Digital Assets Treasuries Stocks Drop 43% Amid Bitcoin Price Decline

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Digital Assets Treasuries (DATs) have faced significant losses in 2025, with median stocks dropping 43% amid Bitcoin’s price decline from $126,000 to $91,000. Holdings value fell 27% to $94 billion despite increased accumulation, projecting 70% of firms to end the year in the red.

-

Bitcoin holdings by DATs reached 1.05 million coins, but their value plummeted from $129 billion to $94 billion due to market volatility.

-

Weekly inflows into DATs sharply declined from a June peak of $4.2 billion to just $8 million, signaling reduced accumulation.

-

Altcoin-focused DATs, including those holding Ethereum and other tokens, suffered steeper losses, with some stocks down over 99% year-to-date.

Discover why Digital Assets Treasuries are losing big in 2025 as Bitcoin and altcoins tumble. Explore impacts on firms like MicroStrategy and market implications. Stay informed on crypto trends—read more now!

What Are Digital Assets Treasuries and Why Are They Declining in 2025?

Digital Assets Treasuries (DATs) refer to corporate reserves holding cryptocurrencies like Bitcoin and altcoins as part of their balance sheets, a strategy popularized by firms following MicroStrategy’s lead. In 2025, these treasuries initially posted gains but have since suffered massive losses, with 70% projected to close the year below their starting values. The decline, driven by a 27% drop in Bitcoin’s value despite higher holdings, underscores the risks of crypto exposure for public companies.

How Have Bitcoin Holdings Impacted DAT Performance?

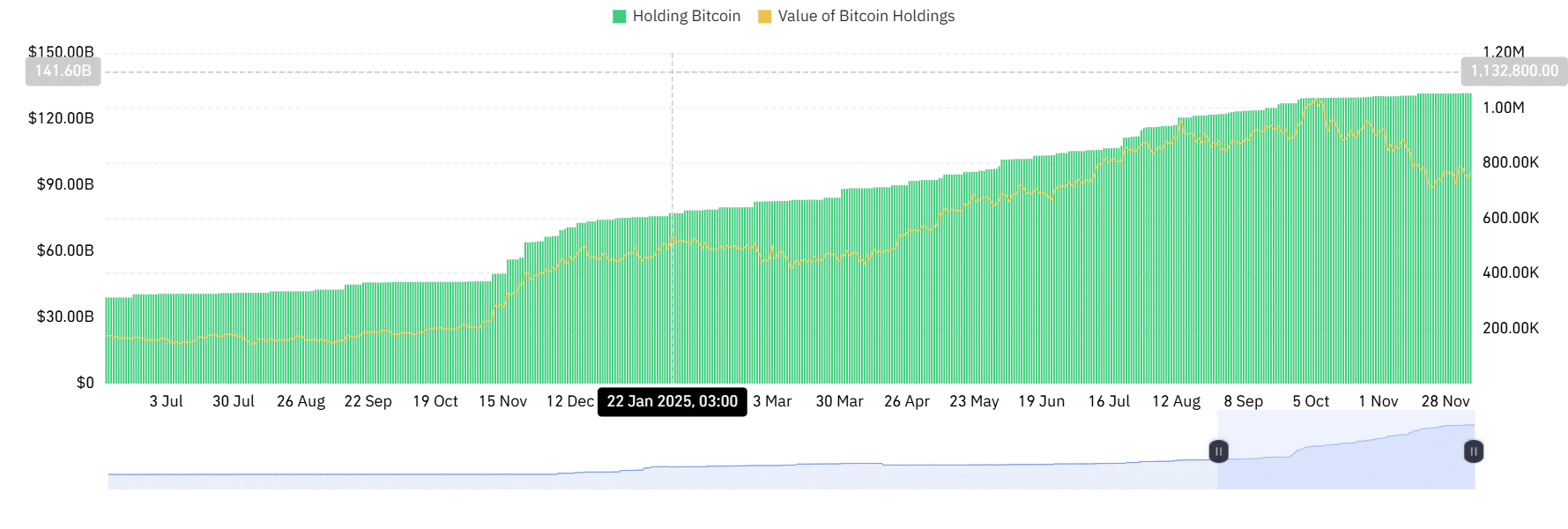

Bitcoin holdings in DATs have surged to 1.05 million coins by late 2025, reflecting aggressive accumulation by U.S. and Canadian-listed firms. However, the value of these assets has decreased by more than 27%, falling from $129 billion to $94 billion, according to data from CoinGlass. This downturn is primarily due to Bitcoin’s price sliding from $126,000 to around $91,000, eroding the treasuries’ worth.

