Ethereum Exchange Supply at 2016 Lows as Institutions Ramp Up Holdings

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s supply is tightening significantly in 2025, with exchange balances at their lowest since 2016 due to institutional accumulation and staking. This reduces available ETH for trading, potentially leading to price increases as demand outpaces supply in a low-liquidity environment.

-

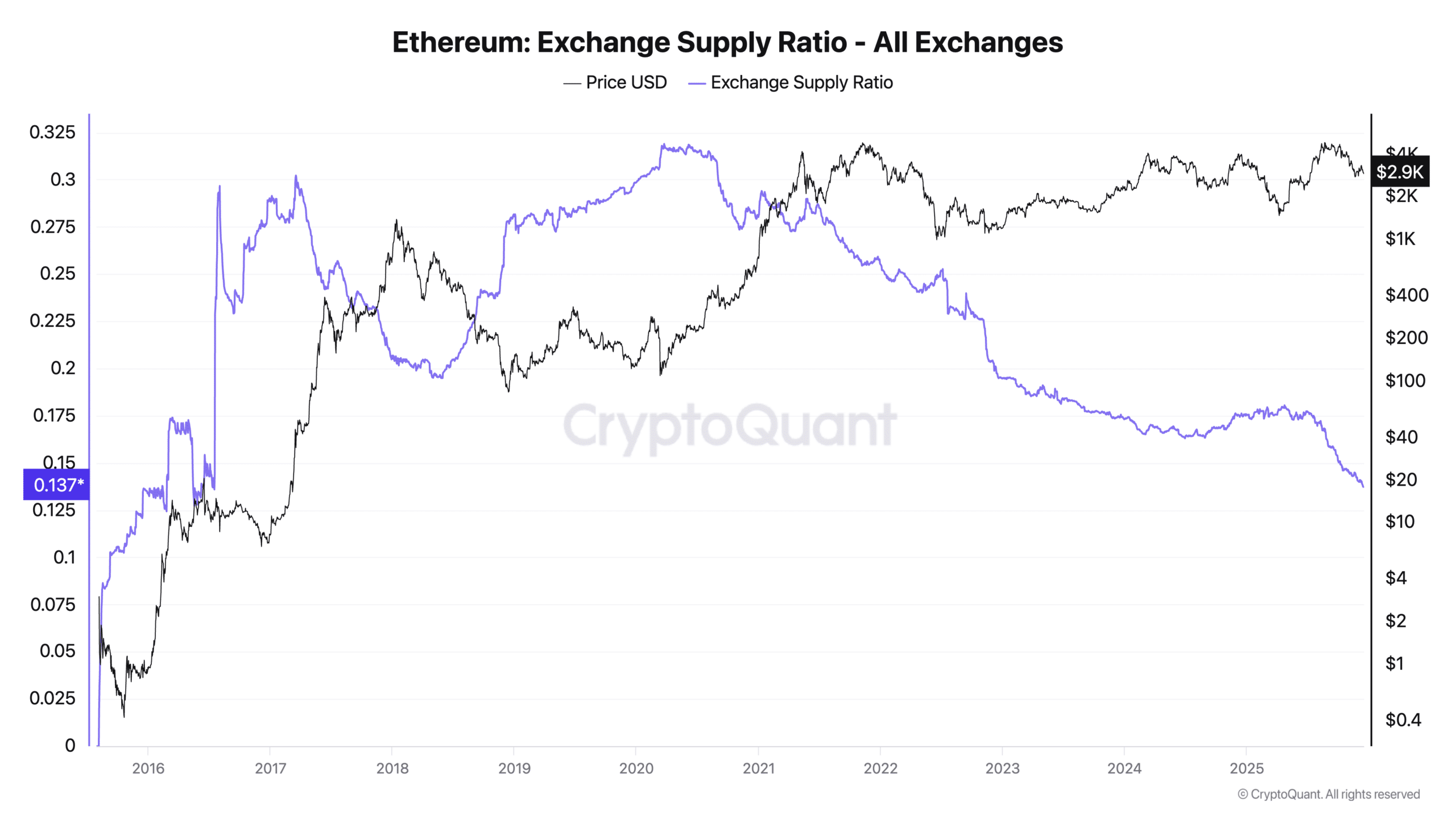

Ethereum exchange balances have fallen to 0.137, the lowest ratio since 2016, signaling reduced sell-side pressure.

-

Institutions and corporations are accumulating ETH at record paces, holding nearly 6 million ETH valued at $17.7 billion.

-

Staking locks 37 million ETH, while layer-2 networks absorb liquidity, contributing to a supply squeeze with historical precedents for upward price volatility.

Ethereum supply squeeze tightens in 2025 as exchange balances hit lows and institutions hoard ETH. Discover how this impacts prices and what it means for investors—read now for key insights!

What is causing Ethereum’s supply squeeze?

Ethereum’s supply squeeze is driven by declining exchange balances and rising institutional holdings, creating a scarcity of available ETH for immediate trading. According to data from CryptoQuant, the exchange supply ratio has dropped to 0.137, a level not seen since 2016, indicating holders are moving assets off platforms into long-term storage. This shift, combined with staking and corporate treasury adoption, reduces circulating supply and could amplify price movements in response to demand.

Source: CryptoQuant

How are institutions contributing to Ethereum’s low exchange supply?

