DraftKings Launches Prediction Markets App in 38 States, Paving Way for Crypto-Linked Contracts

ETH/USDT

$20,913,991,584.91

$2,086.17 / $1,845.41

Change: $240.76 (13.05%)

+0.0071%

Longs pay

Contents

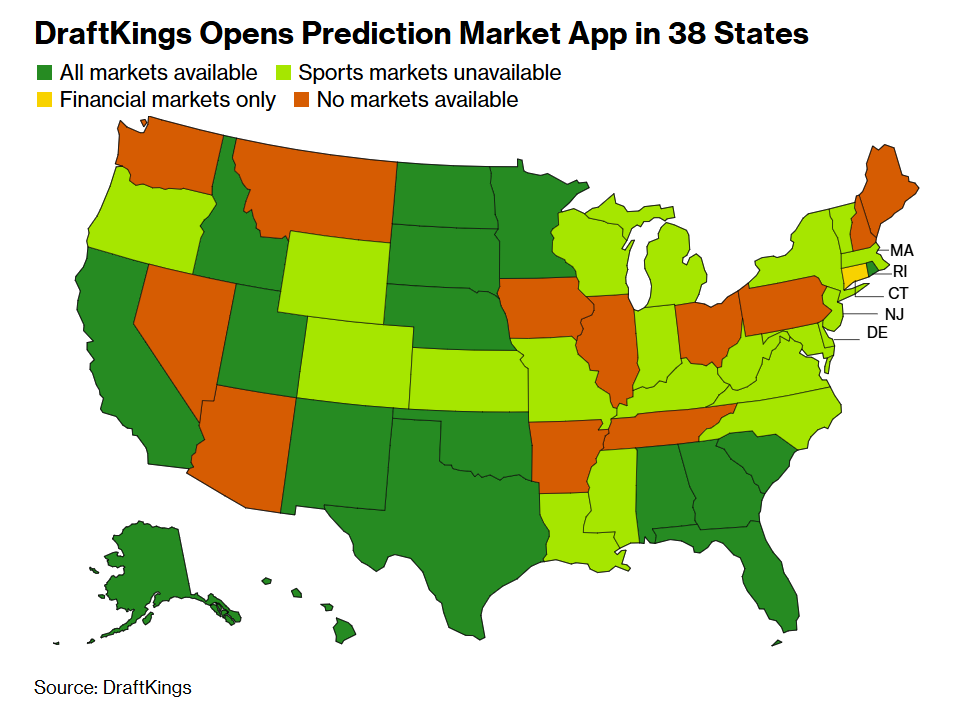

DraftKings has launched its Predictions app in 38 U.S. states, enabling users to trade contracts on sports and financial outcomes. This move establishes a regulated framework for future crypto-linked prediction markets, integrating derivatives standards to expand beyond traditional betting into event-based trading.

-

The app launches in 38 states, with sports trading available in 17, using CFTC-registered Railbird Exchange for compliant operations.

-

It focuses initially on sports and finance, with plans to include crypto, entertainment, and cultural events for broader market access.

-

DraftKings reported $1.14 billion in Q3 2025 revenue, up 4% year-over-year, projecting up to $6.1 billion annually, tripling 2022 figures.

DraftKings prediction markets app launches in 38 states, paving the way for crypto-linked contracts. Explore regulated event trading’s rise and its impact on mainstream finance. Stay ahead—discover how this integrates with crypto trends today.

What is the DraftKings Prediction Markets App?

DraftKings prediction markets app is a new platform that allows users to trade event contracts on outcomes related to sports, finance, and potentially cryptocurrency in the future. Launched in 38 U.S. states, it operates through the CFTC-registered Railbird Exchange, ensuring regulatory compliance while expanding DraftKings’ offerings beyond sports betting. This app marks a significant step toward mainstream adoption of prediction markets, blending traditional finance with emerging event-based trading opportunities.

DraftKings’ growing national footprint. Source: Bloomberg

As a leading publicly traded sports betting company, DraftKings is leveraging its national footprint to introduce this app, which initially supports trading in 17 states for sports-related contracts. The infrastructure draws from established derivatives markets similar to CME Group standards, providing a secure environment for users. This development underscores the company’s strategy to diversify revenue streams amid growing interest in predictive analytics and event trading.

How Will Crypto-Linked Contracts Integrate into DraftKings Prediction Markets?

DraftKings plans to extend its prediction markets to include crypto-linked contracts, allowing trades on cryptocurrency price movements, blockchain events, and related financial outcomes. This integration will build on the app’s regulated derivatives framework, ensuring compliance with U.S. Commodity Futures Trading Commission guidelines. Experts note that such offerings could attract both traditional investors and crypto enthusiasts, potentially increasing liquidity in the sector.

According to industry analysts, the shift toward crypto-inclusive prediction markets addresses the demand for real-time, event-driven trading tools. For instance, contracts could cover Bitcoin halvings or Ethereum upgrades, providing hedged exposure without direct asset ownership. Data from similar platforms shows that crypto-tied events have driven up to 30% higher trading volumes during volatile periods, as reported by financial research firms. This structured approach minimizes risks associated with unregulated decentralized markets, fostering trust among retail participants.

