Ethena Team Buys ENA Amid Rally: $0.50 Target Possible Despite Liquidity Challenges

ENA/USDT

$153,954,500.88

$0.1044 / $0.0951

Change: $0.009300 (9.78%)

-0.0058%

Shorts pay

Contents

Ethena Labs recently purchased over 125 million ENA tokens worth approximately $33.45 million from centralized exchanges, coinciding with a 12% price surge for ENA to around $0.30. This accumulation reflects growing reserves in the USDe stablecoin protocol, potentially signaling further bullish momentum amid increased trading volume.

-

Ethena Labs’ ENA purchases have historically preceded price rallies, with the latest buy injecting significant liquidity into the token.

-

The USDe Reserve Fund reached $62.45 million, underscoring the protocol’s expanding stablecoin ecosystem despite market competition.

-

Trading volume for ENA spiked over fivefold in the last 24 hours, supporting a breakout from a month-long consolidation pattern, though liquidity below $0.29 poses downside risks.

Discover how Ethena Labs’ massive ENA token purchase drives price surges and stablecoin growth. Explore implications for investors in this detailed analysis—stay ahead in crypto markets today.

What is Ethena Labs’ recent ENA purchase strategy?

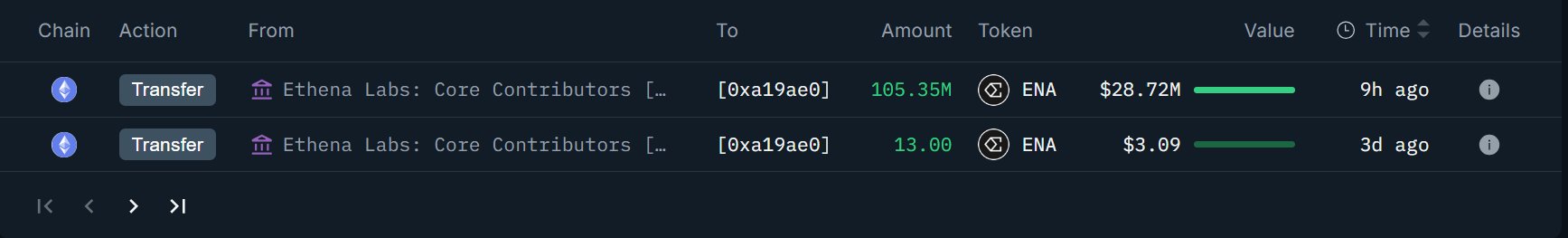

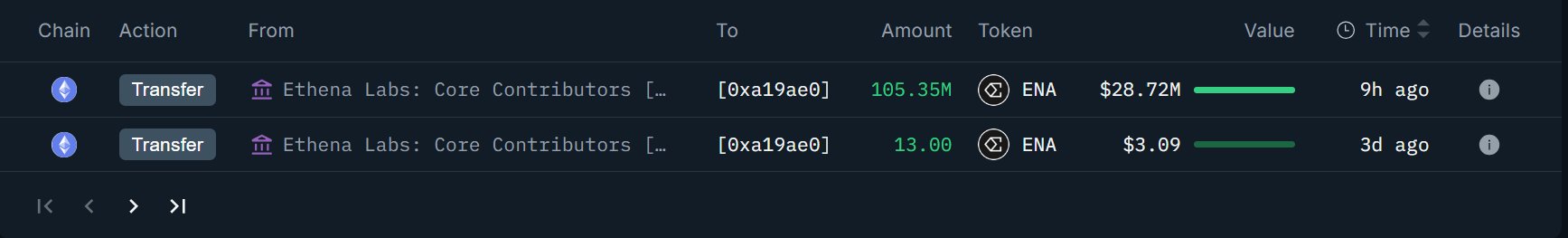

Ethena Labs’ recent ENA purchase strategy involves acquiring substantial amounts of its governance token from centralized exchanges to bolster reserves and support protocol development. On November 26, 2025, the team withdrew over 105.35 million ENA tokens valued at $28 million, followed by an additional 20 million ENA worth $5.45 million from Bybit. This accumulation, bringing total holdings to $88.67 million, aligns with historical patterns where such buys have triggered price increases for ENA.

How has the ENA price responded to Ethena Labs’ buying activity?

