ENA Signals Potential Rebound Amid Whale Accumulation and Exchange Outflows

ENA/USDT

$153,954,500.88

$0.1044 / $0.0951

Change: $0.009300 (9.78%)

-0.0058%

Shorts pay

Contents

Recent whale activity has boosted Ethena’s ENA token, with a major wallet adding 25 million ENA worth $6.7 million from Bybit, increasing holdings to 285.15 million ENA. This accumulation, combined with net exchange outflows of $1.85 million, signals growing confidence in a potential price rebound amid stabilizing technical indicators.

-

Whale Purchase Boosts Holdings: An Ethena-linked wallet acquired 25 million ENA tokens from Bybit, elevating total position to 285.15 million ENA valued at over $74 million.

-

Exchange Outflows Tighten Supply: ENA saw a net outflow of $1.85 million, reducing available tokens on platforms and supporting accumulation trends.

-

Technical Recovery Underway: RSI at 37 and price holding above $0.25 indicate early momentum shift within the descending channel, with 7.97% daily gain to $0.2624.

Discover how whale accumulation and exchange outflows are positioning Ethena’s ENA for a rebound. Explore on-chain data, technical analysis, and market signals driving this crypto surge today.

What is fueling the accumulation trend in Ethena’s ENA token?

Ethena’s ENA token is experiencing notable accumulation driven by strategic purchases from large holders and consistent exchange outflows. A key wallet associated with Ethena recently purchased 25 million ENA tokens valued at $6.7 million from Bybit, bringing its total holdings to 285.15 million ENA. This move, alongside a broader pattern of net outflows totaling $1.85 million, reflects increasing confidence among major stakeholders at current price levels near the $0.22–$0.28 demand zone.

How are exchange outflows influencing ENA’s market dynamics?

Exchange outflows for ENA have reached $1.85 million in net terms, part of a multi-week trend where tokens are moving off platforms to private wallets. This reduces sell-side liquidity and highlights a preference for long-term holding over immediate trading. Data from CoinGlass shows balances shrinking consistently, which historically correlates with reduced supply pressure and higher potential for price appreciation. Analysts note that such patterns often precede rebounds, as seen in similar crypto assets during consolidation phases. With open interest rising 9.34% to $334.94 million, trader engagement is intensifying, further supporting a bullish undercurrent.

Frequently Asked Questions

Why is whale accumulation significant for ENA’s price stability?

Whale accumulation, like the recent 25 million ENA purchase, signals strong conviction from institutional players at undervalued levels. It reduces circulating supply on exchanges and can stabilize prices by countering selling pressure. This activity often leads to sustained rallies, as evidenced by ENA’s 7.97% gain to $0.2624, fostering a more resilient market structure.

What technical indicators suggest ENA could rebound soon?

ENA’s price is stabilizing within a descending channel, with the RSI climbing to 37 from oversold territory, indicating recovering momentum. Holding above the $0.25 support in the $0.22–$0.28 zone shows buyer resilience. If this pattern holds, a push toward the channel midline could follow, driven by positive taker buy volume in derivatives.

Key Takeaways

- Accumulation Pressure Builds: The Ethena-linked wallet’s addition of 25 million ENA underscores strategic positioning, lifting total holdings and reinforcing buyer intent amid market fragility.

- Outflows Reduce Supply Risks: Net exchange outflows of $1.85 million align with whale buys, tightening liquidity and increasing rebound potential as tokens shift to secure storage.

- Technical Signals Align for Upside: RSI recovery and stable demand zone support suggest ENA is poised for a trend shift; monitor for sustained buying to confirm directional change.

Conclusion

In summary, Ethena’s ENA token is at an inflection point, bolstered by whale accumulation, rising exchange outflows, and favorable technical structures like RSI recovery within the descending channel. These factors collectively point to diminishing downside risks and emerging buyer dominance. As market participants continue to build positions, ENA holders should watch for a break above key resistance levels, which could herald a broader recovery in the synthetic dollar ecosystem.

