ECB Views Stablecoin Risks as Limited in Euro Area, Led by USDT and USDC

CROSS/USDT

$944,653.22

$0.10413 / $0.09857

Change: $0.005560 (5.64%)

+0.0050%

Longs pay

Contents

Stablecoin risks in the euro area remain limited, according to the European Central Bank, primarily due to low retail adoption under 1% and dominance in crypto trading, with ongoing monitoring and MiCA regulations mitigating potential threats.

-

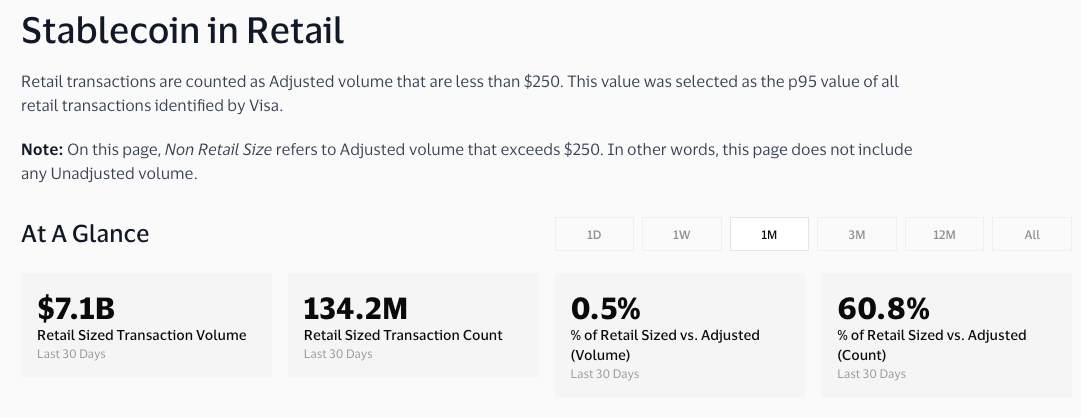

Low adoption: Retail use of stablecoins is minimal, with only about 0.5% of volumes in small transactions under $250, per Visa estimates.

-

Crypto trading drives most stablecoin activity, overshadowing uses like cross-border payments.

-

Preventative measures under the EU’s MiCA framework, including interest payment bans, help contain financial stability risks.

Discover why stablecoin risks in the euro area are contained amid low adoption and strong regulations—explore ECB insights on crypto stability today.

What are stablecoin risks in the euro area?

Stablecoin risks in the euro area are currently limited, as outlined in the European Central Bank’s financial stability review, due to minimal adoption outside crypto trading and robust regulatory safeguards. The report emphasizes that while the stablecoin market is growing rapidly, its interconnections with euro area financial systems are not significant, reducing immediate threats to stability. Authors from the ECB highlight the need for global regulatory alignment to address cross-border issues.

How does the ECB assess stablecoin use cases?

The ECB’s analysis, prepared by financial stability experts Senne Aerts, Claudia Lambert, and Elisa Reinhold, identifies crypto trading as the dominant use case for stablecoins, which are digital assets pegged to fiat currencies like the euro or commodities. Other applications, such as cross-border payments, remain marginal, with a July study from the International Monetary Fund noting substantial cross-border flows but no strong ties to remittances. In retail settings, stablecoin utilization is negligible; Visa estimates indicate that just 0.5% of stablecoin volumes involve organic retail-sized transfers below $250.

Stablecoin use in retail transactions. Source: Visa

This limited engagement suggests stablecoins are largely confined to the crypto ecosystem, and broader adoption in everyday finance is uncertain. The ECB staff concludes that while growth warrants vigilance, the current landscape poses low financial stability risks within the euro area. They stress resolving cross-border regulatory arbitrage to prevent future spillovers from less-regulated jurisdictions.

Dominating the market at 84% are US dollar-pegged stablecoins like Tether’s USDT and Circle’s USDC, yet their links to euro markets are subdued. This separation further insulates European financial systems from potential disruptions. Even as use cases expand, the EU’s Markets in Crypto-Assets Regulation (MiCA) provides a safety net, prohibiting interest payments on stablecoin holdings by issuers and service providers to curb systemic buildup.

Similar proposals are under discussion in the US, where banking groups like the Bank Policy Institute advocate for bans, and federal regulators may finalize rules under the GENIUS Act by 2026 or 2027. These measures align with global efforts to harmonize oversight, as emphasized by the ECB.

Shifting perspectives within the ECB underscore a balanced approach: while executive board members like Piero Cipollone have raised concerns about US stablecoins undermining Europe’s payment sovereignty, the latest review tempers alarms with data on limited risks. This supports ongoing development of a digital euro, with pilots targeted for 2027 and potential issuance in 2029, positioning the ECB to innovate while safeguarding stability.

Frequently Asked Questions

What drives most stablecoin activity in the euro area?

Crypto trading overwhelmingly drives stablecoin activity in the euro area, accounting for the majority of use cases as per the ECB’s financial stability review. Cross-border payments and retail transactions play minor roles, with adoption levels below 1% among consumers, ensuring limited exposure to traditional finance.

Why does MiCA help limit stablecoin risks?

The EU’s MiCA regulation limits stablecoin risks by enforcing strict issuance rules, banning interest on holdings, and promoting global alignment to curb arbitrage. This framework, as detailed in the ECB report, mitigates spillovers and supports financial stability amid growing crypto integration.

Key Takeaways

- Limited risks: Stablecoin threats to euro area stability are low due to confined use in crypto trading and weak retail penetration.

- Regulatory strength: MiCA’s prohibitions and monitoring tools effectively contain potential vulnerabilities from rapid market expansion.

- Global coordination needed: Addressing cross-border gaps is essential to prevent future risks as stablecoins evolve.

Conclusion

The European Central Bank’s assessment reveals that stablecoin risks in the euro area are well-managed through low adoption rates, crypto-centric applications, and MiCA’s proactive measures. As US dollar stablecoins lead the market with minimal euro interconnections, financial stability remains intact, though vigilant oversight persists. Looking ahead, aligning international regulations and advancing the digital euro will fortify Europe’s position in the evolving crypto landscape—stay informed on these developments for strategic insights.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026