Ether Futures Overtake Bitcoin on CME as Volatility Fuels Super-Cycle Speculation

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ether futures have surpassed Bitcoin in trading volume on the Chicago Mercantile Exchange (CME), driven by heightened ETH volatility that is sparking discussions about a potential Ether super-cycle. This shift highlights growing institutional interest in Ethereum amid a market pullback, with open interest in ETH futures exceeding BTC for the first time in July.

-

Ether futures open interest overtook Bitcoin on CME in July, marking a historic flip in derivatives trading activity.

-

Higher volatility in ETH options is attracting more traders, boosting participation in Ether-linked products.

-

Despite a recent market sell-off, Ether treasury companies face losses, yet adoption trends support long-term growth potential toward $10,000.

Ether futures eclipse Bitcoin on CME amid ETH volatility spike: Is a super-cycle underway? Explore rising adoption and market shifts in this crypto update. Stay informed on Ethereum’s pivotal moment.

What Is Driving Ether Futures to Overtake Bitcoin on the CME?

Ether futures have recently surpassed Bitcoin futures in trading activity on the Chicago Mercantile Exchange (CME), signaling a significant evolution in the cryptocurrency derivatives landscape. This development, highlighted in a CME Group analysis, stems from increased volatility in Ether options, which has drawn institutional traders seeking exposure to Ethereum’s growth potential. As open interest in ETH futures exceeded BTC for the first time in July, experts point to broader adoption of Ethereum’s ecosystem as a key catalyst, even as the market experiences a temporary pullback.

Source: CME Group

The surge in Ether futures activity reflects Ethereum’s expanding role in decentralized finance (DeFi), smart contracts, and layer-2 scaling solutions. According to CME data, while Bitcoin maintains dominance in dollar-denominated volume, the number of contracts traded for Ether has grown rapidly, underscoring a diversification trend among investors. Priyanka Jain, director of equity and crypto products at CME Group, noted in a recent discussion that this volatility is not a deterrent but a draw for sophisticated market participants.

“This heightened volatility has served as a powerful magnet for traders, directly accelerating participation in CME Group’s Ether futures,” Jain explained. Her insights emphasize how Ethereum’s technological advancements, such as upgrades to its proof-of-stake consensus mechanism, are fostering sustained interest. This momentum comes at a time when the broader crypto market is navigating regulatory uncertainties and macroeconomic pressures, yet Ethereum’s utility continues to propel its derivatives market forward.

Historically, Bitcoin has led the charge in institutional adoption through CME products, with futures launched in 2017 paving the way for mainstream acceptance. Ether futures followed in 2021, but the recent overtake suggests Ethereum is catching up swiftly. Analysts from firms like Glassnode report that on-chain metrics, including staking participation exceeding 30% of total ETH supply, corroborate this shift. As institutions allocate more to ETH amid expectations of ETF approvals and network enhancements, the derivatives volume disparity could widen further.

How Is ETH Volatility Influencing Trader Participation?

Volatility in ETH options has notably outpaced Bitcoin’s, creating opportunities for hedgers and speculators on the CME. Jain highlighted that this spike, measured by metrics like the 30-day implied volatility index, reached levels above 60% in recent sessions—compared to Bitcoin’s sub-50%—prompting a rush into futures contracts for risk management. Supporting data from CME shows Ether futures notional value climbing 25% month-over-month, while expert quotes from market observers, such as those from Kaiko Research, indicate that Ethereum’s price swings are tied to real-world developments like layer-2 adoption rates surpassing 10 transactions per second on average.

This volatility isn’t isolated; it’s intertwined with Ethereum’s ecosystem growth. For instance, DeFi total value locked (TVL) on Ethereum networks hit $50 billion in late 2025, per DefiLlama reports, driving demand for derivatives to mitigate exposure. Short sentences underscore the impact: Traders are piling in. Open interest surges. Volatility fuels liquidity. Companies like SharpLink and Bit Digital, which hold ETH as treasury assets, have seen portfolio values fluctuate wildly, with recent dips pushing some positions negative by up to 15%, according to CoinGecko data. Yet, this environment is viewed by veterans like CTO Larsson as a classic consolidation phase before upward breakouts.

