Dogecoin’s Bullish Sentiment and Rising Outflows Hint at Potential Rebound

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

Dogecoin (DOGE) displays bullish signals through improved sentiment, significant exchange outflows, and steady accumulation around $0.15–$0.16. These factors suggest reduced selling pressure and potential for an early rebound if it clears $0.188 resistance, amid balanced liquidations stabilizing the market.

-

DOGE sentiment aligns positively for retail and smart money traders, per Market Prophit data.

-

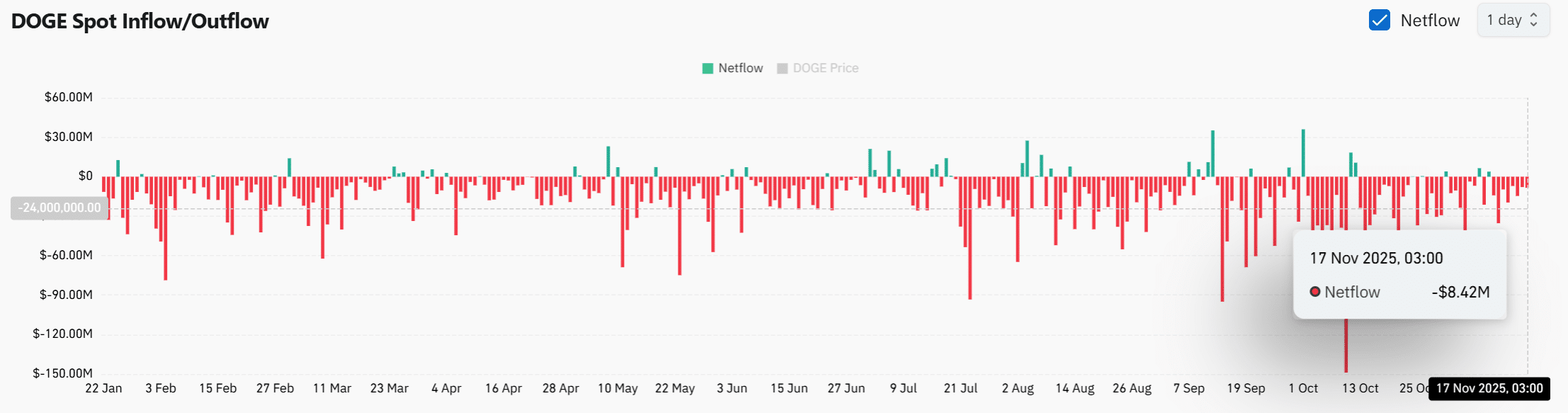

Rising exchange outflows of $8.42 million indicate holders are withdrawing tokens, tightening supply.

-

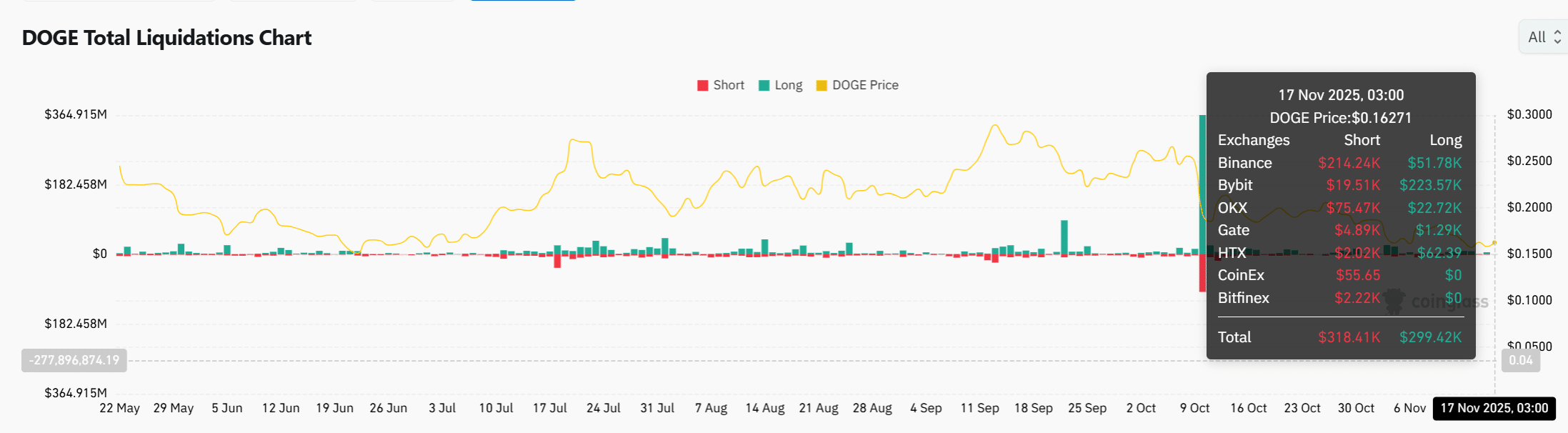

Balanced liquidations totaling over $617K show neutral pressure, supporting accumulation zone defense with 24-hour data from CoinGlass.

