DEX Perpetual Trading Volume Tops $1 Trillion in November, Led by Lighter

LIT/USDT

$26,051,333.16

$1.376 / $1.288

Change: $0.0880 (6.83%)

+0.0031%

Longs pay

Contents

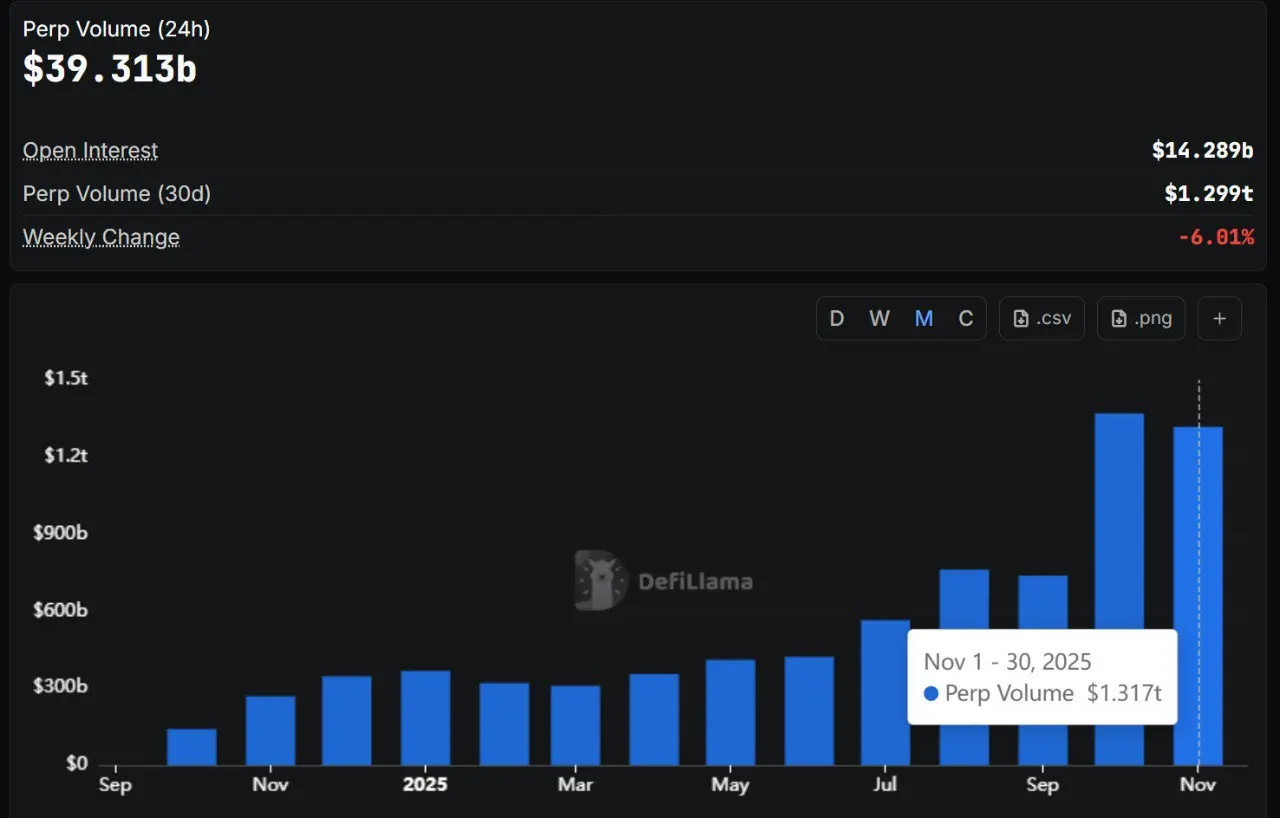

The perpetual trading volume on DEXs exceeded $1 trillion in November 2025, marking the second straight month of such highs after October’s $1.37 trillion peak. This surge highlights growing trader interest in decentralized platforms amid market uncertainties, driven by innovative protocols like Lighter and Aster.

-

November’s perpetual trading volume on DEXs hit $1.317 trillion, up from previous months.

-

Lighter led with $290.605 billion in 30-day volume, surpassing Hyperliquid’s prior dominance.

-

DEXs processed $68.642 billion in single-day volume, down slightly from October’s $78.014 billion, per DefiLlama data.

Discover how perpetual trading volume on DEXs surpassed $1 trillion in November 2025. Explore top platforms like Lighter and Aster gaining traction. Stay ahead in crypto—read key insights now!

What is the perpetual trading volume on DEXs in November 2025?

Perpetual trading volume on DEXs reached $1.317 trillion in November 2025, according to data from DefiLlama, an open-source analytics platform for decentralized finance. This figure represents the second consecutive month of exceeding $1 trillion, following October’s record $1.37 trillion. The growth underscores increasing adoption of on-chain perpetual contracts despite broader market volatility.

