Dogecoin’s Historical Cycles Hint at Potential Accumulation and Upside

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

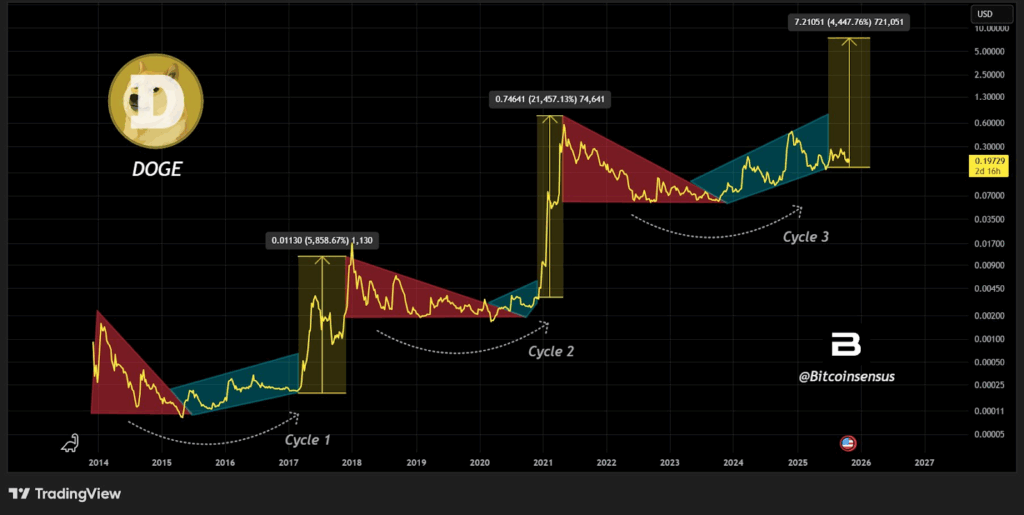

Dogecoin historical cycles feature accumulation phases followed by parabolic rallies and corrections, with the current RSI near 30 signaling oversold conditions and potential upward momentum. Analysts observe patterns from past surges exceeding 21,000% to inform future trends.

-

Dogecoin’s market shows repeated accumulation periods, mirroring cycles since 2014 that led to significant gains.

-

Recent RSI levels around 30 indicate oversold territory, often preceding price stabilization.

-

Daily trading volume exceeds $1 billion, supported by a robust community, highlighting sustained market interest.

Explore Dogecoin historical cycles and RSI signals for insights into potential price movements. Discover accumulation patterns and community-driven trends that shape its future in 2025. Stay informed on crypto dynamics today.

What Are Dogecoin’s Historical Price Cycles?

Dogecoin historical cycles consist of three primary phases: accumulation, parabolic rallies, and corrective downtrends, observed since its inception in 2014. Each cycle begins with extended consolidation, where prices stabilize after previous peaks, building investor interest gradually. For instance, the first cycle saw a remarkable 5,800% increase, setting the foundation for Dogecoin’s volatile yet resilient market behavior. These patterns provide traders with frameworks to predict breakouts, though external factors like regulatory changes can influence outcomes.

How Do Technical Indicators Like RSI Affect Dogecoin’s Short-Term Movements?

The Relative Strength Index (RSI) for Dogecoin currently lingers around the low 30s, entering oversold territory that historically signals exhaustion in selling pressure. This level often leads to temporary stabilizations, as seen in prior instances where RSI below 30 preceded minor relief rallies. Supporting data from exchange volumes shows a recent intraday drop from $0.15 to $0.137–$0.138, accompanied by 1.56 billion tokens traded—six times the average daily volume—indicating possible algorithmic activity rather than retail panic. Experts from platforms like Bitcoinsensus emphasize that such RSI readings, combined with resistance at $0.1383, suggest weakening downward momentum but caution against immediate reversals without confirmed breakouts. Short sentences in analysis like this aid quick comprehension: volume spikes highlight liquidity events; oversold RSI points to potential bounces; overall downtrend persists until key supports hold.

Dogecoin’s price action remains within a broader downtrend, with controlled early trading giving way to abrupt declines. The transition below $0.1495 marked a shift from consolidation to descent, underscoring the role of technical thresholds in guiding market sentiment. As Dogecoin navigates these indicators, its seventh-largest status by market cap—at $22 billion—underscores its enduring appeal amid crypto volatility.

DOGE Coins Price Chart / Source: X

Delving deeper into Dogecoin historical cycles, the second cycle stands out for its explosive growth, surpassing 21,000% and peaking at $0.74, fueled by widespread social media buzz and retail adoption. This phase exemplified how community-driven narratives can propel meme coins to extraordinary heights. In contrast, the third cycle appears to be in an accumulation stage, with projections based on symmetrical patterns suggesting a target around $7—though this relies solely on historical parallels and ignores evolving market conditions like macroeconomic shifts or regulatory developments.

Market observers note that these cycles are not random; they reflect broader crypto market rhythms. Early blue-marked consolidation periods on charts indicate investor positioning before upward thrusts. Analysts from various financial reports, including those referenced in Bitcoinsensus analyses, highlight how Dogecoin’s accessibility and “Do Only Good Everyday” ethos maintain engagement. Daily trading volumes nearing $1 billion on centralized exchanges reinforce this, showing consistent liquidity despite price fluctuations.

From a community perspective, Dogecoin’s strength lies in its grassroots support, which has historically amplified its cycles. Unlike utility-focused cryptocurrencies, Dogecoin thrives on viral momentum, yet its patterns align with technical reliability. Recent observations show no significant rebound post-decline, with stabilization efforts halted by persistent resistance levels. This setup prompts traders to monitor for confirmation of higher lows, a classic sign of trend reversal in Dogecoin historical cycles.

Frequently Asked Questions

What Is the Current Market Position of Dogecoin in 2025?

Dogecoin holds the seventh spot among cryptocurrencies by market capitalization, valued at approximately $22 billion in 2025. It boasts daily trading volumes around $1 billion across major exchanges, driven by strong community participation and historical resilience in volatile markets.

Why Is Dogecoin’s RSI Important for Traders Right Now?

Dogecoin’s RSI near 30 indicates oversold conditions, a signal that selling may be nearing exhaustion and could lead to price stabilization. Traders use this metric alongside volume data to anticipate short-term bounces, as it has reliably preceded recoveries in past cycles spoken naturally for voice queries.

How Has Community Support Influenced Dogecoin’s Price Cycles?

The Dogecoin community has played a pivotal role in amplifying historical cycles through social media campaigns and endorsements, boosting adoption during accumulation and rally phases. This grassroots energy, emphasized in the project’s “Do Only Good Everyday” motto, sustains interest even in corrective trends.

Technical breakdowns, such as the recent liquidity events, further illustrate market dynamics. The surge in traded volume points to institutional or automated influences, differing from retail-driven spikes in earlier cycles. As Dogecoin progresses, integrating these elements with broader crypto trends will be key for informed positioning.

Key Takeaways

- Dogecoin’s cycles repeat accumulation and rallies: Historical data shows three phases since 2014, with gains up to 21,000%, guiding current projections.

- RSI oversold levels signal caution and opportunity: At around 30, it hints at potential stabilization, backed by elevated trading volumes.

- Community and volume drive longevity: With $1 billion daily trades and strong engagement, Dogecoin remains a top crypto asset to watch.

Conclusion

Dogecoin historical cycles and RSI indicators reveal a market poised for potential shifts, from accumulation builds to short-term stabilizations amid downtrends. As the cryptocurrency maintains its $22 billion market cap and robust community support, patterns from past rallies inform trader strategies without guaranteeing outcomes. Looking ahead, monitoring technical signals alongside regulatory developments will be essential; consider evaluating your portfolio’s exposure to such cyclical assets for balanced crypto involvement in 2025.

Comments

Other Articles

Dogecoin Holds Support Near Descending Trendline Amid Oversold RSI Signals

December 31, 2025 at 10:29 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Dogecoin Shows On-Chain Accumulation Signs Amid Rising Social Buzz

December 28, 2025 at 09:40 PM UTC