Key Takeaways

Why do exchange outflows matter right now?

Sustained net outflows tighten sell-side liquidity and signal accumulation, increasing the likelihood of a structural rebound as circulating supply on exchanges shrinks.

What does ENA’s current technical structure suggest?

ENA is stabilizing inside its multi-month descending channel, with RSI recovering — suggesting the early stages of a potential trend shift.

The latest on-chain flow shows aggressive accumulation pressure after an Ethena-linked wallet acquired 25M ENA worth $6.7M from Bybit.

This lifted its total holdings to 285.15M ENA, signaling deepening conviction among large stakeholders near a critical structural zone.

At press time, Ethena [ENA] traded around $0.2624 after a 7.97% 24-hour gain, adding further weight to the accumulation narrative as buyers step in during a fragile market phase.

Moreover, repeated purchases from this entity reflect strong confidence at depressed valuations and highlight a clear intent to accumulate strategically.

This consistent buying pattern reinforces the expectation that larger players position for a potential structural rebound rather than short-term volatility.

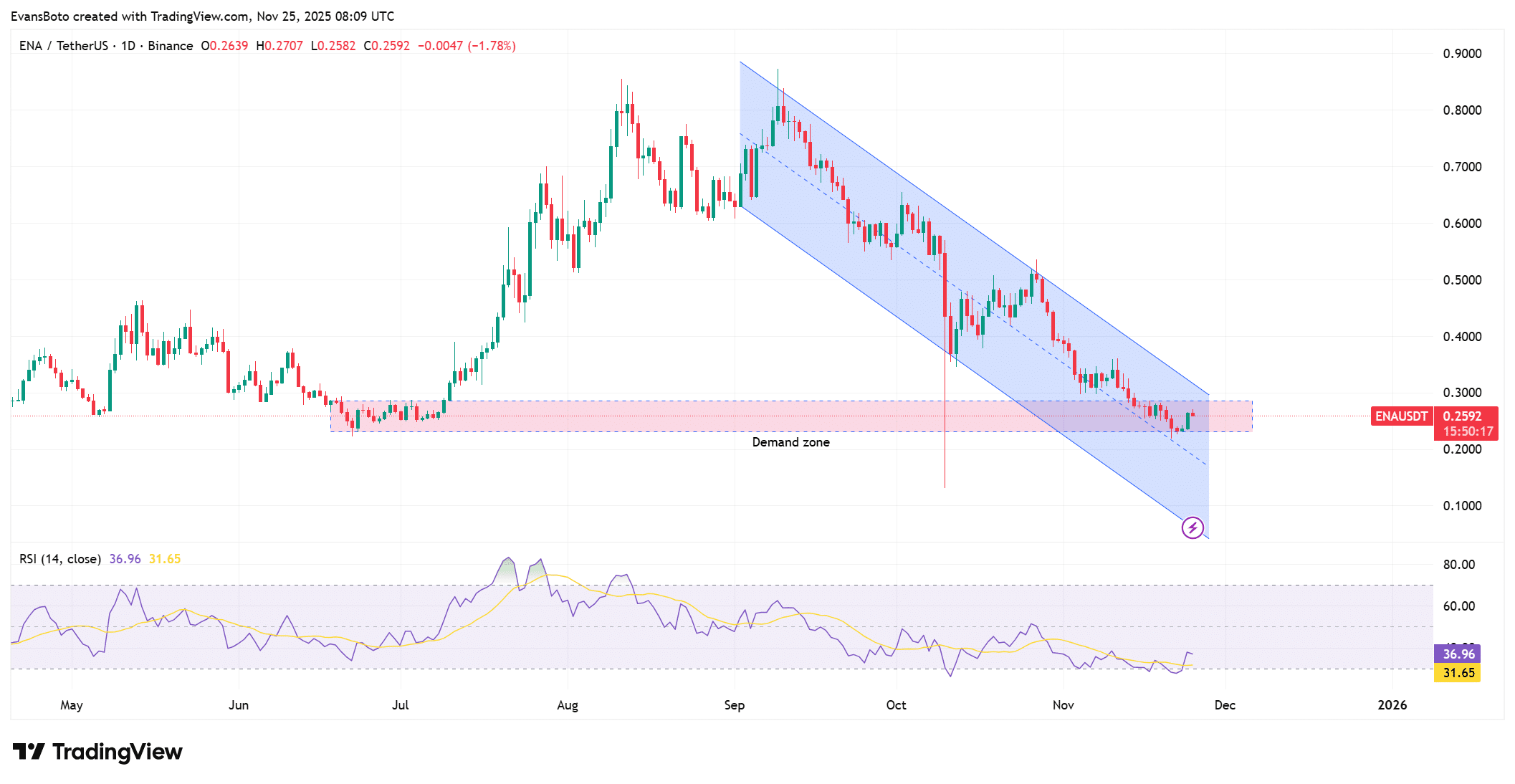

ENA retests its demand zone

ENA continues to hold inside the $0.22–$0.28 demand region after months of compression within a descending channel.

However, the response at this zone looked constructive because buyers recently achieved a clean rebound from the channel’s lower boundary, showing improving strength at a structurally important level.

At press time, the RSI trended upward near 37, revealing early signs of momentum recovery after extended exhaustion. Furthermore, ENA’s stability above $0.25 demonstrates how this zone still provides firm support.

If buyers maintain this traction, ENA could soon target the channel’s midline to establish a stronger technical foundation.

Source: TradingView

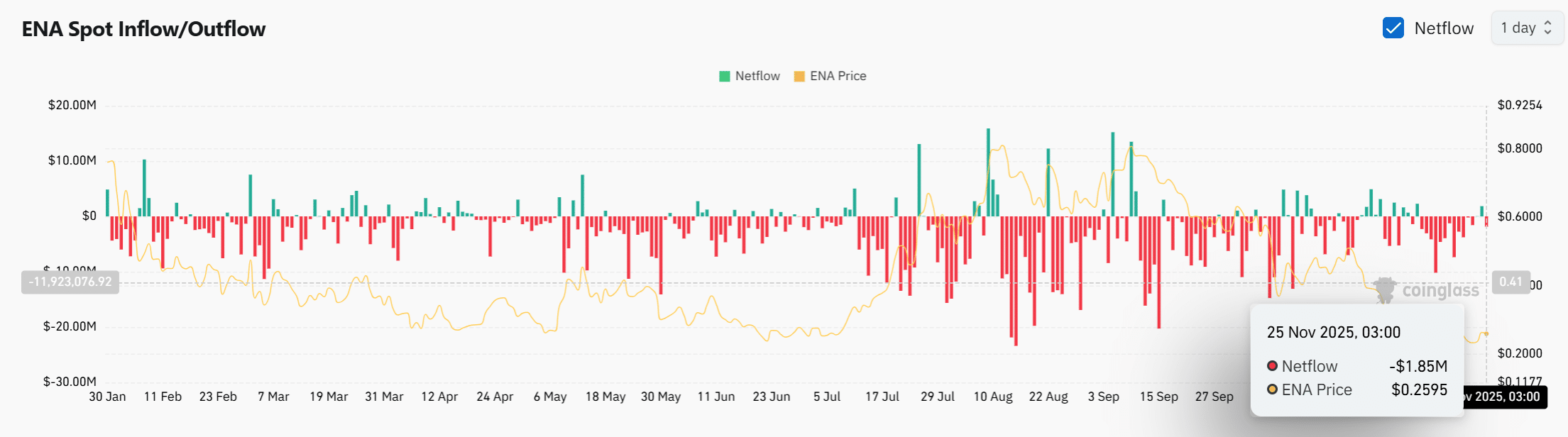

Exchange outflows increase

ENA recorded a – $1.85M net outflow, reinforcing a broader pattern of tokens exiting exchanges rather than entering them.

