.002110 (4.58%)

-0.0180%

Shorts pay

Contents

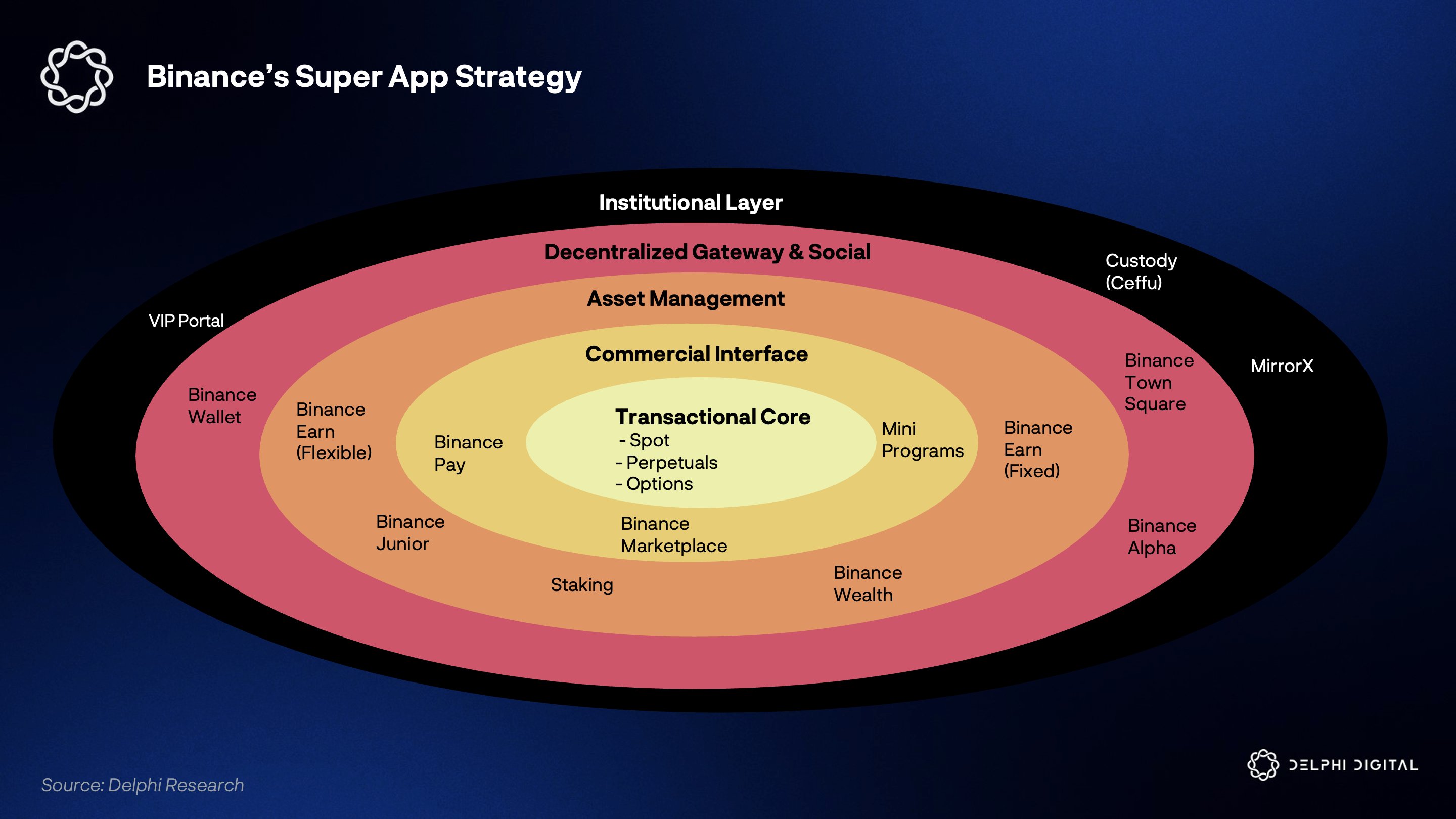

Crypto exchanges are evolving into superapps, serving as central hubs for trading, payments, Web3 apps, and yield generation. According to Delphi Digital, platforms like Binance and Kraken are leading this shift by aggregating services to capture user relationships and control distribution in the aggregation era.

