ETH Leverage Ratios Rise, Hinting at Cautious Recovery Near $3,000

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

ETH leverage recovery is underway as the cryptocurrency hovers around $3,000, with the leverage ratio on major exchanges like Binance climbing back to 0.7 from recent lows, indicating traders are resuming riskier positions in anticipation of directional moves.

-

ETH leverage ratio rises: Since October 14 lows, the metric has increased, signaling renewed interest in derivatives trading.

-

Binance leads with highest leverage activity among exchanges, following a record trading volume for ETH.

-

Open interest reaches over $17 billion: Yet, overall caution persists, with high-leverage positions down 50% from past bull cycles.

Discover ETH leverage recovery signals as traders rebuild positions near $3,000. Analyze risks and market sentiment in this in-depth report—stay informed on Ethereum’s next moves today.

What is ETH Leverage Recovery and How Does It Impact Trading?

ETH leverage recovery refers to the gradual increase in leveraged positions in Ethereum derivatives trading after a period of decline, as measured by the exchange leverage ratio of open interest to coin reserves. This recovery, observed since mid-October, shows traders regaining confidence around the $3,000 price level, with Binance leading the trend. It suggests a potential shift toward more aggressive trading strategies, though overall open interest remains subdued compared to previous cycles.

The leverage ratio serves as a key indicator of market risk appetite. When it rises, it typically means more investors are using borrowed funds to amplify their bets on ETH’s price direction, often through futures or perpetual swaps. In the current environment, this recovery follows ETH’s 42% slide over the past three months, during which it failed to breach $5,000 and now trades at about 0.033 BTC with 11.3% market dominance.

How Is the ETH Leverage Ratio Calculated and Why Is It Rising on Binance?

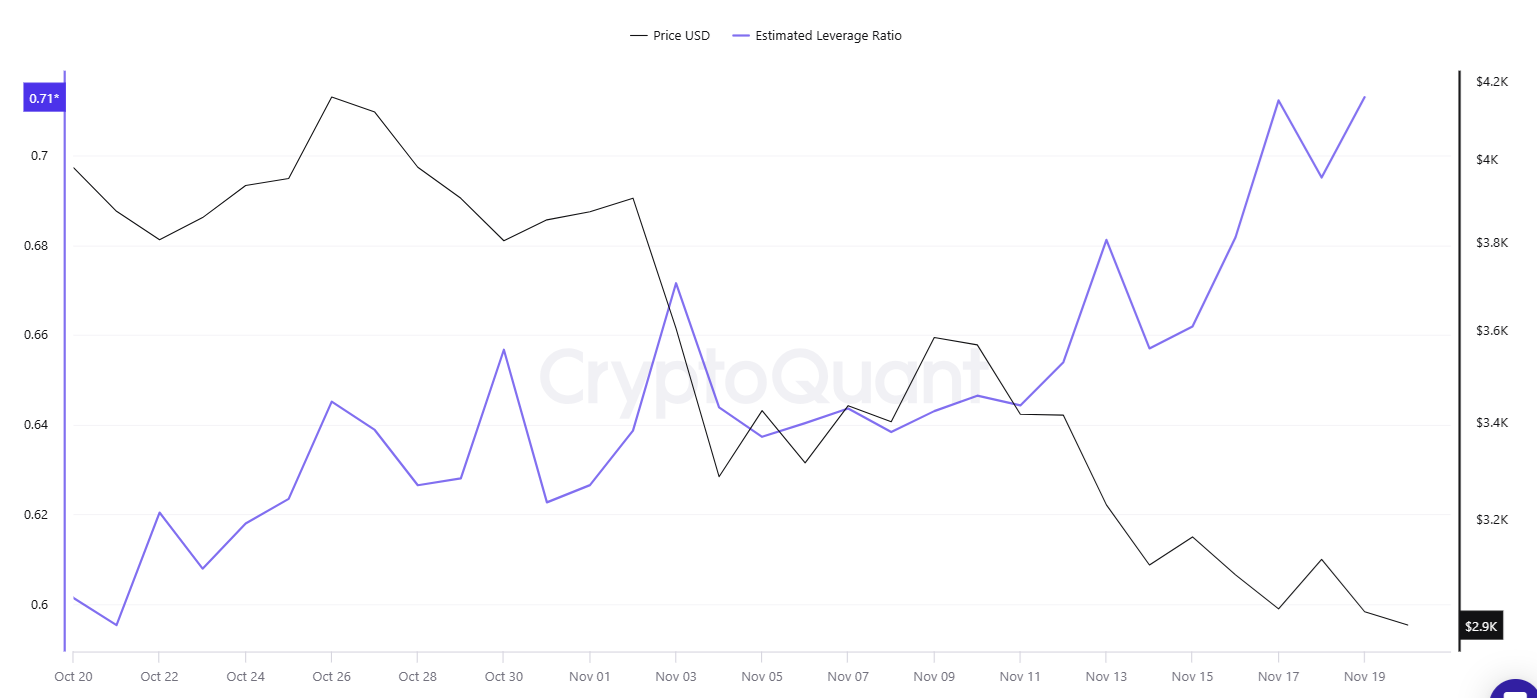

The ETH leverage ratio is calculated by dividing an exchange’s open interest in ETH derivatives by its ETH reserves, providing a snapshot of average leverage across user positions. On Binance, this ratio has climbed from local lows on October 14 to 0.7, matching pre-October 11 crash levels, as reported by analytics platform Cryptoquant. This uptick aligns with accelerated derivative trading on the exchange, which boasts the highest liquidity for ETH pairs.

