ETH Leverage Peaks on Binance Ahead of Fusaka Upgrade, Signaling Potential Market Turbulence

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

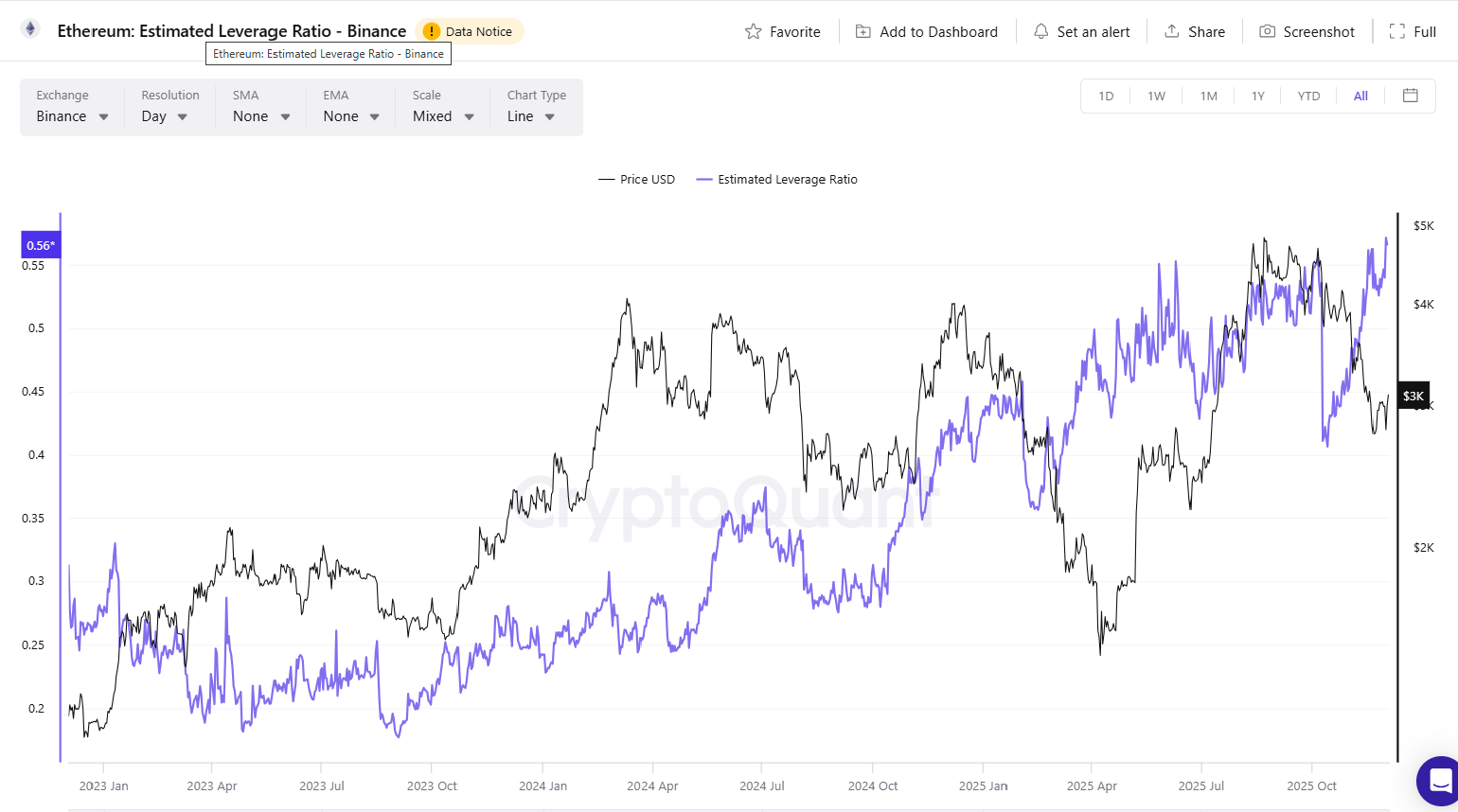

Ethereum (ETH) is trading with record-high leverage on Binance, reaching a ratio of 0.57 ahead of the Fusaka upgrade. This surge indicates increased risk appetite among traders, despite declining position sizes, potentially signaling market turbulence as open interest recovers to $17 billion.

-

Record Leverage on Binance: ETH’s leverage ratio hit an all-time high of 0.57, reflecting traders’ bold risk-taking before the Fusaka upgrade.

-

Growing open interest at $17 billion combined with high leverage heightens ETH’s exposure to volatile price swings and potential liquidations.

