DASH Rallies 12% on Inflows, But Bearish Signals May Signal Reversal

DASH/USDT

$60,970,532.87

$33.54 / $30.57

Change: $2.97 (9.72%)

+0.0060%

Longs pay

Contents

DASH price rallied 12% in the past day due to robust capital inflows from retail investors, with $2.69 million in tokens swiftly transferred to private wallets, signaling growing long-term confidence amid positive trends in privacy tokens.

-

Retail investor activity: Spot market inflows reduced exchange reserves, driving the immediate price surge.

-

Derivatives market saw open interest rise by 26%, injecting $20.58 million, though dominated by short positions.

-

Bearish indicators: Negative funding rates and Aroon Down dominance suggest potential downward pressure, with historical parallels to a 49% drop.

DASH price surges 12% on retail inflows and privacy token gains. Discover bearish signals like negative funding rates warning of volatility. Stay informed on DASH’s market outlook today.

Why is the DASH price rallying today?

DASH price has climbed 12% over the past 24 hours, fueled primarily by significant capital inflows from retail investors in the spot market. These inflows have notably decreased exchange reserves, reflecting heightened buying interest. A key transaction involved $2.69 million worth of DASH being acquired and promptly transferred to private wallets, underscoring a shift toward long-term holding strategies.

What are the main drivers behind DASH’s capital inflows?

The surge in DASH’s spot market activity stems from retail investors actively accumulating tokens, leading to a $5.62 million total purchase volume this week alone. Data from market analytics platforms indicates that these movements from centralized exchanges to private addresses point to bullish sentiment among holders. Privacy-focused cryptocurrencies, including DASH, have outperformed other sectors, as reported by sector performance trackers like Artemis, capturing investor interest in enhanced transaction anonymity features. This trend aligns with broader market liquidity improvements, where spot trading volumes have played a pivotal role in price stabilization and upward momentum.

Source: CoinGlass

In the derivatives arena, open interest for DASH has increased by 26%, representing an influx of approximately $20.58 million in new positions. While this capital injection supports the current rally, it also introduces complexities, as not all inflows favor upward price movement. Market participants, including institutional traders, have contributed to this dynamic, with analytics from platforms like CoinGlass highlighting the balance between spot and futures activities.

Not all capital inflows support a sustained DASH rally

Although derivatives inflows appear supportive, a closer examination reveals a predominance of short positions, which could undermine the rally’s longevity. The open interest-weighted funding rate, a metric that gauges the balance between long and short traders through fee payments, currently stands at 0.8088%. This positive rate indicates that long positions are paying fees to shorts, suggesting bearish bets are gaining traction. According to insights from trading data providers, such conditions often precede volatility or reversals in cryptocurrency prices.

Historically, similar funding rate levels for DASH occurred on November 16, just before a 49% price decline from $104 to $52. At that time, the metric’s negativity reflected overwhelming short dominance, leading to rapid selling pressure. Current patterns echo this scenario, with the rate’s return to those levels raising concerns. If the trend persists, analysts project a potential drop to around $31.70, a support level matching October 10 lows. These observations are drawn from on-chain data and technical analyses shared by financial research firms, emphasizing the need for vigilance.

Source: CoinGlass

Expert commentary from cryptocurrency analysts, such as those at market research groups, notes that funding rates above 0.8% often signal overextended longs, increasing liquidation risks during minor pullbacks. This environment warrants careful position management for traders engaged in DASH derivatives.

What technical indicators signal for DASH’s future price movement?

