Ethereum ETFs’ $854M Outflows May Test ETH $2500 Support Amid Institutional Pullback

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum ETF outflows totaled $853.9 million since December 11, 2025, according to Farside Investors data. Only December 22 saw $84.6 million inflows, led by BlackRock’s ETHA reversing its outflow trend. This institutional pullback contrasts with ETH holding above $2,900 amid retail support.

-

Ethereum ETFs faced steady outflows for two weeks, totaling $853.9 million per Farside Investors.

-

BlackRock’s ETHA surprisingly led the outflows, signaling holiday de-risking by institutions.

-

Bitcoin ETFs saw even larger $1.538 billion outflows since December 11, with only two inflow days.

Ethereum ETF outflows hit $853.9M in Dec 2025 amid institutional sell-off. ETH holds $2,900 despite pressure. Compare with BTC trends & 2026 outlook. Stay informed on crypto ETF flows. (152 characters)

What Are Ethereum ETF Outflows in December 2025?

Ethereum ETF outflows reached $853.9 million since December 11, 2025, as reported by Farside Investors. These funds experienced consistent net outflows over two weeks, with only December 22 recording positive inflows of $84.6 million. BlackRock’s ETHA, a leading product, unexpectedly drove significant outflows, indicating institutions de-risking ahead of year-end.

How Have Bitcoin ETF Outflows Compared?

Bitcoin ETFs recorded $1.538 billion in outflows since December 11, 2025, dwarfing Ethereum’s figures. Only December 12 ($49.1 million inflows) and December 17 ($457.3 million inflows) interrupted the trend, per Farside Investors. This sustained institutional withdrawal has pressured BTC to $88,514.79, highlighting broader market caution. Ethereum’s smaller scale suggests relatively resilient demand, though both assets face holiday profit-taking.

Ethereum’s Price Action

Ethereum traded at around $2,964 amid slight gains alongside Bitcoin over the last 24 hours. However, massive ETF outflows signal institutions locking in tax losses or de-risking portfolios before year-end. The critical support level sits at $2,500; sustained outflows could test it soon.

Remarkably, ETH has maintained above $2,900 on charts, implying retail investors or large on-chain buyers are countering ETF selling pressure. This resilience underscores diverse market participation beyond institutional flows.

A Technical Perspective

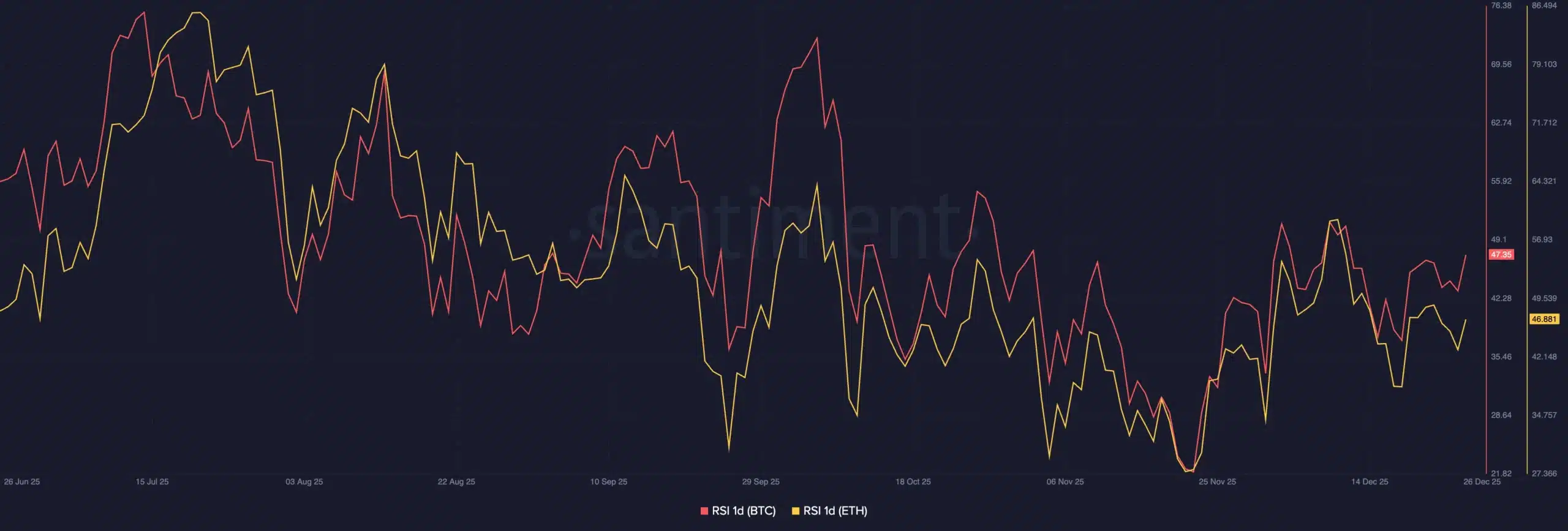

Both BTC and ETH posted minor price gains, yet their Relative Strength Index (RSI) remained below 50, indicating persistent short-term bearish momentum as per Santiment data. Northward RSI movement hints at potential bullish divergence and an approaching trend reversal.

Source: Santiment

Frequently Asked Questions

What Is Causing Ethereum ETF Outflows This December?

Ethereum ETF outflows stem from institutional de-risking and year-end tax loss harvesting, totaling $853.9 million since December 11 per Farside Investors. BlackRock’s ETHA led with major withdrawals, bucking its prior strength. Only one inflow day provided relief amid the two-week drain.

Can Ethereum Hold $2,900 Amid ETF Outflows?

Yes, Ethereum has held above $2,900 despite $853.9 million in ETF outflows, thanks to retail and on-chain buying absorption. Watch $2,500 support if flows persist. RSI below 50 signals bearish pressure, but upward trends suggest reversal potential, as shown in Santiment charts.

Key Takeaways

- ETH ETF Resilience: $853.9 million outflows absorbed without price collapse below $2,900.

- BTC Worse Off: $1.538 billion outflows highlight industry-wide institutional caution.

- Technical Signals: RSI upticks point to possible bullish divergence; monitor $2,500 ETH support.

What to Expect Heading into 2026?

Bitcoin and Ethereum navigate separate trajectories post-December outflows, with BTC facing steeper institutional exits. Ripple ETFs, by contrast, posted consistent inflows, elevating net assets over $1.16 billion and reflecting strong regulatory confidence, per flow trackers.

Conclusion

Ethereum ETF outflows of $853.9 million in December 2025, alongside Bitcoin ETF outflows exceeding $1.5 billion, reveal year-end caution from institutions like BlackRock. Yet ETH’s price stability above $2,900 signals underlying support. As 2026 nears, watch RSI developments and support levels for reversal cues, positioning investors for potential recovery amid evolving ETF dynamics.