Crypto VC Deals Drop 28% in November 2025, Funding Surges on Upbit Acquisition

MON/USDT

$24,932,404.19

$0.02098 / $0.01941

Change: $0.001570 (8.09%)

-0.0009%

Shorts pay

Contents

Crypto VC activity in November 2025 slowed significantly, with 57 disclosed investment deals, down 28% from October’s 79 and 41% from November 2024’s 96, per RootData data. Despite fewer deals, total funding reached $14.54 billion, boosted by Naver’s massive $10.3 billion acquisition of Dunamu.

-

Crypto VC deals dropped to 57 in November 2025, marking a continued decline in volume.

-

DeFi led sectors with 30.4% of transactions, followed by centralized finance infrastructure at 12.5%.

-

Total funding hit $14.54 billion, a 219% increase from October, driven by one landmark $10.3 billion deal representing 70.8% of the total.

Crypto VC activity in November 2025 saw fewer deals but record funding from Naver’s Dunamu buyout. Explore DeFi dominance and key raises—stay ahead in blockchain investments today.

What is the state of crypto VC activity in November 2025?

Crypto VC activity in November 2025 experienced a notable slowdown in deal volume but a dramatic surge in total funding. Publicly disclosed investments fell to 57 projects, reflecting a 28% month-over-month decrease from October’s 79 deals and a 41% drop compared to November 2024’s 96, according to data from RootData. This trend underscores a broader contraction in transaction numbers over the past year, even as unreported financings could influence monthly figures.

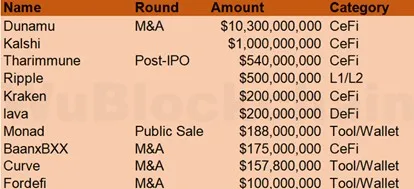

Crypto VC data | Source: Wu Blockchain

Crypto VC data | Source: Wu BlockchainThe decline in deal count highlights a cautious approach among investors amid market uncertainties, yet the sector’s resilience is evident in strategic high-value moves. Sector breakdowns reveal DeFi as the frontrunner, capturing 30.4% of deals, which points to sustained interest in decentralized financial innovations. Centralized finance infrastructure, encompassing exchanges and lending platforms, accounted for 12.5%, while AI-integrated crypto projects and real-world asset or decentralized physical infrastructure efforts each secured 7.1% of the transactions.

Other areas like tool and wallet developments represented 5.4%, with Layer 1 and Layer 2 blockchain infrastructures lagging at just 1.8%. NFTs and GameFi combined for another 1.8%, indicating niche but limited activity in these segments. This distribution emphasizes a focus on core infrastructure and finance over speculative entertainment-driven projects.

How did major acquisitions and funding rounds influence November 2025 crypto investments?

The most transformative event was Naver’s all-stock acquisition of Dunamu, the operator of the Upbit exchange, valued at $10.3 billion, which single-handedly propelled November’s total funding to $14.54 billion—a 219% increase from October’s $4.556 billion. This deal valued Naver Financial at 4.9 trillion won and Dunamu at 15.1 trillion won, making Naver Financial the parent company through a share swap. Dunamu’s consolidated revenue for the first nine months of 2025 grew 22% year-over-year to 1.19 trillion won, with Upbit-related operations contributing nearly 97.9% of that total, according to company reports.

Excluding this acquisition, November’s funding would have stood at around $4.24 billion, underscoring its outsized impact. In prediction markets, Kalshi secured $1 billion at an $11 billion valuation, led by returning investors Sequoia and CapitalG, alongside Andreessen Horowitz, Paradigm, Anthos Capital, and Neo. Bloomberg reports indicate Kalshi’s rival Polymarket is negotiating funding at a $12 billion to $15 billion valuation, signaling robust interest in this space.

DRW Holdings and Liberty City Ventures committed $540 million via a private placement in Tharimmune Inc., tied to the Canton blockchain’s token for financial applications. This follows their participation in Digital Asset’s $135 million round in June. Ripple’s $500 million raise valued it at $40 billion, with leaders like Fortress Investment Group, Citadel Securities affiliates, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace funds involved. Kraken attracted $200 million from Citadel Securities, reaching a $20 billion valuation after a prior $600 million round in September, totaling $800 million in recent capital.

Strategic moves included Monad’s $188 million public sale on Coinbase, offering 7.5% of MON tokens at 0.025 USDC each, implying a $2.5 billion fully diluted valuation for the Ethereum-compatible Layer 1 blockchain. Exodus Movement acquired W3C Corp for $175 million, integrating Baanx and Monavate’s crypto card and payments operations, funded by cash and BTC-collateralized financing from Galaxy Digital, with closure expected in 2026. Lloyds Banking Group committed 120 million pounds to acquire digital wallet provider Curve, which had raised over 250 million pounds historically. Paxos Trust Company bought Fordefi Inc. for more than $100 million, surpassing Fordefi’s $83 million valuation from its last round.

Frequently Asked Questions

What caused the drop in crypto VC deal volume in November 2025?

The decline to 57 deals in November 2025 stems from a year-long trend of reduced transaction announcements, dropping 41% from November 2024’s 96 and 28% from October 2025’s 79, as tracked by RootData. Factors include market caution and delayed reporting of financings, though high-value deals maintained funding momentum.

Which sector dominated crypto VC investments during November 2025?

DeFi led with 30.4% of disclosed deals, highlighting its role as the most active category for crypto venture capital. This focus on decentralized finance reflects investor confidence in protocols that enable lending, trading, and yield farming without intermediaries, making it a cornerstone of blockchain innovation.

How significant was Naver’s acquisition of Dunamu in crypto funding?

Naver’s $10.3 billion purchase of Dunamu represented 70.8% of November 2025’s $14.54 billion total funding, marking the largest crypto financing event to date. It elevated centralized exchange infrastructure and boosted overall investment figures, demonstrating the strategic value of established platforms in the ecosystem.

Key Takeaways

- Declining Deal Volume: November 2025 saw only 57 crypto VC deals, a 28% drop from October, signaling investor selectivity amid broader market dynamics.

- Funding Surge via Mega-Deals: Total investments reached $14.54 billion, driven by Naver’s $10.3 billion Dunamu acquisition, which overshadowed smaller rounds.

- Sector Leadership in DeFi: With 30.4% of deals, DeFi remains a priority, encouraging diversification into AI and infrastructure for balanced portfolios.

Conclusion

In summary, crypto VC activity in November 2025 balanced reduced deal volumes with exceptional funding levels, largely propelled by the landmark Naver-Dunamu merger and notable rounds for Ripple, Kraken, and Kalshi. DeFi’s prominence and strategic acquisitions like those by Exodus and Paxos illustrate the sector’s maturation toward infrastructure and real-world integration. As blockchain evolves, investors should monitor regulatory shifts and innovation in prediction markets to capitalize on emerging opportunities in this dynamic landscape.