Supporting data from Cryptoquant highlights that the ratio’s growth reflects traders establishing new positions amid ETH’s stabilization near $3,000. For instance, recent spikes followed a trading volume record on Binance, indicating renewed activity in leveraged trades. Experts note that such recoveries often precede volatility, with historical patterns showing leverage surges correlating to 10-15% price swings in ETH within weeks, based on past market analyses from on-chain data providers.

However, the rise is not uniform across the ecosystem. While Binance dominates with over 40% of ETH open interest in longs, total high-leverage positions have decreased by approximately 50% compared to ETH’s 2021 bull run peaks. This moderation stems from broader caution after the recent downturn, where ETH lost significant ground against Bitcoin. Traders are accumulating liquidity primarily in long positions below the current range, with 74% of positions oriented bullish, yet overall open interest hovers at $17 billion—well within its established range without aggressive expansion.

The ETH leverage ratio increased in November, signaling some traders still increased the risk on their leveraged positions. | Source: Cryptoquant

The ETH leverage ratio increased in November, signaling some traders still increased the risk on their leveraged positions. | Source: CryptoquantMarket participants interpret this as a tentative return to risk-taking, but with tempered enthusiasm. A quote from a derivatives analyst at a major trading firm underscores this: “The ETH leverage recovery on platforms like Binance points to selective optimism, but subdued open interest warns of lingering caution amid macroeconomic pressures.” This aligns with the Ethereum Fear and Greed Index at 32, firmly in fear territory, suggesting derivative traders are still wary of downside risks.

Beyond Binance, other exchanges show similar but less pronounced trends. For example, on Hyperliquid, shorts make up over 43% of open interest, indicating some aggressive bearish bets. Liquidation heatmaps reveal vulnerabilities: over $51 million in leveraged longs could be wiped out if ETH drops to $2,866, with another $52 million at risk around $2,857. Short liquidity clusters above $3,000, reducing the likelihood of a short squeeze in the near term.

This cautious rebuild of leverage comes as ETH navigates a challenging landscape. The cryptocurrency has yet to confirm a local bottom after sliding from higher levels, maintaining its position relative to BTC without significant shifts in dominance. On-chain metrics from sources like Glassnode further support this view, showing reduced funding rates in perpetual contracts, which typically accompany leverage recovery phases.

In professional trading circles, the ETH leverage recovery is seen as a building block for potential rebound. However, it also heightens price action risks, particularly for longs built in the new $2,800-$3,000 range. If ETH sustains above $3,000, it could trigger further leverage inflows, pushing the ratio higher and amplifying upside momentum. Conversely, a breakdown might cascade liquidations, exacerbating the downturn.

Frequently Asked Questions

What Causes ETH Leverage Recovery After Market Dips?

ETH leverage recovery typically follows price stabilization, as seen after the October 11 crash, when traders anticipate rebounds and rebuild positions. With ETH at $3,000, increased open interest on Binance reflects this, driven by record volumes and a leverage ratio rebounding to 0.7. This process is gradual, with longs dominating at 74%, but tempered by overall market fear.

Is ETH Leverage Recovery a Sign of Bullish Momentum in 2025?

Yes, the ongoing ETH leverage recovery indicates budding bullish momentum, particularly on high-liquidity platforms like Binance, where derivative activity has surged. As open interest climbs to $17 billion with mostly long positions, it suggests traders are positioning for upside from the $3,000 level, though caution persists with the Fear and Greed Index at 32 and reduced high-leverage exposure compared to prior cycles.

Key Takeaways

- Leverage Ratio Surge: ETH’s metric has returned to 0.7 on Binance since October lows, signaling renewed risk appetite in derivatives trading.

- Subdued Open Interest: Total ETH positions at $17 billion reflect caution, with high-leverage down 50% from bull cycle peaks and 74% longs accumulated below current prices.

- Price Risk Highlighted: Liquidation risks loom at $2,866-$2,857, urging traders to monitor for breaks above $3,000 to sustain recovery momentum.

Conclusion

The ETH leverage recovery and rising leverage ratio on exchanges like Binance mark a pivotal shift as Ethereum stabilizes near $3,000, fostering cautious optimism among derivative traders. Despite open interest remaining range-bound at $17 billion and persistent fear signals, this trend—backed by data from Cryptoquant—hints at rebuilding confidence post the 42% quarterly slide. Looking ahead, sustaining this momentum could propel ETH toward reclaiming higher ground, offering opportunities for informed investors to engage strategically in the evolving crypto landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC