Dogecoin Shows Early Rebound Signs Near $0.15300 Amid Rising Liquidity and ETF Focus

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

Dogecoin is showing early rebound signs as buyers defend the $0.15300 support level amid a steady downtrend. Rising liquidity and ETF expectations are drawing trader attention to key resistance, potentially signaling a stronger recovery if breached.

-

Dogecoin exhibits early rebound indicators with buyers holding the $0.15300 zone after prolonged declines.

-

Rising total value locked and positive exchange supply trends bolster market liquidity and interest.

-

ETF anticipation and resistance monitoring guide trader focus toward Dogecoin’s potential upward shift, supported by data from 2025 analyses.

Dogecoin rebound signs emerge as buyers protect $0.15300, with growing liquidity and ETF buzz fueling optimism. Explore key levels and trends shaping DOGE’s next move in this analysis. Stay informed on crypto shifts today.

What Are the Early Signs of a Dogecoin Rebound?

Dogecoin is displaying initial rebound signals after a consistent downtrend, with buyers actively defending the $0.15300 demand zone. Recent price action from this level indicates growing confidence among market participants, potentially leading to a reversal if upward momentum sustains. This development follows lower highs and lows, marking a possible shift in market structure.

$DOGE has been trending downward with repeated corrections and brief consolidation phases.

After another drop, the price is attempting to rebound, but a stronger recovery will only be confirmed if it breaks above the nearby resistance zone. pic.twitter.com/NFKXm5Ic1O

— BitGuru 🔶 (@bitgu_ru) November 18, 2025

The correction phase peaked near $0.16598, followed by consolidation and a subsequent decline, before buyer activity renewed near the support. Traders are closely observing for a decisive break above the prior consolidation ceiling, which could validate increased buying pressure and set the stage for further gains.

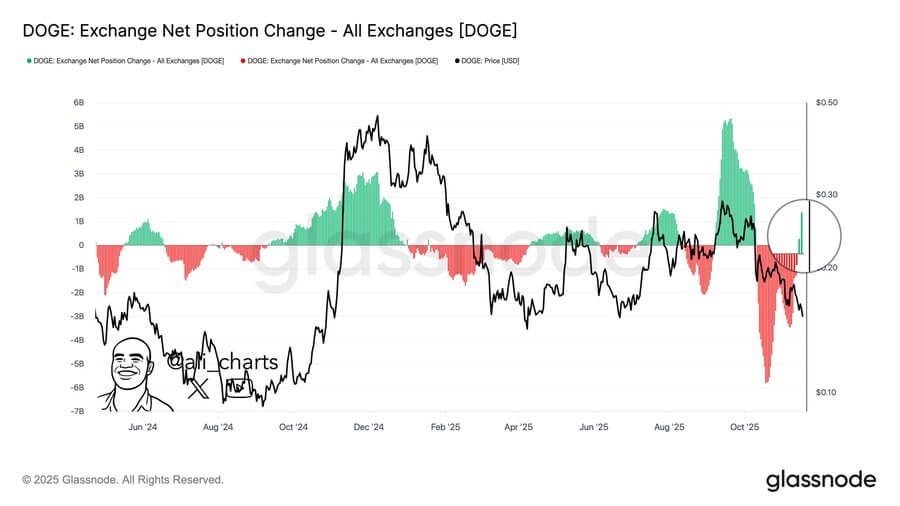

Source: AliCharts(X)

How Is Exchange Supply Influencing Dogecoin’s Price Trends?

AliCharts analysis indicates that Dogecoin supply on exchanges has recently turned positive, a pattern historically linked to sharp rebounds in prior cycles. This positive shift in supply dynamics enhances liquidity and signals stronger holder conviction, reducing selling pressure. As of late 2025, this trend aligns with broader market recovery efforts, providing traders with additional data points for decision-making. Supporting this, exchange metrics show reduced outflows during downtrends, fostering a more stable environment for price appreciation.

