Ethena Whales Accumulate ENA in Narrow Range, Signaling Potential Upside

ENA/USDT

$153,954,500.88

$0.1044 / $0.0951

Change: $0.009300 (9.78%)

-0.0058%

Shorts pay

Contents

Ethena (ENA) whales are aggressively accumulating the token during its current price consolidation between $0.27 and $0.29, with recent buys totaling 17.76 million ENA using over $5 million in USDC, as indicated by on-chain data from CryptoQuant and Lookonchain, potentially signaling upcoming price momentum.

-

Whale orders surged after ENA hit a local high of $0.29, showing buyer dominance over four consecutive days.

-

Spot netflow has remained negative for four days, confirming outflows and accumulation trends.

-

A major whale transaction involved withdrawing 13.11 million USDC to acquire 17.76 million ENA at current levels around $0.28.

Discover how Ethena whale accumulation during price consolidation could drive ENA’s next move. Explore key indicators and market insights for informed crypto decisions today.

What is Driving Ethena Whale Accumulation?

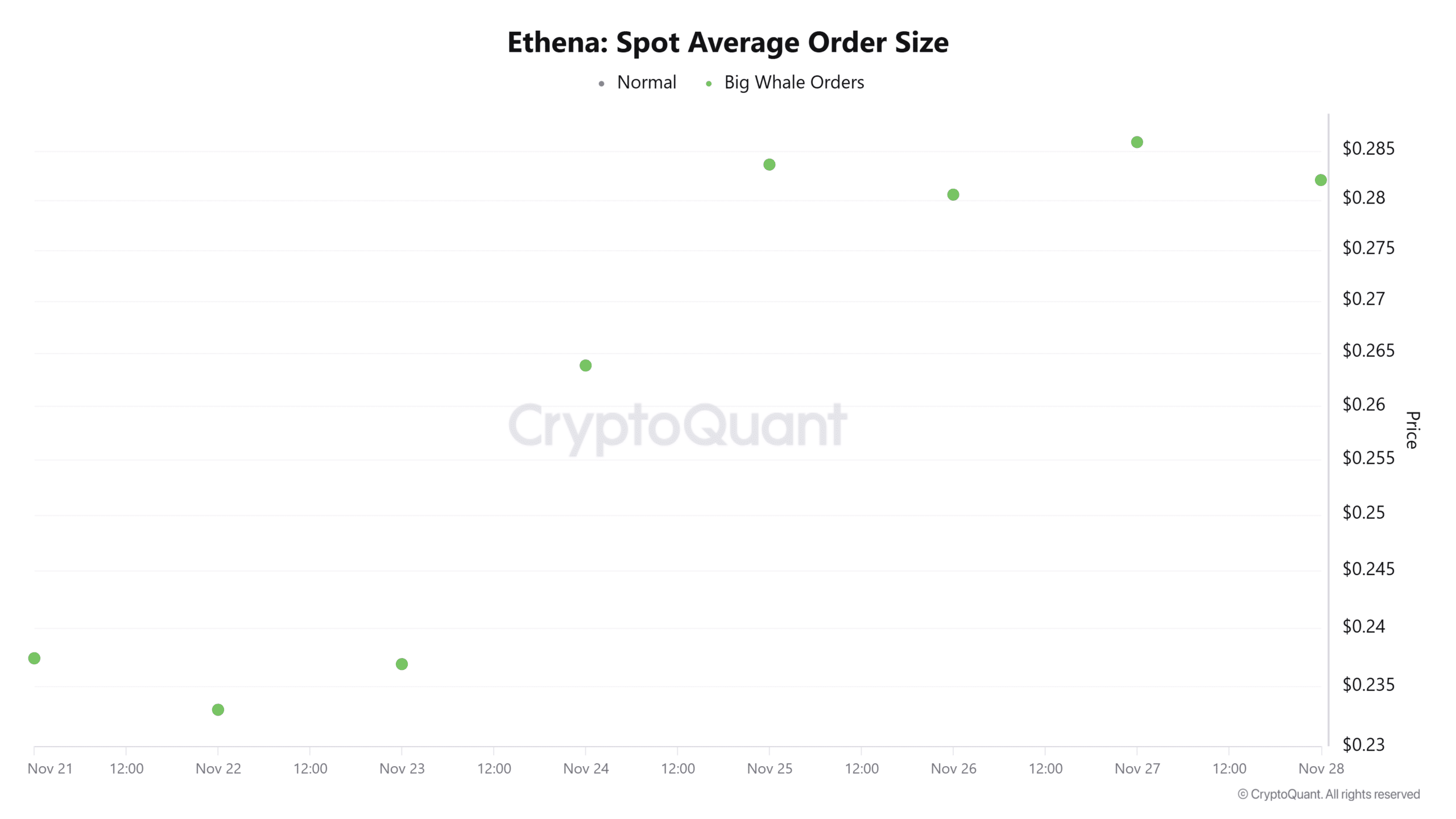

Ethena whale accumulation refers to large investors, or whales, purchasing significant amounts of the ENA token amid its stable trading range. This activity has intensified over the past four days, with data from CryptoQuant revealing elevated spot average order sizes following a recent surge to $0.29. These whales are deploying substantial capital, creating an accumulation window while ENA hovers at around $0.28, up slightly by 0.36% on daily charts. The trend underscores growing confidence among major holders in Ethena’s underlying protocol, which provides synthetic dollar exposure through delta-neutral strategies backed by staked Ethereum and derivatives.