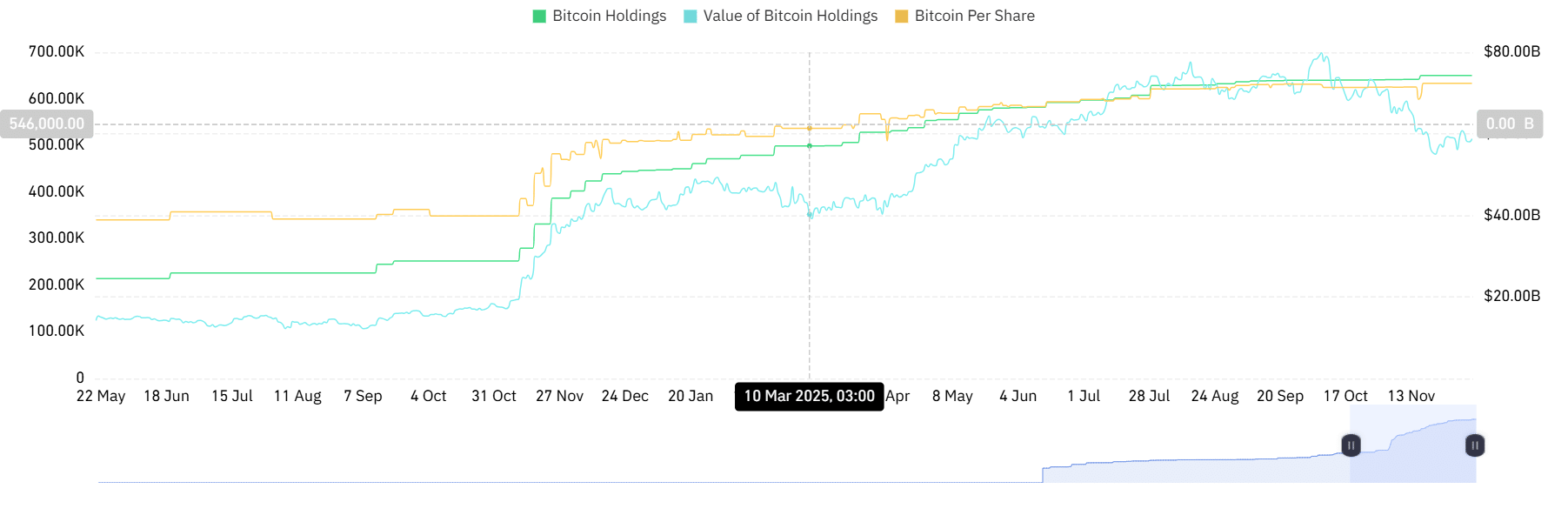

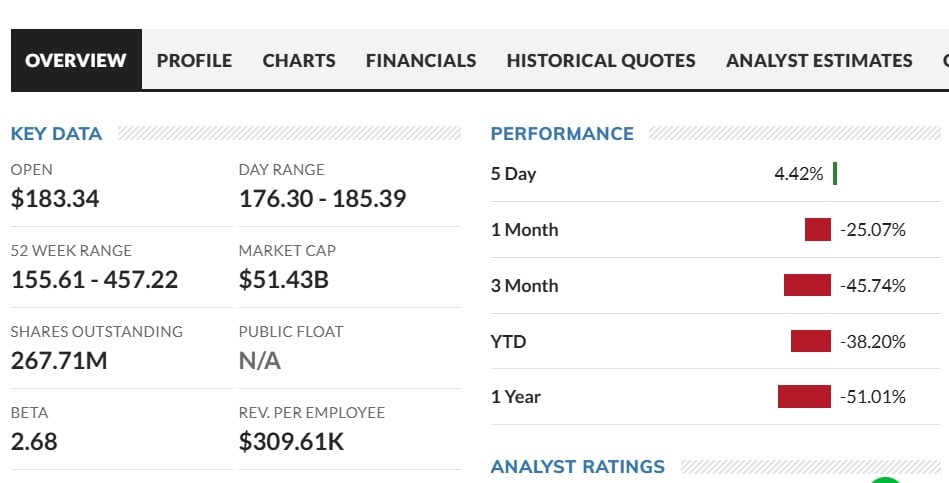

Activity has also slowed, with weekly inflows dropping dramatically from $4.2 billion in June to a mere $8 million recently. MicroStrategy, often referred to as Strategy in market analyses, exemplifies this trend: its Bitcoin holdings grew to 650,000 coins, yet the portfolio value declined 26% from $79 billion to $58 billion. The company’s stock has fallen 51% over the past year, from $455 to $178, resulting in a net asset value (NAV) of 0.88.

Source: CoinGlass

To mitigate losses, MicroStrategy attempted to raise capital by selling perpetual preferred stocks in Europe during November 2025. Despite the discount offered, these stocks traded below their issuance price, failing to stabilize the firm’s position. Bloomberg reports that the median stock among DATs has dropped 43% this year, affecting both Bitcoin and altcoin-linked companies equally.

Source: CoinGlass

Source: Marketwatch

Frequently Asked Questions

What Caused the 43% Drop in Digital Assets Treasuries Stocks in 2025?

The 43% median decline in DAT stocks stems from Bitcoin’s price correction and broader market volatility, as reported by Bloomberg. Early-year gains evaporated in Q3 and Q4, with holdings values falling despite increased accumulation. This has led to reduced investor confidence and scaled-back buying activities across affected firms.

Are Altcoin DATs Experiencing Worse Losses Than Bitcoin Ones?

Yes, altcoin-focused DATs have incurred steeper losses, with some dropping over 99% year-to-date. For instance, companies holding Ethereum or tokens like Bera and WLFI saw their stocks plummet as underlying assets declined sharply, outpacing Bitcoin’s 27% value drop and highlighting higher volatility in altcoins.

Key Takeaways

- Heightened Volatility in DATs: Despite Bitcoin holdings rising to 1.05 million coins, values fell 27% to $94 billion, driven by price drops from $126,000 to $91,000.

