Dogecoin’s On-Chain Signals May Reinforce $0.15 Support Amid Volatility

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

Dogecoin resilience in late 2025 stems from strong on-chain activity and whale accumulation, holding the $0.15 support level amid market volatility. Exchange net positions have turned positive, signaling buyer interest and reinforcing this floor as a key base for potential rebounds.

-

Dogecoin limited November losses to 15%, outperforming most top-cap cryptocurrencies.

-

Positive exchange net position indicates inflows, supporting short-term stability at $0.15.

-

Whale accumulation of 5 billion DOGE this month bolsters the $0.15 level, with deeper support at $0.08 from prior holdings of 27.4 billion DOGE.

Dogecoin resilience shines in 2025 with $0.15 holding firm. Explore on-chain data, whale moves, and technical supports driving this stability. Stay informed on DOGE’s market position today.

What is driving Dogecoin’s resilience in the current market cycle?

Dogecoin’s resilience is evident as it has contained losses to just 15% in November 2025, far better than many peers, while maintaining trades above the $0.15 level for over a month. This stability is underpinned by favorable on-chain metrics, including a positive exchange net position—the first in over two months—which suggests increasing buyer participation. Such dynamics position Dogecoin as one of the more robust large-cap assets amid broader volatility.

How does on-chain data support Dogecoin’s $0.15 floor?

Dogecoin’s on-chain activity reveals robust bid support that reinforces the $0.15 level as a reliable floor. According to data from Glassnode, the exchange net position has flipped positive, indicating net inflows of DOGE to exchanges for the first time in over two months. This shift historically precedes rebounds, as seen in September 2025 when a similar climb to 5 billion DOGE coincided with a breakout above $0.30, boosting trading volume and price momentum.

Short paragraphs like this aid readability: the positive net position means more tokens are entering exchanges, often a precursor to buying pressure. Experts note that such patterns reflect strategic accumulation by investors anticipating upside. In the current context, this activity limits downside risk, with the $0.15 zone acting as a psychological and technical barrier backed by real demand.

Furthermore, transaction volumes have stabilized, with daily active addresses showing modest growth despite market headwinds. Glassnode reports highlight that these metrics, combined with reduced selling pressure, create a bullish undercurrent. For Dogecoin, this translates to enhanced resilience, as the network’s meme-driven community continues to drive organic interest without relying on speculative hype.

Frequently Asked Questions

Is Dogecoin’s $0.15 support level sustainable long-term?

The $0.15 level for Dogecoin appears sustainable in the near term, supported by on-chain inflows and whale holdings. With 27.4 billion DOGE accumulated around $0.08 as a deeper base, and recent additions of 5 billion DOGE by large holders, this creates layered defenses. Market data from platforms like TradingView confirms consistent bid volumes, suggesting buyers are committed to defending this range against further dips.

What makes Dogecoin more resilient than other top cryptocurrencies?

Dogecoin stands out due to its technical hold above key supports and positive on-chain shifts, even as broader markets falter. Unlike many assets that dropped over 20% in November 2025, DOGE’s 15% decline reflects strong community backing and strategic whale activity. This resilience makes it appealing for investors seeking stability in volatile times, with natural voice-search appeal in queries about meme coin performance.

Key Takeaways

- Dogecoin’s on-chain resilience: Exchange net positions turning positive after two months signal buyer inflows, historically leading to price rebounds and reinforcing the $0.15 floor.

- Whale accumulation strength: The 100 million-1 billion DOGE cohort added 5 billion tokens this month, building on a 27.4 billion base at $0.08 for multi-layered support.

- Market positioning insight: With limited November losses and dual support zones, Dogecoin emerges as a top resilient large-cap, poised for gains in a risk-on environment.

Key Takeaways

Does DOGE’s on-chain activity actually support the $0.15 floor?

Strong bid support, a positive exchange net position, and fresh whale accumulation all reinforce DOGE’s $0.15 as a higher support level.

Why does Dogecoin look stronger than other top caps right now?

Because it’s held up technically, stayed above key ranges, and sits on two deep support bases, making it one of the more resilient large-cap plays.

Dogecoin is showing real resilience this cycle.