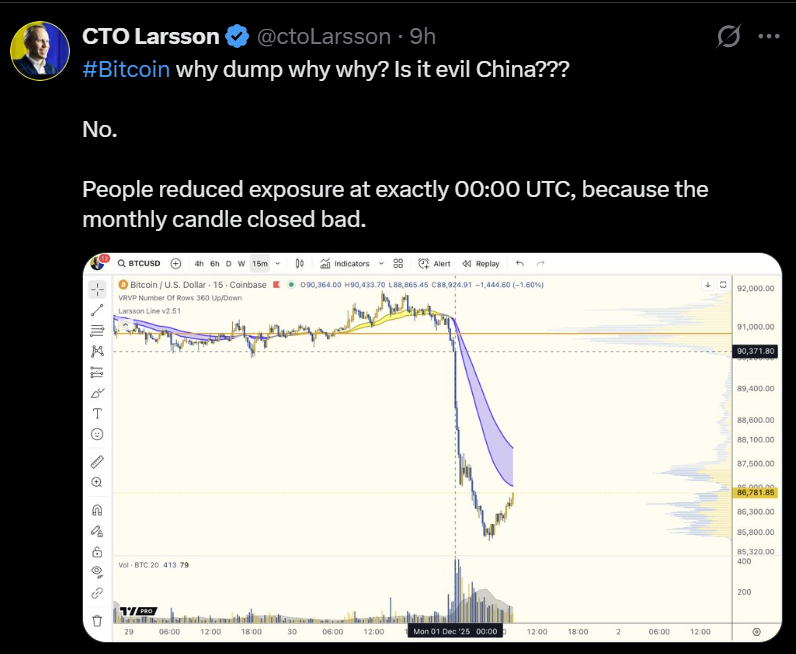

Larsson, a prominent market analyst, observed the sell-off patterns closely: “People reduced exposure at exactly 00:00 UTC, because the monthly candle closed bad.” His commentary, drawn from real-time chart analysis, aligns with patterns seen in prior cycles where volatility preceded rallies. Regulatory bodies like the SEC have also played a role, with ongoing ETF deliberations adding to price uncertainty. Despite these headwinds, participation metrics suggest resilience; CME’s Ether products now represent over 40% of crypto derivatives volume, a figure that has doubled year-over-year. This trend positions Ethereum not just as a competitor to Bitcoin but as a foundational asset for Web3 innovation.

Source: CTO Larsson

Furthermore, the debate around an Ether super-cycle gains traction as network fees stabilize post-upgrades, attracting developers and users alike. Bloomberg Intelligence analysts forecast that if Ethereum captures 20% of global payments volume by 2030, its market cap could triple from current levels. Such projections, grounded in adoption data from sources like The Block, reinforce why volatility is drawing capital rather than repelling it. In essence, the CME overtake is less about short-term noise and more about Ethereum’s structural advantages in a maturing crypto economy.

Frequently Asked Questions

What Does the Ether Futures Overtake on CME Mean for Ethereum’s Future?

The overtake signals growing institutional confidence in Ethereum, with Ether futures volume surpassing Bitcoin indicating accelerated adoption in DeFi and NFTs. This could precede a super-cycle if network upgrades continue, potentially driving ETH prices toward $10,000 by sustaining open interest above current highs, as per CME and on-chain analytics.

Is the Recent ETH Volatility a Sign of a Broader Market Recovery?

Yes, the heightened ETH volatility on CME reflects trader interest amid a pullback, often a precursor to recovery as seen in past cycles. With Ether options showing 60% implied volatility compared to Bitcoin’s lower levels, this dynamic supports Ethereum’s rally potential through increased liquidity and adoption paces.

Key Takeaways

- Ether’s CME Surge: Futures open interest flipping Bitcoin highlights Ethereum’s rising dominance in derivatives trading.

- Volatility as Opportunity: Higher ETH option swings are attracting institutions, boosting overall market participation despite sell-offs.

- Super-Cycle Potential: Monitor treasury holdings and adoption metrics for signs of sustained growth toward long-term price targets.

Conclusion

In summary, Ether futures overtaking Bitcoin on the CME, coupled with spiking ETH volatility, underscores Ethereum’s pivotal role in the evolving crypto landscape. As institutional inflows and technological advancements propel adoption, even amid market pullbacks, the stage is set for potential multi-year growth. Investors should track these derivatives trends closely for opportunities in Ethereum’s ecosystem—consider diversifying portfolios with a focus on utility-driven assets to capitalize on emerging super-cycle dynamics.