ENA Exhibits Bullish Momentum with Whale Accumulation and Downtrend Breakout

ENA/USDT

$153,954,500.88

$0.1044 / $0.0951

Change: $0.009300 (9.78%)

-0.0058%

Shorts pay

Contents

Whale accumulation in ENA has surged, with over 46 million tokens transferred to a key address, now holding more than 451 million ENA. This activity coincides with a 15% price increase, signaling strong investor confidence and a potential rebound from the demand zone near $0.27.

-

Key whale movements: More than 46M ENA flowed into a major wallet, including ties to a Coinbase withdrawal, boosting holdings to 451M tokens.

-

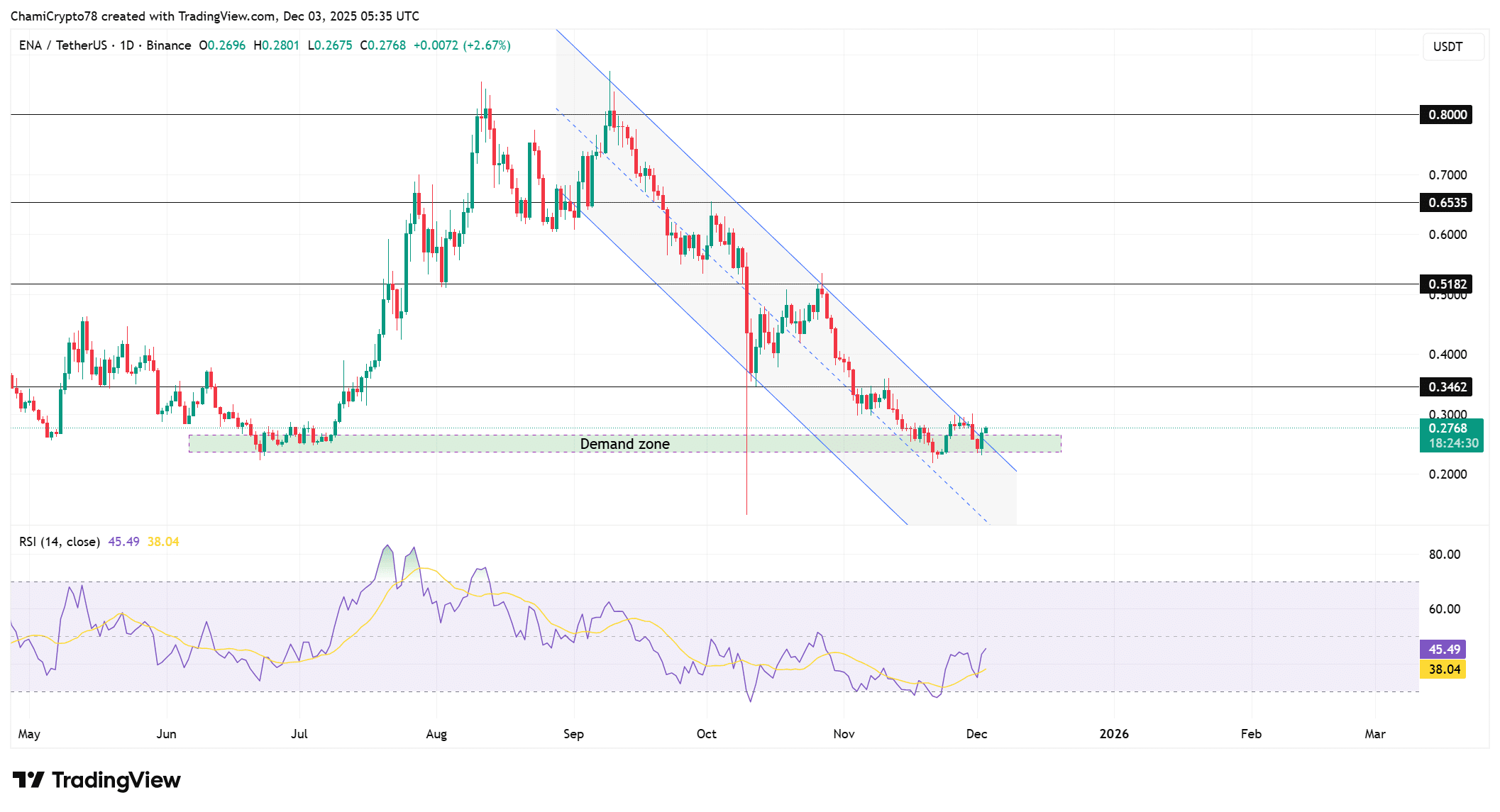

Price action shows ENA breaking a descending channel in the demand zone, with RSI rising toward 45 for improved momentum.

