Despite 2025 Slump, Ethereum’s Stablecoin Dominance and Whale Accumulation Signal Resilience

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

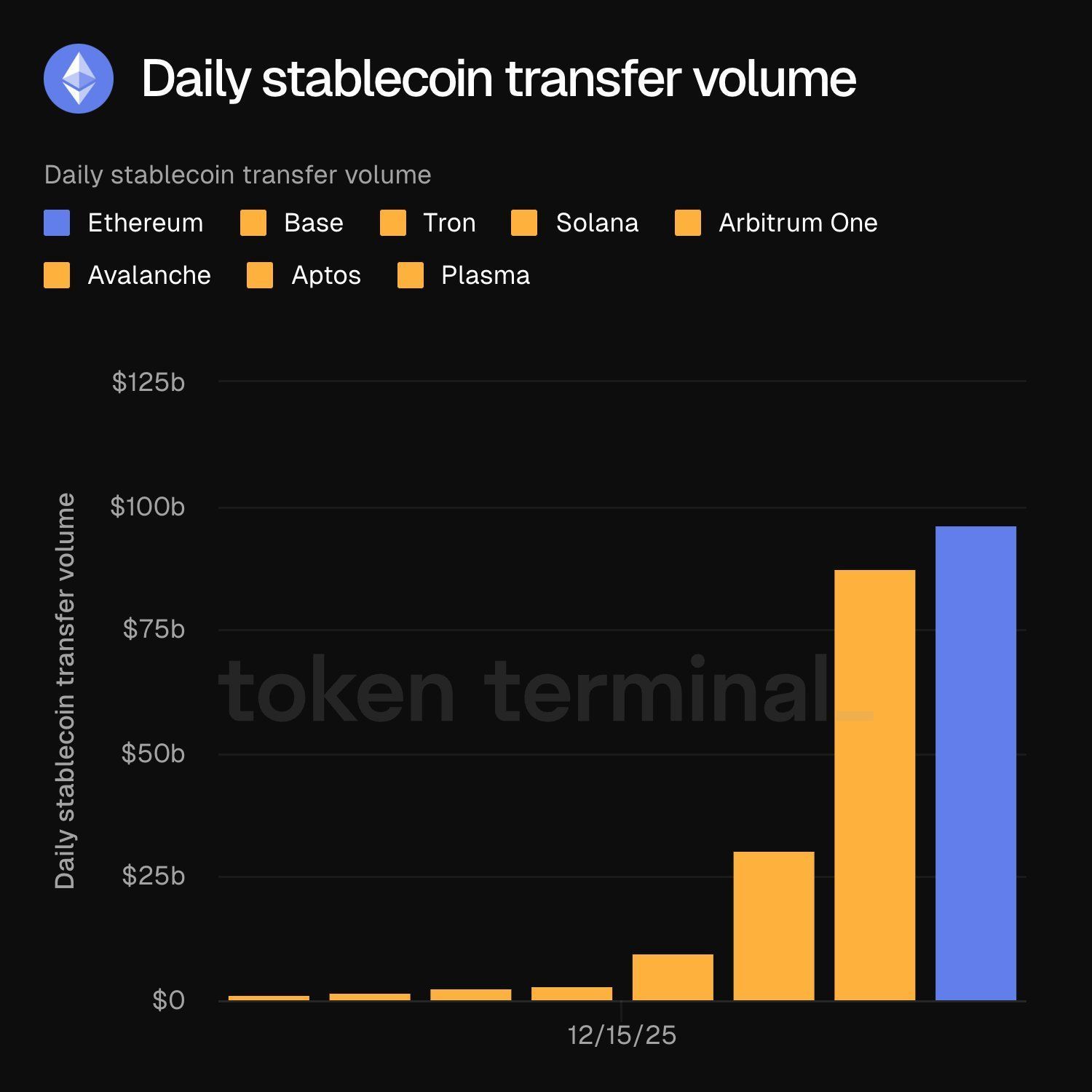

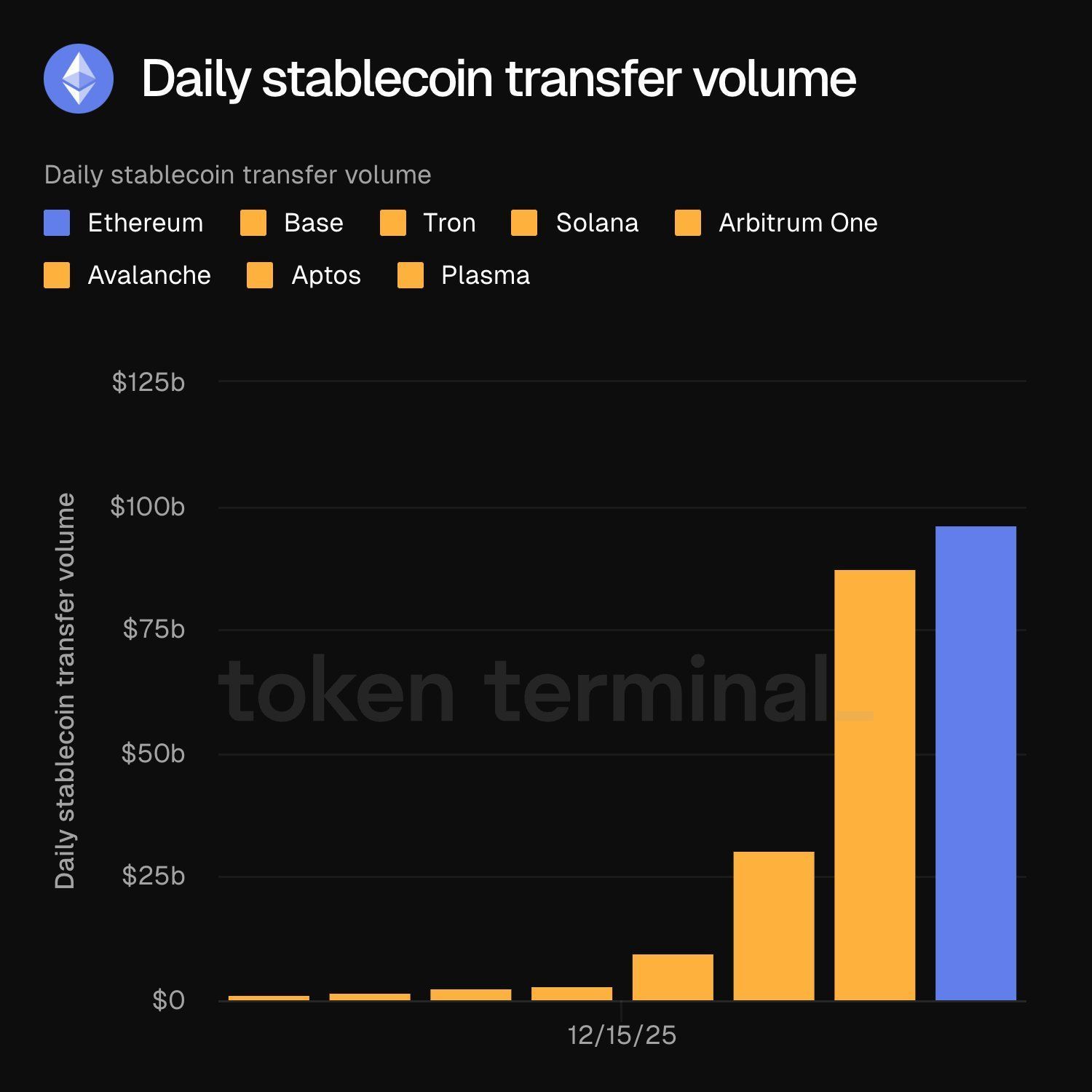

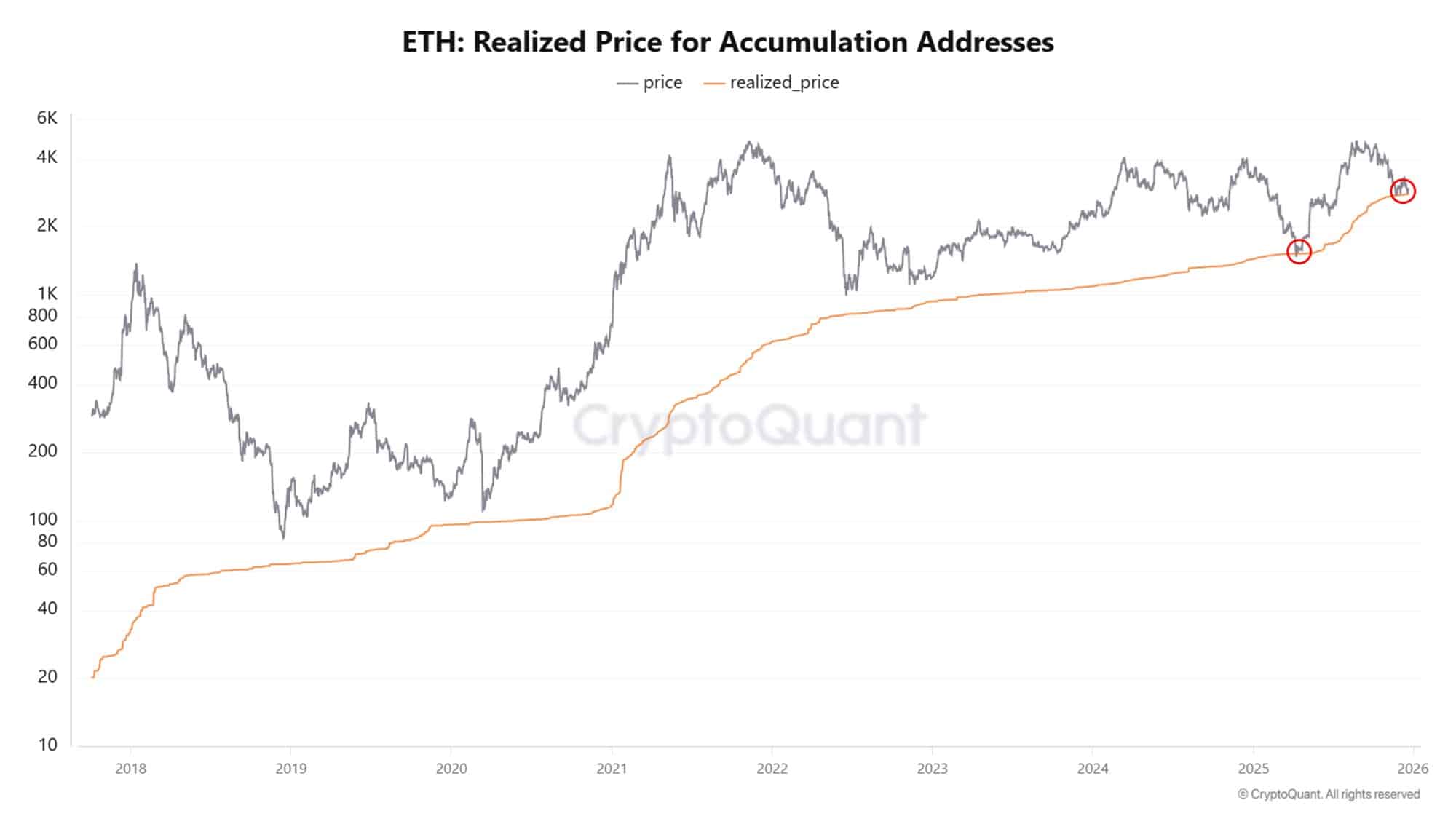

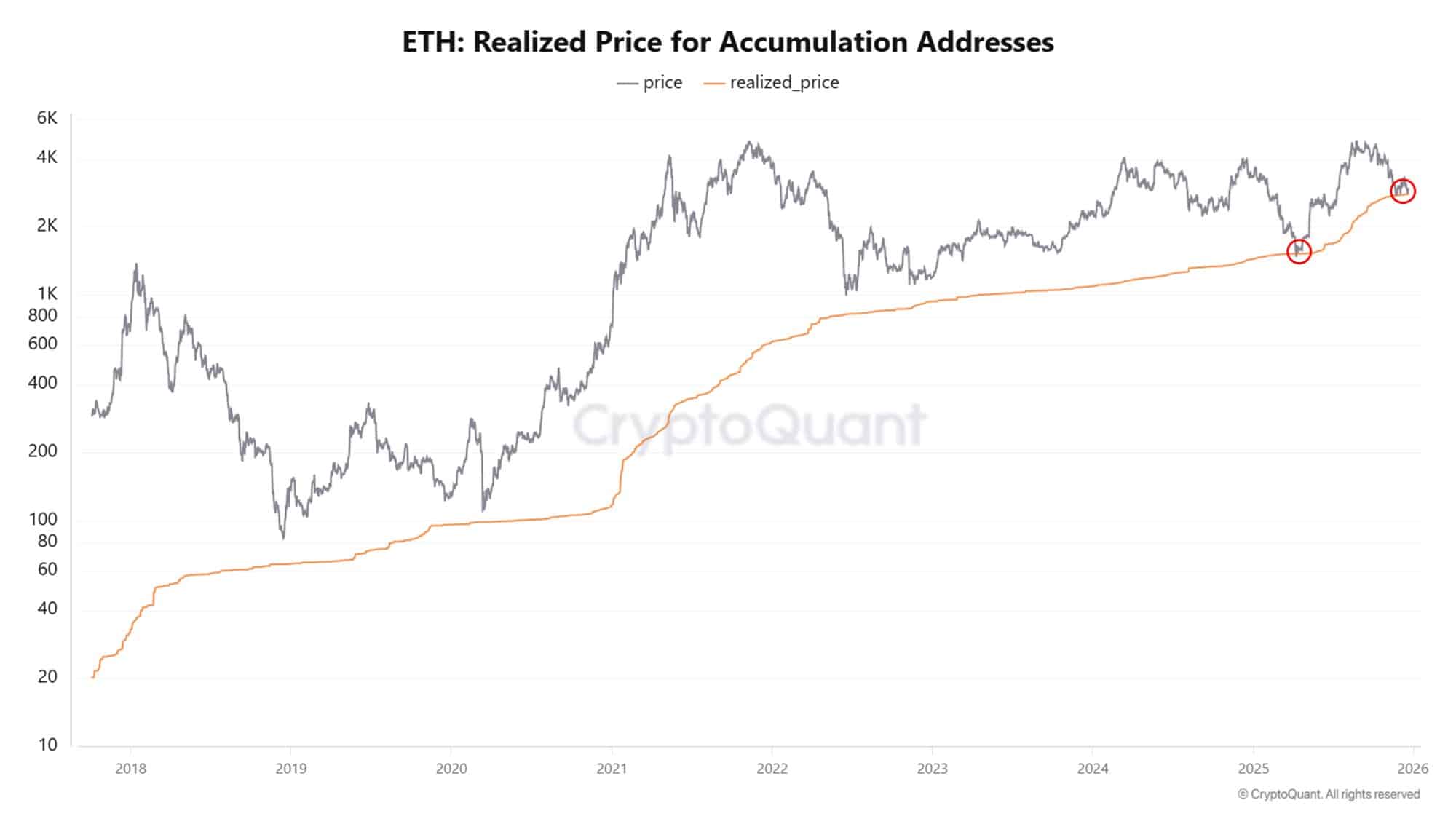

Ethereum’s 2025 performance shows a 12% year-to-date decline amid rising traditional assets, yet it processes $90-100 billion in daily stablecoin transfers, serving as the core settlement layer for global dollar liquidity. Large holders continue accumulating ETH, signaling confidence in its foundational role.

-

Ethereum trails major assets like gold and equities with a 12% drop in 2025.

-

Despite price stagnation, it handles tens of billions in stablecoin movements daily.

