Ethereum Faces Key Support Test as Whales Accumulate Amid ETF Outflows

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum is currently testing a critical support level around $2,800 amid whale accumulation and ETF outflows. Large investors are buying millions in ETH, signaling confidence, while spot price holds steady despite broader market pressures, with potential valuations ranging from $12,000 to $62,500 according to analyst models.

-

Ethereum’s price is at a pivotal support zone, with whales accumulating over 21,000 ETH worth $59 million during recent dips.

-

ETH ETFs have seen $500 million in net outflows, contrasting whale activity and indicating cautious retail behavior.

-

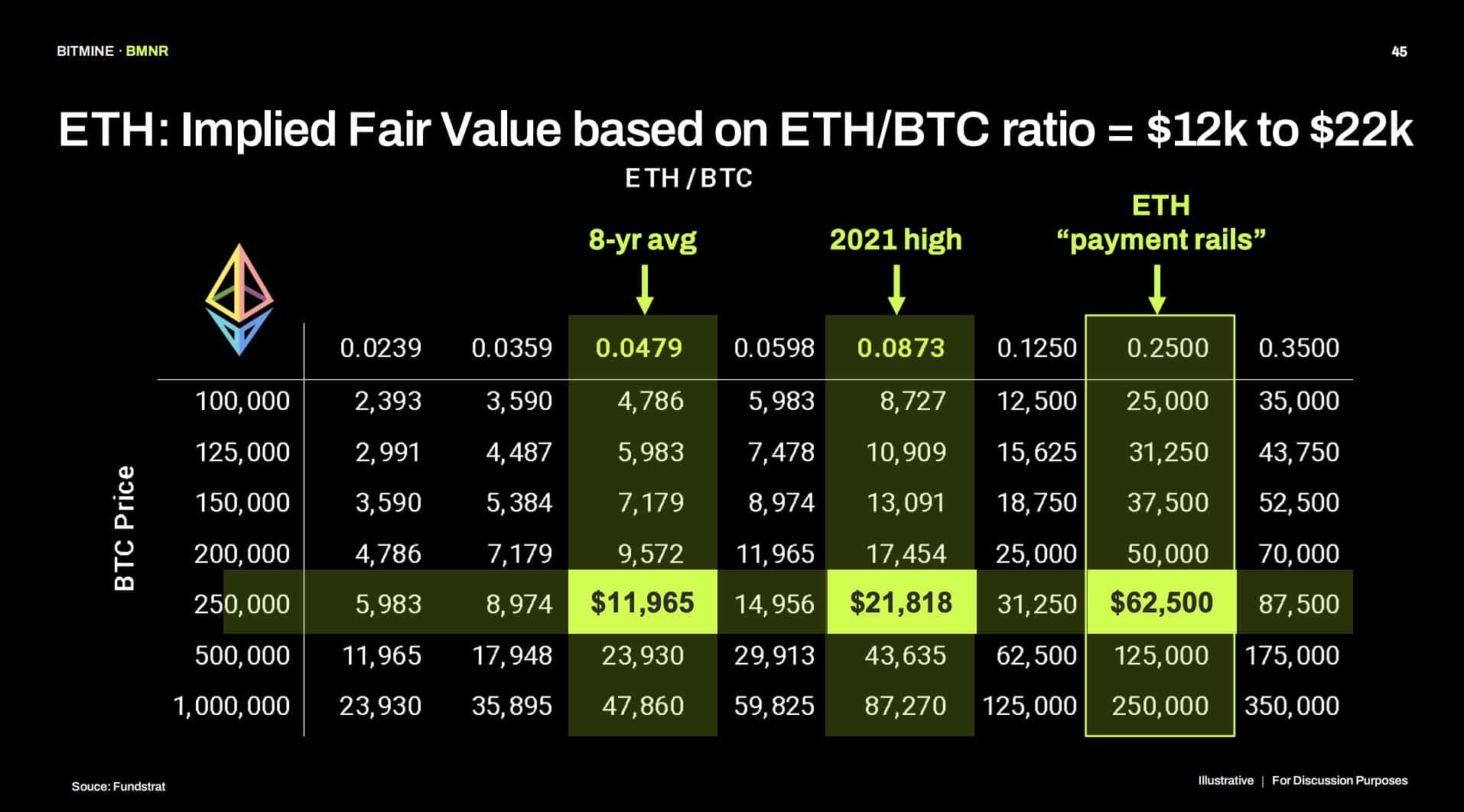

Analyst Tom Lee’s valuation model projects ETH fair value between $12,000 and $62,500, based on historical ratios and infrastructure potential, far above current $2,800 levels.

