Crypto M&A Hits Record $8.6B in 2025, Led by Coinbase Deals

CROSS/USDT

$944,653.22

$0.10413 / $0.09857

Change: $0.005560 (5.64%)

+0.0050%

Longs pay

Contents

Crypto M&A activity in 2025 hit record highs at $8.6 billion across 133 deals, surpassing the prior four years combined. Led by Coinbase and Ripple, this surge reflects industry expansion amid regulatory shifts and easing interest rates, signaling resilience in turbulent markets.

-

Coinbase completed six acquisitions totaling billions, including the $2.9 billion Deribit deal, dominating crypto M&A in 2025.

-

Ripple and Kraken each pursued aggressive expansion strategies through multiple strategic buyouts to enhance their platforms.

-

Overall deal value exceeded previous years, with data from PitchBook showing 133 transactions, driven by favorable U.S. regulatory changes.

Crypto M&A activity in 2025 reached $8.6B in 133 deals, led by Coinbase’s Deribit buyout. Discover key acquisitions and industry trends driving this surge. Stay ahead in crypto—explore now for insights.

What is the state of crypto M&A activity in 2025?

Crypto M&A activity in 2025 has surged to unprecedented levels, reaching $8.6 billion across 133 deals as of November, according to data from PitchBook reported by Bloomberg. This marks an all-time high in both volume and value, outpacing the combined totals of the previous four years. The boom underscores the sector’s maturation and strategic consolidation amid market challenges.

Which companies led crypto M&A in 2025?

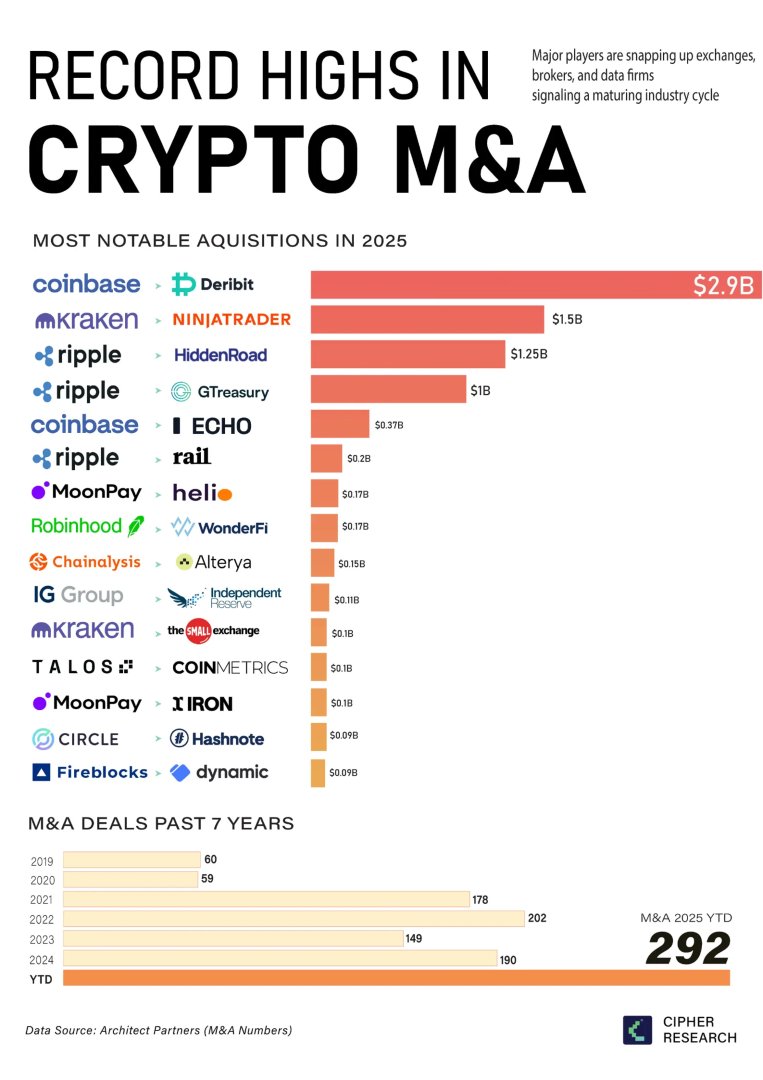

Coinbase spearheaded the year’s activity with six notable acquisitions, including the landmark $2.9 billion purchase of Deribit, a leading crypto derivatives marketplace. Other deals by Coinbase encompassed Spindl, a blockchain-based advertising platform; the Roam web browser team; Echo, an onchain capital raising platform; Vector.Fun, a memecoin exchange; and Liquifi, a token management firm. These moves position Coinbase to broaden its ecosystem in trading, advertising, and decentralized finance.