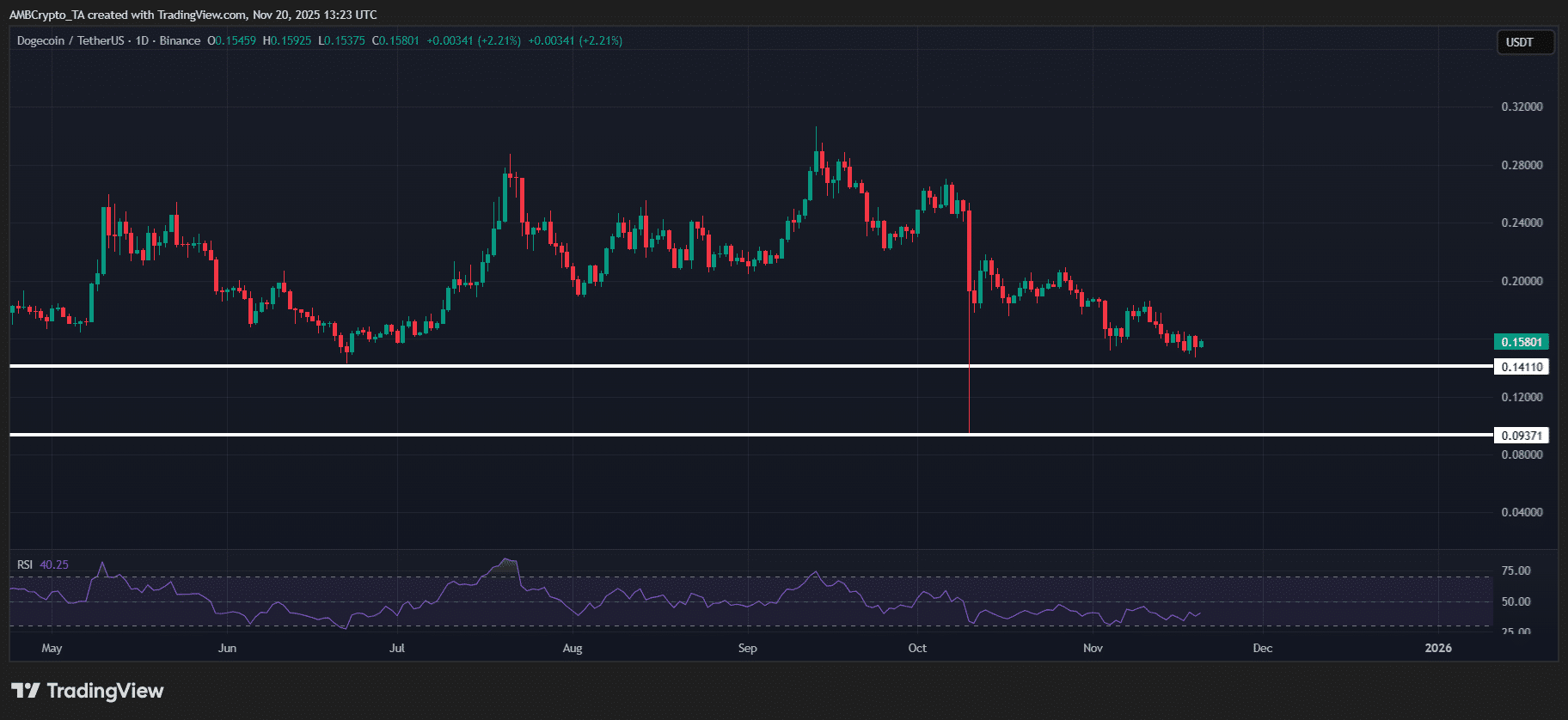

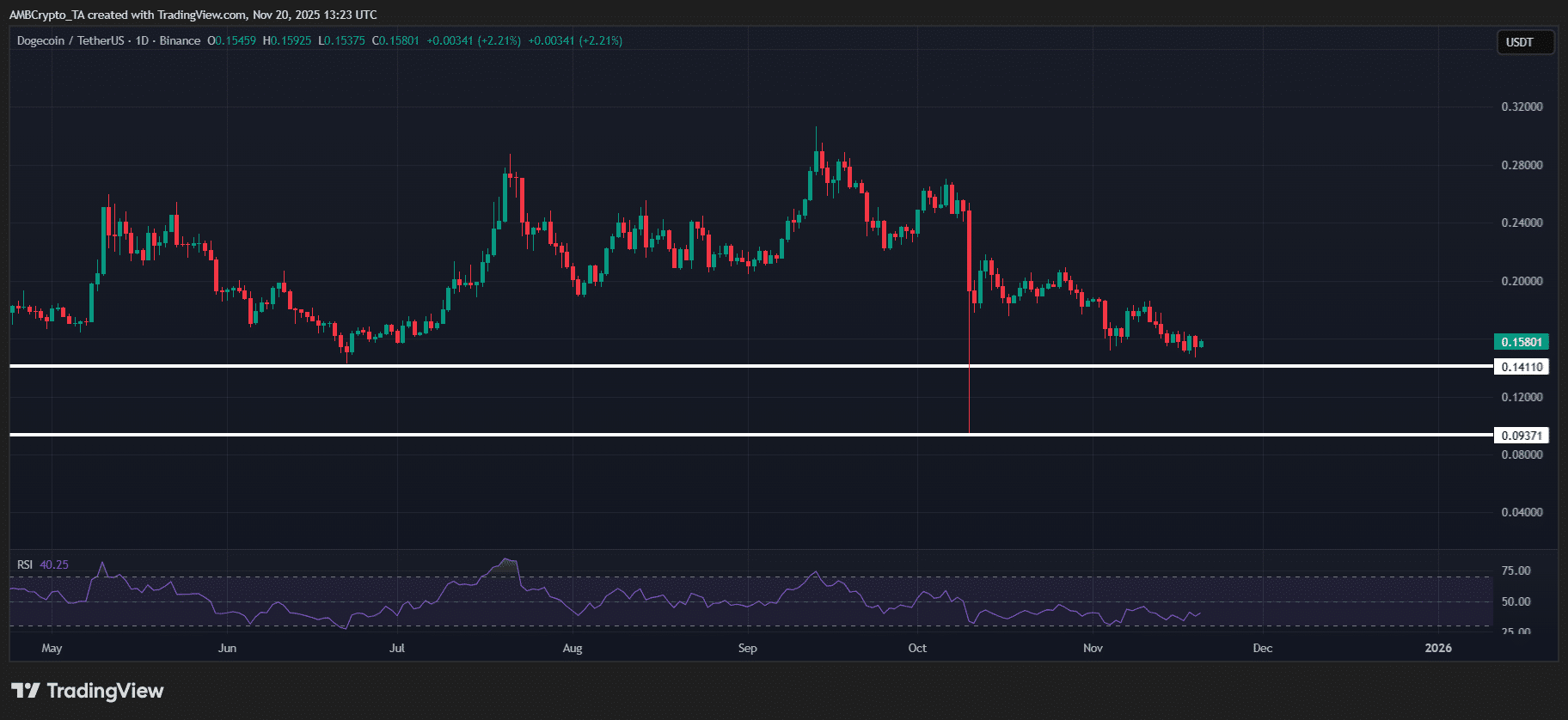

On the technical side, despite market volatility, Dogecoin [DOGE] limited its November losses to just 15%, well below most top-cap assets. The result? Less than two weeks into December, it’s still holding the $0.15 level.

That means DOGE has spent over a month trading above this range, reinforcing it as a solid floor. On-chain data supports this, with the exchange net position flipping green for the first time in over two months.

Source: Glassnode

Simply put, DOGE’s resilience is backed by strong bid support.

Technically, a positive exchange net position means more DOGE is moving onto exchanges than leaving. Historically, these flips line up with short-term rebounds, signaling that buyers may be stepping in around key levels.

For instance, DOGE’s September breakout above $0.30 was backed by the exchange net position climbing to 5 billion DOGE, signaling a clear boost in activity. So does the current bid support make $0.15 a solid floor?

Why DOGE’s base looks stronger this cycle

Dogecoin’s strong bid support suggests stronger hands are stepping in.

On-chain data indicates that the most influential whale cohort (100 million-1 billion) has accumulated roughly 5 billion DOGE so far this month. That’s a meaningful pickup in activity, even as other whale groups remain sidelined.

