Ethena’s USDe Supply Declines 24% in November as USDT Leads Stablecoin Gains

ENA/USDT

$155,019,662.11

$0.1123 / $0.0974

Change: $0.0149 (15.30%)

+0.0031%

Longs pay

Contents

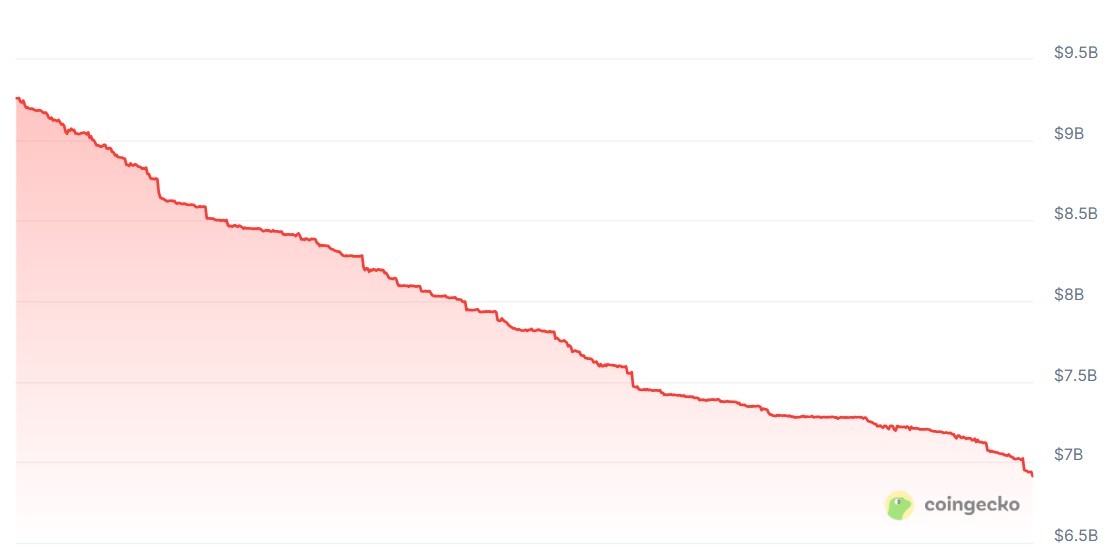

Ethena’s USDe stablecoin experienced a 24% supply decline in November 2025, dropping from $9.3 billion to $7.1 billion in market cap due to significant redemptions amid competition from fiat-backed rivals like USDT and USDC.

-

USDe’s contraction highlights risks in synthetic stablecoins, as users redeemed $2.2 billion worth amid market shifts.

-

Fiat-backed stablecoins such as Tether’s USDT and Circle’s USDC saw steady inflows, bolstering their dominance in the $311 billion stablecoin sector.

-

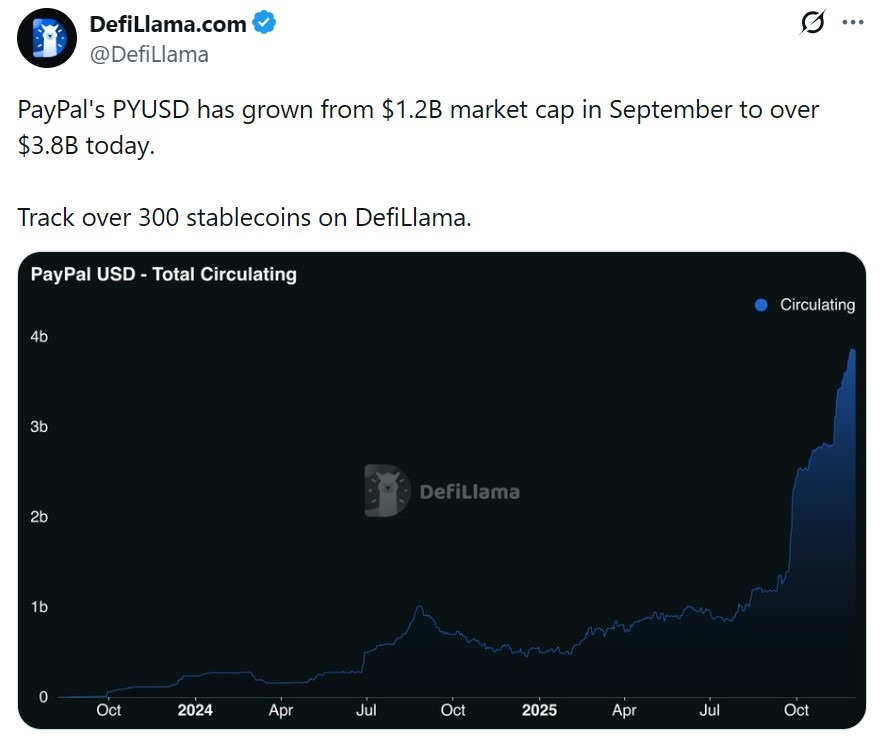

PayPal’s PYUSD grew 35% to $3.8 billion, while Ripple’s RLUSD crossed $1 billion, reflecting increased adoption of regulated assets with 300 million in new capitalization.

