DASH May Face Further Drop Amid Seller Dominance, But Spot Accumulation Signals Potential Rebound

DASH/USDT

$60,970,532.87

$33.54 / $30.57

Change: $2.97 (9.72%)

+0.0060%

Longs pay

Contents

Dash (DASH) experienced a sharp 17% price decline to $67.07 over the last 24 hours, driven primarily by outflows from perpetual traders amid a broader market downtrend. Despite this, spot market accumulation by retail investors signals potential long-term confidence in the privacy-focused cryptocurrency.

-

DASH saw one of the largest outflows in the crypto market, with $66.84 million in derivatives selling pressure contributing to the drop.

-

Negative funding rates indicate sellers dominating positions in both spot and futures markets.

-

Spot investors accumulated over $14 million in DASH this week, including $2.55 million in the past day, suggesting buying opportunities during the pullback.

DASH price drops 17% to $67.07 amid heavy derivatives outflows, but spot buying rises. Explore why perpetual traders are selling and if accumulation hints at recovery. Stay informed on DASH trends today.

What caused the recent DASH price drop?

DASH cryptocurrency has undergone a significant downturn, falling 17% to $67.07 in the past 24 hours due to substantial outflows from perpetual traders. This bearish pressure follows a 50% monthly gain for the altcoin, prompting profit-taking in the derivatives market. While the broader privacy coin sector expanded by 85%, DASH’s decline highlights specific market dynamics at play.

How are derivatives traders influencing DASH’s market direction?

The privacy-oriented DASH token has been hit hard by activity in the derivatives arena, where approximately $66.84 million in capital has flowed out, predominantly from sellers. Data from Coinglass shows that the funding rate has turned negative, meaning short position holders are paying fees to longs, which underscores seller dominance in both spot and futures trading. This shift became evident after DASH’s recent rally, as traders locked in gains, leading to increased short interest.

Source: Coinglass

The Open Interest-Weighted Funding Rate, a key indicator of overall sentiment, has also dipped into negative territory, reinforcing that bearish forces are steering the price action. Should this trend hold, it could lead to further declines, potentially sparking liquidations among leveraged positions and amplifying volatility in the short term.

Frequently Asked Questions

What is the current support level for DASH after its recent decline?

