Dogecoin ETF Launch Amid 2025 Market Turmoil Signals Potential Institutional Shift

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

The Grayscale Dogecoin ETF (GDOG) launched on the NYSE on November 24, 2025, amid a turbulent crypto market. Despite a 38% drop in DOGE’s value wiping out $13 billion, this ETF provides institutional investors indirect exposure to the leading memecoin, potentially boosting legitimacy while highlighting ongoing volatility risks.

-

DOGE down 38% in Q4 2025, contributing to a $13 billion market value loss for the top memecoin.

-

Memecoin sector lost $20 billion since mid-October, reducing total value to $40 billion amid broader $1 trillion crypto market decline.

-

GDOG ETF enables easier access for institutions, with BTC and ETH ETFs seeing $4.5-5.5 billion in outflows, signaling caution for new launches.

Discover the impact of the Grayscale Dogecoin ETF (GDOG) launch in 2025’s volatile market. Explore DOGE’s performance, ETF details, and investment risks. Stay informed on crypto trends—read more now!

What is the Grayscale Dogecoin ETF (GDOG) and why does it matter now?

The Grayscale Dogecoin ETF (GDOG) is a spot exchange-traded fund that allows investors to gain exposure to Dogecoin (DOGE) without directly holding the cryptocurrency. Approved for trading on the New York Stock Exchange starting November 24, 2025, it comes at a time when the crypto market faces significant sell-offs, with total capitalization dropping nearly $1 trillion since mid-October. This launch underscores growing institutional interest in memecoins like DOGE, despite its 38% decline this quarter, potentially offering a bridge between speculative assets and traditional finance.

How has the Dogecoin ETF launch affected market sentiment amid 2025 sell-offs?

The introduction of the GDOG ETF has sparked mixed reactions in a bearish environment. While it signals institutional legitimacy for DOGE, whale holders—those with 10 to 100 million DOGE—have offloaded about 7 billion coins in the past month, aligning with a 21% price drop that keeps DOGE below $0.15, far from its September 2025 peak of $0.30. Data from TradingView indicates DOGE has not recovered Q1 losses, hitting lows of $0.09, with technical indicators showing weakness. Experts from financial analysis firm CryptoQuant note that such ETF launches can stabilize sentiment over time, but short-term volatility persists due to broader outflows from Bitcoin and Ethereum ETFs, totaling $4.5 to $5.5 billion in Q4. Grayscale’s move follows the REX-Osprey DOGE ETF (DOJE), which began trading earlier, and filings by 21Shares, pointing to increasing mainstream adoption. However, with memecoins absorbing 2.5% of the market’s $1 trillion loss—equating to $20 billion—the sector now stands at $40 billion, emphasizing DOGE’s disproportionate 38% decline and $13 billion value erasure. This context suggests the ETF may provide a floor for prices through institutional inflows, but analysts from Bloomberg Intelligence warn that speculative risks remain high without fundamental drivers.

Frequently Asked Questions

What are the key details of the Grayscale Dogecoin ETF launch in 2025?

The Grayscale Dogecoin ETF (GDOG) received approval to trade on the NYSE on November 24, 2025, offering spot exposure to DOGE. It enables investors to buy shares tracking DOGE’s price without managing cryptocurrency wallets, similar to Bitcoin and Ethereum ETFs. This development follows regulatory nods for other memecoin products, aiming to attract capital amid DOGE’s volatile 38% Q4 drop.

Is the Dogecoin ETF a good investment during the current crypto market downturn?

When considering the Dogecoin ETF in today’s market, focus on its role in providing diversified exposure to memecoins. While GDOG simplifies access for institutions, DOGE’s technical weakness and recent whale selling suggest high risk, with prices lingering under $0.15 after a 21% monthly decline. Voice search queries often highlight that such ETFs can mitigate some volatility, but professional advice recommends balancing with established assets like Bitcoin amid ongoing outflows.

Key Takeaways

- DOGE’s resilience in 2025: Despite market turmoil, Dogecoin has maintained relative strength, though it failed to reclaim Q1 gains and hit lows of $0.09.

