Dogecoin’s Downside Risk Grows with Inflows, Thin Support, and Fading Activity

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

Dogecoin’s market structure is deteriorating due to rising exchange inflows, thinning support levels, and declining network activity, increasing downside pressure on its price currently hovering around $0.14. This bearish setup suggests potential further declines unless key resistance at $0.15 is reclaimed, as per on-chain data from platforms like Arkham and Glassnode.

-

Exchange inflows signal selling intent: Steady Dogecoin transfers to centralized exchanges indicate holders may be preparing to sell, adding to price pressure amid weak technicals.

-

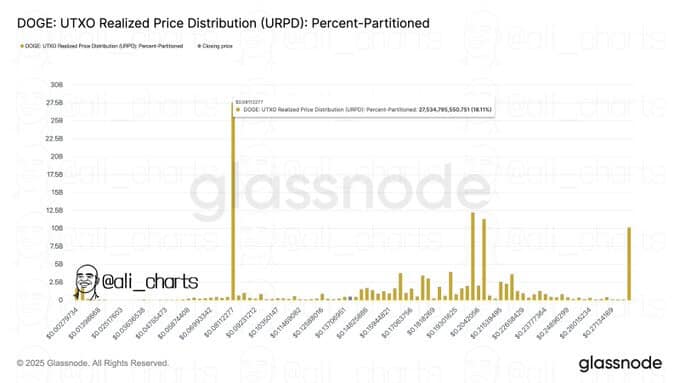

Realized support is thin below $0.13, risking rapid drops to $0.08 if breached, according to Glassnode’s UTXO Realized Price Distribution analysis.

-

Network activity has dropped to about 29,000 daily active addresses, per Token Terminal, reducing liquidity and bull defense capabilities by 20% from recent peaks.

Dogecoin price faces mounting bearish pressures from inflows and fading engagement—explore key indicators signaling potential decline to $0.08. Stay informed and adjust strategies today.

What is causing Dogecoin’s current market structure to deteriorate?

Dogecoin’s market structure is weakening primarily due to increased exchange inflows, sparse support zones, and reduced on-chain activity, creating a precarious environment for price stability. Data from Arkham Intelligence highlights consistent inflows to trading platforms, suggesting sellers are positioning for liquidation, while Glassnode metrics reveal limited buyer interest below recent lows. This combination heightens the risk of a deeper correction if bullish momentum fails to emerge.

How are exchange inflows impacting Dogecoin’s price momentum?

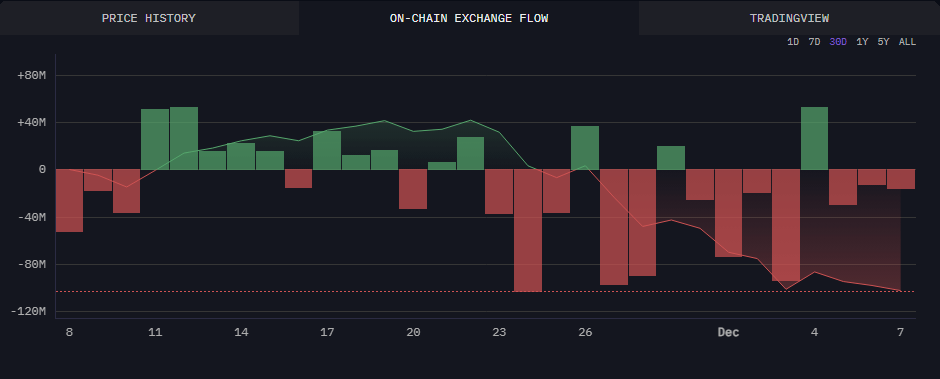

Exchange inflows have been a persistent drag on Dogecoin’s price throughout the week, with Arkham Intelligence data showing a steady stream of DOGE tokens moving to centralized platforms like Binance and Coinbase. This movement, totaling millions in value, typically precedes sell-offs as holders seek liquidity rather than holding for long-term gains. In the past, similar patterns during 2024’s volatile periods led to 15-20% price dips within days, underscoring the bearish sentiment now evident in trading volumes that have contracted by 10% week-over-week.

Traders are interpreting these inflows as a defensive strategy amid broader cryptocurrency market uncertainty. For instance, Bitcoin’s consolidation around $90,000 has spillover effects on altcoins like Dogecoin, amplifying the pressure. Expert analyst Ali Martinez, known for on-chain insights, notes that such accumulations on exchanges often correlate with fading confidence, where retail investors shift to profit-taking. Without a reversal in inflow trends, Dogecoin could test lower supports sooner, as momentum indicators like the RSI remain below 50, signaling oversold but unrecovered conditions.

Source: Arkham

The chart above illustrates the inflow surge, correlating directly with Dogecoin’s inability to break above the descending channel’s upper boundary. Historical precedents from early 2024 show that when inflows exceed 50 million DOGE in a week, prices often decline by at least 10%, a threshold recently crossed. This data reinforces the need for caution among investors, as it points to a market where supply pressure outweighs demand.