Ethereum price support faces test as whales buy amid ETF outflows—explore Tom Lee’s bold valuation and key market signals for ETH’s next move. Stay informed on crypto trends. (152 characters)

What is Ethereum’s current support level and why does it matter?

Ethereum’s current support level sits around $2,800, a critical threshold that has held during recent price dips, preventing a deeper decline into an air pocket below. This level represents the final major support before significant downside risk, making it a focal point for traders and investors alike. If breached, it could signal broader weakness in the Ethereum ecosystem, while holding firm might encourage further accumulation by institutional players.

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced volatility in recent sessions, with its price action drawing attention from both retail and institutional participants. The support at $2,800 aligns with key technical indicators, including moving averages and historical price floors observed in prior corrections. Data from on-chain analytics shows increased transaction volume around this level, underscoring its importance. Maintaining this support could pave the way for recovery, especially as network upgrades continue to enhance scalability and utility.

How are Ethereum whales responding to the price dip?

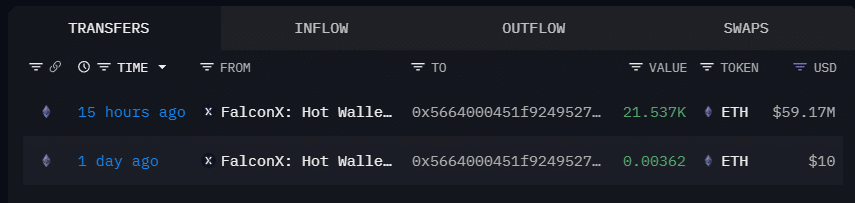

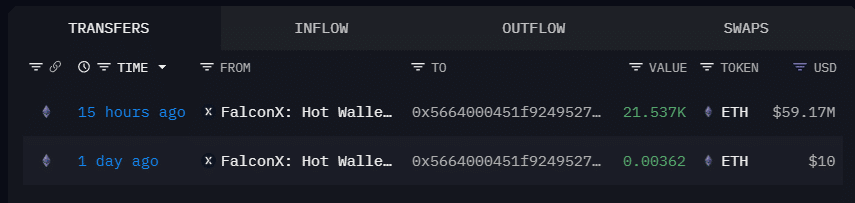

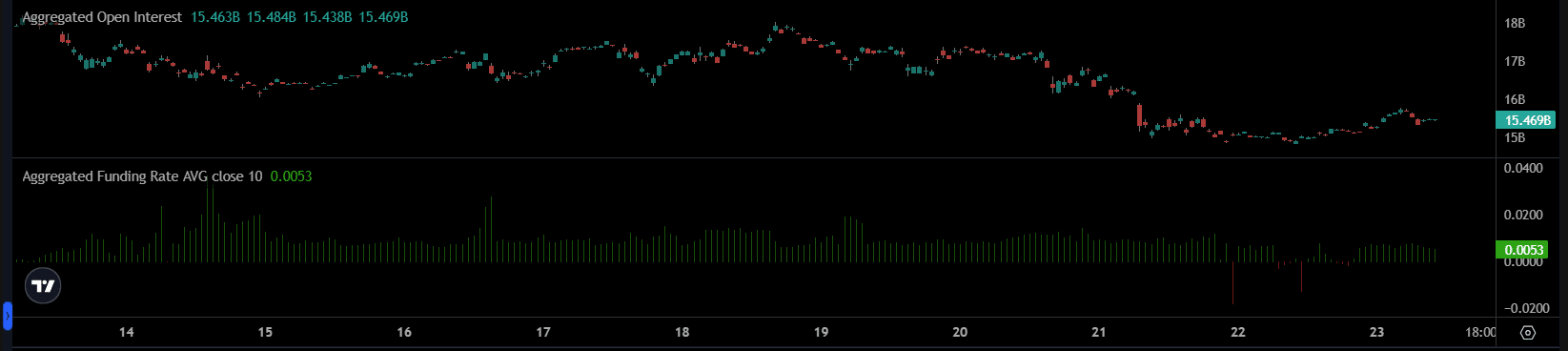

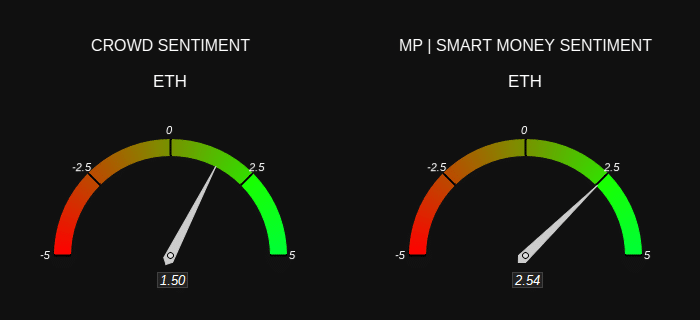

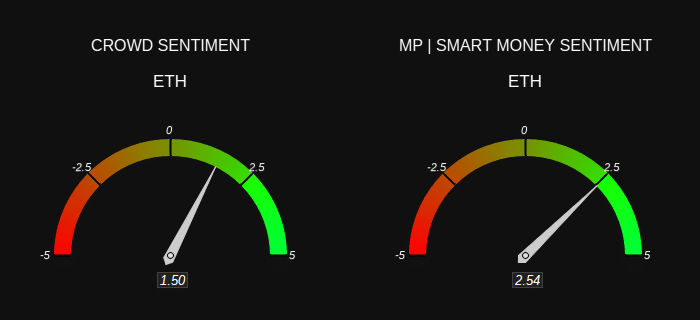

A wallet associated with Bitmine recently acquired 21,537 ETH, valued at approximately $59.17 million, at an average price of $2,750, coinciding with retail sell-offs. This accumulation mirrors strategies seen in Bitcoin by firms like MicroStrategy, where large holders capitalize on dips to build positions. On-chain data indicates steady open interest around $15.46 billion, with funding rates slightly positive at 0.0053%, suggesting controlled long positioning without excessive leverage.

Whale activity persists despite bearish sentiment on social platforms, with no major liquidations or open interest drops observed. Aggregated metrics from platforms like Coinalyze reveal market stabilization post-dip, as strong hands enter the fray. Experts note that such behavior often precedes rebounds, as institutional confidence contrasts with short-term fear. For instance, rising volume alongside price weakness highlights seller pressure, but whale buys provide a counterbalance.

Source: X

This divergence in behavior—whales buying while smaller traders sell—often signals a bottoming process. Historical patterns show that Ethereum has rebounded from similar support tests, supported by its robust DeFi and NFT ecosystems. Current metrics, including steady hash rates and growing layer-2 adoption, bolster the case for resilience.