In fact, an analyst flagged 27.4 billion DOGE being accumulated at $0.08, making it a major support zone. So if these HODLers keep defending it, that reinforces $0.15 as a higher support level above that base.

Source: TradingView (DOGE/USDT)

Simply put, Dogecoin’s resilience isn’t random.

With on-chain signals flipping bullish and two solid support bases underneath, it reinforces the idea that real buying interest is helping stabilize the trend. In turn, making Dogecoin a relatively stronger play.

In essence, DOGE’s November resilience looks set to carry into December. So once the market flips back to risk-on, Dogecoin remains well-positioned to benefit.

Conclusion

Dogecoin’s resilience in the 2025 market cycle, driven by on-chain activity like positive exchange net positions and whale accumulation, solidifies the $0.15 support as a key threshold. With technical indicators showing layered defenses at $0.08 and above, DOGE demonstrates superior stability compared to peers. As broader sentiment improves, investors should monitor these metrics closely for opportunities in this enduring meme coin, potentially leading to renewed upward momentum.

Comments

Other Articles

Dogecoin Holds Support Near Descending Trendline Amid Oversold RSI Signals

December 31, 2025 at 10:29 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Dogecoin Shows On-Chain Accumulation Signs Amid Rising Social Buzz

December 28, 2025 at 09:40 PM UTC