- Reduced Accumulation: Inflows into DATs plummeted from $4.2 billion weekly in June to $8 million, as firms like MicroStrategy face stock declines of 51%.

- Potential Market Pressure: Ongoing losses may force sales of crypto assets, risking further price spirals in Bitcoin and altcoins—monitor firm announcements closely.

Altcoin DATs Led by Ethereum Are Bleeding Heavily

Altcoin treasuries have outperformed Bitcoin in losses, with Ethereum-linked firms bearing the brunt. SharpLink Gaming Inc., for example, initially surged over 2,600% after accumulating Ethereum but has since lost 86% from its peak, now trading at just 0.9 times its ETH holdings value.

Source: Marketwatch

Bitmine Immersion Technologies, another ETH holder, saw shares drop 74% in the last four months, from $135 in September to $34 currently. Broader altcoin exposure has been disastrous: Greenlane Holdings, with $48 million in Bera tokens, plunged more than 99% year-to-date after the token fell over 90%.

Source: Marketwatch

Even high-profile ventures like Alt5 Sigma Corp, associated with Donald Trump’s family, allocated over $1 billion to WLFI tokens but watched shares decline 86% from June highs. These cases illustrate the amplified risks of altcoin strategies in volatile markets, as noted in analyses from Marketwatch.

Conclusion

Digital Assets Treasuries in 2025 have transitioned from early promise to substantial losses, with Bitcoin and altcoin holdings alike devalued amid price corrections and reduced inflows. Firms like MicroStrategy and SharpLink Gaming highlight the challenges of crypto integration into corporate balance sheets. As DATs consider asset sales to sustain operations, the broader crypto market faces potential downward pressure—investors should track regulatory developments and price trends for informed decisions moving forward.