- ETF implications for investors: Launches like Grayscale’s GDOG and REX-Osprey’s DOJE offer institutional pathways to DOGE, but underscore speculative nature with $13 billion in recent losses.

- Market caution advised: With $1 trillion in total crypto outflows and memecoin sector down to $40 billion, monitor whale activity and technicals before investing.

Key Takeaways

How has DOGE fared in 2025 despite market turmoil?

DOGE has held relatively strong, but technicals remain weak. It hasn’t reclaimed Q1 losses, with lows reaching $0.09.

What does the GDOG ETF launch mean for investors?

Grayscale’s GDOG and other ETFs like REX‑Osprey provide institutional access to DOGE, but price action highlight ongoing speculative risk.

No part of the market has been safe from the Q4 shakeup. Since mid-October, the total market cap has dropped nearly $1 trillion, and memecoins have taken about 2.5% of that hit.

Technically, that’s roughly a $20 billion loss, bringing the total memecoin market down to $40 billion. Dogecoin [DOGE], the biggest memecoin, has been hit the hardest. It is down 38%, wiping out $13 billion in value.

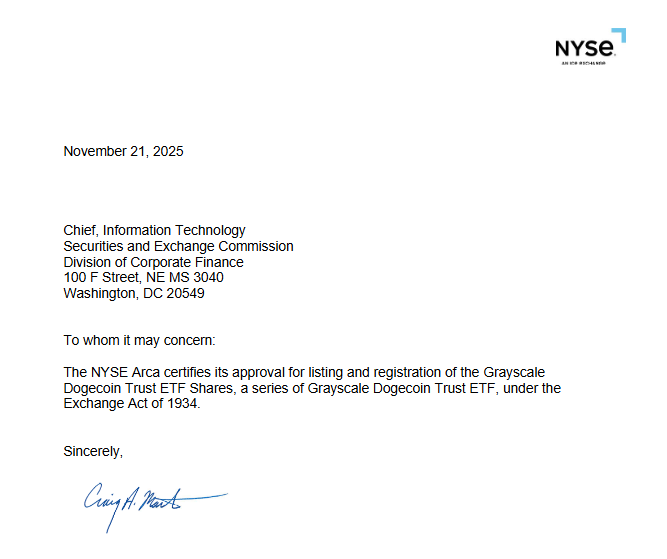

Against this setup, Grayscale’s Dogecoin spot ETF [GDOG] just got the green light to trade on the NYSE starting the 24th of November. That means indirect exposure without having to store the coin themselves.

Source: X

At the macro level, the timing is rough.

Q4 has seen major outflows from top-cap Bitcoin [BTC] and Ethereum [ETH] ETFs, with BTC ETFs losing around $4 billion and ETH ETFs shedding $1.8 billion, putting total outflows in the $4.5–5.5 billion range.