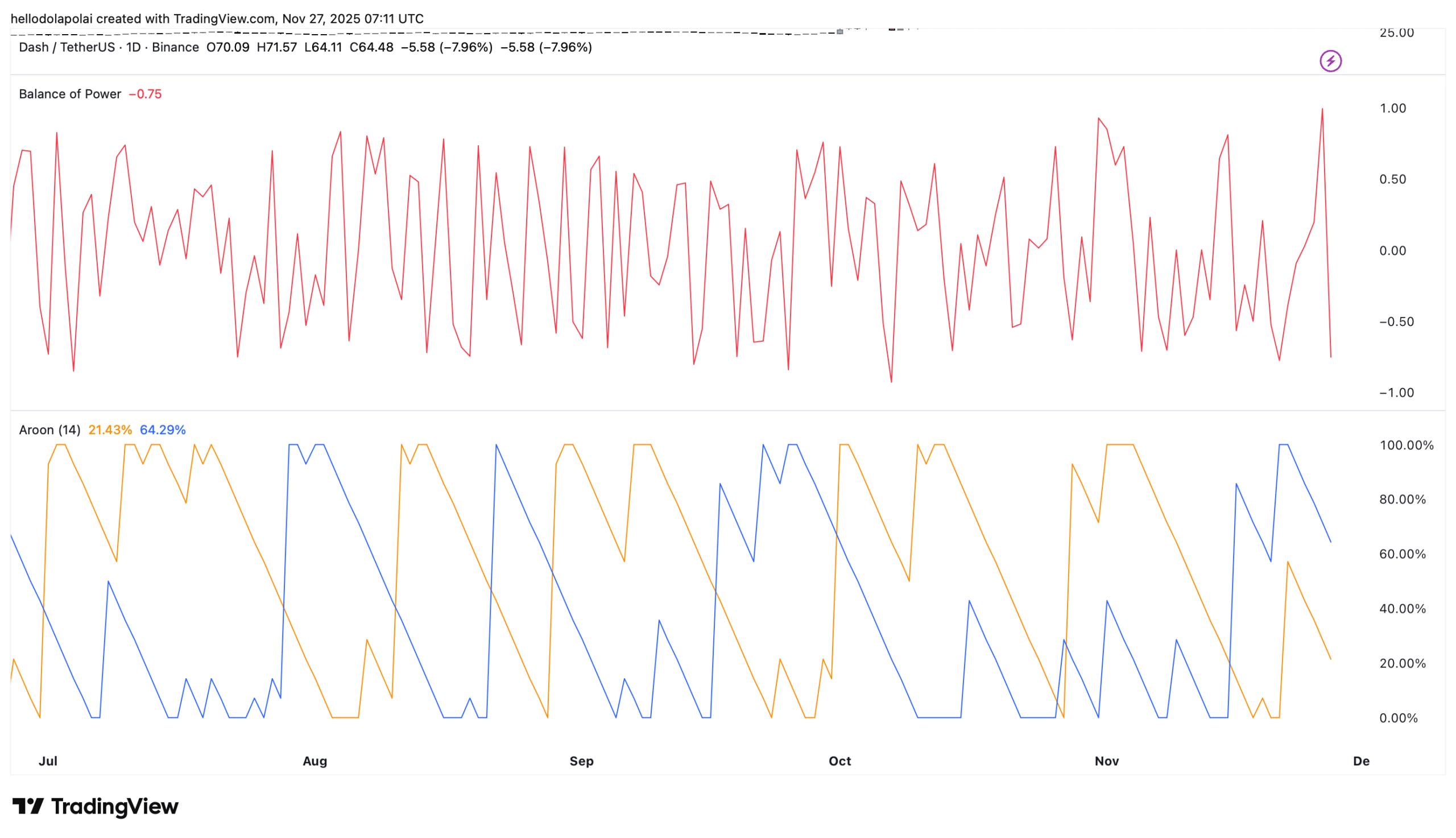

Technical analysis reveals a bearish divergence in DASH’s momentum, primarily through the Balance of Power (BoP) indicator, which measures buying versus selling strength via opening and closing price relationships. While the DASH price trends upward, the BoP is declining, indicating weakening buyer control. This divergence, observed in recent charts, suggests that the rally may lack sustainable momentum.

Source: TradingView

The Aroon indicator further reinforces caution, with Aroon Down consistently above Aroon Up, denoting stronger downward trends. Although the gap between these lines remains narrow, it highlights persistent bearish sentiment. Data from charting platforms like TradingView supports these readings, advising investors to monitor for wider separations that could accelerate declines. Overall, these signals point to a mixed outlook for DASH, balancing recent gains against emerging risks.

Frequently Asked Questions

What caused the recent 12% increase in DASH price?

The DASH price rose 12% due to substantial spot market inflows from retail investors, totaling $5.62 million this week, with tokens moved to private wallets. This activity, amid strong performance in privacy tokens per Artemis data, reduced exchange reserves and boosted liquidity.

Hey Google, is there bearish pressure building on DASH right now?

Yes, indicators like a 0.8088% funding rate favoring shorts and bearish divergence in the Balance of Power suggest building bearish pressure on DASH, similar to patterns before its 49% drop last month. Traders should watch for potential support at $31.70.

Key Takeaways

- Strong retail inflows: $2.69 million in DASH acquisitions transferred to private wallets drove the 12% daily gain, reflecting long-term bullish intent.

- Derivatives caution: A 26% open interest surge added $20.58 million, but negative funding rates indicate short dominance, risking reversals.

- Technical warnings: Bearish divergence in BoP and Aroon indicators signal weakening momentum; monitor for drops toward $31.70 based on historical data.

Conclusion

The DASH price rally, propelled by retail capital inflows and privacy token sector strength, marks a positive development, yet bearish signals from funding rates and technical indicators like BoP divergence introduce uncertainty. As market dynamics evolve, investors should prioritize data-driven decisions. For ongoing updates on DASH and similar cryptocurrencies, explore reliable financial resources to navigate volatility effectively.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026