ECB Report Highlights Euro Stablecoins’ Lag Behind USDT-USDC Dominance

CROSS/USDT

$944,653.22

$0.10413 / $0.09857

Change: $0.005560 (5.64%)

+0.0050%

Longs pay

Contents

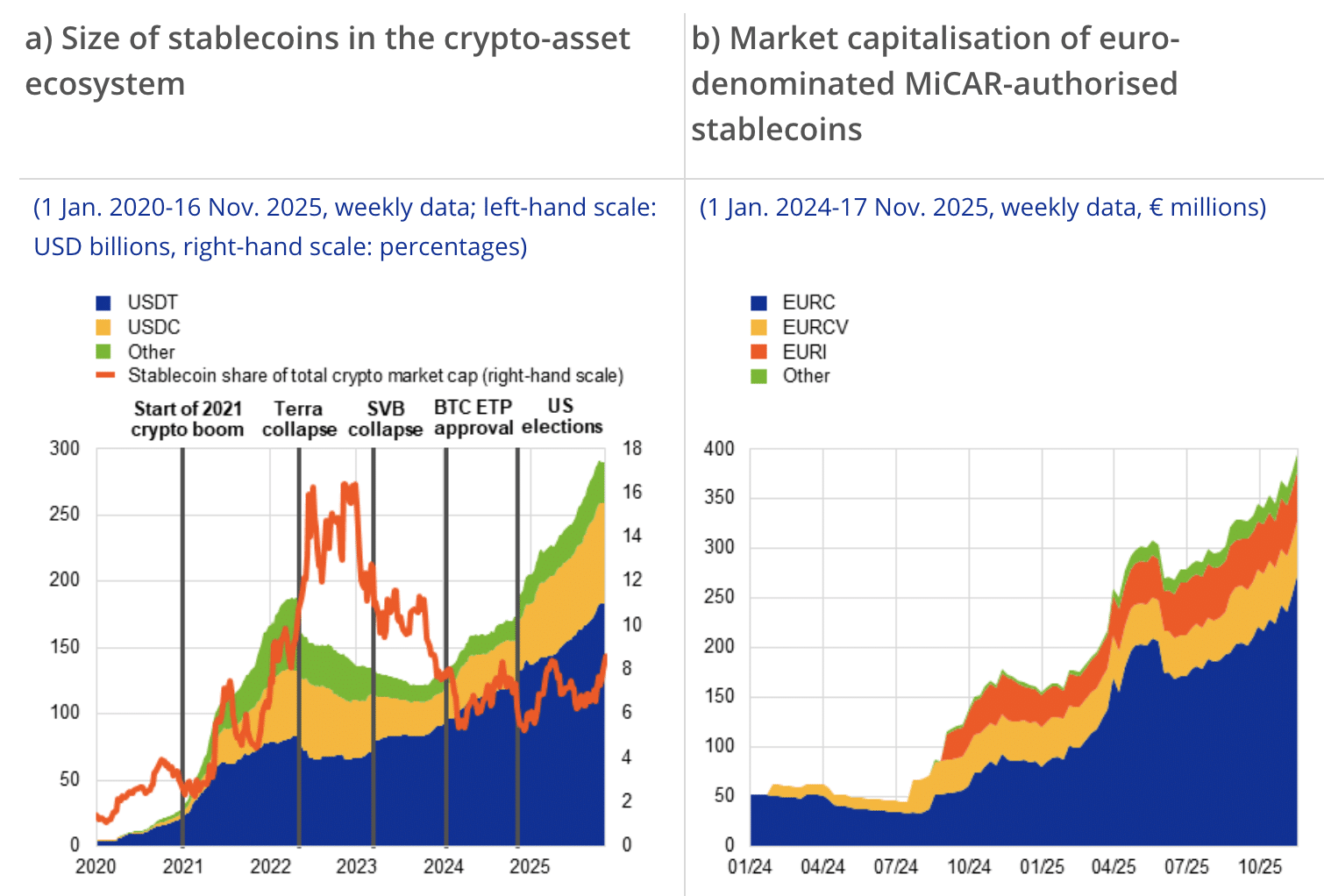

Europe’s stablecoin market features euro-denominated tokens totaling just €395 million, a tiny fraction of the global landscape where USD stablecoins dominate 90% of the value. This imbalance highlights regulatory and competitive challenges limiting euro stablecoins’ growth in trading and liquidity.

-

Euro stablecoins represent under 0.5% of the total market, lagging far behind USD counterparts like USDT and USDC.

-

USD stablecoins underpin 80% of centralized exchange trading pairs, establishing the dollar as the crypto market’s base currency.

-

MiCAR regulations prohibit interest on euro stablecoins, hindering their appeal as savings options amid potential U.S. yield offerings.

Discover why Europe’s stablecoin market trails USD dominance, with euro tokens at €395M. Explore regulatory hurdles and implications for digital finance. Stay informed on crypto trends today.

What is the current state of Europe’s stablecoin market?

