Curve DAO Whale Capitulates on CRV Holdings Amid Persistent Downtrend

CRV/USDT

$48,816,840.53

$0.2443 / $0.2274

Change: $0.0169 (7.43%)

+0.0031%

Longs pay

Contents

A Curve DAO whale capitulated by selling over 4 million CRV tokens to Binance at $0.34, realizing just $400,000 in profit after holding through a rally to $1.30 where gains peaked at $5.2 million. This move highlights market weakness in CRV amid declining trends and outflows.

-

Whale’s acquisition: Accumulated 5 million CRV at $0.26 last year, costing $1.3 million.

-

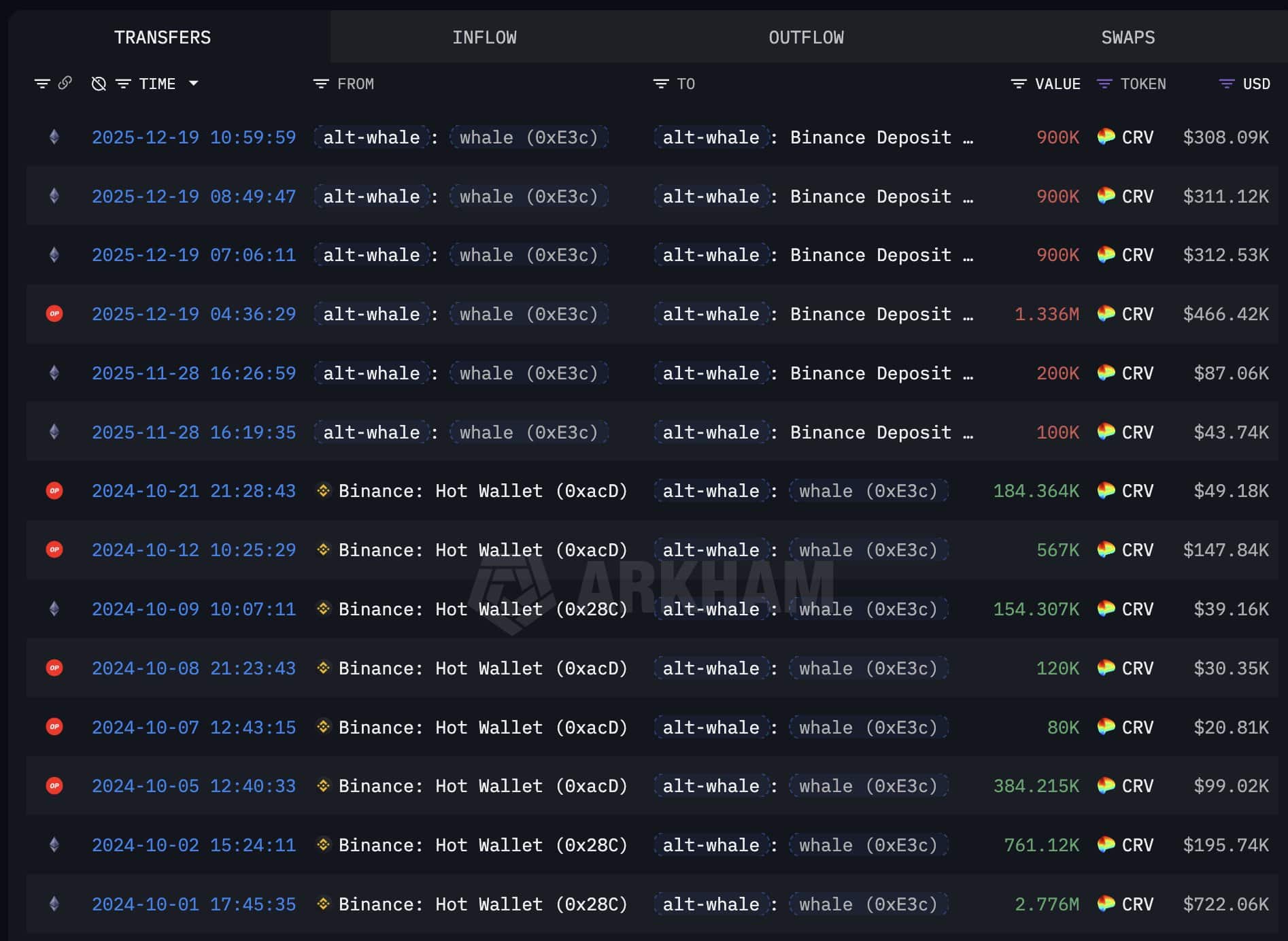

On-chain data from Arkham reveals no sales during the uptrend, only capitulation into weakness this week.

-

CRV price downtrend persists, with indicators showing negative outflows; token trades near $0.34 support level, per TradingView charts.

Discover the Curve DAO whale capitulation: A major holder sells 4M+ CRV at a loss after missing peak profits. Analyze impacts on price and market cycle. Stay informed on CRV trends—read now for key insights.

What is the Curve DAO Whale Capitulation Event?