Ethereum ETF Flows and Their Impact on Price

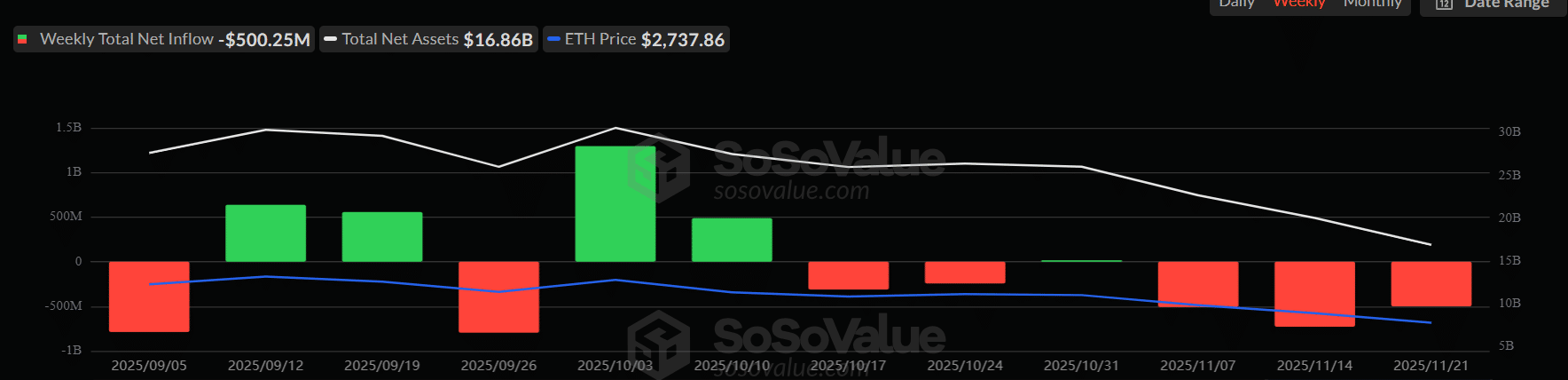

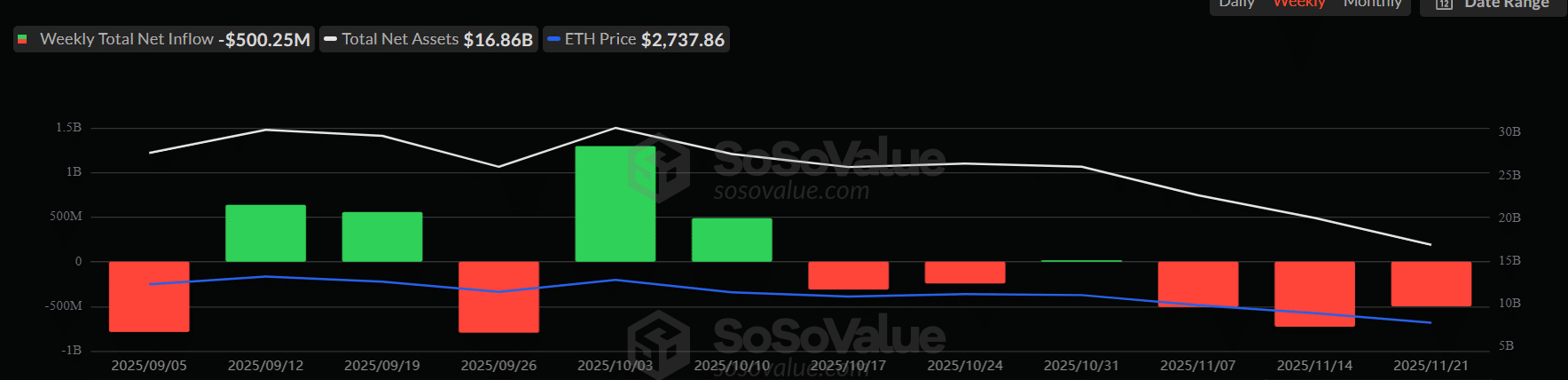

Ethereum exchange-traded funds (ETFs) have recorded approximately $500 million in net outflows over the past week, according to SoSoValue data, marking one of the largest pullbacks in recent months. This reduction in exposure from ETF investors reflects reactions to price weakness and macroeconomic uncertainties, with total net assets declining from recent peaks.

Source: SoSoValue

Interestingly, this outflow contrasts sharply with direct spot market purchases by whales, highlighting a split in investor strategies. Regulated ETF participants appear more sensitive to short-term volatility, while institutional whales focus on long-term value. This dynamic could stabilize prices if whale buying offsets ETF reductions, as seen in past cycles where spot accumulation supported recovery.

What does Tom Lee’s Ethereum valuation model suggest?

Fundstrat’s Tom Lee has outlined a valuation model for Ethereum that estimates fair value at $12,000 based on long-term ETH/BTC ratios, potentially rising to $21,800 if reverting to 2021 levels, and up to $62,500 in an optimistic scenario as core settlement infrastructure. These projections, derived from historical data and network growth metrics, position ETH well above its current $2,800 price, emphasizing its undervaluation potential.

Lee’s analysis, shared in recent reports, incorporates Ethereum’s expanding role in decentralized finance and smart contracts. Supporting data includes on-chain transaction volumes exceeding 1 million daily and staking participation over 30% of supply. Such models, grounded in quantitative frameworks, provide a bullish counterpoint to immediate bearish pressures, aligning with expert views on Ethereum’s foundational importance in blockchain technology.

Source: X