Why are DEXs seeing a surge in perpetual contract trading?

The rise in perpetual trading volume on DEXs stems from enhanced platform features and trader preferences for decentralization. Newer protocols like Lighter, built on Ethereum, have attracted significant activity with user-friendly interfaces and incentives such as airdrops. Data from DefiLlama indicates Lighter processed $290.605 billion over the last 30 days and $8.882 billion in the past 24 hours, overtaking Hyperliquid, which held $317.6 billion in October but now stands at $237.86 billion for 30 days.

Aster has also climbed ranks, recording over $248 billion in 30-day volume and $7.414 billion daily, up from $177.6 billion in October. This shift reflects traders’ migration from centralized venues due to past incidents like hacks and regulatory pressures. EdgeX follows with $163.533 billion monthly, while Apex Protocol logs $80.337 billion. Single-day peaks hit $68.642 billion in November, a modest dip from October’s $78.014 billion, yet indicative of sustained momentum.

Overall, these platforms offer self-custody and early token access, fostering trust. DefiLlama’s analytics show volumes far surpassing earlier months, like August’s $759 billion and July’s $564.622 billion, signaling robust investor confidence in DeFi infrastructure.

November perpetual trading volume on DEXs exceeds $1 trillion

Source: DefiLlama. Perpetual Trading Volume on Decentralized Exchanges

Source: DefiLlama. Perpetual Trading Volume on Decentralized ExchangesThis milestone highlights the maturation of decentralized exchanges in handling high-volume perpetual futures, a derivative allowing indefinite positions without expiry. Platforms such as Hyperliquid, Lighter, and Aster have driven this trend, with on-chain data revealing a clear pivot toward DEXs for their transparency and reduced counterparty risks.

Expert analysis from DeFi researchers, including insights shared in industry reports by DefiLlama contributors, points to technological advancements like layer-2 scaling solutions enabling faster, cheaper trades. For instance, Lighter’s Ethereum-based architecture supports seamless perpetuals, appealing to retail and institutional users alike. This volume boom occurs even as crypto markets face uncertainties, such as price fluctuations in major assets like Bitcoin and Ethereum.

Centralized exchanges still lead the crypto futures market despite DEXs’ boom

While DEXs flourish, centralized exchanges maintain dominance in overall crypto futures. Coingecko data reveals centralized platforms amassed $570 billion in 24-hour derivatives volume, dwarfing DEXs’ $39.313 billion. Binance Futures tops the list at $58.4 billion daily, with Bybit at $20.1 billion, benefiting from established liquidity and advanced tools.

DEX growth is fueled by factors like improved interfaces and reward programs, countering centralized exchange vulnerabilities exposed in past scandals. Traders increasingly value DEXs for retaining fund custody and accessing nascent tokens promptly. Recent developments, such as MetaMask’s integration with Hyperliquid for mobile perpetual trading, include reward incentives to boost adoption.

This partnership exemplifies how wallets are bridging DeFi accessibility, potentially accelerating volume shifts. Nonetheless, centralized entities’ scale ensures they lead open interest metrics, though DEXs’ trajectory suggests narrowing gaps over time.

Frequently Asked Questions

What factors are driving the $1 trillion perpetual trading volume on DEXs in November 2025?

The surge in perpetual trading volume on DEXs to over $1 trillion in November 2025 is driven by innovative platforms offering better incentives and security. Protocols like Lighter and Aster provide airdrops and self-custody, attracting traders wary of centralized risks, as reported by DefiLlama analytics.

How does perpetual trading on DEXs compare to centralized exchanges for daily volume?

Perpetual trading on DEXs handles about $39.313 billion in daily volume, significantly less than centralized exchanges’ $570 billion, according to Coingecko. However, DEXs are closing the gap through decentralization benefits, making them ideal for users seeking transparency and control in volatile markets.

Key Takeaways

- Record-Breaking Volumes: November’s $1.317 trillion in perpetual trading on DEXs marks sustained growth, following October’s $1.37 trillion high, per DefiLlama.

- Platform Leadership Shift: Lighter now leads with $290.605 billion in 30-day volume, overtaking Hyperliquid amid rising competition from Aster and others.

- Future Incentives Matter: Integrations like MetaMask-Hyperliquid offer rewards, encouraging more traders to explore DEX perpetuals for secure, rewarding experiences.

Conclusion

The perpetual trading volume on DEXs surpassing $1 trillion in November 2025, as detailed by DefiLlama, signals a pivotal evolution in crypto derivatives markets. With platforms like Lighter and Aster leading the charge, decentralized exchanges are reshaping trader preferences toward safer, innovative alternatives despite centralized dominance. As DeFi matures, expect further surges in adoption—position yourself by monitoring these trends for informed trading decisions.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026