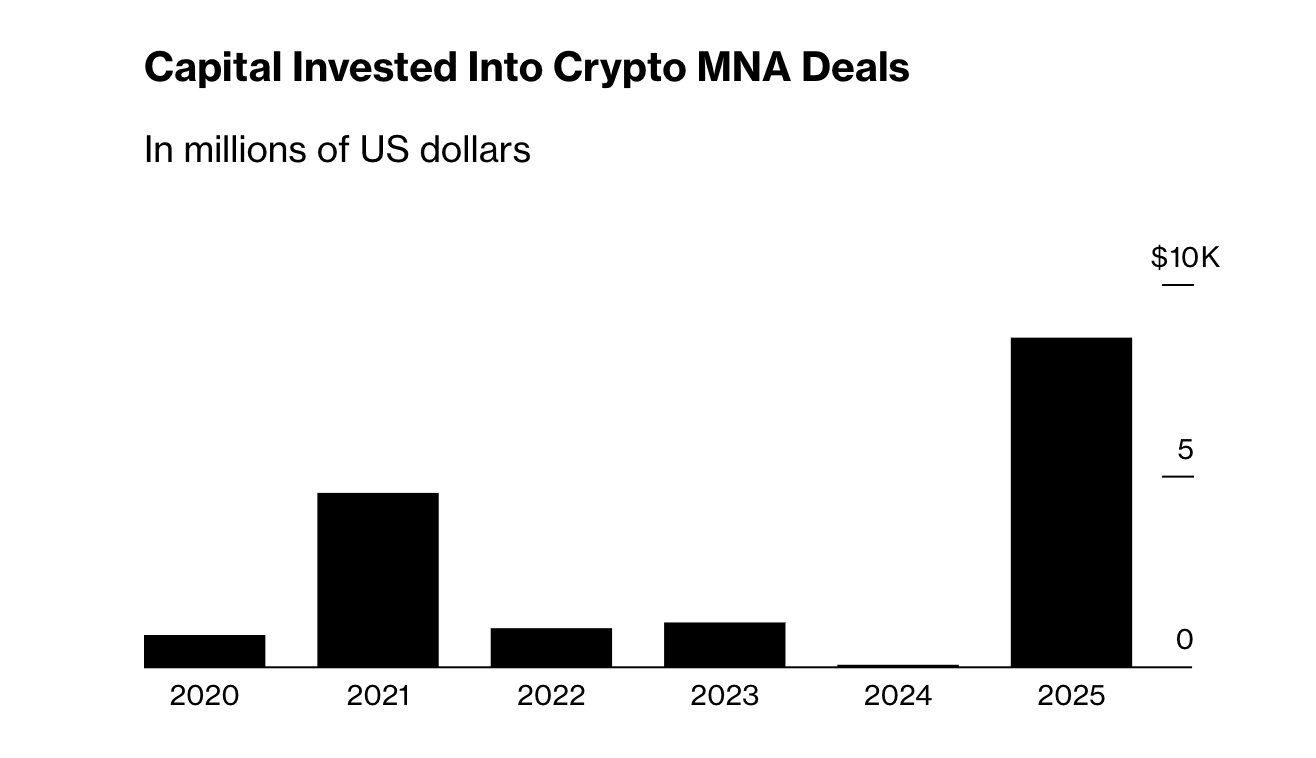

Total amount of capital invested in crypto deals every year since 2020. Source: Bloomberg

Ripple followed with four strategic acquisitions totaling over $2.65 billion, aiming to fortify its cross-border payment and treasury solutions. Key purchases included Hidden Road, a prime brokerage for $1.25 billion; GTreasury, a corporate treasury management company for $1 billion; Rail, a stablecoin platform for $200 million; and Palisade, a wallet provider. Industry analysts note these deals enhance Ripple’s competitiveness in institutional finance.

Breakdown of M&A deals in 2025. Source: Voronoi

Kraken rounded out the top performers with five acquisitions, expanding its derivatives and trading capabilities. The exchange acquired NinjaTrader, a futures trading platform, in May; Breakout, a proprietary trading platform, in September; Small Exchange for $100 million in October to develop U.S. crypto derivatives markets; and Backed Finance AG in November, issuer of the tokenized stock platform xStocks. These transactions, per PitchBook data, reflect Kraken’s focus on regulatory-compliant growth.

The elevated M&A pace signals broader industry tailwinds, such as the U.S. regulatory environment’s evolution under new frameworks and the Federal Reserve’s interest rate reductions. Despite macroeconomic pressures like inflation and volatility in digital asset prices, these factors have encouraged consolidation. Experts from financial research firms emphasize that such activity fosters innovation, with deal counts rising 25% year-over-year based on aggregated transaction reports.

Crypto venture capital also complemented this trend, injecting $4.6 billion in the third quarter alone—the strongest since the 2022 FTX collapse—further bolstering M&A momentum. Ethereum-based treasury initiatives have sparked discussions on a potential “DeFi Summer 2.0,” highlighting how acquisitions could accelerate decentralized applications and yield-generating protocols.

Frequently Asked Questions

What were the major crypto acquisitions by Coinbase in 2025?

Coinbase’s 2025 acquisitions included the $2.9 billion Deribit deal for derivatives trading, Spindl for blockchain advertising, Roam for web browsing tech, Echo for onchain fundraising, Vector.Fun for memecoin exchanges, and Liquifi for token management. These six deals totaled significant value and expanded Coinbase’s service offerings in a competitive market.

How has U.S. regulatory change impacted crypto M&A activity in 2025?

U.S. regulatory shifts in 2025, including clearer guidelines on digital assets and institutional participation, have boosted crypto M&A by reducing uncertainty. This environment encouraged deals like Kraken’s Small Exchange acquisition for compliant U.S. derivatives, making the sector more attractive for strategic investments and long-term growth.

Key Takeaways

- Record-Breaking Volume: Crypto M&A in 2025 achieved $8.6 billion over 133 deals, exceeding prior years and demonstrating sector resilience.

- Leadership by Exchanges: Coinbase, Ripple, and Kraken drove activity with targeted buys in trading, payments, and tokenized assets for ecosystem expansion.

- Future Outlook: Regulatory easing and VC inflows suggest continued consolidation—monitor emerging DeFi and institutional trends for investment opportunities.

Conclusion

In summary, crypto M&A activity in 2025 shattered records with $8.6 billion in deals led by Coinbase’s Deribit acquisition and Ripple’s treasury expansions, amid favorable U.S. regulatory changes. This consolidation highlights the industry’s shift toward maturity and innovation. As interest rates stabilize, expect further strategic mergers to shape the crypto landscape—position your portfolio accordingly for upcoming opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026