David Sacks Denies Alleged Conflicts in Bitcoin Investments from NYT Report

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

David Sacks, the U.S. AI and crypto czar, has firmly denied allegations of conflicts of interest in a New York Times report, calling it a “nothing burger” and pursuing defamation action. He claims full divestment compliance while advocating for crypto policies that benefit the industry broadly, not personal gains.

-

David Sacks rejects New York Times claims of using his White House role to favor personal crypto investments, emphasizing ethical standards in policy-making.

-

The report highlighted retained stakes in 20 crypto firms, contradicting White House divestment statements and raising questions about influence on legislation like the GENIUS Act.

-

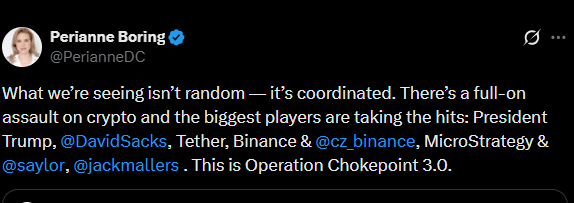

Crypto leaders, including Tether CEO Paolo Ardoino, defend Sacks, labeling the coverage a coordinated attack on the sector’s progress.

David Sacks denies crypto conflict of interest amid New York Times scrutiny. Explore his response, industry support, and policy impacts. Stay informed on U.S. crypto regulation developments—read now for key insights.

What is David Sacks’ Response to Crypto Conflict of Interest Allegations?

David Sacks’ response to crypto conflict of interest allegations involves a strong denial of the claims made in a detailed New York Times investigation. In a public statement, Sacks described the report as a “bungled mess” and a “nothing burger,” asserting that it misrepresented his actions and financial dealings. He has initiated legal proceedings against the publisher for defamation, underscoring his commitment to transparency and ethical governance in his role as the U.S. AI and crypto czar. Sacks maintains that his policy advocacy aligns with national interests in fostering innovation, not personal enrichment.

David Sacks, the U.S. AI and crypto czar, has distanced himself from a recent New York Times (NYT) report alleging widespread conflicts of interest.

The report claimed that Sacks leveraged his influential White House role to push policy directions that benefited himself and his tech and crypto cronies.

However, Sacks denied the allegations and slammed the report as a ‘bungled mess,’ a “nothing burger,” and sued the publisher for defamation.

Source: X

How Have Sacks’ Retained Crypto Investments Drawn Scrutiny?

The New York Times analysis revealed that David Sacks, through his venture firm Craft Ventures, holds stakes in 20 crypto-related companies and 449 AI investments, directly challenging earlier White House assurances of divestment. According to the report, Sacks was supposed to have sold over $200 million in crypto positions to avoid any appearance of bias. This discrepancy has fueled concerns about potential undue influence, particularly regarding his promotion of the GENIUS Act, a stablecoin regulatory bill.

Specifically, the investigation pointed to Sacks’ interest in BitGo, a custody provider and stablecoin infrastructure firm where Craft owns 7.8 percent—a stake valued at over $130 million based on 2023 valuations. BitGo supports USD1, the stablecoin from Trump-backed World Liberty Financial. While BitGo has stated it derives no direct benefit from the GENIUS Act’s passage, critics argue the timing of its September initial public offering filing aligns suspiciously with Sacks’ legislative efforts. Financial filings and public records support these valuations, but Sacks insists his involvement stems from a genuine push for a competitive U.S. crypto ecosystem. Industry observers, citing data from blockchain analytics firms, note that stablecoin markets have grown to over $150 billion in circulation globally, making regulatory clarity crucial yet contentious.

Experts like those from the Blockchain Association have commented on the broader implications, with one analyst stating, “Policy roles in emerging sectors like crypto demand ironclad separation of interests to maintain public trust.” This scrutiny extends to Sacks’ overall portfolio, which includes early investments in Bitcoin and Solana ecosystems, though he claims partial divestitures were completed as required.

Sacks’ Crypto Policy Push

Sacks began Craft Ventures in 2017, targeting tech start-ups.

However, he reportedly divested some of his investments in Bitcoin, Solana, and others to minimize a conflict of interest, according to a White House statement earlier in the year.

As a top policy figure shaping the White House’s role in crypto, Sacks secured some notable wins, including the passage of the stablecoin law and pushing back against some crypto-related debanking.

Still, the strategic BTC reserve and market structure bill has not yet crossed the finishing line.

Source: X

Frequently Asked Questions

What Specific Crypto Investments Does David Sacks Still Hold?

According to the New York Times report, David Sacks retains stakes in 20 cryptocurrency firms through Craft Ventures, including interests in BitGo valued at over $130 million. These holdings contradict prior White House statements on divestment exceeding $200 million, focusing on assets like Bitcoin and Solana-related ventures to address potential conflicts in his policy role.

What Impact Has David Sacks Had on U.S. Crypto Regulation?

David Sacks has significantly influenced U.S. crypto policy by championing the GENIUS Act for stablecoin oversight and combating debanking practices that hinder crypto firms. His efforts have advanced regulatory frameworks, though key proposals like a Bitcoin strategic reserve remain pending, aiming to position the U.S. as a global leader in digital assets.

Key Takeaways

- Denial and Legal Action: Sacks has categorically rejected conflict allegations, suing The New York Times for defamation while affirming his divestment efforts.

- Industry Defense: Leaders like Tether’s Paolo Ardoino back Sacks, viewing the report as an unjust attack on crypto’s regulatory gains.

- Policy Progress: Despite scrutiny, Sacks’ work has propelled stablecoin legislation forward, benefiting the broader ecosystem.

Conclusion

The controversy surrounding David Sacks’ crypto conflict of interest highlights the challenges of balancing influential roles with personal investments in fast-evolving sectors like cryptocurrency and AI. While the New York Times report raises valid questions about transparency, Sacks’ denials and the crypto industry’s vocal support underscore a commitment to responsible innovation. As U.S. policies on stablecoins and digital assets continue to develop, stakeholders must prioritize ethical standards to build lasting trust. Investors and enthusiasts should monitor ongoing legal and legislative updates for opportunities in this dynamic landscape.

Final Thoughts

- Sacks has denied any conflict of interest, and the NYT claims that he pushed crypto policies to benefit his firm, Craft Ventures.

- The crypto industry, led by Tether CEO, defended Sacks and condemned the report as a coordinated attack against the sector.