The ENA price experienced a sharp 12% rise in the past 24 hours, climbing from $0.2288 to approximately $0.30, fueled by heightened trading volume that exceeded five times the price movement. Technical indicators like the Bull Bear Power at 0.0396 and RSI at 78 confirm strong bullish control on the 4-hour chart, though the overbought RSI suggests possible short-term pullbacks. Data from OnChain Lens reveals this surge followed the team’s purchases, mirroring past instances where ENA rallied post-acquisition, with cumulative protocol fees now at $600 million supporting sustained growth.

Ethena has maintained its flair in the stablecoin market even though there has been competition from other protocols.

Ethena team buys as its reserves grow

As per data from OnChain Lens, Ethena Labs was buying and withdrawing ENA from centralized exchanges (CEXs). First, they bought more than $28 million worth of 105.35 million ENA.

Also, another 20 million ENA valued at $5.45 million was received from Bybit. This followed a string of additional purchases from the Bybit exchange since the 21st of November.

The Ethena team’s holdings were at $88.67 million, representing massive accumulation. Price surges have historically followed such purchases.

Source: Onchain Lens

These purchases coincided with growth in the USDe Reserve Fund and supply, as well as the protocol’s fees. At the time of writing, the Reserve Fund was at $62.45 million, while cumulative fees were at $600 million.

Source: Dune

The increasing stablecoin reserves meant that there was enough liquidity. Furthermore, the purchases from the team injected capital into the cryptocurrency. According to Dune Analytics, the USDe supply has expanded steadily, reflecting user confidence in Ethena’s synthetic dollar mechanism backed by hedged positions in derivatives markets. This reserve growth not only enhances protocol stability but also positions Ethena competitively against rivals like MakerDAO and Aave in the decentralized stablecoin space.

ENA price breaks out: What now?

Ethena price broke out of the month-and-a-half consolidation. ENA surged from $0.2288 to around $0.30, with most of the candles closing green in the 4-hour chart.

The Bull Bear Power (BBP) and RSI highlighted the strength of bulls. The BBP reading was at 0.0396, while the RSI was at 78. The RSI was in the oversold zone, hinting at potential short-term retaliation by the sellers.

Source: TradingView

Interestingly, ENA price was above $0.28, a zone that had three equal highs. Sustained momentum could push the price toward $0.50, which rhymed with the top of the falling wedge pattern.

However, the $0.3534 was challenged due to seller accumulation around this zone. Earlier, this zone initiated the move to lows at $0.2280, where the reversal started following price contraction.