-

Open Interest grew 16.82% to $381M, while top traders show 69.72% long positions, per CoinGlass data, indicating bullish sentiment.

Discover how whale accumulation drives ENA’s price breakout. Explore key indicators and trader sentiment for Ethena’s recovery—stay informed on crypto trends today.

What is Driving Whale Accumulation in ENA?

Whale accumulation in ENA refers to large-scale purchases by major holders, exemplified by the recent transfer of over 46 million ENA tokens to a significant address. This wallet, linked to prior Coinbase withdrawals, now controls more than 451 million ENA, reflecting sustained interest amid Ethena’s protocol dynamics. Such moves often precede broader market shifts, enhancing confidence in the token’s long-term potential.

How Does ENA’s Price Breakout Align with These Inflows?

The ENA price breakout occurred as the token surpassed a multi-week descending channel within a critical demand zone around $0.27. This zone had previously absorbed selling pressure, preventing deeper declines and fostering a stable base for the current 15% daily gain. According to TradingView charts, the breakout targets the $0.30 level, though sustained momentum requires holding above this support. The Relative Strength Index (RSI) has climbed to near 45, curving upward to indicate building buyer strength without entering overbought territory. Expert analysis from on-chain data providers like Lookonchain highlights that similar whale activities in synthetic dollar protocols like Ethena often correlate with 10-20% short-term rallies, as seen in past cycles. Traders note that while failed breakouts could retest the channel, the current structure remains positive as long as the demand zone holds. Open Interest surged 16.82% to $381 million, per CoinGlass metrics, underscoring expanding trader participation and conviction in the upward move. This growth typically amplifies volatility near key levels, but current levels appear balanced without excessive long exposure that might invite corrections.

Source: TradingView

Derivatives markets further validate this trend, with top traders on Binance displaying a pronounced long bias. Data from CoinGlass reveals 69.72% of high-volume accounts in long positions versus 30.28% short, yielding a 2.30 Long/Short Ratio. This tilt among sophisticated participants often foreshadows reversals, as they position ahead of retail flows. Their actions reinforce the demand zone’s importance, where ENA has shown resilience against downside risks.

Source: CoinGlass

In the broader context, Ethena’s ENA token benefits from its role in a synthetic dollar ecosystem, where whale accumulation signals faith in the protocol’s stability. On-chain analytics from platforms like Santiment confirm that such inflows reduce circulating supply, potentially supporting price floors during volatile periods. Market participants, including those cited in reports from Glassnode, emphasize that whale behaviors in DeFi tokens like ENA can influence liquidity and adoption rates, with historical data showing 15-25% average gains following major accumulations.

Frequently Asked Questions

What Does the Recent 46M ENA Transfer Indicate for Whale Accumulation?

The transfer of over 46 million ENA to a wallet holding 451 million tokens points to strategic accumulation by whales, often early indicators of bullish shifts. Linked to Coinbase outflows, this move reduces available supply and builds long-term positions, aligning with Ethena’s 15% price surge as demand strengthens in the $0.27 zone.

Is ENA’s Open Interest Growth a Sign of Sustained Price Breakout?

Yes, the 16.82% rise in Open Interest to $381 million reflects increased trader commitment, typically fueling momentum during breakouts. As ENA holds above its demand zone, this expansion supports volatility in a positive direction, though monitoring for balanced long-short ratios remains key for ongoing recovery.

Key Takeaways

- Whale Accumulation Strengthens Foundation: Over 46M ENA inflows to a major wallet signal deep confidence, now totaling 451M tokens and aligning with price rebounds.

- Breakout from Descending Channel: ENA’s escape above the multi-week downtrend in the demand zone targets $0.30, backed by RSI gains near 45.

- Bullish Trader Sentiment: Rising Open Interest and 69.72% long positions among top traders indicate robust short-term upside potential.

Conclusion

In summary, whale accumulation in ENA, coupled with the price breakout from its descending channel, underscores a promising recovery phase for Ethena’s token. Supported by surging Open Interest and a strong long bias from top traders, these factors create a solid backdrop for continued momentum. As the market evolves, monitoring key supports like $0.27 will be essential—investors should consider these trends in their strategies for informed decisions ahead.

Source: CoinGlass