Dragonfly Capital Enters Blockchain Finance with 650M$ 4th Fund

BTC/USDT

$15,625,149,390.75

$70,126.67 / $68,000.00

Change: $2,126.67 (3.13%)

-0.0011%

Shorts pay

Contents

Dragonfly Capital closed its fourth fund by raising $650 million. The fund will focus on the next stage of blockchain companies, particularly traditional financial products: innovative products like credit card-like services, money market funds, and real-world asset (RWA) tokens linked to stocks and private credit.

Source: Rob Hadick

Dragonfly Capital's Blockchain Finance Transformation

This approach reflects the shift in the crypto sector from consumer applications to financial infrastructure: payments, lending, stablecoin systems, and tokenized RWAs. Dragonfly general partner Tom Schmidt described it as the "biggest meta shift in the sector." The fund was raised after the "mass extinction" triggered by high interest rates and token declines. The firm previously closed funds of $100M in 2018, $225M in 2021, and $650M in 2022.

How Does the Dragonfly Fund Affect the BTC Market?

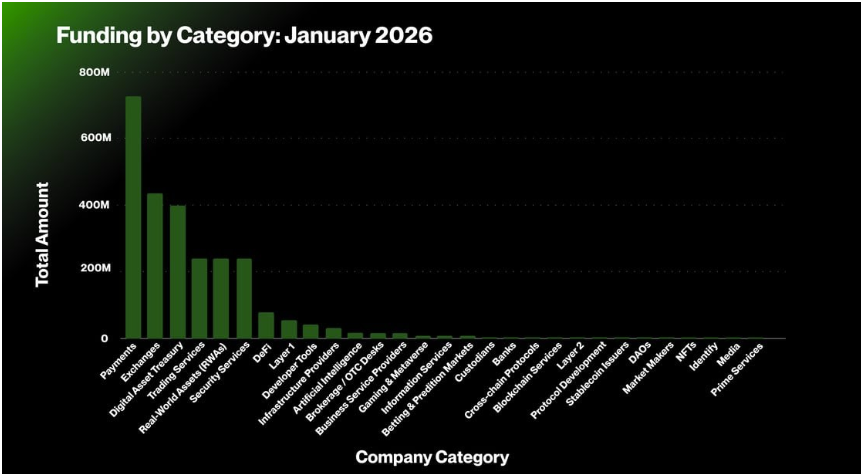

In 2025, as blockchain investments slowed, capital shifted to public offerings, PIPEs, and equity offerings. In January 2026, 111 crypto companies raised $2.5 billion (The TIE). Focus: stablecoin infrastructure, institutional custody, digital asset treasuries. These trends could support market recovery by strengthening BTC's institutional adoption in BTC detailed analysis. RWA tokens could play a complementary role to BTC futures: BTC futures.

Payments, exchanges, digital asset treasuries and trading services saw the largest funding surge in January. Source: The TIE

- Largest Funding Surge: Payments, exchanges, digital asset treasuries, and trading services.

- Total Raised: $2.5 billion in January 2026.

- Number of Companies: 111 crypto startups.

Frequently Asked Questions About the Dragonfly Capital Fund

What does Dragonfly's new fund focus on? RWA tokens that bring traditional financial products to blockchain and stablecoin infrastructure.

What is the difference from previous funds? It focuses on more mature stages and the meta shift.

What is its importance for BTC investors? It can stabilize the BTC spot market by increasing institutional investments.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/16/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/15/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/14/2026

DeFi Protocols and Yield Farming Strategies

2/13/2026