Corporate and institutional entities are playing a pivotal role in Ethereum’s tightening supply dynamics. Data from Coingecko indicates that 27 public companies and government-linked organizations now hold a combined 5,961,187 ETH, totaling $17.7 billion in value—a 50% increase from the prior period. This represents 4.94% of the total ETH supply. Firms like BitMine Immersion have aggressively added holdings, with 407,331 ETH acquired in the last 30 days alone, marking one of the largest such accumulations by a public entity. Experts, including blockchain analyst Ki Young Ju from CryptoQuant, note that “this treasury adoption introduces a stable demand base, unlike retail-driven cycles of the past.” Such moves reflect growing confidence in Ethereum as a strategic asset for balance sheets and operations. Layer-2 solutions like Base and Arbitrum further divert liquidity from exchanges, locking ETH in ecosystems that support scalable applications. Staking activity remains robust, with nearly 37 million ETH committed to validators, effectively removing it from circulation. Long-term holders are also withdrawing to self-custody, prioritizing security over trading. These factors converge to create a low-liquidity environment where even modest buying pressure could lead to significant price appreciation, as observed in prior bull markets.

Frequently Asked Questions

What does Ethereum’s low exchange supply mean for investors in 2025?

Ethereum’s exchange supply at its lowest since 2016 suggests reduced selling pressure and potential for upward price momentum. With institutions holding nearly 6 million ETH, this structural demand supports long-term stability. Investors should monitor staking trends and corporate filings for signs of continued accumulation, as historical data shows such squeezes often precede rallies of 50% or more.

Is Ethereum’s supply squeeze similar to past market cycles?

Yes, Ethereum’s current supply squeeze mirrors patterns from 2017 and 2021, where declining exchange balances preceded major price surges. However, this cycle features stronger institutional involvement and staking mechanisms, potentially leading to more sustained growth. Voice search users often ask this to gauge risks—overall, it points to a maturing asset with enhanced scarcity drivers.

Key Takeaways

- Ethereum exchange supply lowest since 2016: The ratio of 0.137 indicates holders are securing ETH off exchanges, limiting short-term sell-offs and fostering scarcity.

- Institutional holdings surge to $17.7 billion: 27 entities control 4.94% of ETH supply, adding reliable demand that bolsters network resilience against volatility.

- Staking and L2s lock liquidity: With 37 million ETH staked, explore participation to earn yields while contributing to the supply dynamic—consult financial advisors for personalized strategies.

Conclusion

Ethereum’s supply squeeze in 2025, marked by record-low exchange balances and robust institutional accumulation, underscores a maturing ecosystem with diminished circulating supply. Factors like staking and corporate treasury adoption, as reported by sources including CryptoQuant and Coingecko, position ETH for potential volatility driven by demand imbalances. As the network evolves, this trend could enhance its role in decentralized finance. Stay informed on Ethereum developments to capitalize on emerging opportunities, and consider diversifying portfolios with professional guidance.

Ethereum is entering one of its tightest supply eras ever, with new data showing that exchange balances have dropped to their lowest point since 2016, just as corporate and institutional entities increase their ETH holdings at the fastest pace in years. Ethereum’s exchange supply ratio has fallen to 0.137, according to CryptoQuant — a level last seen in the network’s earliest days. In previous cycles, similar supply squeezes have preceded major price expansions, as less ETH available on exchanges reduces immediate sell-side pressure and signals growing conviction among long-term holders.

Supply leaves exchanges as institutions accumulate Ethereum

New data reveals a clear counter-trend: while ETH on exchanges continues to contract, entities holding ETH in treasury are steadily rising. Figures from Coingecko show: 27 public companies and government-linked entities now hold ETH; combined holdings total 5,961,187 ETH; treasury ETH is valued at $17.7bn, up nearly 50% from the previous reporting period; treasury ownership accounts for 4.94% of all ETH. The list includes U.S.-listed firms such as Tom Lee’s BitMine Immersion, SharpLink, Coinbase Global, and others. Notably, BitMine Immersion added 407,331 ETH in the last 30 days alone — one of the most aggressive accumulation streaks by a public entity in ETH’s history. This expansion of corporate ETH reserves adds a layer of structural demand that did not meaningfully exist in previous cycles.

Why Ethereum’s supply is tightening

Multiple forces are contributing to the decline in exchange balances: Staking: Nearly 37 million ETH remains locked in validators; L2 ecosystems: Base, Arbitrum, Optimism, and others continue absorbing ETH liquidity; Treasury adoption: Corporates increasingly view ETH as an operational and strategic asset; Long-term holding behavior: Investors are withdrawing to self-custody rather than actively trading. With sell-side supply dwindling and institutional absorption rising, Ethereum appears to be entering a low-liquid, high-demand environment — one that historically precedes strong upward volatility.

What this could mean for ETH’s price

Ethereum recently traded around $2,900, stabilizing after a choppy few weeks. While short-term price action remains tied to broader market sentiment, the supply structure is shifting beneath the surface. If exchange balances continue to fall and treasury accumulation remains steady, Ethereum could face a classic “supply shock” scenario — where even moderate demand triggers outsized upside.

Final Thoughts

- Ethereum is experiencing its tightest exchange-supply conditions since 2016, setting the stage for a potential supply squeeze.

- Institutional accumulation of nearly 6 million ETH adds strong long-term support and introduces a new demand engine not present in earlier cycles.