-

Binance exemplifies the monolithic superapp model, integrating spot trading, Earn products, lending, staking, and payments into one interface.

-

Kraken adopts a federated constellation approach with specialized apps like Inky for memecoins and Krak for remittances, while maintaining unified backend liquidity.

-

Major players including Coinbase and OKX are enhancing Web3 wallets, NFT markets, and DeFi access, positioning exchanges as gateways for the next wave of users, with projections estimating over 100 million new entrants.

Crypto exchanges are transforming into superapps for seamless trading and Web3 access. Discover how Binance, Kraken, and others lead this shift per Delphi Digital’s insights. Stay ahead in 2025—explore now!

What Are Crypto Exchanges Becoming Superapps?

Crypto exchanges becoming superapps means platforms are expanding beyond simple trading to integrate comprehensive services like payments, staking, and Web3 applications into a single user interface. This evolution, highlighted in a Delphi Digital report, aims to own the user experience and distribution of crypto products. Exchanges are competing to become the primary gateway, mirroring Asia’s superapp success while adapting to Western preferences and regulatory frameworks.

How Is the Aggregation Era Shaping Crypto Platforms?

The aggregation era in crypto shifts power from base protocols to platforms that control user interactions, as detailed by Delphi Digital. Exchanges are now distributing liquidity for stablecoins, NFTs, gaming, and more, creating default gateways for users. This model emphasizes convenience, with platforms bundling services to streamline onboarding and discovery. Supporting data from the report shows that unified interfaces can boost user retention by simplifying access to diverse onchain activities. Experts note that whoever masters this distribution layer will dominate the next user influx, potentially adding hundreds of millions of participants.

Delphi Digital’s analysis underscores that the race involves not just product integration but also regulatory positioning. A superapp consolidates oversight, appealing to regulators seeking clear accountability, while federated models offer flexibility. Statistics indicate that platforms with integrated wallets see 30-50% higher engagement in DeFi and staking, per industry benchmarks. This era promises enhanced utility but raises questions about centralization risks and user data privacy.

Source: Delphi Digital

Frequently Asked Questions

What Makes Binance a Leading Example of Crypto Superapps?

Binance leads as a crypto superapp by evolving from a trading venue into a multifunctional platform offering spot and derivatives trading, Earn products, lending, staking, payments through Binance Pay, and a Web3 wallet. Delphi Digital compares this to WeChat’s model, where one interface provides infinite utility, all while serving institutional clients. This integration has positioned Binance to capture diverse user behaviors seamlessly.

How Does Kraken Differ in Its Approach to Building Crypto Superapps?

Kraken’s strategy focuses on a constellation of specialized apps connected by shared infrastructure for liquidity, custody, and identity, making it ideal for voice searches on crypto platform innovations. For instance, Inky targets memecoin entertainment, Krak handles stablecoin remittances with yield options, and Kraken Pro supports advanced trading. This unbundled front-end with rebundled backend, as per Delphi Digital, allows tailored experiences without overwhelming users.

Source: Delphi Digital

Key Takeaways

- Aggregation Drives Competition: Crypto exchanges are prioritizing user relationship control over protocol dominance, turning platforms into versatile distribution layers for trading, payments, and Web3 services.

- Diverse Models Emerge: Binance’s monolithic superapp contrasts with Kraken’s federated apps, both aiming to simplify access while adapting to regulations and user preferences.

- Future User Growth: The winner in this superapp race could onboard the next 100 million users, influencing crypto’s mainstream adoption through enhanced discovery and convenience.

Conclusion

As crypto exchanges becoming superapps accelerates in the aggregation era, platforms like Binance, Kraken, Coinbase, and OKX are redefining user interfaces with integrated trading, Web3 wallets, and DeFi tools. Delphi Digital’s report illustrates how this shift positions exchanges as central hubs, balancing innovation with regulatory compliance. Looking ahead, these developments promise broader accessibility, empowering users to engage with the evolving crypto landscape—consider exploring these platforms to navigate the opportunities in 2025.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026