Explore the Ethena USDe stablecoin decline: 24% supply drop in November 2025 as fiat rivals like USDT surge. Key insights on stablecoin trends and future implications. Stay informed on crypto stability—read now!

What Caused the Ethena USDe Stablecoin Decline in November 2025?

Ethena’s USDe stablecoin underwent a notable contraction in November 2025, with its supply decreasing by 24% as investors redeemed approximately $2.2 billion in tokens. This drop, from a market capitalization of $9.3 billion at the month’s start to $7.1 billion by the end, stems from outflows driven by user sales on open markets, withdrawals from liquidity pools, and position unwinds on decentralized applications. The synthetic nature of USDe, which relies on crypto trading strategies and futures contracts to maintain its dollar peg rather than direct fiat reserves, amplified sensitivity to market dynamics.

How Did the October Depeg Event Impact USDe’s Performance?

The November decline for Ethena’s USDe followed a depegging incident in October 2025 on the Binance exchange, where the token temporarily fell to $0.65. Ethena founder Guy Young attributed this solely to a platform-specific oracle malfunction, emphasizing that USDe’s core collateral backing remained intact. During the event, minting and redemption processes functioned smoothly, with around 2 billion tokens successfully redeemed via DeFi platforms, underscoring the protocol’s resilience despite the temporary price volatility. By late October, USDe held a $14.8 billion market cap as the third-largest stablecoin, but it has since lost over 53% of that value, settling at $6.9 billion and slipping to fourth place in rankings per CoinGecko data. This sequence of events illustrates how isolated technical issues can erode confidence in synthetic stablecoins, prompting sustained outflows. Experts note that such volatility contrasts with the predictability of fiat-backed alternatives, influencing investor preferences in a maturing stablecoin ecosystem.

The broader stablecoin market, valued at $311 billion as of late 2025, continues to be overwhelmingly composed of USD-pegged assets, accounting for $303 billion. This dominance persists even as synthetic options like USDe face scrutiny over their reliance on derivatives and hedging strategies. Data from CoinGecko reveals that USDe’s redemptions reflect broader trends where users prioritize stability and regulatory clarity, especially following high-profile depegs in the sector. Financial analysts observing these shifts point out that the 24% supply reduction not only diminishes USDe’s market share but also signals potential challenges for yield-generating stablecoins in competitive environments.

Frequently Asked Questions

What Factors Contributed to the 24% Decline in Ethena USDe Supply?

In November 2025, Ethena’s USDe stablecoin saw a 24% supply drop primarily due to $2.2 billion in redemptions, driven by open-market sales, pool withdrawals, and DeFi position closures. This followed an October depeg on Binance, eroding trust despite the founder’s assurances of protocol integrity, as users shifted toward more conventional fiat-backed options.

Why Are Fiat-Backed Stablecoins Like USDT Outperforming USDe?

Fiat-backed stablecoins such as Tether’s USDT and Circle’s USDC provide greater perceived security through direct dollar reserves and regulatory oversight, attracting inflows during volatile periods. In natural terms, they’re like a reliable savings account compared to USDe’s more complex hedging approach, which involves crypto futures—explaining their steady growth while synthetic peers contract.

Key Takeaways

- Synthetic Stablecoin Vulnerabilities: USDe’s 24% November decline underscores risks in non-fiat models, with depegs accelerating outflows despite quick recoveries.

- Fiat Stablecoin Resilience: USDT added $1.3 billion to reach $184.6 billion, USDC gained $600 million to $76.5 billion, highlighting investor preference for backed assets.

- Emerging Players Gain Ground: PYUSD surged 35% with $1 billion inflows, and RLUSD hit $1.26 billion—consider diversifying into regulated stablecoins for portfolio stability.

Conclusion

The Ethena USDe stablecoin decline in November 2025, marked by a 24% supply reduction and over $2.2 billion in redemptions, highlights ongoing tensions between synthetic and fiat-backed stablecoins like USDT and USDC, which collectively added billions amid market consolidation. As the stablecoin sector reaches $311 billion, with fiat options dominating at $303 billion, regulatory advancements and investor caution continue to shape preferences toward more transparent assets. Looking ahead, protocols like USDe may need to enhance collateral mechanisms to regain traction, while market participants should monitor these trends for opportunities in a stabilizing crypto landscape—consider evaluating your stablecoin exposure today for long-term security.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/26/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/25/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/24/2026

DeFi Protocols and Yield Farming Strategies

2/23/2026