Dogecoin bullish signals emerge with stronger sentiment and outflows; explore how accumulation and balanced liquidations boost rebound potential. Stay informed on DOGE trends for smart trading decisions.

What are the bullish signals for Dogecoin right now?

Dogecoin is showing clear bullish signals as sentiment improves across retail and institutional levels, according to Market Prophit indicators. Exchange outflows have reached $8.42 million in the last 24 hours, signaling reduced sell-side pressure and increased holding activity. This setup, combined with steady defense of the $0.15–$0.16 accumulation zone, positions DOGE for a potential rebound above the descending channel if momentum sustains.

How do exchange outflows impact Dogecoin’s supply dynamics?

Exchange outflows for Dogecoin have surged to $8.42 million over the past day, as reported by on-chain analytics from platforms like CoinGlass. This movement reflects holders transferring tokens off exchanges, which typically reduces immediate selling availability and eases downward pressure during volatile periods. For months, DOGE has seen consistent negative netflows, meaning more tokens are being accumulated than deposited, shrinking the liquid supply on trading platforms.

Experts note that such patterns often precede price recoveries, as fewer tokens on exchanges limit the impact of panic sells. In DOGE’s case, this tightening coincides with its current position in a key accumulation range between $0.15 and $0.16, where buyers have repeatedly stepped in to absorb dips. Data from TradingView charts further illustrates this, showing wick reactions within the zone that hint at growing buyer confidence.

According to blockchain analysts, sustained outflows like these can amplify bullish momentum by creating scarcity, especially when paired with positive sentiment shifts. If this trend continues, it could support DOGE pushing toward higher resistance levels, provided broader market conditions stabilize.