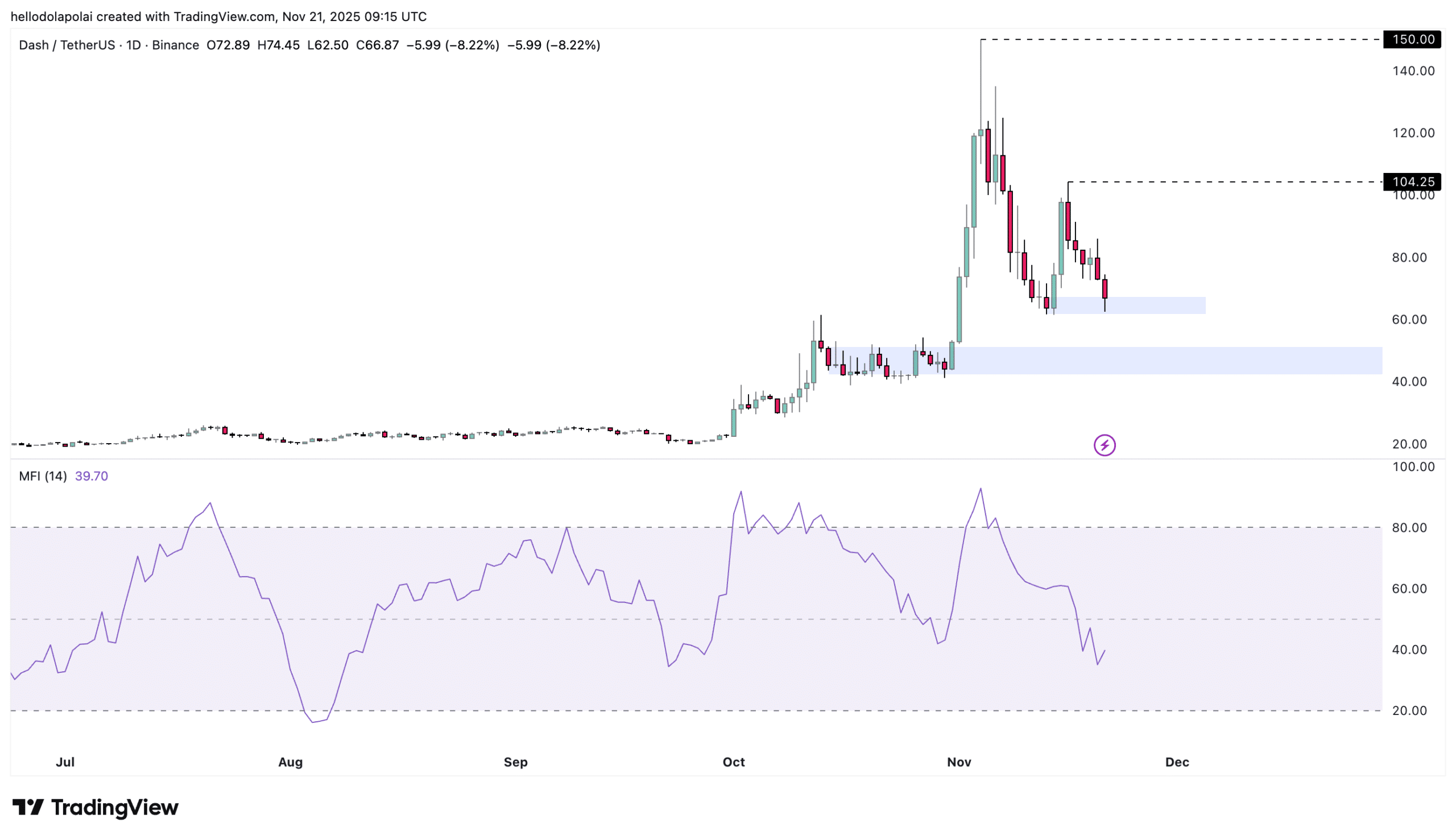

DASH is currently trading within a demand zone between $61 and $67, which has historically provided some bounce potential. However, with weakening momentum, a break below this could target the next support at $42.15 to $51.28, an area that acted as consolidation for 16 days prior to a previous breakout.

Is spot market activity showing bullish signs for DASH amid the downtrend?

Yes, spot investors have been actively accumulating DASH, with over $14 million bought this week and $2.55 million in the last 24 hours alone. This influx during the price pullback points to retail confidence in long-term value, potentially countering the derivatives-led sell-off if it persists.

Key Takeaways

- Derivatives Outflows Drive Decline: Perpetual traders’ selling has caused a 17% drop in DASH to $67.07, following monthly gains and turning funding rates negative.

- Spot Accumulation Offers Hope: Retail buyers invested $14 million this week, viewing the dip as a buying opportunity for potential recovery.

- Monitor Key Indicators: Watch the Money Flow Index at 39.70 and support zones; a push above 50 on MFI could signal rebound momentum.

Where might DASH head next in this market environment?

Analysis indicates that DASH could face additional downside if selling pressure from derivatives persists, potentially testing lower demand zones. At present, the token hovers in a $61-$67 range, but momentum indicators like the Money Flow Index (MFI) at 39.70 show early signs of liquidity returning, though it remains below the 50 threshold for confirmed bullishness.

Source: TradingView

The broader privacy coin market’s 85% growth provides a contrasting backdrop, suggesting DASH’s issues are more tied to trader behavior than sector-wide weakness. Experts from platforms like Coinglass note that sustained negative funding could exacerbate the slide, but spot demand might stabilize prices if it intensifies.

In summary, the DASH price drop reflects heavy influence from perpetual market outflows, yet rising spot accumulation hints at underlying resilience in the DASH cryptocurrency. As derivatives dynamics evolve, investors should track funding rates and MFI for shifts, positioning for a possible rebound in the coming weeks.

Conclusion

The recent turbulence in DASH underscores the volatility inherent in cryptocurrency markets, particularly for privacy-focused assets like DASH amid derivatives-driven pressures. With spot investors stepping in amid the 17% decline to $67.07, there may be opportunities for recovery if buying sustains. Keep an eye on key support levels and indicators for informed decisions in this evolving landscape.

A closer look at spot market trends for DASH

Despite the overarching bearish sentiment from futures trading, spot market participants have demonstrated resilience by increasing their holdings in DASH. Over the past week, inflows totaled more than $14 million, with a notable $2.55 million added in the last day alone. This activity, as tracked by Coinglass, points to a strategic accumulation phase where investors are capitalizing on the lower prices to build positions for anticipated future gains.

Source: Coinglass

Such patterns often precede price stabilizations or upturns, especially in a market where the privacy segment continues to show robust growth. Financial analysts emphasize that this divergence between spot and derivatives flows can create a foundation for DASH to regain footing, provided the current support holds against further selling.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Solana Shows Potential Bullish Breakout with Growing Institutional ETP Assets

December 17, 2025 at 08:36 AM UTC

Saylor’s Strategy Adds $963M in Bitcoin as BitMine Boosts ETH Holdings

December 9, 2025 at 01:53 PM UTC