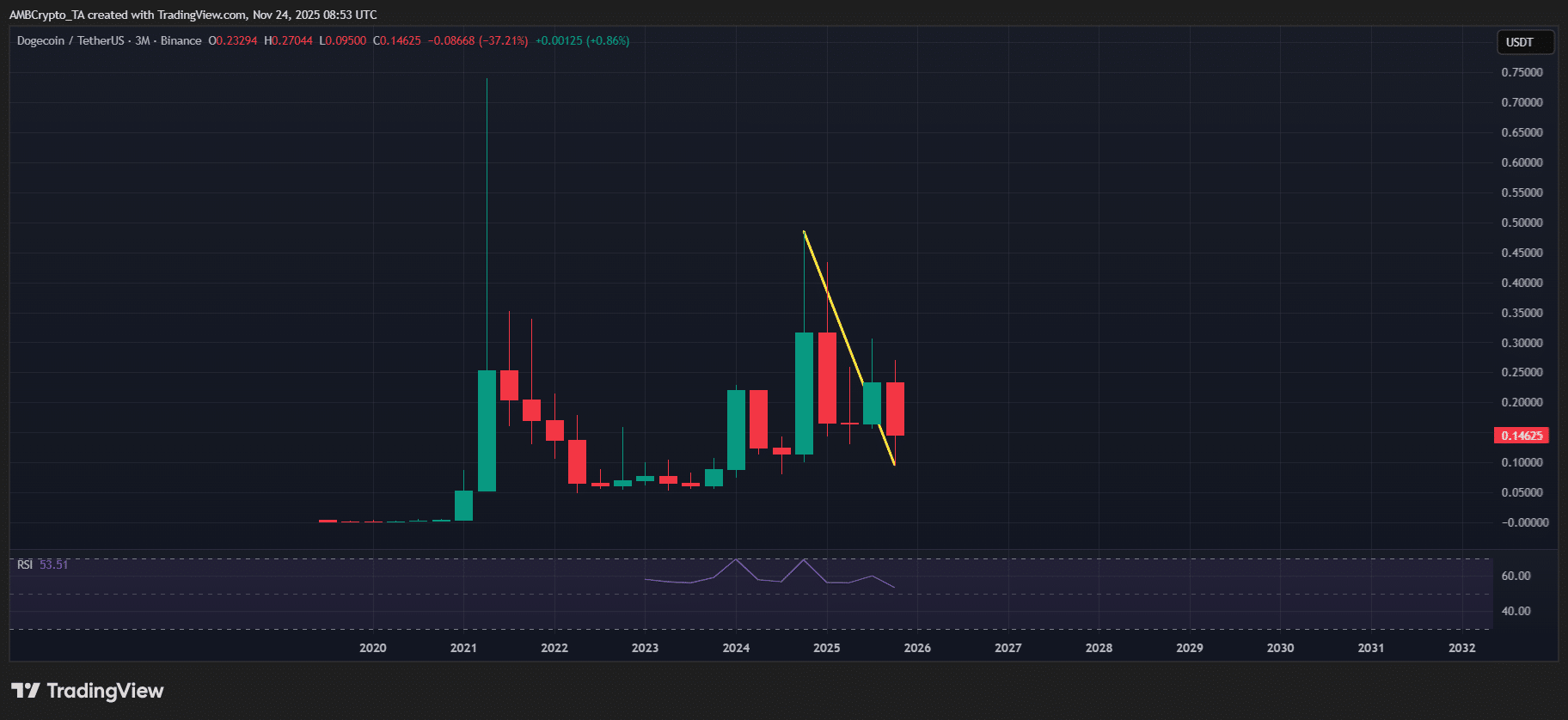

The chart shows the impact: Both have hit multi-month lows. In this context, Grayscale’s GDOG listing raises the question: Does it signal DOGE’s gaining institutional legitimacy, or just highlight its speculative risk?

Spot DOGE ETF launches amid major market sell-offs

Despite market FUD, Dogecoin has held relatively strong in 2025.

On the ETF side, DOGE has seen two key launches: the REX‑Osprey ETF (DOJE), already trading, and Grayscale’s GDOG. Firms like 21Shares have also filed for a spot DOGE ETF, showing growing institutional interest.

Still, the technical picture is weak. DOGE hasn’t reclaimed its Q1 losses, drifting further from the $1 target, with each quarter hitting lower lows, with the latest lowest wick reaching $0.09, highlighting ongoing volatility.

Source: TradingView (DOGE/USDT)

On the micro side, whales (holding 10–100 million DOGE) have dumped about 7 billion coins over the past month. This aligns with the memecoin’s 21% drop, keeping it under $0.15 and far from September’s $0.30 peak.

In short, DOGE is getting its ETF moment, but the picture is mixed.

Institutional access is growing, yet weak technicals and whale selling show the memecoin is still risky. GDOG makes it easier to invest in DOGE, but price action suggests caution.

Conclusion

In summary, the Grayscale Dogecoin ETF (GDOG) launch marks a pivotal step for memecoins in 2025, offering institutional pathways amid a $1 trillion market sell-off that saw DOGE lose 38% of its value. While technical weaknesses and whale dumps pose risks, growing ETF interest from firms like REX-Osprey and 21Shares could foster long-term stability. Investors should weigh these factors carefully, staying attuned to crypto trends for informed decisions ahead.