This behavior matters because sustained outflows typically tighten sell-side liquidity and reflect growing preference for off-exchange holding.

Additionally, the multi-week pattern of consistent negative netflows strengthens the idea that the market favors accumulation at current levels.

Moreover, these outflows appear more meaningful when aligned with the recent whale purchase, creating a synchronized accumulation signal.

Because exchange balances continue to shrink, the market now enters a phase where supply pressure reduces and the probability of structural rebounds increases.

Source: CoinGlass

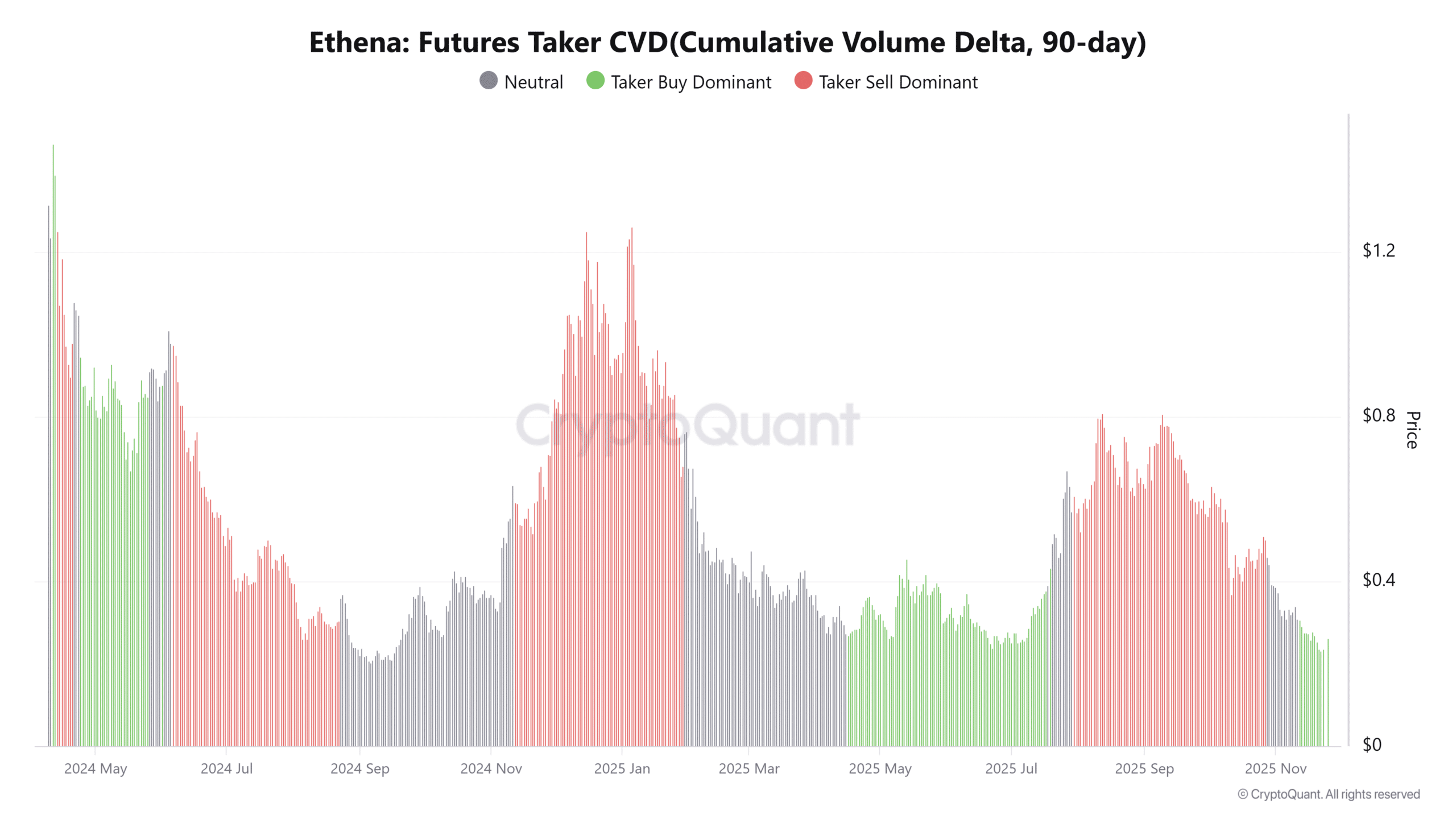

Steady CVD dominance

Taker Buy CVD displays decisive strength across its 90-day window, showing that market buys continue to outweigh sell orders throughout derivatives markets.

This pattern becomes more interesting because it develops despite ENA’s broader downtrend, often suggesting that informed traders accumulate early.

Additionally, the consistency of this trend indicates sellers fail to maintain meaningful control, leaving room for an upside push if momentum accelerates.

Moreover, this dominance aligns seamlessly with whale accumulation and increasing demand-zone stability, creating a confluence of signals that often precede directional shifts.