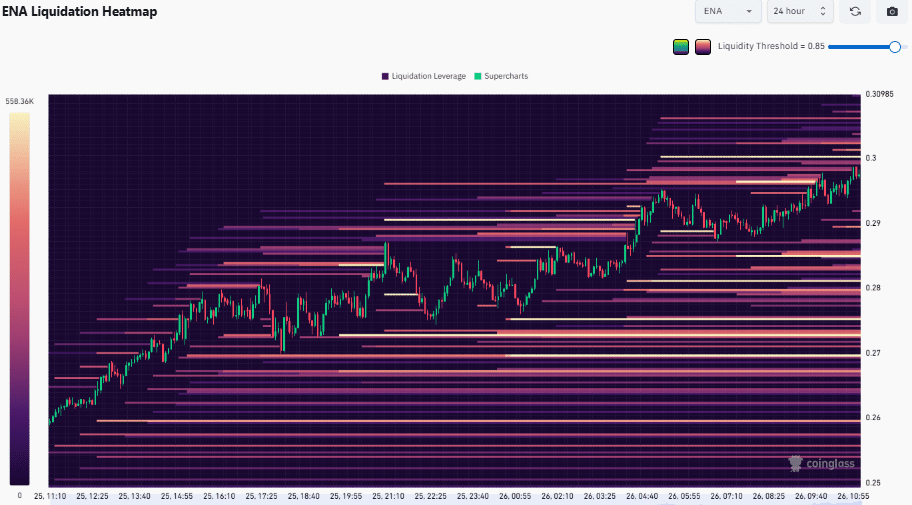

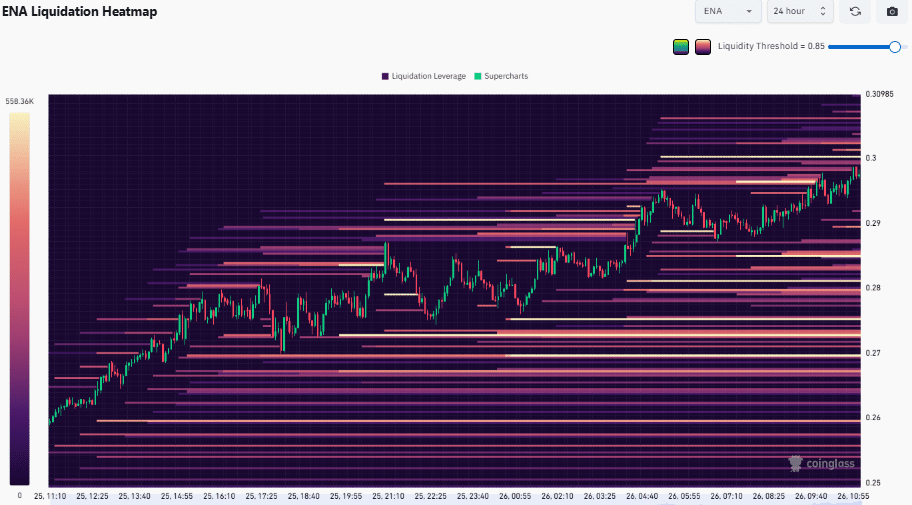

The liquidity heatmap presented a different picture. TradingView charts indicate that while the breakout shows promise, resistance at prior highs could cap gains unless volume sustains the uptrend. Historical data from similar consolidations in ENA suggests that breakouts above key levels often lead to 20-30% extensions, provided no major market corrections intervene.

Liquidation heatmap hints at a potential drop

The liquidity heatmap showed more capital was located to the downside. The liquidity above $0.30 was very minimal compared to the one below $0.29.

The high liquidation leverage between $0.26 and $0.28 was the highest for the day. Thus, the price of ENA could decline to pick up this liquidity.

This concentration of orders was inside a price range, as seen in the CoinGlass data chart.

Source: CoinGlass

This contradicts the potential of ENA price rising past $0.50. If price followed the highest liquidity clusters, then it was more likely for ENA to decline. CoinGlass metrics highlight that downside liquidity often attracts price action in volatile assets like ENA, where leveraged positions amplify movements. Experts from the crypto analytics community note that such imbalances typically resolve through wicks targeting clustered stop-losses, potentially stabilizing ENA around $0.26 before any renewed upside.

The price action of ENA rose by 12% in the past 24 hours, while volume spiked by more than 5 times the price change.

A technical breakout from the consolidation drove the rally immediately after the Ethena team began buying ENA tokens.

Frequently Asked Questions

Why is Ethena Labs accumulating ENA tokens now?

Ethena Labs is accumulating ENA to strengthen its treasury amid expanding USDe reserves and protocol fees, which reached $600 million cumulatively. This move, as tracked by OnChain Lens, supports governance and development while historically correlating with token price appreciation, enhancing ecosystem liquidity without relying on external funding.

What factors could influence ENA’s price after this breakout?

ENA’s price trajectory post-breakout depends on sustained buying volume, reserve growth, and broader market sentiment. While bullish indicators like RSI at 78 favor upside to $0.50, downside liquidity below $0.29 per CoinGlass could trigger a pullback to $0.26, making it ideal for monitoring liquidation levels and protocol metrics for voice search clarity.

Key Takeaways

- Ethena Labs’ ENA accumulation signals confidence: Purchases totaling $33.45 million in tokens have boosted holdings to $88.67 million, aligning with USDe reserve expansion to $62.45 million.

- Price breakout shows bullish strength: ENA’s 12% surge to $0.30, backed by fivefold volume increase, breaks a prolonged consolidation, though overbought RSI warns of volatility.

- Liquidity risks suggest caution: Downside clusters at $0.26-$0.28 may draw price lower, per CoinGlass data, advising investors to watch for support before targeting $0.50.

Conclusion

Ethena Labs’ strategic ENA purchase amid growing USDe reserves and fees underscores the protocol’s resilience in the competitive stablecoin landscape. With ENA’s recent breakout and historical rally patterns, the token remains a focal point for investors, though liquidity heatmaps highlight potential short-term dips. As the ecosystem evolves, monitoring on-chain metrics will be key—consider positioning for long-term growth in synthetic stablecoins.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026