Europe’s stablecoin market remains underdeveloped, with euro-denominated stablecoins totaling only €395 million in value, according to a European Central Bank report. This figure underscores a stark contrast to the global dominance of USD-backed stablecoins, which control nearly 90% of the market. The limited scale of euro stablecoins restricts their role in trading, liquidity provision, and broader financial integration within the European Union.

Why do euro stablecoins lag behind USD stablecoins?

Euro stablecoins struggle due to a combination of market dynamics and regulatory constraints. The European Central Bank report indicates that USD tokens like USDT and USDC capture 90% of global stablecoin value, powering most crypto trading and DeFi activities. In Europe, trading infrastructure heavily favors USD pairs, with stablecoins comprising up to 80% of exchange volumes, leaving euro options sidelined.

This disparity extends to reserve management, where major USD stablecoin issuers rank among the top 20 holders of U.S. Treasury bills, integrating deeply with traditional finance. Euro stablecoins, lacking comparable scale, play no significant role in global markets. Data from the ECB shows euro tokens at under 0.5% of the USD ecosystem, amplifying Europe’s dependence on foreign digital currencies.

Regulatory factors under the Markets in Crypto-Assets Regulation (MiCAR) further handicap euro stablecoins by banning interest payments. The ECB notes this prohibition could deter users if U.S. issuers introduce yields, potentially drawing deposits from European banks and corporate treasuries. Short sentences highlight the urgency: Europe risks ceding control over digital money without competitive alternatives.

Frequently Asked Questions

How does MiCAR impact the growth of euro stablecoins?

MiCAR’s ban on interest payments limits euro stablecoins’ attractiveness as savings tools, as noted in the European Central Bank report. This rule prevents issuers from offering yields, reducing competitiveness against USD stablecoins that may soon provide returns. The regulation aims to mitigate risks but inadvertently widens the market gap, affecting €395 million in euro tokens.

What role do stablecoins play in Europe’s digital economy?

Stablecoins serve as key infrastructure for crypto trading and DeFi, but Europe’s market relies heavily on USD versions. According to the ECB, USD stablecoins dominate 90% of global value and 80% of exchange pairs, marginalizing euro options. This setup influences everyday digital transactions, making the dollar the default for European users in blockchain-based finance.

Key Takeaways

- Euro stablecoin market size: Totals €395 million, less than 0.5% of the USD-dominated global ecosystem, per ECB data.

- USD stablecoin dominance: USDT and USDC control 90% of market value and 80% of trading pairs, embedding the dollar in crypto infrastructure.

- Regulatory challenges: MiCAR’s interest ban hinders euro stablecoins’ appeal, risking deposit outflows if U.S. yields emerge—consider diversifying digital assets strategically.

Conclusion

Europe’s stablecoin market faces significant hurdles, with euro stablecoins at €395 million amid USD tokens’ 90% global control, as detailed in the European Central Bank report. Regulatory measures like MiCAR’s interest prohibition exacerbate the competitive disadvantage, threatening monetary sovereignty in digital finance. As crypto integrates further with traditional systems, Europe must address these gaps to foster robust euro-based alternatives and maintain influence in the evolving tokenized economy.

USD stablecoins control 90% of global market

The ECB’s latest assessment shows that USD stablecoins now account for the majority of global crypto activity. USDT and USDC collectively capture nearly 90% of the market by value, despite the EU’s regulatory ambitions for digital finance.

Source: European Central Bank

The gap carries structural implications for Europe’s role in the tokenized economy, particularly in trading infrastructure where stablecoins, overwhelmingly USD-based, represent up to 80% of all centralized exchange trading pairs. This positions dollar-backed assets as the base currency of the crypto market, meaning European traders, liquidity pools, DeFi users, and institutions operate in a USD-native digital ecosystem with minimal euro reliance.

Stablecoin issuers now among top 20 treasury holders

The ECB warns that the largest USD stablecoins are becoming increasingly intertwined with traditional financial markets. USDT and USDC reserve portfolios now place issuers among the top 20 holders of U.S. Treasury bills, underscoring their growing global footprint and potential for systemic impact during redemptions. Euro stablecoins, lacking scale, hold no comparable influence.

MiCAR prohibition on interest payments creates competitive handicap

Europe’s regulatory framework under MiCAR contributes to the imbalance by prohibiting interest payments on stablecoins, a constraint the ECB says could prevent euro tokens from serving as attractive savings vehicles. If U.S. issuers offer yields, they might attract retail users and corporate treasuries, siphoning deposits from European banks.

The ECB also points to cross-border risks with multi-jurisdiction stablecoins, where reserves in one area may not cover outflows elsewhere, heightening contagion during stress periods.

Europe trails in race to define digital money

Without competitive euro stablecoins or a digital euro, Europe risks depending on foreign currencies for its financial infrastructure. The €395 million market pales against USD dominance, threatening monetary sovereignty as stablecoins deepen ties with traditional finance.

According to a recent European Central Bank report, Europe’s stablecoin market remains a rounding error in the global crypto economy, with euro-denominated tokens at just €395 million. The figures highlight a widening competitiveness gap as USD-backed stablecoins continue to dominate trading, liquidity, and market infrastructure across the digital asset sector.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026