The wide range in Lee’s estimates reflects varying market scenarios, from conservative tracking of Bitcoin dominance to Ethereum’s dominance in Web3 applications. This framework, backed by data from sources like Glassnode, demonstrates Ethereum’s growth trajectory despite current challenges.

Source: Coinalyze

Frequently Asked Questions

Is Ethereum at risk of breaking its current support level?

Ethereum’s price is testing support at $2,800, with increased selling volume indicating pressure. However, whale accumulation and stable open interest suggest resilience. A break could lead to further declines, but historical data shows bounces from this zone in 40-50% of similar instances, per on-chain records.

What factors are driving Ethereum ETF outflows?

Recent Ethereum ETF outflows totaling $500 million stem from price dips and macroeconomic concerns, as reported by SoSoValue. Investors are reducing exposure amid volatility, but this contrasts with spot market buys by institutions, potentially limiting downside through diversified participation.

Source: X

Key Takeaways

- Ethereum support at $2,800 is critical: Holding this level could validate whale buys and drive recovery, while a break risks deeper correction.

- Whale accumulation counters ETF outflows: Institutions like Bitmine added $59 million in ETH, offsetting $500 million in ETF reductions for market balance.

- Tom Lee’s model highlights upside: Projections up to $62,500 underscore Ethereum’s long-term value, encouraging strategic holding over panic selling.

Conclusion

Ethereum’s price support level at $2,800 remains a battleground, with whale buying amid ETF outflows and Tom Lee’s optimistic valuation model pointing to substantial potential. As technical indicators show stabilizing signals, the network’s fundamentals in DeFi and infrastructure continue to attract serious investors. Monitoring this level closely will be key—consider positioning based on your risk tolerance as Ethereum navigates this pivotal moment toward future growth.