Frequently Asked Questions

What support levels should Dogecoin holders watch if price breaks below $0.13?

If Dogecoin’s price falls below the $0.13358 support, the next major zone is around $0.081, where Glassnode’s Realized Price Distribution identifies limited historical buyer accumulation. This thin support could lead to accelerated selling, potentially dropping the price 40% in a short span, based on similar breakdowns in 2024. Holders should monitor volume spikes for signs of capitulation.

Is Dogecoin’s declining network activity a sign of long-term weakness?

Dogecoin’s network activity, with daily active addresses dipping to 29,000 according to Token Terminal metrics, indicates reduced user engagement that could hinder recovery efforts. This decline from monthly highs of over 35,000 suggests waning interest, but historical upticks often follow major endorsements or market rallies. For now, it contributes to liquidity shortages, making voice searches for “Dogecoin trends” highlight this as a key bearish factor.

Key Takeaways

- Heightened exchange inflows: Indicate potential selling pressure, with Arkham data showing no signs of abatement, risking further price erosion.

- Thin realized supports: Below $0.13, demand is sparse per Glassnode, increasing the likelihood of a swift drop to $0.08 without intervention.

- Fading network metrics: Lower active addresses and transactions urge investors to watch for renewed engagement to bolster bullish cases.

Source: X

Conclusion

In summary, Dogecoin’s market structure deterioration stems from mounting exchange inflows, fragile support levels, and waning network activity, positioning the memecoin for potential further declines unless bulls defend $0.13358 and push toward $0.15356 resistance. As on-chain data from sources like Arkham and Glassnode underscore these vulnerabilities, investors should prioritize risk management in the volatile crypto landscape. Looking ahead, a surge in user engagement or positive broader market catalysts could shift the outlook—stay vigilant for opportunities to engage with evolving Dogecoin price trends.

