ETH-Focused DATs Face Potential Backlash Amid MSCI Review and Market Pressure

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Digital asset treasuries (DATs) are facing community backlash due to alleged supply overhangs and venture capital ties amid a market sell-off. Major players like SharpLink have sold significant Ethereum holdings, contributing to price pressure, while MSCI’s potential index exclusion adds uncertainty to the sector.

-

SharpLink’s recent Ethereum sales total over $33 million, exacerbating market volatility.

-

Critics label DATs as VC-backed entities with potential overhang risks, sparking distrust among retail investors.

-

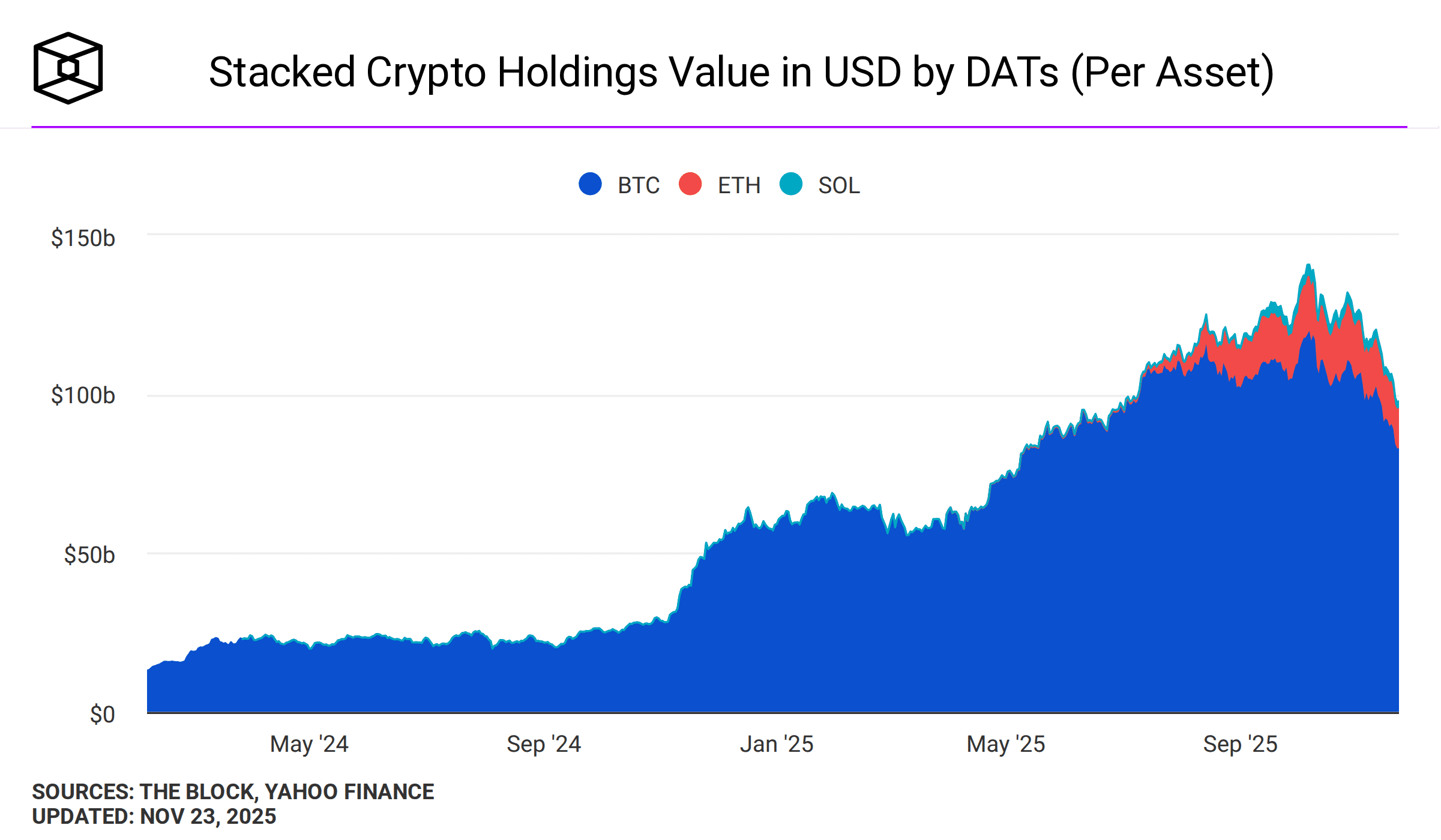

Crypto treasuries have lost $45 billion in value, dropping from $140 billion to $97 billion in Q4 2025.