-

Neutral sentiment prevails with the fear and greed index at 54, as ETH trades around $3,089, poised between a short squeeze to $3,200 or a drop to $2,900 based on liquidation data.

Discover how surging ETH leverage on Binance signals risks ahead of the Fusaka upgrade. Explore market dynamics, open interest trends, and potential price pivots for informed trading decisions.

What is Driving the Record ETH Leverage on Binance Ahead of the Fusaka Upgrade?

ETH leverage on Binance has reached an unprecedented peak of 0.57, driven by traders’ anticipation of the upcoming Fusaka upgrade. This hard fork aims to enhance Ethereum’s efficiency without disrupting core operations or layer-2 chains, yet it has spurred aggressive positioning. Despite shrinking notional values and outflows since mid-October, the leverage ratio’s climb suggests efforts to capitalize on expected price recovery.

Leverage increased to an all-time peak on Binance, showing traders were willing to take more risks on ETH ahead of the Fusaka upgrade. | Source: Cryptoquant

Leverage increased to an all-time peak on Binance, showing traders were willing to take more risks on ETH ahead of the Fusaka upgrade. | Source: CryptoquantThe escalation in leverage over the past week underscores a broader trend across exchanges, where the average ETH leverage ratio nears its historical high. On Binance specifically, this marks a new record, highlighting a shift toward higher risk tolerance in derivative markets. Traders appear to be leveraging smaller positions to amplify potential gains, betting on the upgrade’s positive impact.

How Does Rising ETH Leverage Impact Market Volatility?

The combination of elevated leverage and recovering open interest—now at $17 billion from a recent $15 billion low—positions the ETH market for heightened volatility. Small price movements could trigger cascading liquidations, especially on Binance, where overleveraged trades dominate. According to data from Cryptoquant, this setup leaves ETH vulnerable to both upward short squeezes and downward long liquidations, with potential targets at $3,200 or $2,900 based on liquidation heatmaps.

Current trading levels around $3,089 reflect a fragile balance, with the Ethereum fear and greed index stabilizing at 54, indicating neutral sentiment after periods of fear. While short-term upside to $3,150 remains possible under existing liquidity, historical patterns show leverage peaks often precede corrections. Experts note that such ratios do not predict direction but flag potential pivots, as traders unwind positions post-event. For instance, a post-upgrade dump could exacerbate liquidations if sentiment sours.

In this environment, the relatively low open interest acts as a buffer against extreme downside, limiting the scale of forced sales. However, the Fusaka upgrade’s non-disruptive nature might still catalyze directional trades, amplifying swings. Market analysts from Glassnode emphasize that derivative metrics like these provide early warnings of turbulence, urging caution amid the risk buildup.

Frequently Asked Questions

What Factors Are Contributing to the High ETH Leverage Ratio on Binance?

The high ETH leverage ratio on Binance stems from traders’ anticipation of the Fusaka upgrade, pushing the metric to a record 0.57. Despite declining position sizes since October, risk appetite has grown, with leverage climbing rapidly in the past week. This reflects attempts to recover losses and bet on post-upgrade gains, as per exchange data.

Will the Fusaka Upgrade Lead to Increased ETH Price Volatility?

Yes, the Fusaka upgrade could heighten ETH price volatility due to the current high-leverage environment on platforms like Binance. With open interest at $17 billion and leverage at peaks, even minor shifts might trigger liquidations toward $3,200 or $2,900. The upgrade’s efficiency improvements are positive, but trader positioning adds uncertainty for short-term movements.

Key Takeaways

- Record Leverage Surge: ETH’s leverage on Binance hit 0.57, an all-time high, signaling aggressive risk-taking ahead of the Fusaka upgrade amid recovering open interest.

- Volatility Risks: Elevated leverage and $17 billion in open interest expose ETH to sharp swings, with liquidation levels at $3,200 and $2,900 based on heatmap data.

- Neutral Sentiment Outlook: With the fear and greed index at 54, ETH at $3,089 could test $3,150 short-term, but leverage peaks often precede corrections—monitor for post-upgrade unwinds.

Conclusion

The surge in ETH leverage on Binance ahead of the Fusaka upgrade underscores a market bracing for potential turbulence, with open interest rebounding and risk ratios at records. This dynamic, coupled with neutral sentiment and fragile positioning, highlights the need for vigilant trading strategies. As December progresses, options expiries and historical patterns suggest mixed outcomes, but the upgrade’s enhancements could pave the way for sustained ETH growth—stay informed to navigate the evolving landscape.