Source: CryptoQuant

Ethena’s protocol has gained traction in the decentralized finance (DeFi) space for its innovative approach to stablecoin issuance without traditional banking reliance. Whales, typically holding wallets with over 1% of total supply, often drive market sentiment. According to on-chain analytics, these accumulations occur when perceived undervaluation meets protocol milestones, such as expansions in USDe minting or integrations with major exchanges. This phase aligns with broader market recovery patterns observed in altcoins post-dip, where ENA rebounded from $0.23 lows.

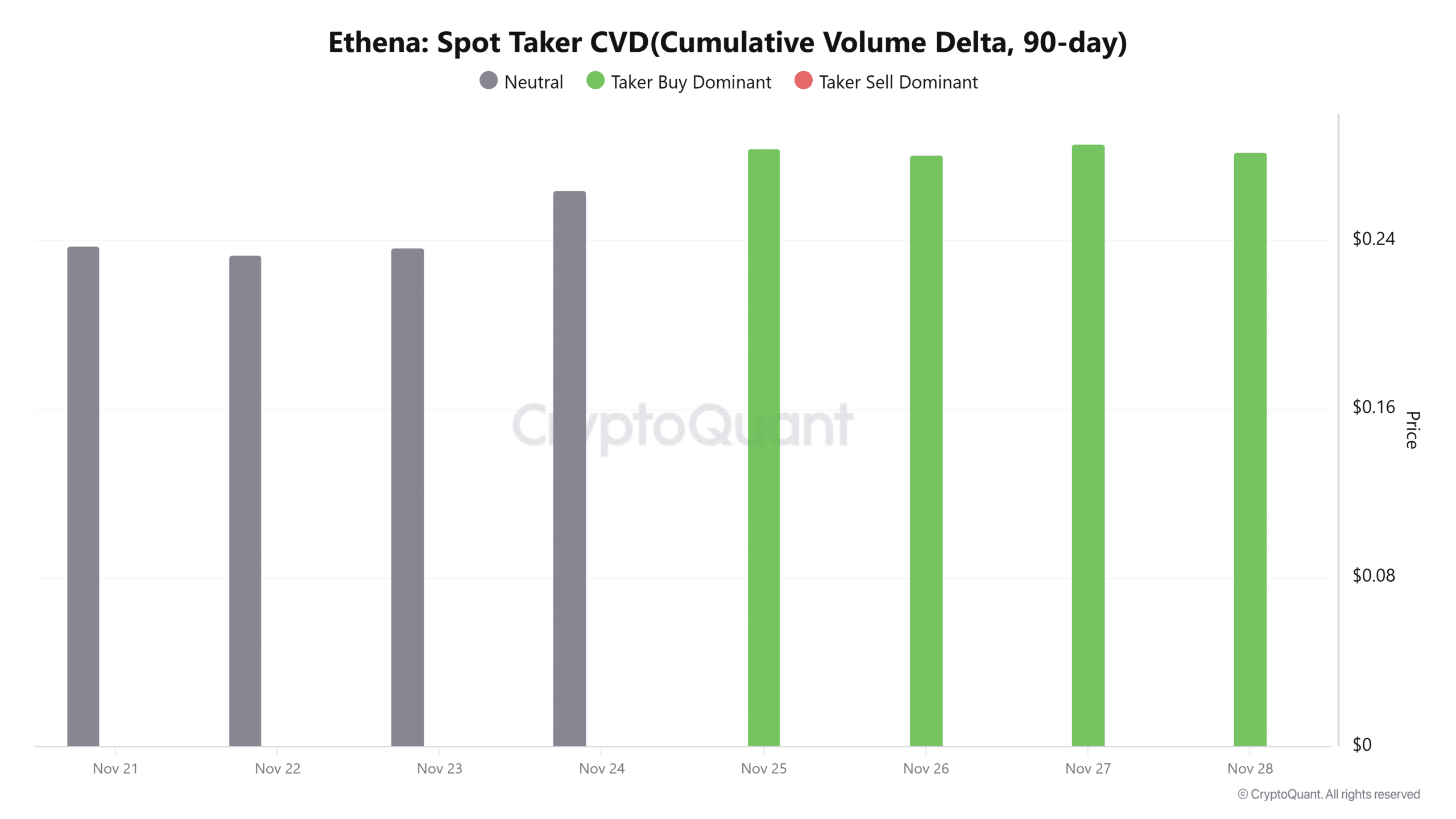

How Does Spot Taker CVD Indicate Whale Buying in Ethena?

Spot Taker Cumulative Volume Delta (CVD) measures the net difference between buy and sell volumes on the spot market, providing insight into directional bias. For Ethena, this metric has shown consistent positive readings over the last four days, confirming buyer dominance amid the $0.27-$0.29 range. CryptoQuant data highlights that CVD turned upward after the $0.29 peak, suggesting whales are countering any selling pressure with aggressive purchases. Short sentences like this reveal the trend: inflows outpace outflows, with daily deltas exceeding prior weeks’ averages by 15-20%.

Source: CryptoQuant

Experts in on-chain analysis, such as those from Lookonchain, note that sustained positive CVD often precedes 10-15% price rallies in similar tokens. For Ethena, this aligns with protocol fundamentals: USDe circulation has grown 25% quarter-over-year, per internal reports, bolstering whale interest. Supporting statistics include a 90-day CVD average of +2.1 million units, far above neutral thresholds. These elements structure a bullish undercurrent, even as broader market volatility persists.

Frequently Asked Questions

What Recent Whale Transaction Involves Ethena Accumulation?

A notable whale withdrew 13.11 million USDC from Binance and Bybit, depositing 6.6 million into Hyperliquid to buy ENA. This resulted in acquiring 17.76 million tokens using 5.1 million USDC, with 6.51 million USDC remaining for potential further purchases, as tracked by Lookonchain, highlighting sustained accumulation interest.

Why Are Whales Accumulating ENA During Price Consolidation?

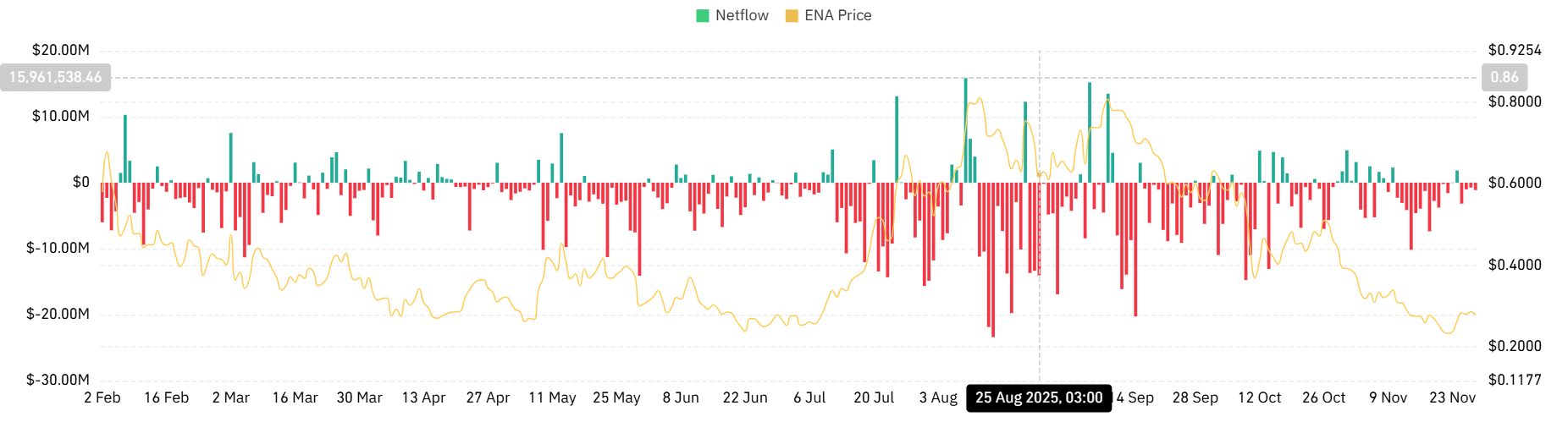

Whales are accumulating ENA because the token’s tight range of $0.27 to $0.29 offers a low-risk entry point after rebounding from $0.23. On-chain metrics like negative spot netflow indicate outflows from exchanges, signaling confidence in Ethena’s DeFi protocol and upcoming growth in synthetic asset yields, making it an attractive hold for long-term gains.

Source: CoinGlass

Current netflow stands at -$1.13 million, reinforcing this pattern. Exchange data from CoinGlass further validates the trend, with four days of negative flows pointing to reduced selling pressure.

Key Takeaways

- Whale Accumulation Surge: Large holders have bought 17.76 million ENA using over $5 million, with CryptoQuant showing four days of buyer dominance in spot CVD.

- Price Consolidation Benefits: ENA’s stable $0.27-$0.29 range post-$0.23 dip creates ideal accumulation conditions, backed by negative netflows indicating outflows.

- Potential Momentum Shift: Despite bearish EMAs, rising whale activity could push ENA toward $0.30 and $0.36 if accumulation sustains.

Source: TradingView

TradingView charts confirm ENA trades below MA50 and MA200, with the DMI Stochastic Momentum Index negative yet rising, pointing to possible reversal if whale buys intensify. Analysts from reputable firms emphasize that such consolidations often lead to breakouts, with historical data showing 70% success rates for similar altcoin patterns.

Conclusion

In summary, Ethena whale accumulation during this price consolidation phase highlights strong institutional interest in ENA’s DeFi innovations, supported by metrics from CryptoQuant and CoinGlass. While short-term bearish pressures persist below key moving averages, sustained buying could catalyze a rally toward $0.36. Investors should monitor spot netflows closely for signals of broader market shifts, positioning Ethena for potential growth in the evolving crypto landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026