Curve DAO whale capitulation refers to a significant investor selling a large holding of CRV tokens at a suboptimal price point after enduring market volatility. This particular whale, tracked via on-chain data from Arkham, acquired approximately 5 million CRV tokens at an average price of $0.26 last year, establishing a cost basis of about $1.3 million. Despite witnessing the token surge to $1.30 in October, where unrealized profits approached $5.2 million, the holder refrained from any sales during the rally. This week, however, the whale transferred more than 4 million CRV to Binance at around $0.34, locking in only $400,000 in realized profit—a sharp contrast to the potential multi-million-dollar gains foregone.

Source: X

This event underscores a pattern of Curve DAO whale capitulation where long-term holders exit positions amid broader market pressures, rather than capitalizing on earlier highs. On-chain analytics from Arkham indicate the transfer occurred during a period of thin liquidity, amplifying the signal of distress in the CRV ecosystem. Such moves are not isolated; they reflect wider sentiment shifts in decentralized finance protocols like Curve, which relies on stablecoin liquidity and governance token dynamics for stability.

Why Did the CRV Whale Sell Into Weakness Now?

The decision to sell more than 4 million CRV tokens at $0.34, despite holding through a rally that could have yielded over $5 million in profit, points to mounting pressures on large holders in the Curve DAO ecosystem. Arkham’s on-chain data reveals the whale’s accumulation occurred at $0.26, building a substantial position that appreciated significantly during CRV’s October surge to $1.30. However, with the token now entrenched in a downtrend since early November, as evidenced by TradingView’s 12-hour charts showing lower highs and persistent declines, the holder likely faced liquidity needs or waning confidence in a near-term recovery.

Source: TradingView

Technical indicators further support this narrative. The Year-to-Date Moving Average Multiple is at -0.84, meaning CRV trades well below its annual trend line, a statistic derived from standard technical analysis tools. Additionally, the Chaikin Money Flow (CMF) over 20 periods reads -0.18, indicating ongoing capital outflows and limited buying interest. Expert analysis from blockchain analysts, such as those at Arkham Intelligence, notes that such capitulations often stem from broader DeFi sector challenges, including reduced stablecoin volumes on Curve pools and competition from newer automated market makers. “Whales holding through peaks but folding into dips signal exhaustion in the protocol’s governance token,” observed a senior on-chain researcher from Arkham in recent reports. With CRV hovering between $0.34 and $0.35, the sale aligns with testing the lower end of this range, potentially exacerbating downward pressure if similar exits follow.

Curve DAO, as a cornerstone of DeFi liquidity provision, facilitates efficient stablecoin swaps through its automated market maker model. CRV tokens incentivize liquidity providers and voters in the protocol’s governance. However, recent market dynamics, including macroeconomic factors like interest rate shifts and regulatory scrutiny on crypto, have strained token performance. Data from DeFi analytics platforms shows Curve’s total value locked (TVL) has fluctuated, dipping below $2 billion in late 2025, down from peaks over $20 billion in prior years. This context likely contributed to the whale’s timing, as prolonged underperformance erodes holder resilience.

Historically, whale activities in CRV have influenced price swings. For instance, during the 2024 bull run, coordinated buys by large addresses propelled the token higher. In contrast, this capitulation mirrors events in other DeFi tokens where major holders liquidated amid bearish cycles, leading to temporary price stabilization followed by further declines if sentiment doesn’t shift. The realized profit of $400,000, while positive, represents a mere fraction of the unrealized windfall, emphasizing the risks of diamond-hand strategies in volatile assets.

Frequently Asked Questions

What Does the Curve DAO Whale Sale Mean for CRV Price in the Short Term?

The Curve DAO whale’s sale of over 4 million CRV tokens to Binance at $0.34 could pressure the price downward in the short term, potentially testing support at $0.33. On-chain data from Arkham shows this as a capitulation signal amid weak liquidity, with indicators like CMF at -0.18 confirming outflows. If volume doesn’t rebound, CRV may see further declines before stabilizing.

Is Curve DAO Experiencing a Market Cycle Bottom After This Whale Capitulation?

While whale capitulation in Curve DAO often marks sentiment exhaustion, current data from TradingView and Arkham suggests it’s not yet a bottom. CRV’s downtrend features lower highs since November, with price at $0.34 and negative money flow. A reversal would require breaking resistance at $0.40, but persistent outflows point to continued vulnerability in this cycle phase.

Key Takeaways

- Capitulation Signal: The whale’s sale after holding through $1.30 highs indicates broader holder fatigue in CRV, realizing only $400,000 from a potential $5.2 million gain.

- Technical Weakness: Indicators like YTD Moving Average Multiple at -0.84 and CMF at -0.18 highlight ongoing downtrends and capital outflows, per TradingView analysis.

- Watch Levels: Monitor $0.33 support, $0.38-$0.40 resistance; increased buy volume is essential to counter downside risks in Curve DAO’s market cycle.

Conclusion

The Curve DAO whale capitulation event, involving the sale of over 4 million CRV tokens at $0.34 amid a persistent downtrend, reveals underlying structural challenges in the protocol’s tokenomics and market sentiment. With on-chain insights from Arkham and technical confirmation from TradingView showing negative flows and lower highs, CRV faces near-term risks unless liquidity improves. Investors should track key support levels and broader DeFi trends, as such moves often precede either deeper corrections or stabilization—positioning now requires careful analysis of Curve DAO’s governance and TVL recovery potential.