If buyer aggression remains steady, derivatives flow could reinforce an upcoming rebound.

Source: CryptoQuant

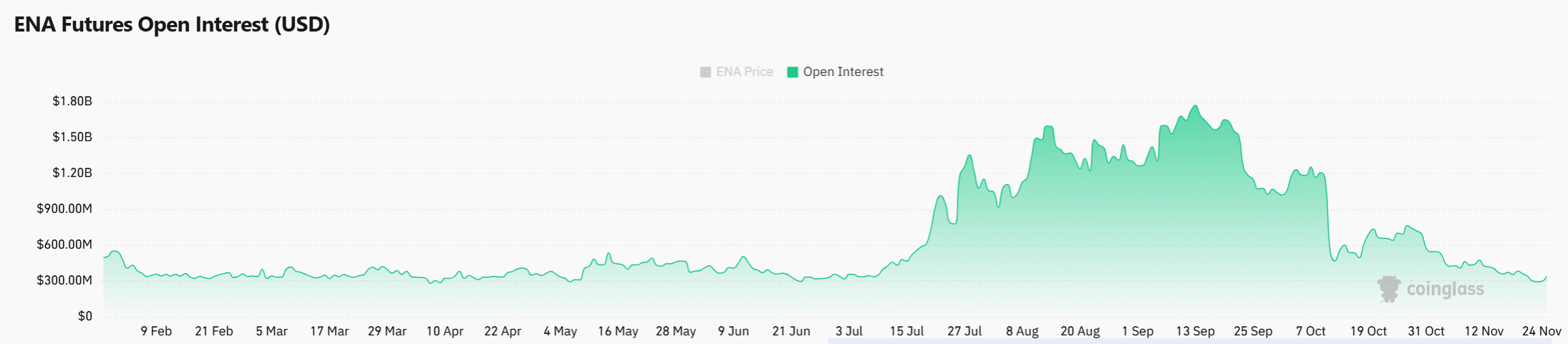

Traders build positions at key levels

Open Interest has climbed 9.34% to $334.94M, signaling heightened engagement as traders expand speculative exposure near ENA’s macro support.

This rise gains importance because expanding OI during a compression phase often precedes sharp volatility, especially when combined with strong CVD.

Additionally, leveraged participation appears to shift toward bullish positioning, suggested by the broader buy-side dominance in derivatives activity.

If OI continues rising from this level, ENA may soon attempt a stronger move away from the bottom of its trend channel.

Source: CoinGlass

To sum up, ENA now sits at a critical inflection point as whale accumulation builds, demand-zone interaction strengthens, exchange outflows rise, CVD dominance persists, and Open Interest expands.

These aligned metrics hint at improving confidence among informed actors. If buyers maintain pressure at current levels, ENA could eventually break its descending structure and attempt a broader recovery.