Discover why digital asset treasuries face exclusion threats and community scrutiny in 2025. Explore expert insights on ETH sales and market impacts—stay informed on crypto trends today.

What Are Digital Asset Treasuries and Why Are They Under Fire?

Digital asset treasuries (DATs) are corporate holdings of cryptocurrencies, often managed by public companies or VC-backed firms focused on assets like Ethereum or Solana. These treasuries have come under intense scrutiny following sharp sell-offs and potential exclusion from major indices like MSCI. In late 2025, firms such as SharpLink liquidated $33.5 million in ETH, fueling accusations of market manipulation and supply overhangs from venture capital influences.

How Have Recent Sales Impacted the Crypto Market?

SharpLink, an ETH-focused DAT, executed a significant dump of $33.5 million in Ethereum in November 2025, following an earlier sale that drew widespread criticism. This action intensified selling pressure on an already declining market, with community members decrying DATs as “terrible, VC scams with overhangs.” According to data from blockchain analytics, such transactions have contributed to broader volatility, though not all DATs are actively selling.

Hasseb Qureshi, Partner at Dragonfly Capital, pushed back against blanket condemnations, emphasizing that DATs are not inherently net sellers. He stated, “So DATs may have ran up too large, but the idea that when it’s all said and done, DATs were net bad for crypto prices is obviously wrong.” Qureshi further noted that many DATs plan to resume buying once their modified net asset values (mNAVs) exceed 1, indicating holdings surpassing enterprise value.

Source: X

On the broader sell-off trend, Qureshi clarified that market movements are not primarily driven by DAT liquidations. He remarked, “Markets are not moving because of DAT selling. Almost no DATs have sold anything. The ones that have are tiny.” This perspective highlights that only smaller entities like SharpLink have offloaded assets, while larger players maintain their positions amid mNAV dips below 1.

Venture capital involvement remains a flashpoint. Firms such as MultiCoin Capital backed Forward Industries, a leading Solana-focused treasury, alongside support from chain foundations and individual raises. The historical pattern of “VC tokens” flooding retail markets post-vesting has bred suspicion, even as top DATs like BitMine Immersion and Strategy show no selling records as of late 2025.

Frequently Asked Questions

What Triggers Community Backlash Against Digital Asset Treasuries?

Backlash stems from perceived supply overhangs where DATs, often VC-linked, sell holdings during downturns, as seen with SharpLink’s ETH dumps. Critics fear these actions mimic past VC token exploits, eroding trust despite evidence that most major DATs hold steady without net negative impact on prices.

Will MSCI’s Review Affect the Future of Crypto Treasuries?

The MSCI index review, expected by mid-January 2026, could reclassify or exclude DATs, pressuring the sector similarly to past regulatory hurdles. Analysts like David Bailey warn this resembles “Operation ChokePoint 3.0,” potentially limiting institutional access. However, resilient DATs may adapt by bolstering mNAVs and resuming acquisitions.

Key Takeaways

- Community Skepticism on VC Ties: DATs’ venture capital connections fuel fears of overhangs, but experts argue they provide long-term stability rather than consistent selling pressure.

- Limited Selling Scale: Only minor players like SharpLink have sold significantly, with larger treasuries like Forward Industries holding firm amid $45 billion in collective losses.

- Index Review Implications: MSCI’s potential exclusion could reshape DAT strategies, urging firms to prioritize mNAV recovery and selective buying in 2026.

Source: The Block

Conclusion

Digital asset treasuries continue to navigate turbulent waters in 2025, balancing community backlash over sales like SharpLink’s ETH offloads with MSCI index review uncertainties that could redefine their role. Despite a $45 billion valuation drop to $97 billion, expert voices from Dragonfly and others underscore DATs’ potential for net positive contributions through strategic holding and future buys. As the market stabilizes, investors should monitor mNAV trends and regulatory shifts for opportunities in this evolving crypto treasury landscape.

Comments

Other Articles

Bitwise’s Bitcoin-Topped Crypto Index Fund Shifts to NYSE Arca Amid Institutional Inflows

December 9, 2025 at 06:27 PM UTC

Bitcoin Privacy Debate Intensifies: Saylor Cautions on Shutdown Risks as Advocates Push Viewing Keys

December 6, 2025 at 08:30 AM UTC

Project Rubicon Integrates Chainlink CCIP to Potentially Expand Bittensor Liquidity on Base

November 19, 2025 at 04:16 PM UTC