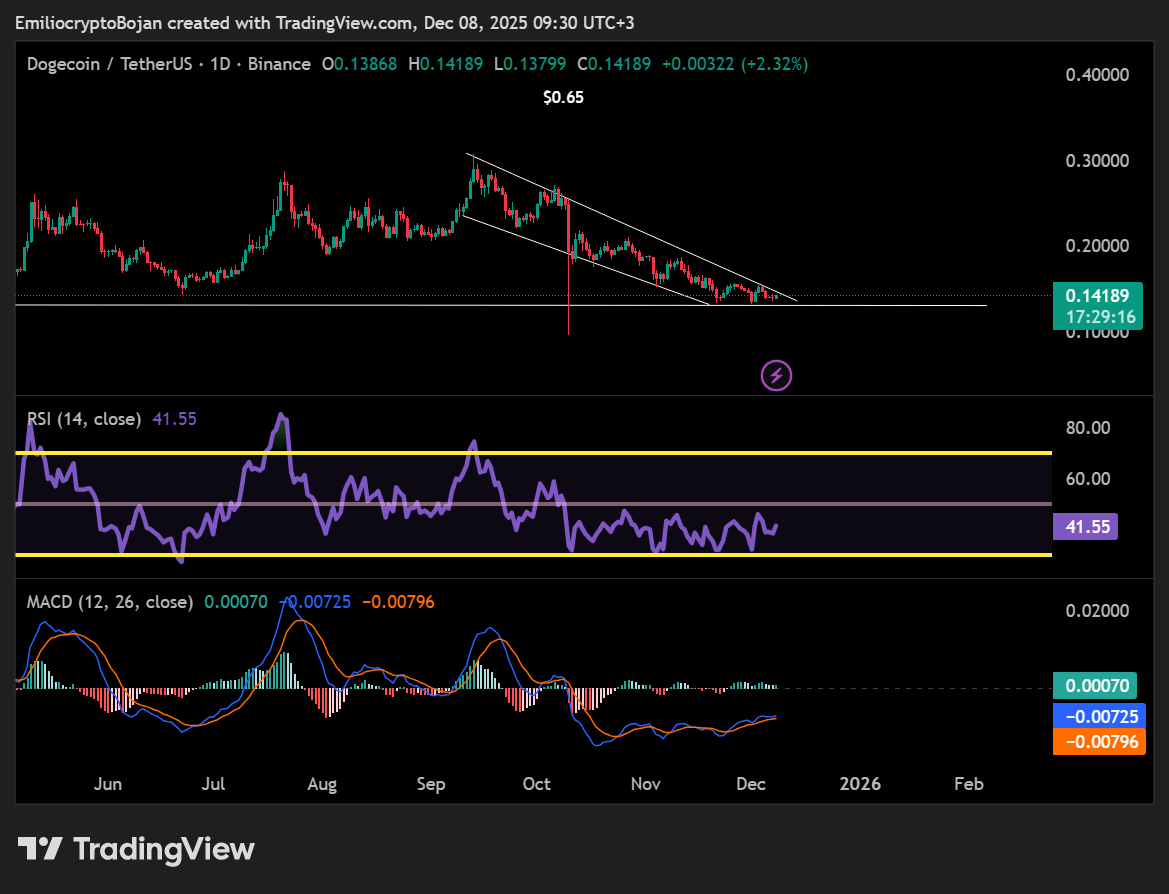

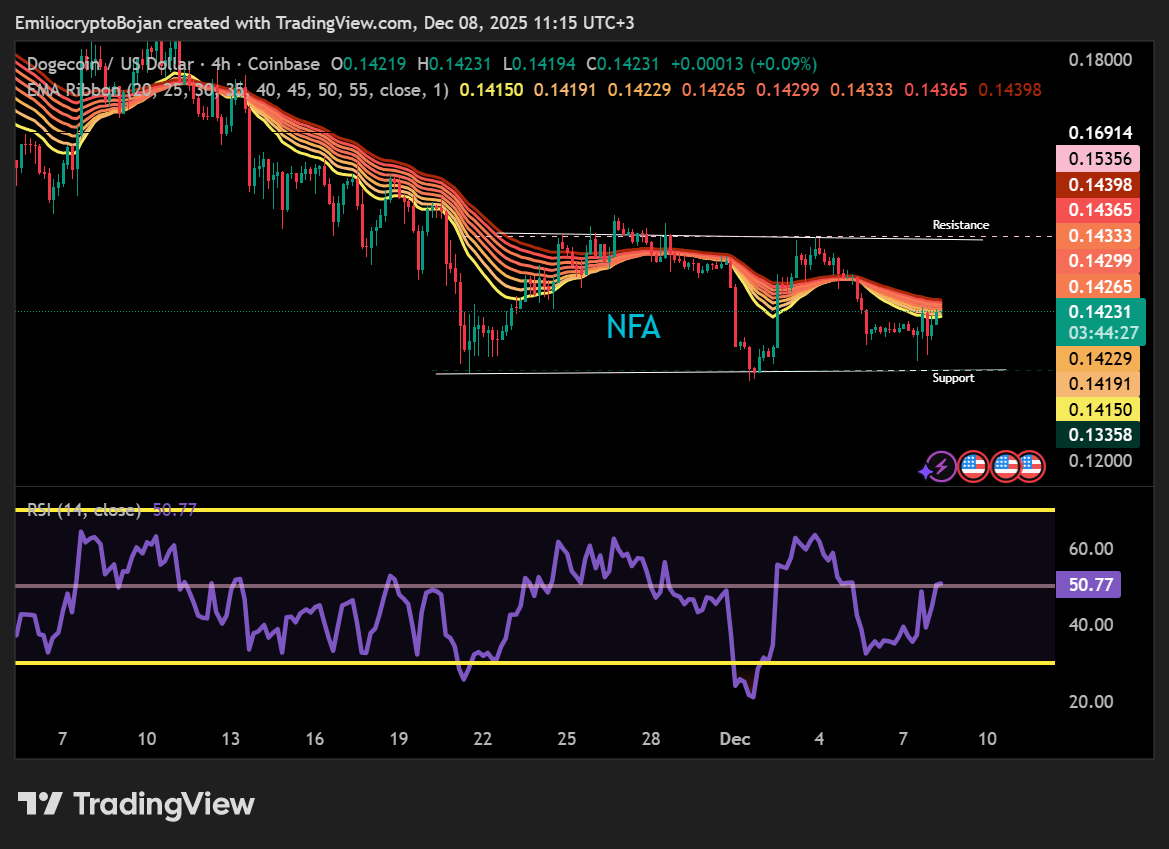

Source: TradingView

Dogecoin currently trades at $0.14189, confined to the lower edge of its descending channel, with technical indicators like RSI and MACD showing persistent weakness. This setup, analyzed on daily and 4-hour charts, leaves little room for optimism without a clear breakout. Defending the $0.13358 level remains critical, as failure could accelerate losses into the low-demand zone.

Source: TradingView

Reclaiming $0.15356 would signal a potential reversal, but current trends favor caution. Market participants should track on-chain metrics closely, as declining engagement—evident in Token Terminal’s reports of reduced transactional throughput—continues to undermine liquidity and price defense efforts. This bearish confluence, observed in late 2024 patterns, serves as a reminder of Dogecoin’s sensitivity to sentiment shifts in the meme coin sector.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Saylor’s Strategy Adds $963M in Bitcoin as BitMine Boosts ETH Holdings

December 9, 2025 at 01:53 PM UTC

Dogecoin ETFs Hit Lowest Trading Volume Since Launch, Hinting at Fading Interest

December 9, 2025 at 12:54 PM UTC