-

Whale accumulation persists, with inflows to long-term holders increasing near key price levels, per on-chain data from sources like OnChainHQ.

Ethereum 2025 performance: Uncover why ETH lags prices but leads in stablecoin settlements and whale buys. Explore the bigger picture for investors today.

What is driving Ethereum’s 2025 performance?

Ethereum’s 2025 performance has been marked by a roughly 12% year-to-date decline, contrasting with gains in silver, gold, and U.S. equities. This underperformance stems from capital rotation into traditional assets, yet Ethereum remains vital as the primary network for stablecoin settlements, processing $90-100 billion daily in transfers like USDT and USDC for payments and treasury operations. Bitcoin has held up slightly better, while many altcoins have dropped further, highlighting Ethereum’s relative resilience in transaction volume.

How does Ethereum’s stablecoin volume impact its ecosystem?

Ethereum’s dominance in stablecoin activity underscores its role as a trusted settlement layer, even as other blockchains offer lower fees or higher speeds. On an average day, the Ethereum Mainnet facilitates $90-100 billion in stablecoin transfers, primarily USDT and USDC, according to data from OnChainHQ. This volume supports critical functions such as global payments, corporate treasury management, and final settlements where reliability trumps cost. Users accept higher fees on Ethereum because failed transactions at this scale could result in significant losses, emphasizing the network’s neutrality and finality. Expert Leon Waidmann, Head of Research at OnChainHQ, notes that this concentration of liquidity reflects Ethereum’s unmatched trust in handling dollar-based assets worldwide. While competitors like Solana or Tron see growth in niche areas, Ethereum’s ecosystem processes over 70% of all stablecoin transfers by value, per reports from Chainalysis, reinforcing its position as the backbone of decentralized finance.

Source: X

Capital flows have shifted toward metals and equities, leaving Ethereum’s price stagnant and suggesting waning market enthusiasm. However, this narrative overlooks the network’s operational strength, where daily stablecoin activity far exceeds that of rivals, maintaining Ethereum’s utility in real-world finance.