Frequently Asked Questions

What Factors Are Driving Liquidity Growth in the Dogecoin Ecosystem?

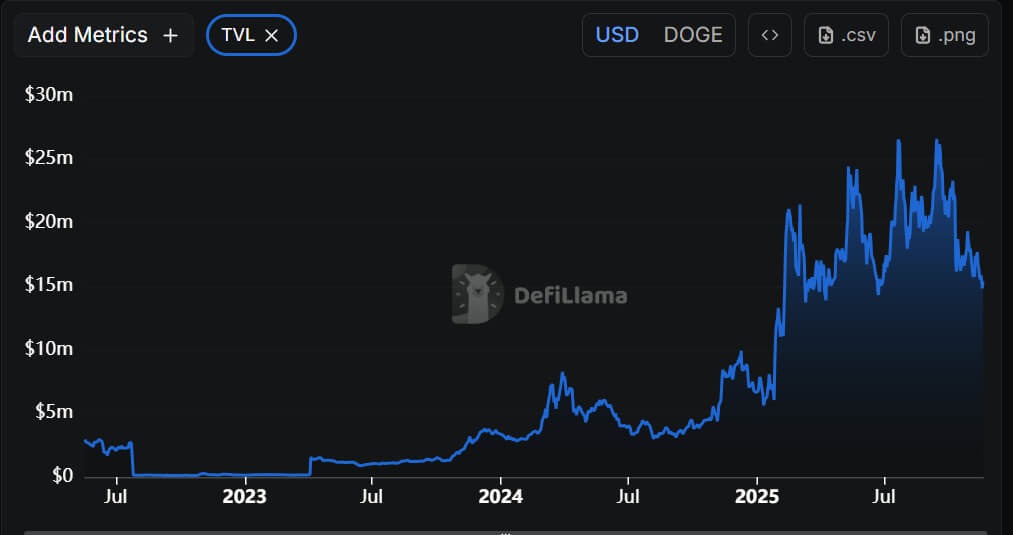

Liquidity in the Dogecoin ecosystem is expanding due to a 3.63% rise in total value locked over the past 24 hours, reaching $15.4 million as reported by DeFiLlama. Long-term trends from 2022 to 2025 reveal successive higher waves of TVL, with momentum accelerating through mid-2024 and into 2025, driven by increased DeFi integrations and user adoption.

Source: DeFiLlama

What Role Do ETF Expectations Play in Dogecoin’s Market Outlook?

Expectations around potential Dogecoin ETFs, particularly Grayscale’s filing timeline set for November 24, 2025, are heightening market interest according to Bloomberg analysts. This structured regulatory progress positions Dogecoin for broader institutional exposure, potentially stabilizing prices near $0.16 and supporting a market cap around $23.953 billion. Such developments encourage sustained trader vigilance on resistance levels for upward breakouts.

Key Takeaways

- Buyer Defense at Support: Strong activity around $0.15300 highlights potential reversal, as noted in BitGuru’s market structure review.

- Positive Supply Dynamics: Exchange supply turning positive, per AliCharts, correlates with historical rebounds and improved liquidity.

- ETF and Liquidity Momentum: Rising TVL to $15.4 million via DeFiLlama data, combined with ETF buzz, points to constructive trends—monitor for resistance breaks to confirm gains.

Conclusion

Dogecoin’s early rebound signs, bolstered by buyer defense at $0.15300 and liquidity growth, position it for potential upside amid ETF expectations. Exchange supply positivity and TVL increases from 2022-2025 underscore a resilient ecosystem. As traders eye resistance levels, staying updated on these Dogecoin trends will be crucial for informed strategies in the evolving crypto landscape.

Comments

Other Articles

Dogecoin Holds Support Near Descending Trendline Amid Oversold RSI Signals

December 31, 2025 at 10:29 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Dogecoin Shows On-Chain Accumulation Signs Amid Rising Social Buzz

December 28, 2025 at 09:40 PM UTC