The company’s acquisition of Railbird Exchange plays a pivotal role, offering a cleared venue for these contracts under federal oversight. As prediction markets evolve, DraftKings’ entry could standardize crypto derivatives, aligning them with Wall Street practices. Supporting statistics from quarterly earnings indicate robust growth, with adjusted losses narrowing despite expansion costs, signaling long-term viability.

Frequently Asked Questions

What States Can Access the DraftKings Prediction Markets App?

The DraftKings Predictions app is available in 38 U.S. states at launch, with full sports-related trading permitted in 17 of them. Availability depends on state-specific regulations, focusing on areas with established betting frameworks to ensure compliant operations and user protection.

How Does DraftKings’ App Compare to Crypto-Native Prediction Platforms?

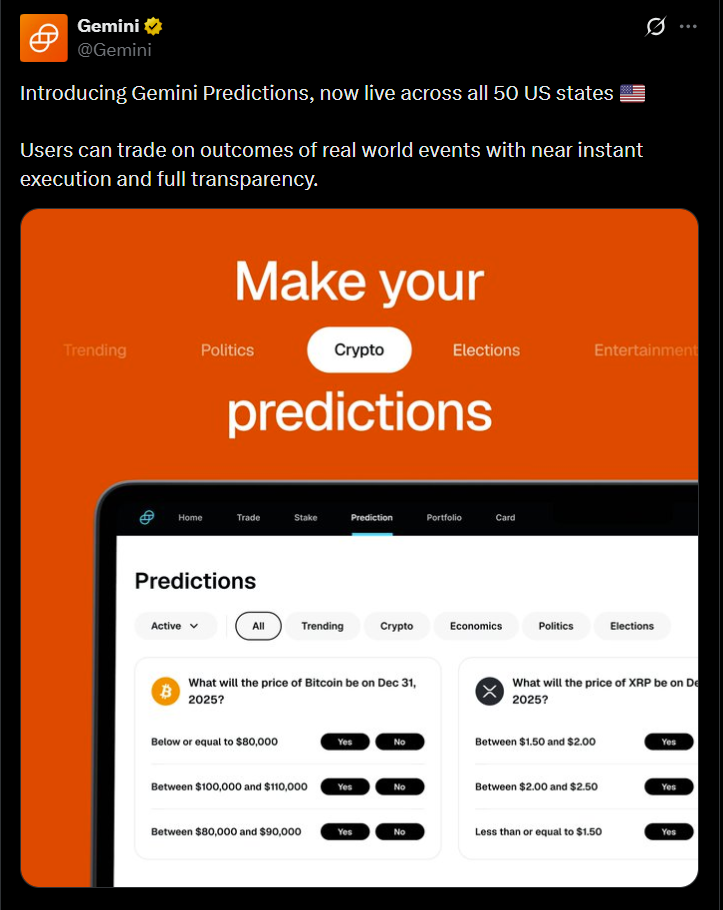

DraftKings’ app provides a regulated, centralized alternative to crypto-native platforms like those using blockchain for instant settlements. It emphasizes U.S. compliance and broader accessibility for non-crypto users, while planning crypto integrations to bridge traditional and digital finance seamlessly, appealing to a wider audience through familiar interfaces.

Prediction markets have transitioned from niche crypto applications to mainstream tools, as seen in the popularity of on-chain platforms during the 2024 U.S. presidential election. These venues enabled global betting on political outcomes with cryptocurrency, achieving settlement speeds unattainable in traditional systems. Regulated players like DraftKings now aim to replicate this engagement while adhering to federal rules, potentially drawing in institutional capital.

Other developments include U.S.-regulated platforms operating under CFTC supervision, which have seen steady user growth. Crypto exchanges are also venturing into this space, announcing expansions that incorporate prediction features alongside spot trading. For example, major platforms have integrated event contracts tied to macroeconomic indicators, enhancing their utility as comprehensive financial hubs.

Source: Gemini

This convergence highlights a maturing ecosystem where prediction markets serve as a gateway for crypto adoption. By offering cleared, transparent trading, DraftKings positions itself as a key player in this hybrid landscape, potentially influencing how event-based finance intersects with digital assets.

Key Takeaways

- Regulated Expansion: DraftKings’ app launches via CFTC-registered infrastructure, ensuring secure trading in 38 states and setting standards for crypto-linked products.

- Revenue Momentum: With $1.14 billion in Q3 2025 revenue and projections up to $6.1 billion annually, the company demonstrates strong financial health amid diversification.

- Mainstream Bridge: This initiative could mainstream prediction markets, integrating crypto elements to attract traditional users while complying with U.S. regulations—consider exploring similar platforms for diversified investment strategies.

Conclusion

DraftKings’ launch of the prediction markets app represents a pivotal advancement in DraftKings prediction markets, blending regulated derivatives with prospective crypto-linked contracts to redefine event trading. As platforms like this gain traction, they underscore the sector’s growth, driven by compliant infrastructure and increasing investor interest. Looking ahead, this could accelerate mainstream crypto integration—users are encouraged to monitor updates for emerging opportunities in this dynamic space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/26/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/25/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/24/2026

DeFi Protocols and Yield Farming Strategies

2/23/2026