Source: CoinGlass

Dogecoin’s accumulation zone and price action analysis

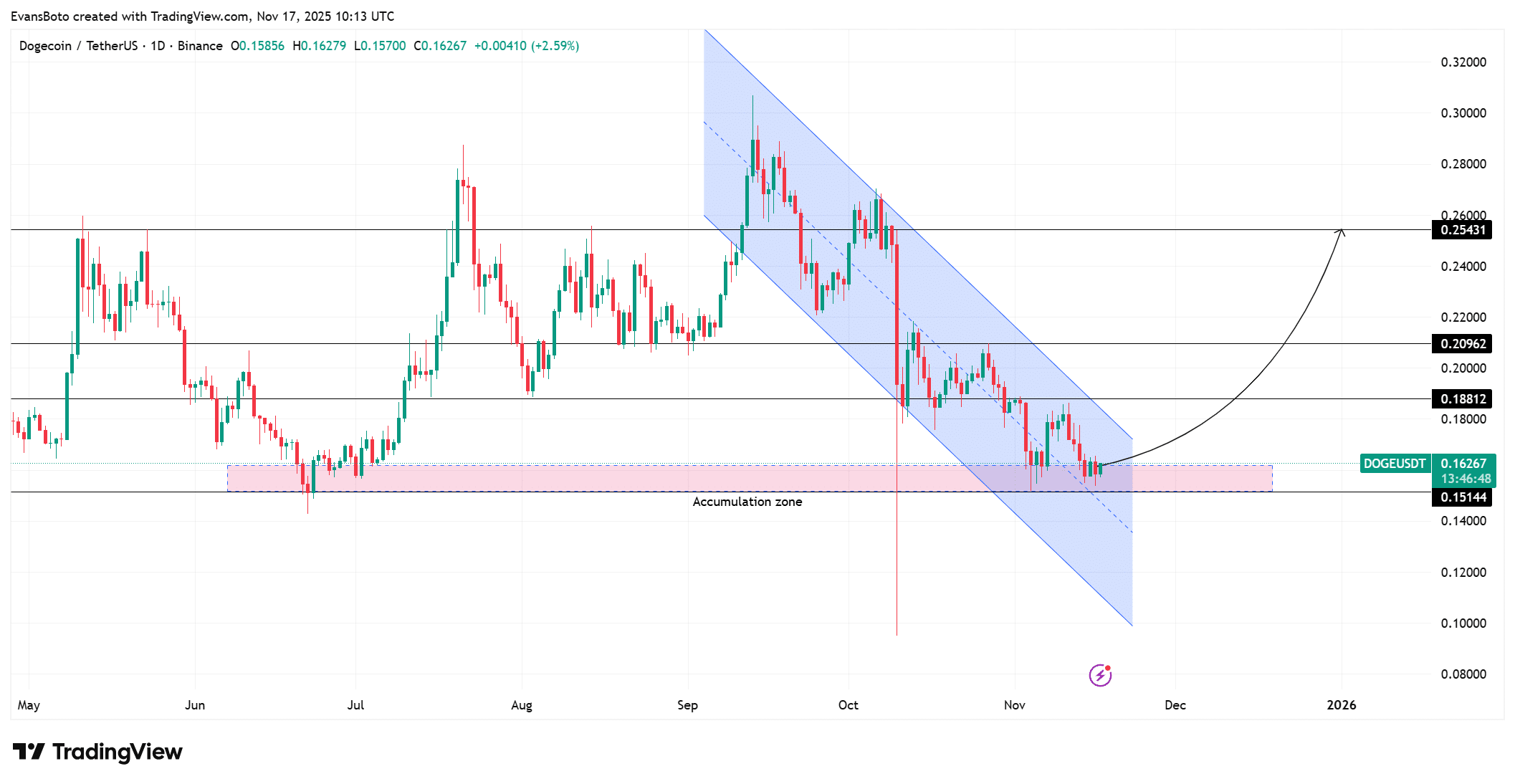

Dogecoin is actively retesting its accumulation zone around $0.15 to $0.16, where buyers are demonstrating resilience against further declines. Technical charts from TradingView reveal that while a descending channel continues to constrain upward moves, the price is showing signs of stabilization at the lower end, with visible buyer interventions through wick formations.

This zone has served as a strong support level in recent weeks, absorbing multiple downside tests without breaking lower. Analysts from financial research firms emphasize that such defensive action often signals the early stages of a reversal, particularly when volume picks up in tandem. For DOGE, breaking free from the channel could open paths to $0.188 as the immediate target, followed by $0.209 and potentially $0.254 if bullish momentum builds.

However, maintaining structure above this accumulation range is crucial; any failure to hold could lead to renewed pressure toward lower supports. The interplay between on-chain accumulation and technical defense underscores DOGE’s potential for upside, but confirmation requires sustained buying volume amid ongoing market uncertainty.

Source: TradingView

Sentiment data from Market Prophit highlights a rare alignment between retail enthusiasm and smart money flows, which is occurring even as the wider cryptocurrency market faces instability. This synchronization adds weight to the bullish case for DOGE, as it suggests coordinated interest from diverse trader groups. Rising confidence levels, evidenced by these indicators, often correlate with stronger price resilience, setting a foundation for potential follow-through gains.

Furthermore, the cryptocurrency’s on-chain metrics align with this narrative, showing persistent accumulation that counters broader sell-offs. Traders monitoring these developments note that DOGE’s ability to hold ground independently amplifies the signal’s reliability. As such, the week opens with optimism for those eyeing entry points in the accumulation phase.

Dogecoin liquidations and market balance

Liquidation data for Dogecoin reveals a balanced landscape, with $318.41K in short positions liquidated against $299.42K in longs, according to CoinGlass metrics. This near-equilibrium prevents any dominant directional squeeze, fostering a stable environment where price swings are less likely to escalate dramatically.

Balanced liquidations like these indicate that leverage is not overly skewed, allowing organic price discovery to take precedence over forced moves. On platforms such as Bybit, long liquidations show a slight uptick, pointing to pockets of volatility, but overall, the data supports DOGE’s structural integrity above key supports. Market observers from firms like Glassnode stress that such neutrality can pave the way for breakouts when paired with positive catalysts like sentiment improvements.

In DOGE’s context, this balance reinforces the accumulation narrative, as it minimizes downside risks while buyers consolidate positions. If spot demand increases, this setup could transition into upward momentum, targeting channel resistance levels.

Source: CoinGlass

Frequently Asked Questions

What factors are driving Dogecoin’s current bullish sentiment?

Dogecoin’s bullish sentiment stems from aligned retail and smart money indicators via Market Prophit, alongside $8.42 million in exchange outflows reducing sell pressure. These elements, combined with accumulation around $0.15–$0.16, create a supportive environment for potential gains, as confirmed by on-chain data from CoinGlass.

Is Dogecoin poised for a price breakout soon?

Dogecoin could see a breakout if it surpasses the descending channel and $0.188 resistance level. Balanced liquidations and steady buyer defense in the accumulation zone, as shown in TradingView charts, suggest improving odds, though sustained momentum is needed for targets like $0.209 and higher.

Key Takeaways

- Bullish sentiment alignment: Retail and smart money synchronization from Market Prophit boosts DOGE’s rebound potential amid market volatility.

- Supply tightening via outflows: $8.42 million withdrawn in 24 hours signals reduced selling, supporting accumulation at $0.15–$0.16.

- Balanced liquidations: Neutral pressure of $617K total enables stable conditions; monitor for spot demand to confirm upside.

Conclusion

In summary, Dogecoin’s bullish signals are evident through enhanced sentiment, exchange outflows, and robust accumulation zone defense, while balanced liquidations maintain equilibrium. These dynamics position DOGE favorably for a potential reversal, provided it breaches $0.188 resistance. As market conditions evolve, investors should track on-chain metrics from sources like CoinGlass for ongoing insights and consider strategic positioning in this strengthening setup.

Comments

Other Articles

Saylor’s Strategy Adds $963M in Bitcoin as BitMine Boosts ETH Holdings

December 9, 2025 at 01:53 PM UTC

Bitcoin Dips Below $100,000 for First Time Since May: Bull Run in Jeopardy?

November 4, 2025 at 07:02 PM UTC

Grok 4 Shows Potential Edge in Crypto Trading with Timely XRP, SOL Positions

October 20, 2025 at 01:25 PM UTC