Ethereum Attracts Largest 2025 Net Inflows at $4.2B Amid L2 Shifts

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

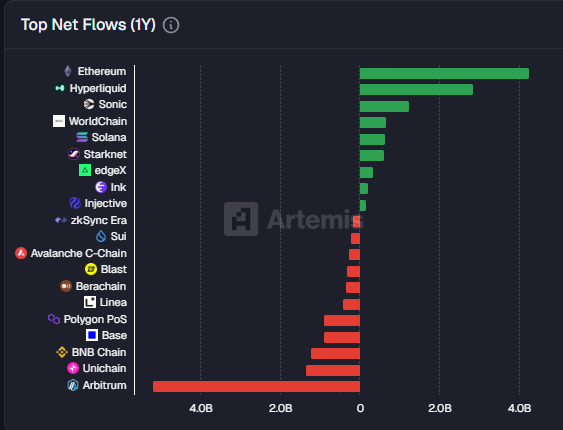

Ethereum led with $4.2 billion in net inflows in 2025, attracting high-value DeFi liquidity back to its Layer 1 from L2 chains. Despite temporary shifts, it remained the central hub for bridging and settlements, outpacing competitors like Hyperliquid.

-

Ethereum net inflows 2025 reached $4.2 billion, the highest among all chains.

-

Arbitrum saw major outflows as liquidity returned to Ethereum’s main network.

-

Hyperliquid secured second place with $2 billion in net inflows amid shifting DeFi activity.

Ethereum net inflows 2025 hit $4.2B, dominating DeFi liquidity. Discover why Ethereum leads despite L2 competition and ETH volatility. Stay ahead in crypto trends today!

Ethereum prepares to end 2025 with over $4.2B in net inflows, while liquidity abandoned the Arbitrum L2 chain. | Source: Artemis

Ethereum prepares to end 2025 with over $4.2B in net inflows, while liquidity abandoned the Arbitrum L2 chain. | Source: ArtemisWhat are Ethereum’s net inflows in 2025?

Ethereum net inflows 2025 totaled $4.2 billion, marking the largest among blockchain ecosystems. This surge reflects Ethereum’s role as a primary hub for high-value DeFi liquidity, drawing funds back from Layer 2 solutions to its Layer 1 network. Even with short-term migrations to other chains, Ethereum sustained long-term dominance in bridging and settlement activities.

Ethereum’s chain saw substantial activity throughout the year, positioning it ahead of rivals. The network welcomed $195 million in inflows over the past week alone, underscoring ongoing investor confidence. In contrast, outflows from chains like Arbitrum highlighted a broader trend of liquidity consolidation on Ethereum.

Hyperliquid followed as the second-highest with $2 billion in net inflows. Ecosystem flows fluctuated, indicating traders prioritize platforms with superior trading volume and liquidity over specific chains. Data from Artemis confirms Ethereum’s top position, with over $64 billion in total inflows against $60 billion in outflows for the year.

As previously noted by Cryptopolitan, Ethereum also hit peaks in smart contract deployments and usage, bolstering its ecosystem strength. Stablecoins played a pivotal role, with Ethereum hosting the most liquid versions widely used across exchanges and DeFi protocols for final settlements.

How did Ethereum maintain leadership in ecosystem flows?

Ethereum’s dominance stems from its extensive bridge infrastructure, connecting numerous chains and facilitating seamless asset transfers. In 2025, inflows exceeded outflows significantly, driven by these bridges and the network’s status as a settlement layer for stablecoins.

A notable liquidity shift occurred post the October 10 liquidation event. From October 12, L2 chains’ share declined as users favored Ethereum’s security for high-value holdings. Riskier L2 protocols saw rapid abandonment, boosting Ethereum’s inflows. As of December 29, L2s held just 13.5% of the Ethereum ecosystem’s economy, with Layer 1 retaining the majority of applications.

Gas fees dropped to record lows, enhancing Ethereum’s usability. While L2s process over 93% of transactions, Ethereum’s Layer 1 commands the lion’s share of liquidity. L2 stablecoin supply peaked at $18 billion but fell to 8.8% of total, losing $1 billion in the past month amid market contraction.

Analysts from Artemis note that Ethereum’s bridge activity and stablecoin liquidity make it indispensable for DeFi. Experts emphasize its role in whale accumulation and lending, even as competition from L2s grows. Ethereum’s infrastructure ensures it captures value long-term, with data showing consistent net positive flows.

Frequently Asked Questions

What chain had the highest Ethereum net inflows in 2025?

Ethereum’s Layer 1 recorded $4.2 billion in net inflows for 2025, per Artemis data. This topped all chains, including Hyperliquid’s $2 billion, as DeFi liquidity consolidated on the main network amid bridging advantages and stablecoin settlements.

Why did liquidity shift back to Ethereum from L2 chains in 2025?

After the October 10 liquidation event, liquidity flowed from riskier L2 protocols to Ethereum’s secure Layer 1. Lower gas fees, superior bridges, and high stablecoin liquidity on Ethereum drove this trend, with L2s holding only 13.5% of the ecosystem’s economy by year-end.

Ethereum’s appeal extends beyond inflows. Its vast DeFi ecosystem supports diverse applications, from lending to derivatives trading. Traders value Ethereum’s deep liquidity pools, which minimize slippage during large transactions. In 2025, this reliability attracted institutions and whales despite periodic volatility.

Stablecoin dynamics further solidify Ethereum’s position. Major issuers like USDT and USDC maintain primary liquidity on Ethereum, with bridging to L2s for efficiency but returning for settlements. This pattern contributed to the $4.2 billion net inflow figure, highlighting Ethereum’s enduring centrality.

Key Takeaways

- Ethereum net inflows 2025 leader: $4.2 billion total, driven by DeFi consolidation and bridging.

- L2 outflows benefit Ethereum: Arbitrum and others lost liquidity, returning to Layer 1 for security.

- Future-proof hub: Low fees and stablecoin dominance position Ethereum for sustained growth.

Conclusion

Ethereum’s net inflows 2025 of $4.2 billion underscore its unmatched position in DeFi liquidity and ecosystem flows. Despite L2 competition and ETH’s 12.1% net loss amid volatility—from $4,948 highs to $1,400 lows—Ethereum remains the go-to hub for settlements and bridges. Looking ahead, continued low fees and infrastructure upgrades signal stronger adoption in the evolving crypto landscape. Monitor Ethereum trends for investment opportunities.