Source: X

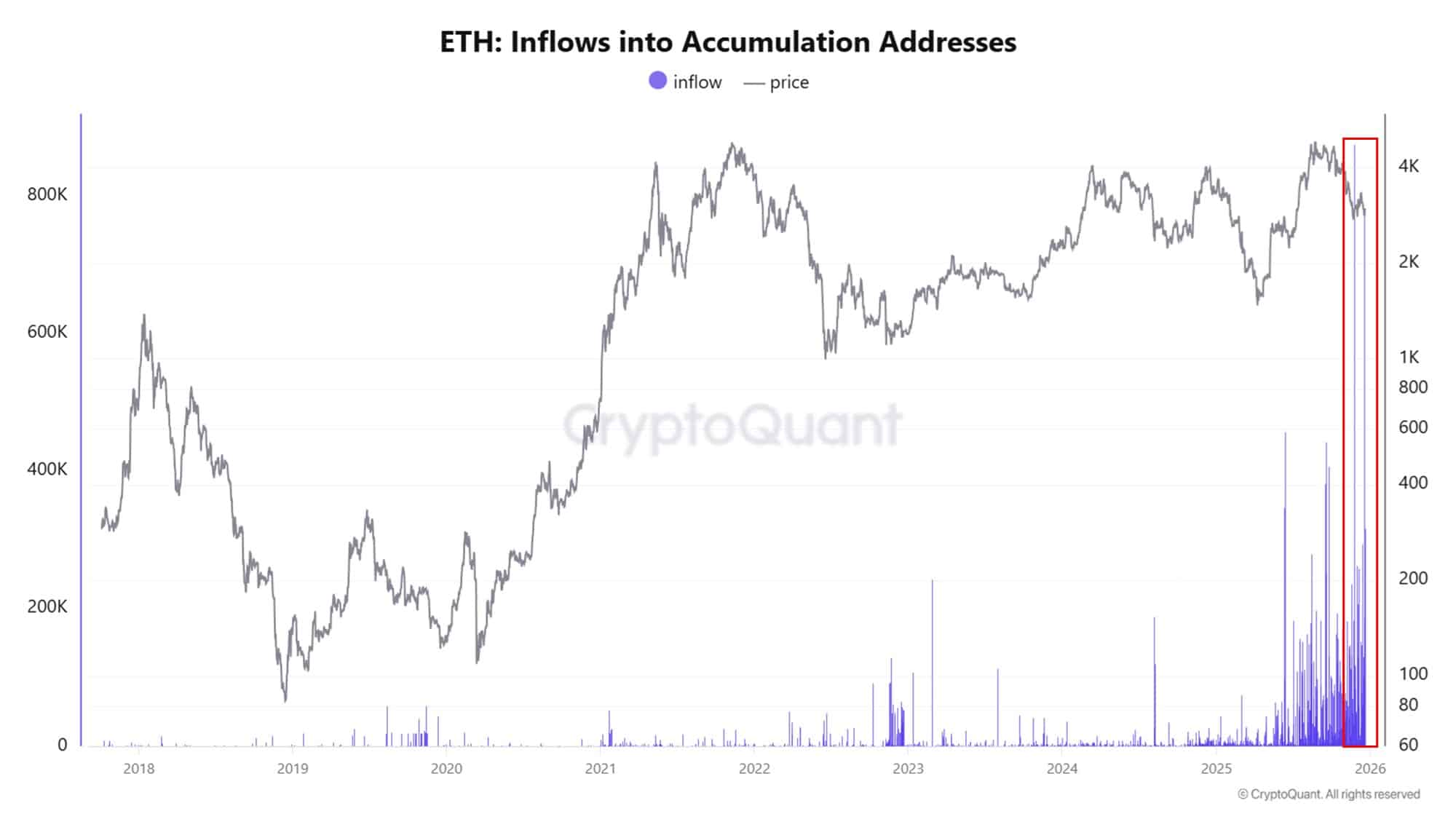

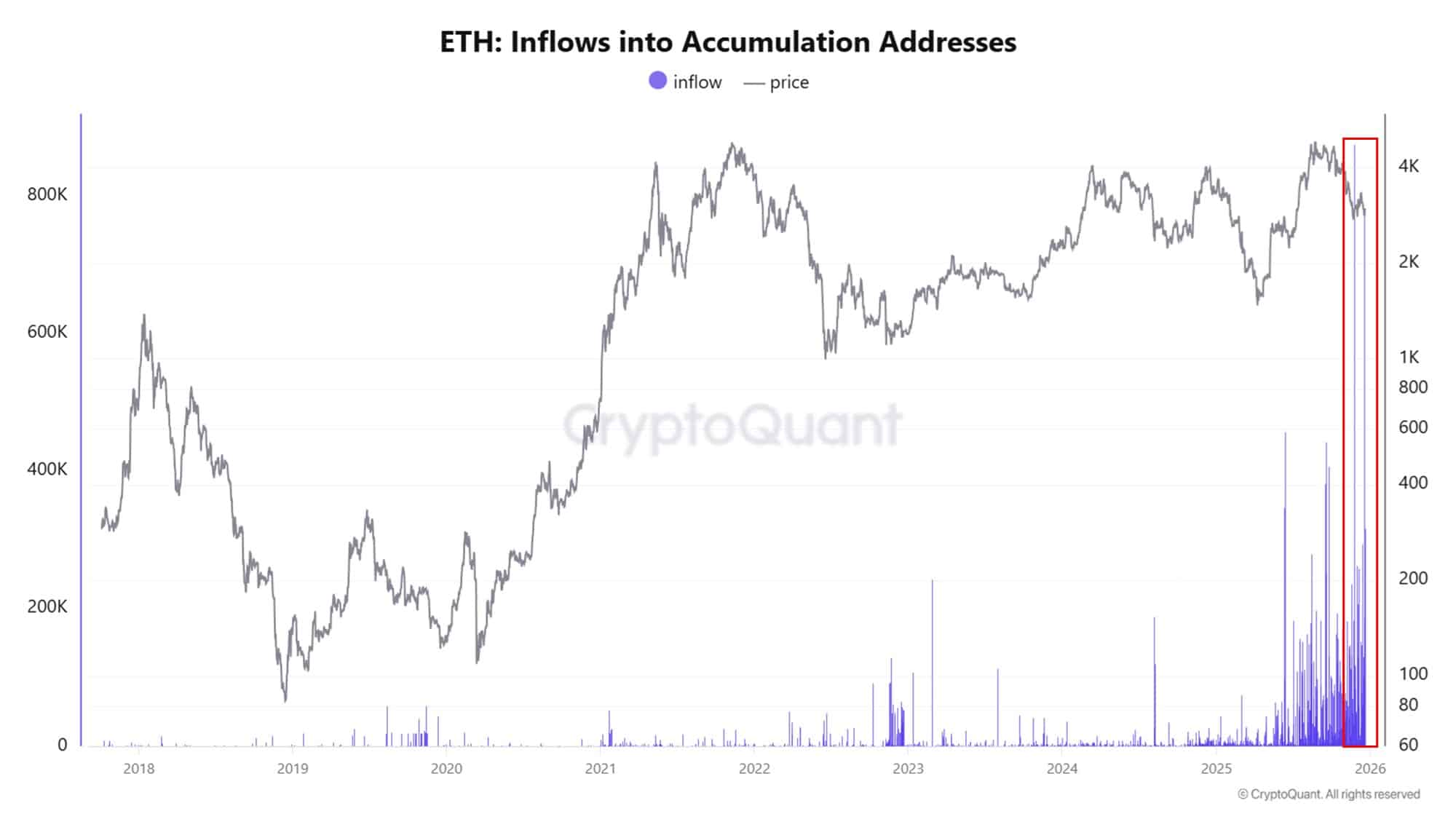

Institutional and whale behaviors further illustrate Ethereum’s enduring appeal. As prices hover near the realized price for accumulation addresses—the average cost basis for long-term holders—these entities have not only held steady but increased their positions. On-chain analytics from platforms like Glassnode reveal that whale profits have compressed to near zero, a level that typically prompts sales, yet accumulation inflows have risen, demonstrating strategic patience amid market volatility.

Source: X

Source: X

This pattern of accumulation by large holders points to a disconnect between short-term price action and long-term fundamentals. Ethereum’s network effects, bolstered by its extensive DeFi protocols and layer-2 solutions, continue to attract substantial liquidity, positioning it for potential recovery as market sentiment shifts.

Frequently Asked Questions

Why is Ethereum underperforming other assets in 2025?

Ethereum’s 2025 underperformance, with a 12% YTD drop, results from investors favoring traditional assets like gold and equities amid economic uncertainty. Stablecoin volumes remain robust at $90-100 billion daily, but price lags due to broader crypto market weakness and capital outflows, as tracked by on-chain metrics.

What role does Ethereum play in global stablecoin settlements?

Ethereum serves as the leading platform for global stablecoin settlements, handling the majority of USDT and USDC transfers for payments and operations. Its proven security and decentralization make it ideal for high-value transactions, where users prioritize settlement finality over lower costs on alternative networks.

Key Takeaways

- Ethereum’s price decline masks strength: Despite a 12% YTD loss, it dominates stablecoin processing with $90-100 billion daily.

- Whale accumulation signals confidence: Large holders are adding ETH near cost basis levels, countering selling pressure per Glassnode data.

- Focus on fundamentals for investors: Monitor network activity and liquidity flows to gauge Ethereum’s true 2025 potential.

Conclusion

Ethereum’s 2025 performance may appear lackluster with its price trailing traditional assets, but its unmatched stablecoin volume and whale accumulation highlight a resilient ecosystem essential for global finance. As on-chain data from sources like OnChainHQ and Glassnode affirm, Ethereum’s foundational role in dollar liquidity positions it for future growth. Investors should consider these metrics beyond surface-level prices and explore opportunities in the evolving crypto landscape.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC